DeFi vs Traditional Finance Comparison Tool

This tool compares key aspects of Decentralized Finance (DeFi) and Traditional Finance to help understand their fundamental differences.

Decentralized Finance (DeFi)

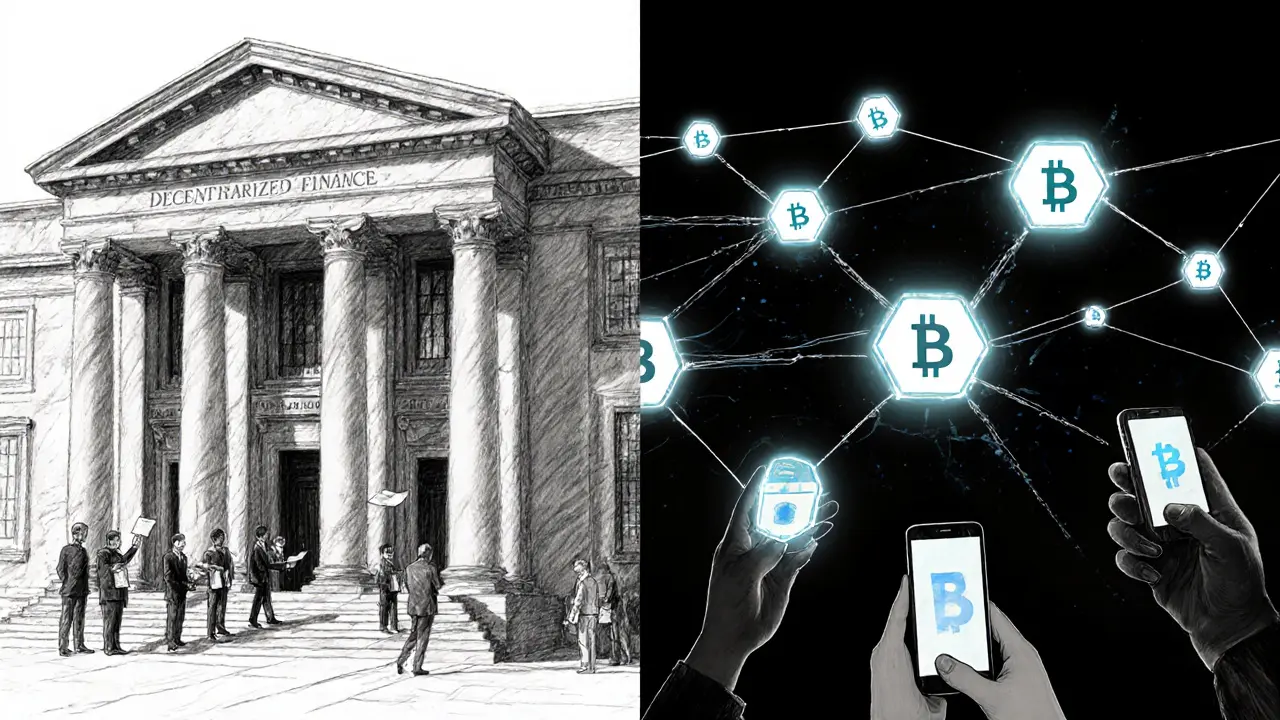

A blockchain-based financial ecosystem that replaces traditional intermediaries with open-source protocols and smart contracts.

Core ConceptTraditional Finance

Established financial systems involving banks, payment processors, and regulatory oversight.

Traditional Model| Dimension | Traditional Finance | Decentralized Finance |

|---|---|---|

| Intermediary Layer | Multiple banks, payment processors, and clearing houses | No central intermediaries; protocols enforce rules |

| Transaction Cost | ~2-3% + $0.30 per card transaction | 0.01-0.1% gas fees; often a fraction of a cent |

| Settlement Speed | 3-7 business days for cross-border transfers | Minutes, regardless of geography |

| Privacy | Extensive KYC/AML reporting; data shared with regulators | Pseudonymous on-chain activity; optional privacy layers |

| Fraud Protection | Chargebacks, guarantee schemes, insurance | Irreversible transactions; emerging insurance protocols |

Key Benefits of DeFi

- Eliminates intermediaries

- Lower transaction fees

- Instant settlement

- Borderless access

- Programmable money

Key Benefits of Traditional Finance

- Established fraud protection

- Consumer protections

- Regulatory oversight

- Wide acceptance

- Credit underwriting capabilities

Comparison Summary

DeFi offers lower costs and faster transactions but requires more technical understanding. Traditional finance provides security and familiarity but comes with higher costs and slower processing times.

decentralized finance is no longer a niche buzzword-by 2025 it’s on track to become a mainstream alternative to banks and payment processors. This article breaks down what’s changed, why businesses are jumping in, and what obstacles still need fixing.

