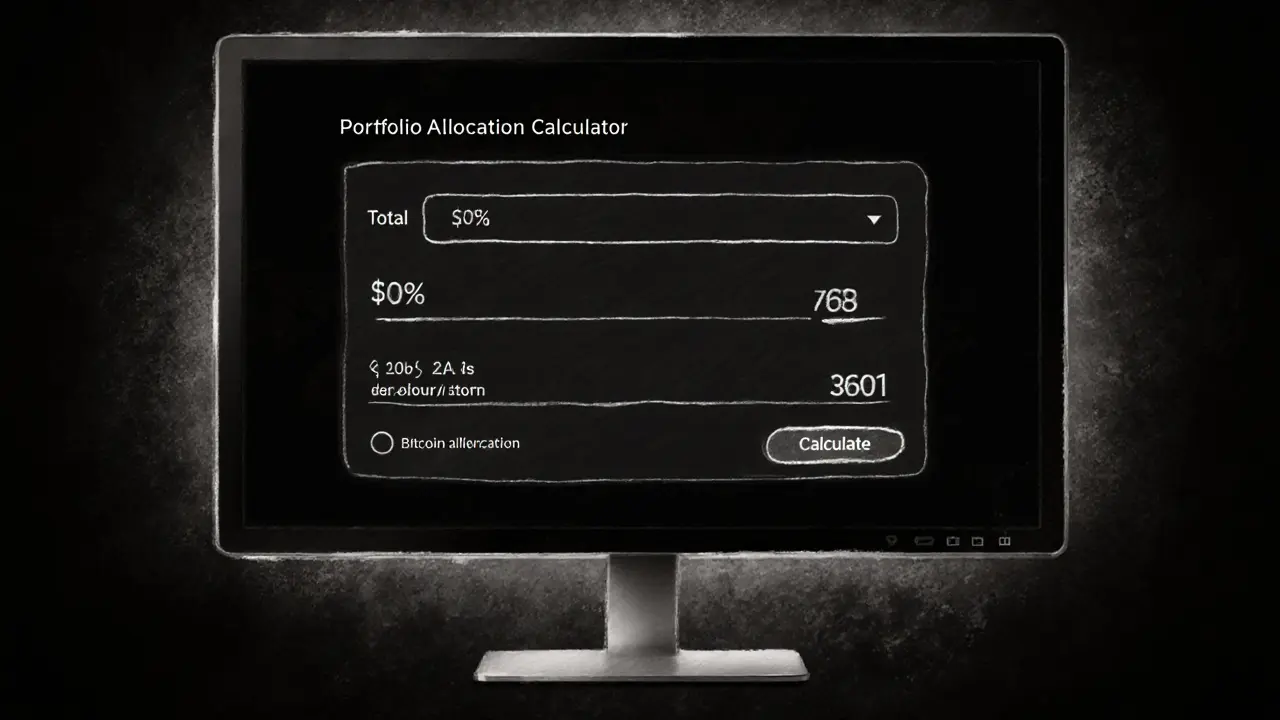

Bitcoin Portfolio Allocation Calculator

Use this calculator to determine your ideal Bitcoin allocation based on your total portfolio value and desired percentage. Start with 1-7.5% and adjust to suit your risk tolerance.

Allocation Summary

Bitcoin Dollar Amount:

$0.00

Recommended Equity Reduction:

$0.00

Allocation Range:

1% - 7.5%

When you start mixing Bitcoin with stocks, bonds, or real estate, the biggest question isn’t "if" you should add it - it’s "how much". A well‑thought‑out Bitcoin allocation can lift your portfolio’s return without blowing up its volatility, but getting the percentage wrong can just add stress. Below you’ll find the numbers that institutions trust, a step‑by‑step way to size your own exposure, and practical tips for keeping the balance right.

TL;DR

- Most institutions recommend 1%-7.5% of total portfolio value in Bitcoin, depending on risk tolerance.

- Start with the lowest tier (1%-4%) if you’re new; increase only after you’ve mastered rebalancing.

- Use monthly or quarterly rebalancing to keep the allocation on target and control transaction costs.

- Fund the Bitcoin slice from equity positions for the best risk‑adjusted boost.

- Monitor Sharpe and Sortino ratios to see if the extra Bitcoin is actually improving performance.

Why Bitcoin Belongs in a Diversified Portfolio

Bitcoin is a decentralized digital currency that operates on a peer‑to‑peer network, offering a store of value and a potential hedge against traditional market swings. Over the past decade its price moves have shown a low correlation with equities, bonds, and commodities, meaning it can provide an extra source of return when other assets are flat.

Institutional research consistently points to an improvement in risk‑adjusted metrics when a modest Bitcoin slice is added. For example, moving from 0% to 1% Bitcoin often lifts the Sharpe ratio by 0.05‑0.10 points - a meaningful bump for large portfolios that track performance fees.

