Explore how multi-chain support, AI-driven iNFTs, DeFi integration, and real-world asset tokenization are reshaping NFT marketplace technology in 2025 and beyond.

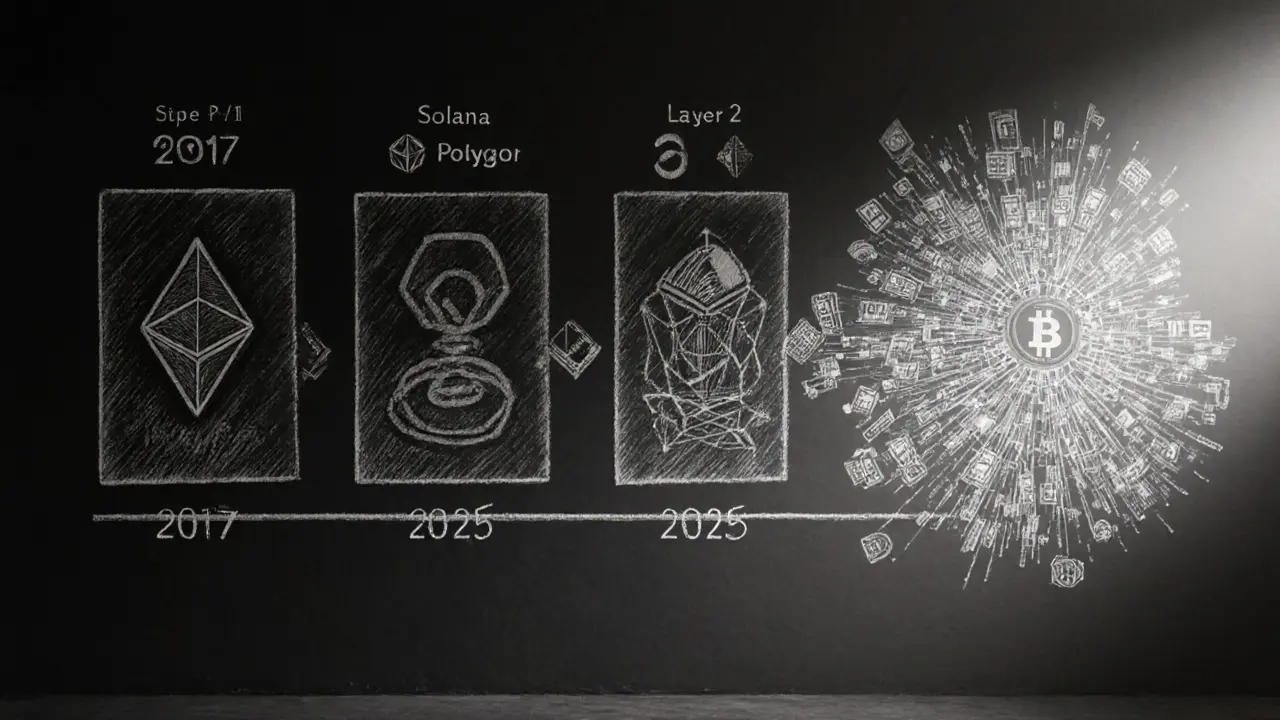

Multi-chain NFT Platforms Explained

When working with multi-chain NFT platforms, digital marketplaces that let users buy, sell, and trade NFTs across different blockchains. Also known as cross-chain NFT hubs, they bridge isolated token ecosystems so assets can move without a single-chain lock‑in.

These platforms rely on blockchain foundations to guarantee ownership and scarcity. The term blockchain, a decentralized ledger that records transactions securely provides the immutable record every NFT needs. Without that trust layer, an NFT would be just a picture, not a verifiable asset.

Why Cross-chain Technology Matters

Cross-chain bridges are the secret sauce behind multi-chain NFT platforms. A cross-chain, technology that enables data and tokens to move between separate blockchains eliminates the friction of staying on one network. This means a collector can mint on Ethereum, then list the same token on a Solana‑based marketplace without re‑minting. The result is lower fees, faster trades, and a broader audience for creators.

Because NFTs are core to many GameFi, games that blend gaming and decentralized finance projects, cross-chain capability unlocks new play‑to‑earn models. A game on Polygon can reward players with an NFT that later sells on a Binance Smart Chain marketplace, letting gamers cash out faster and at better rates. This synergy fuels both the gaming and NFT economies.

Practical benefits extend beyond fees. Multi-chain platforms often support a wider range of wallet types, from MetaMask on Ethereum to Phantom on Solana. This inclusivity broadens participation, especially for users in regions where one network dominates due to lower gas costs or local infrastructure. It also encourages developers to build tools that speak a universal NFT language rather than a single‑chain dialect.

Security is another critical link. Cross-chain bridges have historically been target points for hacks, so reputable multi-chain NFT platforms implement rigorous audits and use proven bridge designs like optimistic or zero‑knowledge proofs. When a bridge fails, the entire NFT ecosystem can suffer, so platform operators treat bridge resilience as a top priority.

From a market perspective, multi-chain NFT platforms boost liquidity. An NFT listed on multiple chains can attract bids from users who prefer one network's speed over another's security. This competition drives price discovery and reduces the slippage that often plagues single‑chain markets.

All these pieces—blockchain integrity, cross-chain bridges, GameFi integration, and security layers—come together to form a robust ecosystem. Below you’ll find a curated set of articles that dig into validator economics, airdrop mechanics, hard fork impacts, and more, all tied back to the multi-chain NFT landscape. Explore them to see how each element influences the broader picture.