LIKE Token Investment Calculator

Current LIKE Token Status

Ever wondered what the LIKE crypto coin actually does? It’s not just another meme token-LikeCoin aims to give content creators real ownership of their work on the emerging Web3.0 internet. Below you’ll get a clear picture of how the token works, its tech stack, market reality, and whether it’s worth a look.

TL;DR

- LikeCoin (tickerLIKE) is a blockchain‑based platform for decentralized publishing.

- It uses a liquid‑democracy DAO where token holders delegate voting power to validators.

- Current price hovers around $0.0018USD with tiny daily volume (~$600) and effectively zero market cap.

- Token is not on major exchanges like Binance, limiting liquidity.

- If you’re a creator, you can earn LIKE by publishing content; otherwise treat it as a high‑risk, low‑liquidity investment.

What is LikeCoin and the LIKE token?

LikeCoin is a protocol for decentralized publishing that lets creators mint, manage, and own digital content on an application‑specific blockchain. The native asset, LIKE, functions as both a utility token and a governance token within the ecosystem.

Founded on September12017 by CEO KinKo, LikeCoin was one of the first projects that tied a cryptocurrency directly to the creator economy. Unlike Bitcoin, which only stores value, LIKE is meant to reward actions like publishing articles, videos, or NFTs and to give holders a say in protocol upgrades.

Technical architecture - ISCN and inter‑chain networking

The heart of the platform is the Inter‑blockchain Service Communication Network (ISCN). ISCN acts as a cross‑chain bridge, allowing content metadata to be recorded on the LikeCoin chain while still being readable by other blockchains such as Ethereum or Polygon.

Because ISCN stores content fingerprints rather than the full file, creators keep the bulk of their media on traditional storage (IPFS, Arweave, or even centralized servers) while the blockchain guarantees provenance and immutable proof of ownership.

From a developer’s view, the protocol offers a set of smart‑contract templates that let any app integrate "like‑buttons" that automatically mint LIKE rewards when users engage with content. This creates a feedback loop where popular posts generate more tokens, and token holders can reinvest those rewards into further creation.