TL;DR

- DeFi eliminates intermediaries, cutting transaction fees to fractions of traditional costs.

- Multi‑chain wallets with biometric security are now the go‑to interface for users.

- Regulators in the UK, EU, and Asia are publishing clear frameworks, easing compliance fears.

- SMEs-especially cafés, retail stores, and gig platforms-are the first wave of enterprise adopters.

- Tokenized government bonds and stablecoins will bridge the gap between DeFi and legacy finance by 2028.

What Decentralized Finance Looks Like Today

At its core, Decentralized Finance is a blockchain‑based financial ecosystem that replaces banks, brokers, and payment processors with open‑source protocols and smart contracts. In 2025 the total value locked (TVL) across major DeFi platforms ranges in the hundreds of billions, reflecting rapid growth from a speculative fringe to a viable financial layer.

Unlike traditional finance, DeFi offers instant settlement, borderless access, and programmable money that executes automatically when predefined conditions are met. Users retain full custody of assets via private keys, meaning there’s no central institution to freeze funds.

Core Technologies Powering the Shift

Three technical pillars have matured enough to support mass adoption:

- Blockchain networks now provide sub‑second finality on layer‑2 solutions, solving the scalability problems that plagued early DeFi.

- Smart contracts have become audited, upgradeable modules that can manage complex derivatives, yield farms, and loan agreements without human intervention.

- Wallets have evolved into multi‑chain hubs. Modern wallets integrate biometric login, hardware‑wallet support, built‑in swaps, staking, and cross‑protocol dashboards-all under a single user‑friendly UI.

These advances reduce the friction that earlier users complained about and bring DeFi onto par with the convenience of a mobile banking app.

DeFi vs. Traditional Finance: A Quick Comparison

| Dimension | Traditional Finance | Decentralized Finance |

|---|---|---|

| Intermediary Layer | Multiple banks, payment processors, and clearing houses | No central intermediaries; protocols enforce rules |

| Transaction Cost | ~2‑3% + $0.30 per card transaction | 0.01‑0.1% gas fees; often a fraction of a cent |

| Settlement Speed | 3‑7 business days for cross‑border transfers | Minutes, regardless of geography |

| Privacy | Extensive KYC/AML reporting; data shared with regulators | Pseudonymous on‑chain activity; optional privacy layers |

| Fraud Protection | Chargebacks, guarantee schemes, insurance | Irreversible transactions; emerging insurance protocols |

What’s Driving Mainstream Adoption in 2025?

Three forces have aligned to push DeFi out of the lab and into everyday business:

- Regulatory clarity. The UK’s FCA sandbox, the EU’s MiCA framework, and Singapore’s Money‑Tech guidelines give developers a legal runway to launch compliant products.

- Tech maturity. Layer‑2 scaling, cross‑chain bridges, and user‑centric wallet designs remove the latency and usability hurdles that early adopters faced.

- Economic pressure. Small‑to‑medium enterprises (SMEs) are bleeding money on credit‑card fees. DeFi’s near‑zero‑cost payments deliver immediate bottom‑line relief.

Industry analysts from NMI highlighted these three factors as the “tipping point” for 2025. Venture firms like a16z crypto echo the sentiment, betting that branded SMEs will become the first wave of enterprise DeFi users.