What the Big Players Recommend

Several major firms have run extensive back‑tests. Their findings converge around a narrow band that balances upside capture with volatility control.

| Firm | Suggested Range | Typical Portfolio Mix | Key Metric Improved |

|---|---|---|---|

| CoinShares - research arm | 4%-7.5% | 60% equities, 30% bonds, 5% gold, 5% real estate, Bitcoin as shown | Sharpe ratio (+0.12to+0.18) |

| VanEck - crypto asset manager | 3% Bitcoin + 3% Ethereum (total 6% crypto) | 57% S&P500, 37% U.S. bonds, 6% crypto | Return per unit of risk (highest among tested models) |

| Galaxy Digital - digital asset firm | 1%-10% (strongest jump at 1%) | Varies; recommend funding from equity slice | Sharpe & Sortino ratios (both improve at 1%) |

| BlackRock - investment institute | 1%-2% | Standard 60/40 stock‑bond mix | Portfolio risk contribution comparable to a ‘Magnificent7’ tech stock |

Notice the overlap: all firms agree that staying below about 8% keeps volatility in check while still delivering a risk‑adjusted edge.

How to Pick Your Personal Bitcoin Slice

Start with three questions:

- What’s your risk tolerance? If a 20% drop in Bitcoin would make you lose sleep, aim for the 1%‑2% tier. If you can tolerate a 30%‑40% drawdown in that slice, consider 4%‑6%.

- How long is your investment horizon? Longer horizons (10+ years) give Bitcoin time to smooth out its roller‑coaster, allowing higher allocations.

- Which existing asset will you fund the Bitcoin exposure from? Research from Galaxy Digital shows shifting a small portion of equities into Bitcoin yields the best volatility reduction.

Plug your answers into the quick calculator below (feel free to copy‑paste into a spreadsheet). The goal is to land between the “minimum effective” (1%) and the “institutional ceiling” (7.5%).

Total portfolio value: $______ Desired Bitcoin %: ______ (choose 1‑7.5) Bitcoin dollar amount = Total * Desired % Equity reduction = Bitcoin dollar amount (recommended source)

Adjust the percentage up or down until the resulting equity reduction feels comfortable.

Rebalancing: Keeping the Allocation in Check

Because Bitcoin’s price can swing 15%‑30% in a single month, stale allocations drift fast. Two common schedules work well:

- Monthly rebalancing: Best for active traders. Maintains tight control but incurs higher transaction fees and potential tax events.

- Quarterly rebalancing: A sweet spot for most investors. Limits trading costs while still correcting major drifts.

When rebalancing, follow these steps:

- Calculate current Bitcoin weight (Bitcoin market value ÷ total portfolio value).

- If the weight is more than 1.5× your target, sell enough Bitcoin to bring it back to target.

- If it’s below 0.75× target, buy Bitcoin using the pre‑selected funding source (usually equities).

- Record the trade for tax purposes and update your portfolio tracker.

Automation tools on platforms like Kraken or Coinbase Pro let you set “target weight” orders, reducing manual effort.

Practical Steps to Implement Your Bitcoin Allocation

- Select a compliant broker or exchange. Post‑2024 Bitcoin ETFs (e.g., NYSE’s BTCETF) provide a regulated way to gain exposure without holding the raw coin.

- Open a dedicated crypto account. Keep Bitcoin separate from other assets to simplify tracking.

- Fund the allocation. Transfer the calculated dollar amount from your equity holdings.

- Set up alerts. Use price‑threshold notifications (e.g., 20% drop) to avoid panic selling.

- Schedule rebalancing. Mark the calendar for the chosen frequency and stick to it.

Remember to consider tax implications. In NewZealand, Bitcoin is treated as property for tax, so each sale could trigger a CGT event. Keeping a clear audit trail helps when filing your return.

Common Pitfalls and How to Avoid Them

Sharpe ratio is a measure of risk‑adjusted return calculated as excess return divided by standard deviation is a great sanity check, but many investors misuse it.

- Chasing high allocations. Retail forums often flaunt 10%‑15% Bitcoin exposure. That may look impressive, but data shows stress levels rise sharply above 10%.

- Neglecting rebalance costs. Frequent trading can erode the extra return. Use limit orders and batch trades.

- Funding Bitcoin from cash. Since cash already offers low volatility, moving cash into Bitcoin adds risk without the diversification benefit that equity‑funded allocations provide.

- Ignoring regulatory changes. Keep an eye on local AML/KYC rules; NewZealand’s Financial Markets Authority (FMA) may adjust reporting thresholds.

By staying disciplined, you capture the upside while keeping the downside manageable.

Frequently Asked Questions

What is a reasonable Bitcoin allocation for a beginner?

For most first‑time crypto investors, 1%-2% of total portfolio value is a good starting point. It offers a measurable risk‑adjusted boost without exposing you to the extreme swings that larger positions endure.