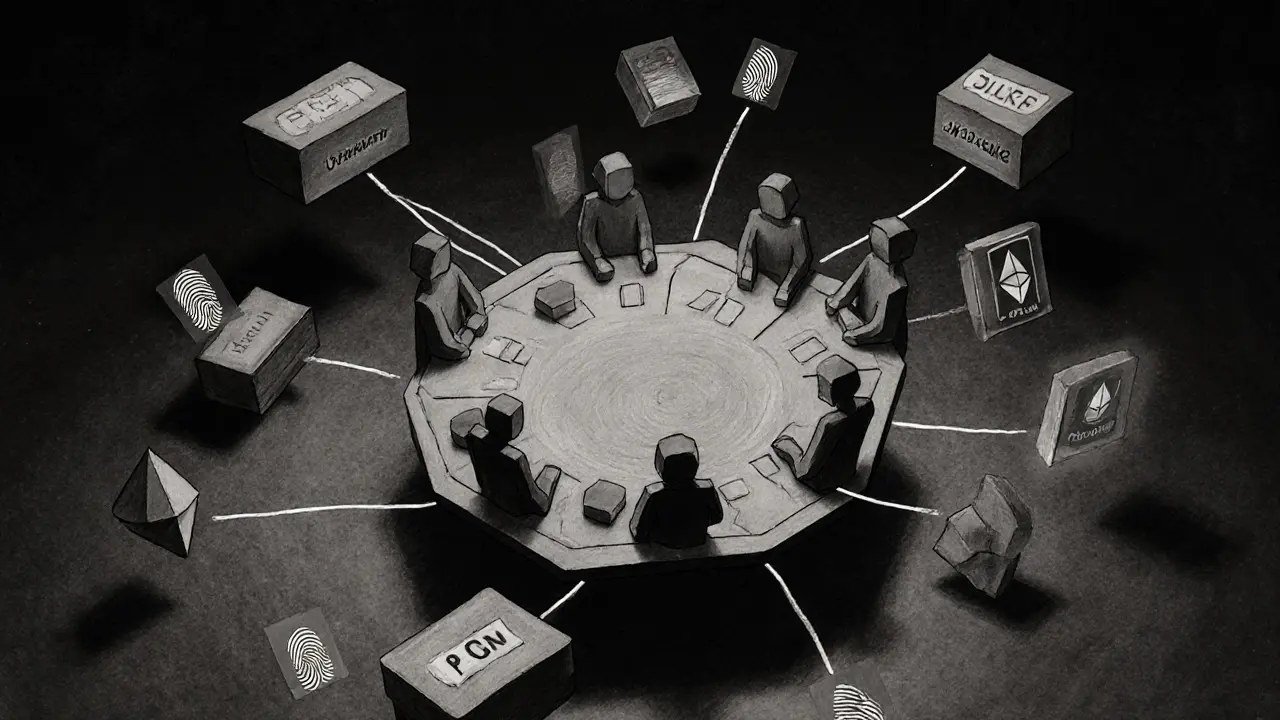

Governance model - DAO and liquid democracy

LikeCoin runs a decentralized autonomous organization (DAO) that follows a liquid‑democracy model. Token holders can either vote directly on proposals or delegate their voting power to trusted validators. Delegations are fluid-users can shift support at any time without locking tokens.

Key decisions handled by the DAO include:

- Setting inflation rates for new LIKE issuance.

- Choosing default "Content Jockeys" that curate high‑quality streams.

- Approving protocol upgrades or cross‑chain bridges.

This structure aims to keep the network community‑driven while preventing the centralization pitfalls seen in many proof‑of‑stake chains.

Market performance and liquidity

LikeCoin’s market data paints a stark picture. As of October2025, the token trades around $0.0018USD, a 0.27% dip in the last 24hours. Its 24‑hour volume sits at roughly $628, indicating almost non‑existent liquidity. Many price aggregators even list a market cap of $0.00 and a circulating supply of zero, suggesting the token’s distribution may be stuck in a technical or custodial limbo.

Historically, the all‑time high was reported at $1,801.91USD-a figure that likely reflects a data glitch rather than genuine market activity, given the token’s tiny niche. In the past 30days the price has fallen nearly 28%, underscoring the high‑risk nature of the asset.

One major factor is the lack of listings on major exchanges. LIKE is absent from Binance, Coinbase, and Kraken, confining most trading to obscure DEXes with thin order books. This hampers price discovery and makes sizable purchases costly due to slippage.

How to acquire and use LIKE

If you’re determined to get your hands on LIKE, the typical path is:

- Set up a non‑custodial wallet that supports custom tokens (e.g., MetaMask, Trust Wallet).

- Find a decentralized exchange (DEX) that lists the LIKE contract address-most often on Binance Smart Chain or Polygon networks.

- Swap a stablecoin (USDT, USDC) for LIKE, remembering that the slippage may be high.

Once you hold the token, you can:

- Delegate your voting power to a validator via the official DAO dashboard.

- Earn rewards by publishing content on platforms that integrate the ISCN protocol (e.g., Medium‑like blockchain blogs, video apps).

- Stake LIKE in liquidity pools on small‑cap DeFi platforms-though these pools often carry smart‑contract risk.

How LIKE stacks up against other crypto projects

| Feature | LikeCoin (LIKE) | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|---|

| Primary purpose | Decentralized publishing & creator rewards | Store of value & peer‑to‑peer cash | Smart‑contract platform for dApps |

| Governance | Liquid‑democracy DAO (token‑based) | No on‑chain governance (soft forks only) | EIP‑1559 upgrades, DAO proposals |

| Supply model | Unclear; current data shows 0 circulating | Fixed at 21M BTC | Inflationary, ~0.5% annual |

| Major exchange listings | None on Binance, Coinbase, Kraken | All major exchanges | All major exchanges |

| Liquidity (24‑hr volume) | ~$600 USD | ~$30B USD | ~$20B USD |

The table makes it clear why LIKE feels like a niche experiment rather than a mainstream store of value.

Risks, challenges, and future outlook

Several red flags should make any potential investor pause:

- Liquidity scarcity: With under $1,000 of daily trading, exiting a position can be painful.

- Unclear tokenomics: The reported zero circulating supply suggests either a technical glitch or a distribution that’s not publicly verifiable.

- Exchange exclusion: Absence from Binance, Coinbase, and similar platforms limits exposure and credibility.

- Development opacity: Public roadmaps are sparse; recent commits to the repository are minimal, raising questions about active maintenance.