Real‑World Use Cases Emerging Now

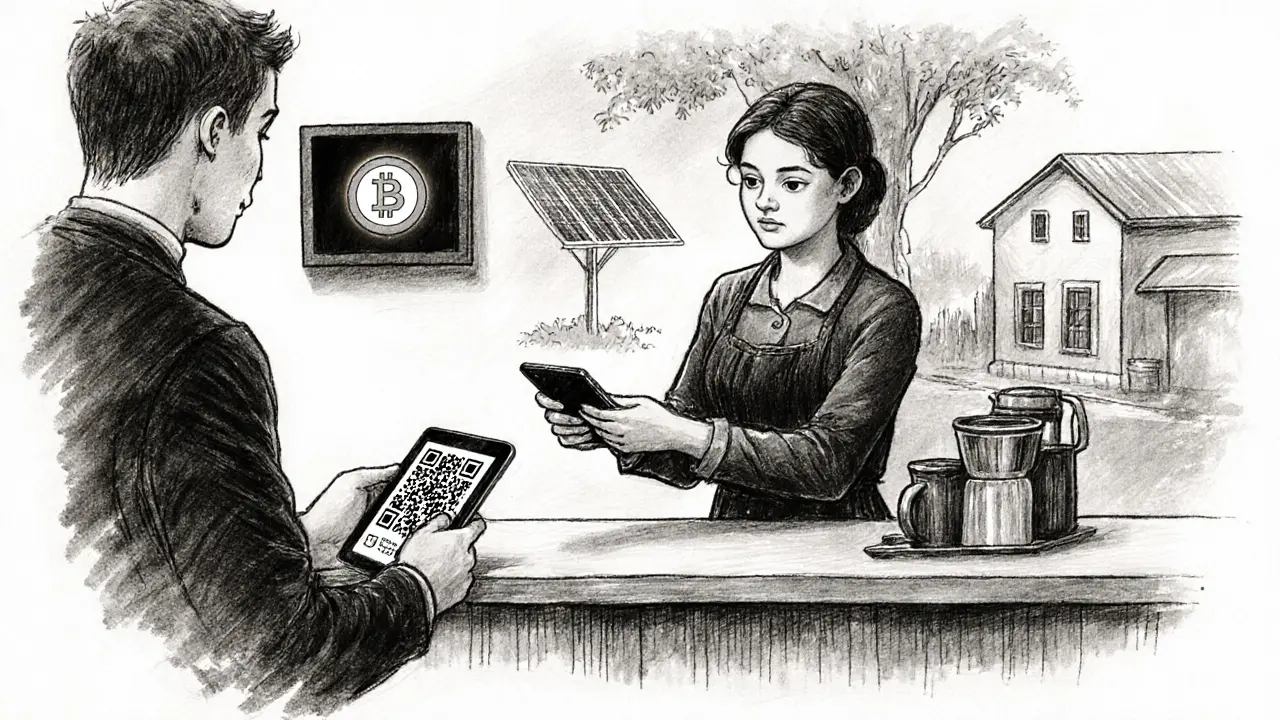

1. SME Payments - Coffee shops and corner stores are swapping card terminals for QR‑code DeFi payments. A Seattle café reported a 1.8% increase in net profit after moving 60% of its sales to a stablecoin‑based checkout.

2. Tokenized Physical Assets - Companies are issuing digital certificates for solar‑farm production, agricultural yields, and even real‑estate shares. These tokens trade on DeFi marketplaces, unlocking liquidity that traditional asset registries can’t provide.

3. Stablecoin Integration - Corporations use USD‑pegged stablecoins for cross‑border payroll. The transaction costs drop from ~2% (SWIFT) to under 0.1%, and settlement occurs in minutes.

4. Central Bank Digital Currencies (CBDCs) - Nations such as the Bahamas and Sweden have launched pilots. When a CBDC can be wrapped into a DeFi protocol, it offers a government‑backed anchor that satisfies regulators while preserving DeFi’s efficiency.

5. Tokenized Government Bonds - Tokenized government bonds are being minted on public chains, allowing DeFi lenders to use sovereign debt as collateral. This brings institutional‑grade credit quality into otherwise risk‑heavy DeFi markets.

Challenges Still Holding Back Full Adoption

Even with breakthroughs, several pain points remain:

- Steep learning curve. New users spend 2‑4 weeks just to master wallet creation and private‑key management. Advanced strategies like yield farming require 2‑3 months of focused study.

- Security concerns. Hacks targeting smart contracts and phishing attacks on private keys still dominate headlines. While hardware‑wallet adoption is rising, many users still rely on vulnerable mobile apps.

- Missing fraud guarantees. Traditional credit‑card chargebacks protect consumers; DeFi lacks an equivalent, making risky merchants hesitant.