How often should I rebalance my Bitcoin position?

Quarterly rebalancing strikes a balance between cost and control for most investors. If you have a high‑frequency trading setup, monthly rebalancing can keep drift under 0.5% of target weight.

Should I fund Bitcoin from cash or equities?

Equity‑funded allocations tend to improve the Sharpe and Sortino ratios more than cash‑funded ones, because equities already share some correlation with Bitcoin, reducing overall portfolio volatility.

Does holding Bitcoin reduce overall portfolio risk?

When the allocation stays within the 1%‑7.5% band, many studies show a modest improvement in risk‑adjusted metrics. The effect disappears if the slice grows too large, as Bitcoin’s own volatility starts to dominate.

What is the Sortino ratio and why does it matter for Bitcoin?

Sortino ratio is a variation of the Sharpe ratio that only penalizes downside volatility. Because Bitcoin’s upside can be dramatic, the Sortino ratio often highlights its benefit better than the Sharpe ratio, especially for aggressive investors.

Wow, the calculator is a neat tool! 😄 If you’ve got a $50k portfolio, a 3% Bitcoin slice gives you $1.5k in BTC – that’s a solid hedge while keeping your risk in check. Remember to rebalance quarterly so you don’t drift too far from your target.

Look, America’s strongest portfolios still need a crypto edge – but don’t go crazy. A 1‑2% allocation lets you ride the upside without letting foreign volatility dictate your savings.

From a portfolio theory standpoint, integrating Bitcoin at a sub‑5% weight optimally diversifies the systematic risk factor, thereby enhancing the Sharpe ratio under a mean‑variance framework.

🤔 That’s a solid point, Fiona. Think of your allocation as a compass – a little north‑east tilt toward Bitcoin can guide you through market storms, but you must keep your core compass calibrated to your long‑term goals.

Honestly, most folks overestimate Bitcoin’s stabilizing effect.

Sure, the volatility's real, but a modest slice can still act like a fire‑starter for portfolio growth when paired with disciplined rebalancing and a clear exit strategy.

Yo, the UI looks slick. Just plug in your numbers and you’ll see if you’re living in the future or still stuck in the past.

Hey crew! This tool is like a crystal ball for crypto‑curious investors – sprinkle a dash of BTC, watch the magic happen, and remember, patience is the secret sauce behind every successful allocation.

Don’t get all wavy, Emma. If you’re not ready to watch the value swing like a roller‑coaster, keep that Bitcoin slice under 2% and you’ll stay afloat.

Most people think more Bitcoin equals more profit, but the market’s a gamble – sometimes a tiny pinch is safer than a big bite.

Determining the appropriate Bitcoin allocation requires a disciplined assessment of one's risk tolerance.

Begin by quantifying the total capital you are willing to expose to volatile assets.

Next, consult the modern portfolio theory which suggests that adding a low‑correlation asset can improve overall portfolio efficiency.

In practice, the calculator’s suggested range of 1 % to 7.5 % aligns with academic findings on optimal diversification.

A 1 % exposure introduces a modest upside potential while limiting downside to an acceptable level.

Conversely, a 7.5 % allocation significantly raises the portfolio’s beta, which may be suitable for investors with a longer horizon.

It is critical to evaluate your investment time frame; if you intend to hold for more than ten years, a higher allocation may be justified.

Additionally, consider liquidity needs; Bitcoin, though increasingly liquid, may still present challenges during severe market stress.

Rebalancing frequency should be calibrated to transaction costs; quarterly rebalancing often strikes a balance between responsiveness and fee management.

Tax implications cannot be ignored, as capital gains treatment varies across jurisdictions.

For U.S. investors, holding Bitcoin for more than one year benefits from long‑term capital gains rates.

Integrating the calculator’s output with a broader asset allocation plan ensures that Bitcoin does not dominate risk exposure.

Scenario analysis can be performed by adjusting the percentage input and observing the impact on the equity reduction figure.

Ultimately, the decision rests with the individual, but adhering to a systematic methodology reduces emotional bias.

Remember, no tool can replace sound judgment, but this calculator provides a valuable starting point.

Yo Alex, that’s a lot of textbook talk – just remember the market can flip on a dime, so keep some actual cash on hand instead of loading every cent into Bitcoin.

Hey guys, if u wanna try this out just type in ur total assets and put a low % like 2 – it’ll show u exactly how much BTC u get and how much equity u should pull back.

Exactly, Holly! And it’s also a good habit to set alerts so when Bitcoin spikes you can decide whether to lock in profits or stay the course.

Consider, dear investors; the act of allocating Bitcoin is not merely a numeric exercise; it is a reflection of one's philosophical stance on risk, destiny, and the evolving nature of value-truly a modern alchemy.

While the poetic sentiment is noted, one must adhere to rigorous quantitative analysis; otherwise, the allocation becomes an exercise in wishful thinking, not disciplined investment.