- Regulatory exposure: As a utility token tied to content rewards, LIKE could fall under future digital‑asset regulations in jurisdictions like the EU or NewZealand.

On the upside, the concept of rewarding creators with on‑chain tokens aligns with the broader Web3.0 narrative. If the team can secure a few strategic partnerships-say with a major video platform-and improve liquidity, the token could see a modest rebound. Until then, treat LIKE as a speculative asset with high downside risk.

Frequently Asked Questions

What exactly does the LIKE token do?

LIKE serves two roles: it powers the LikeCoin ecosystem (paying creators, staking for governance) and gives holders voting rights in the DAO. It is not designed as a generic store of value.

Can I buy LIKE on a mainstream exchange?

No. LIKE is not listed on Binance, Coinbase, or Kraken. You’ll need to use a DEX that supports the token’s contract address, which means higher slippage and less security.

How does the DAO’s liquid‑democracy work?

Token holders can delegate their voting power to any validator they trust. Delegations are revocable at any time, allowing the community to shift influence quickly as validator performance changes.

Is LIKE a good long‑term investment?

Given the near‑zero liquidity, unclear token supply, and lack of exchange listings, LIKE is high‑risk. It may have niche utility for creators, but as an investment it should be approached with caution.

What are the alternatives for decentralized publishing?

Projects like Mirror, Audius, and Arweave offer similar creator‑centric models with more established token economies and better liquidity. Comparing features and community size can help you decide which platform aligns with your goals.

Zero volume, no major exchanges, and I swear my transaction just vanished into thin air.

Not worth the stress.

It is not merely illiquid-it is epistemologically incoherent.

One cannot assign value to an entity that does not demonstrably exist in the market.

It is a token, not a brand name.

And the use of 'Web3.0' without proper hyphenation or citation is academically irresponsible.

One would expect better from a technical guide.

It’s not about the price now-it’s about the idea.

If you’re a creator, this could be your first step into owning your work.

Don’t dismiss it just because the numbers look bad today.

Brilliant.

It’s like building a Ferrari with no gas stations.

And the DAO? A bunch of people delegating votes to strangers who probably don’t even know what ISCN stands for.

It’s not innovation-it’s theater.

And the $1,801 ATH? Yeah, that was when someone accidentally typed an extra zero.

And now we’re supposed to believe this isn’t just a glorified honeypot?

And the fact that the team hasn’t updated their GitHub in months? That’s not ‘quiet development.’

That’s abandonment.

And calling it a ‘creator economy’ while charging people to mint metadata? That’s not empowerment.

That’s rent-seeking with blockchain buzzwords.

They want you to think you’re decentralizing content, but the ISCN is just a backdoor for the SEC to track every blog post you ever write.

They’re using ‘DAO’ to make it look democratic, but the validators? All tied to the same VC firm.

And the zero supply? That’s because they haven’t distributed the tokens yet-because they’re waiting for the perfect moment to dump.

Don’t be fooled.

One writer I know started using LikeCoin on her blog, and within three months, she was earning more from likes than from ads.

It’s slow, it’s messy, but it’s real.

And if you’re not trying to build something that doesn’t rely on Google or Instagram’s whims? This is the only path forward.

Don’t judge it by its price. Judge it by its purpose.

It’s not much... but it felt like someone actually saw me.

❤️ Maybe that’s the real value?

Not the price chart. Not the exchange listings.

Just... being seen.

However, the current implementation suffers from a lack of tooling for non-technical users.

Without intuitive interfaces for minting, delegating, or claiming rewards, the protocol remains inaccessible to the very audience it claims to empower.

And while the liquid democracy model is theoretically sound, the absence of on-chain voter turnout metrics undermines transparency.

Until these gaps are addressed, LIKE remains a promising prototype, not a functional ecosystem.

This is about the rich hiding money in fake tokens while you chase ghosts.

They want you to believe in something that doesn’t exist so you forget your real problems.

Work harder. Save money. Don’t gamble on crypto that’s not even real.

ISCN? A cleverly disguised metadata tracker.

Liquid democracy? A facade for governance by insiders.

And the zero circulating supply? That’s not a glitch-it’s a feature.

It means the tokens are still in the dev wallets.

They’re waiting for retail FOMO to inflate the price before they exit.

And you? You’re the last sucker holding the bag while they fly to the Caymans with your $600.