- Regulatory patchwork. While Europe and the UK have advanced frameworks, the U.S. remains fragmented, creating uncertainty for cross‑border services.

Addressing these gaps will require industry‑wide insurance products, better UX design, and coordinated policy efforts.

Looking Ahead: 2026‑2030 and Beyond

Experts forecast a three‑phase evolution:

- 2026‑2027: Parallel ecosystems. DeFi will coexist with legacy finance, handling high‑volume, low‑margin use cases like micropayments, cross‑border remittances, and tokenized assets.

- 2028‑2029: Institutional bridge. Stablecoins backed by central banks and tokenized sovereign debt will flow into DeFi lending pools, giving the sector institutional-grade liquidity.

- 2030+: Integrated finance. Hybrid platforms will let users move seamlessly between on‑chain and off‑chain services, with regulators providing a safety net for consumer protection while preserving DeFi’s speed and cost advantages.

The World Economic Forum predicts that by 2030, at least 30% of global retail transactions could be settled on decentralized protocols, provided the regulatory and security challenges are resolved.

Practical Steps for Individuals and Businesses

Whether you’re a solo crypto enthusiast or a café owner, follow this quick checklist to start benefiting from DeFi today:

- Choose a reputable multi‑chain wallet with biometric lock and hardware‑wallet backup.

- Secure your recovery phrase offline; treat it like a passport.

- Start with a stablecoin (e.g., USDC) for payments to avoid volatility.

- Integrate a DeFi payment gateway that auto‑converts crypto to fiat if needed.

- Participate in community forums (Discord, Reddit) for real‑time support and best‑practice advice.

After you’re comfortable with basic transfers, explore liquidity provision on reputable AMM pools or lend stablecoins to earn yields that outpace traditional savings accounts.

Frequently Asked Questions

Is DeFi safe for small businesses?

Safety hinges on three factors: using a hardware‑wallet for private‑key storage, selecting audited protocols, and limiting exposure to a single stablecoin. When these steps are followed, transaction fees drop dramatically and settlement becomes near‑instant, which many cafés and retailers have already verified.

How do stablecoins differ from CBDCs?

Stablecoins are privately issued tokens pegged to a fiat basket, while CBDCs are sovereign digital versions of legal tender. Both can be used on DeFi platforms, but CBDCs carry direct regulatory backing, making them attractive for large‑scale settlements and government‑linked tokenized bonds.

What’s the biggest barrier to DeFi adoption right now?

User experience. Most people still have to learn private‑key management and navigate multiple chains. The industry is responding with better UI designs and educational resources, but the learning curve remains the top friction point.

Can I earn a comparable return on DeFi lending versus a traditional bank?

Yes, especially with USD‑pegged stablecoins. Year‑over‑year yields of 4‑7% are common on reputable platforms, outpacing most high‑yield savings accounts, while still bearing smart‑contract risk.

Will DeFi replace traditional banks entirely?

Experts see a parallel system rather than a full replacement. DeFi excels at low‑cost, fast, programmable transactions, while banks retain advantages in consumer protection, large‑scale credit underwriting, and regulatory compliance.

DeFi is really gaining steam, and it’s exciting to see how small businesses are starting to experiment with it. The lower fees and instant settlement can make a noticeable difference on the bottom line. If you’re still on the fence, try a tiny pilot with a stable‑coin payment gateway and watch the results. Keep the experiment low‑risk and you’ll learn a lot without jeopardizing cash flow.

Absolutely love the vibrant energy swirling around DeFi these days! 🌈 It’s like watching a kaleidoscope of innovation where every new protocol adds a splash of color. For anyone hungry for practical steps, start by swapping a modest portion of your cash for a reputable stablecoin – USDC or USDT – and test out a QR‑code checkout at your favorite coffee shop. You’ll be amazed at how seamless the experience feels once you get past the initial learning curve.

Look, the hype train won’t stop until people realize that most of these “new” solutions are just copy‑pasted hacks from the early 2020s. Sure, the UI looks slick, but under the hood there are still massive security gaps. If you’re not ready to lose a few thousand dollars to a flash‑loan exploit, stay put and wait for proven, audited platforms to mature.

defi can actually save ur cafe $.

