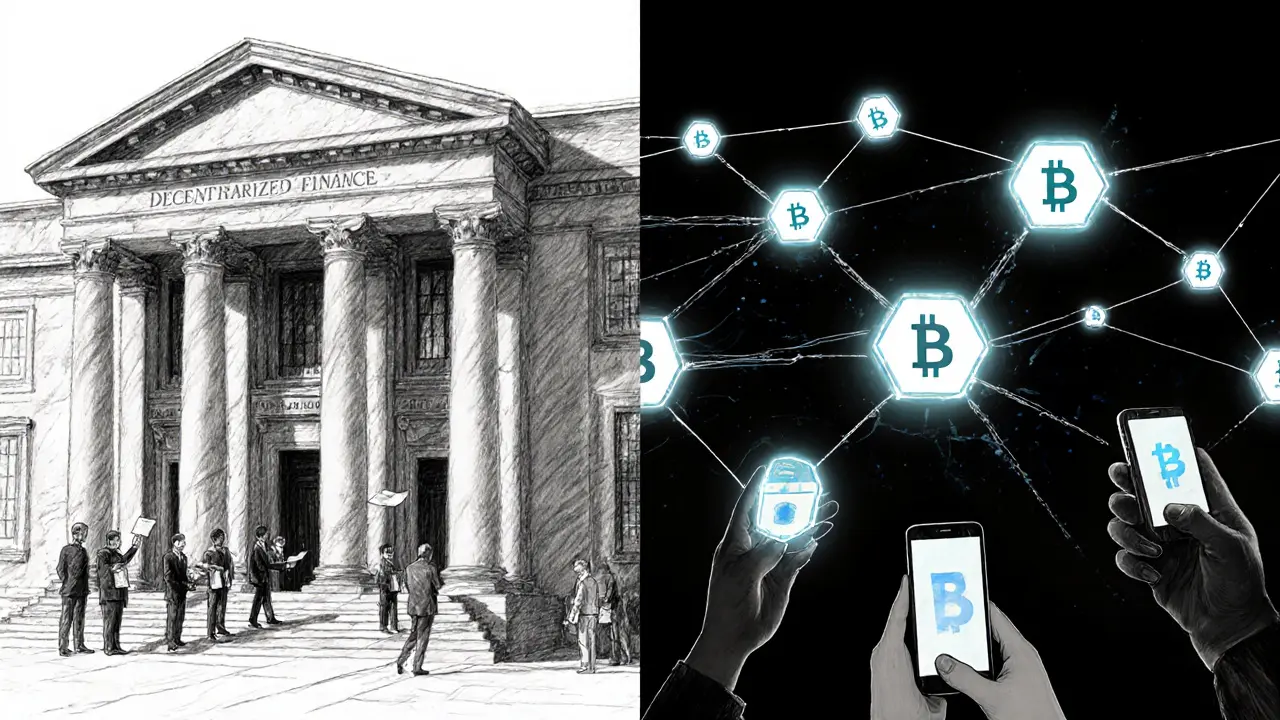

Explore how decentralized finance (DeFi) will reshape payments, lending, and asset tokenization by 2025, covering technology, adoption drivers, use cases, and remaining challenges.

Stablecoin Adoption: Why It Matters and How It’s Shaping Crypto

When you hear about stablecoin adoption, the growing use of price‑pegged digital assets for payments, trading and savings, you’re looking at a shift that ties traditional finance to blockchain. It’s also called stablecoin integration and it connects fiat‑backed tokens with decentralized applications. stablecoin adoption is more than a buzzword; it’s a catalyst for liquidity, a bridge for regulators, and a sandbox for new tokenomics. The core asset behind this trend is the stablecoin, a digital token that stays close to a reference price, usually a dollar, through collateral or algorithmic mechanisms. These assets power DeFi platforms, letting users earn yield without exposure to wild price swings. Meanwhile, crypto exchanges see higher trading volume and tighter spreads because stablecoins act as a reliable base pair for virtually every crypto.

How Adoption Shapes the Ecosystem

Stablecoin adoption drives liquidity growth (stablecoins → higher market depth) and reduces slippage for traders. DeFi platforms require stablecoins to offer low‑risk lending, borrowing, and stable farming pools, meaning that without stablecoin adoption, many yield strategies would crumble. Regulators influence adoption by setting compliance standards; clearer rules attract institutional players who bring massive capital. Tokenomics also evolve: projects design fee‑sharing, burn mechanisms, and reserve strategies to keep pegs stable while rewarding holders. Real‑world use cases—like cross‑border remittances, payroll, and merchant payments—turn stablecoins into everyday money, pushing exchanges to list more pairs and upgrade custody solutions. The interplay is simple: stablecoin adoption ↔ liquidity ↔ DeFi utility ↔ exchange growth ↔ regulatory clarity.

Looking ahead, the next wave of adoption will focus on interoperability and on‑ramp simplicity. Multi‑chain bridges let stablecoins move between Ethereum, Solana, and emerging layer‑2 networks without losing peg integrity, expanding their reach. Payment processors are embedding stablecoin APIs, letting consumers pay with a tap of their phone, which fuels further demand. As more traditional finance firms experiment with tokenized dollars, the line between banking and crypto blurs, making stablecoin adoption a cornerstone of the new financial infrastructure. Below you’ll find a curated set of articles that dig into validator rewards, airdrop mechanics, exchange reviews, and other hot topics that intersect with stablecoins, giving you a practical roadmap to navigate this rapidly evolving space.