Let’s be real: the market is saturated with over‑promised yield farms that barely cover the gas fees. The average small‑biz owner doesn’t have time to monitor contract upgrades and can’t afford to lose capital on a rug‑pull. It’s a dangerous gamble disguised as innovation.

Why not just stick to good old cash? All this blockchain buzz is just a fad that will fizzle out when the next regulation hits. Those “stablecoins” are as stable as a house of cards, and the whole thing feels like a tech‑hipster’s wet dream.

Hey folks, if you’re looking for a low‑risk entry point, start with a hardware‑wallet and a modest amount of USD‑pegged stablecoins. Keep the exposure limited, and you’ll get a feel for on‑chain transactions without the volatility of crypto assets. It’s a solid stepping stone before diving deeper into yield farming or decentralized lending.

One cannot overlook the philosophical implications of decentralized finance; it heralds a shift from fiduciary hegemony toward algorithmic sovereignty, a transition that resonates across economic, social, and technological spectra. The removal of intermediaries, while ostensibly a triumph of efficiency, simultaneously democratizes power, redistributing control to a collective of network participants. This diffusion of authority challenges traditional notions of trust, compelling societies to reconceptualize risk, accountability, and governance. Moreover, the programmable nature of smart contracts introduces a new legal substrate, one that operates on deterministic code rather than human discretion, thereby reshaping contractual enforcement. As we observe the burgeoning integration of multi‑chain wallets, each equipped with biometric safeguards and hardware‑wallet compatibility, the user experience converges toward the familiarity of mobile banking while retaining the core ethos of decentralization. The rise of layer‑2 solutions, delivering sub‑second finality, mitigates earlier scalability concerns, fostering broader adoption among enterprises that previously balked at latency and cost. Yet, this rapid evolution also surfaces novel vulnerabilities; audit‑free contracts can become vectors for systemic exploits, underscoring the necessity for rigorous formal verification. In parallel, regulatory frameworks emerging across the UK, EU, and Singapore aim to codify compliance pathways, offering a semblance of legal clarity without stifling innovation. These initiatives, however, must balance consumer protection with the intrinsic autonomy that defines DeFi. When viewed through the lens of economic pressure, the allure of near‑zero transaction fees presents a compelling value proposition for SMEs, whose margins are often eroded by traditional card processing costs. Consequently, tokenized assets-including sovereign bonds and real‑estate fractions-are poised to unlock liquidity reservoirs previously inaccessible to smaller market participants. In summation, the trajectory of decentralized finance is not a binary march toward total replacement of legacy systems but rather a nuanced co‑existence, wherein each paradigm leverages its strengths to address distinct market demands. The future, therefore, resides in hybrid architectures that seamlessly bridge on‑chain agility with off‑chain regulatory safeguards, crafting an ecosystem where efficiency, security, and inclusivity converge.

Honestly, the whole DeFi circus is just a playground for developers to showcase how many lines of code they can write before they break something, and most users end up watching their wallets empty faster than a meme spreads on Twitter; the lack of real‑world insurance, the perpetual risk of smart‑contract bugs, and the fact that every new protocol promises “zero fees” while quietly charging hidden gas premiums make this space a disaster waiting to happen.

I appreciate the enthusiasm surrounding DeFi, yet it’s essential to maintain a balanced perspective-while the technology offers undeniable advantages, it also carries non‑trivial risks that need thoughtful mitigation. Open dialogue and shared learning can help us navigate these complexities responsibly.

Sure, DeFi saves a few bucks, but you still have to watch your phone 24/7 for a phishing attack. Guess you’re trading one headache for another.

DeFi is the future, plain and simple. It’s not just an experiment; it’s a revolution that will change how we think about money.

From a nationalistic standpoint, it is imperative that our country leads the charge in blockchain adoption, ensuring that sovereignty over monetary policy is retained and not outsourced to foreign entities; therefore, we must invest heavily in domestic DeFi infrastructure, ignoring the frivolous criticisms of outsiders.

When you strip away the hype, what remains is a set of tools that can either empower individuals or become another layer of complexity. The key is to ask whether the benefits truly outweigh the learning curve.

Give it a try – start small, stay safe, and you’ll see the benefits. 🚀

Our nation needs to stand strong and adopt DeFi now.