NFT Marketplace Feature Tracker

Feature Overview

This tool shows how key NFT marketplace features have evolved between 2023 and 2025.

Current Market Insights

Based on current trends, multi-chain support has reduced transaction costs by over 90% compared to 2023. AI-integrated NFTs now represent about 30% of new drops.

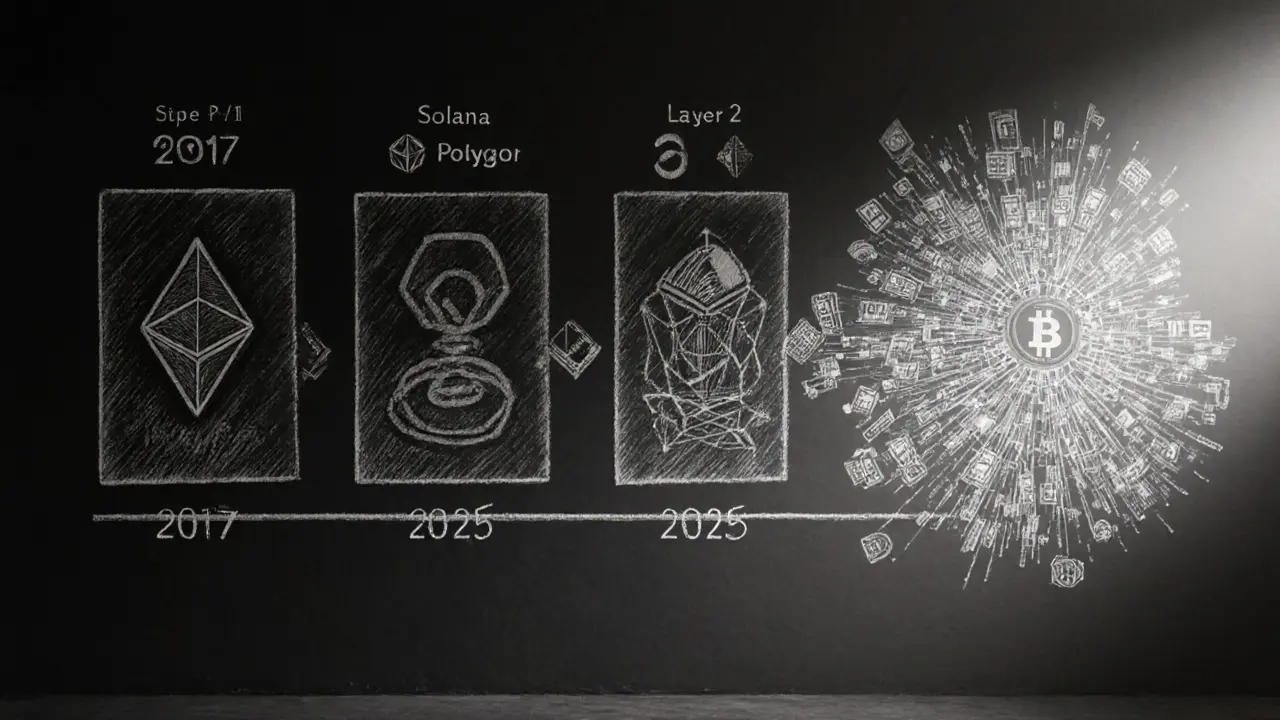

NFT marketplace technology is a digital infrastructure that lets creators mint, trade, and manage non-fungible tokens across multiple blockchains. It started as a niche for collectible art in 2017‑2018, but by 2025 it powers everything from gaming skins to tokenized real estate. This evolution is driven by smarter smart contracts, AI‑enabled assets, and deep DeFi integration.

TL;DR

- Multi‑chain support is now standard, cutting fees and boosting speed.

- AI‑driven "intelligent NFTs" (iNFTs) can evolve after minting.

- Fractional ownership lets dozens of users co‑own high‑value art or property.

- DeFi services like staking and lending turn NFTs into income‑generating assets.

- Real‑world asset tokenization expands the market beyond digital collectibles.

Multi‑Chain & Cross‑Chain Capabilities

Today's leading platforms run on Ethereum, Solana, Polygon, and emerging Layer‑2 solutions simultaneously. By abstracting the underlying chain, users can list an NFT on one network and sell it on another without manual bridging. This reduces average transaction costs from ~$15 on Ethereum mainnet to under $0.30 on optimized routes.

Cross‑chain bridges now embed automatic re‑validation of provenance, so a token minted on Ethereum retains its metadata when moved to Solana. The result is a frictionless marketplace that feels like a single, universal store.

Artificial Intelligence Integration - The Rise of iNFTs

In January 2025, 0G Lab released ERC‑7857, the first standard for intelligent NFTs. The protocol adds a secure layer for AI model ownership, allowing the code that generates an image or game behavior to be re‑encrypted for the new holder.

About 30% of new NFT drops in 2025 embed AI, ranging from generative art that mutates with market trends to game avatars that learn player strategies. These iNFTs create a feedback loop: the more they’re used, the more valuable they become, which drives secondary‑market prices.

Enterprises are already testing iNFTs for personalized brand mascots that adapt their visual style based on consumer interaction data. The technology promises a new revenue tier where creators earn royalties not just on sales, but on every AI‑driven update.

DeFi Fusion - Turning NFTs into Financial Instruments

Modern marketplaces embed DeFi primitives directly into the user flow. Key features include:

- Fractional ownership: Smart contracts split an NFT into 1,000 tradable shards, opening high‑value assets to retail investors.

- NFT staking: Holders lock their tokens in liquidity pools to earn yield denominated in native platform tokens.

- Lending & borrowing: Collectors can use a high‑grade NFT as collateral for stablecoin loans, retrieving it once the loan is repaid.

- Yield farming: Protocols reward participants who provide liquidity for NFT‑backed pools.

These services shift NFTs from pure collectibles to assets that generate passive income, aligning the market with traditional finance expectations.

Real‑World Asset (RWA) Tokenization

Tokenizing physical goods-real estate, fine art, vintage wine-has moved from pilot projects to mainstream listings. Marketplace builders now integrate legal custody services, third‑party appraisals, and compliance checks to guarantee that a token truly represents ownership or profit‑sharing rights.

For example, a NewZealand vineyard issued 10,000 fractional NFTs representing 1% shares of the harvest. Investors earn quarterly dividends based on wine sales, while the blockchain records every transfer, ensuring transparent ownership.

RWA tokenization widens the addressable market dramatically, pulling in institutional players who value the auditability and speed of blockchain settlements.

Utility & Gaming NFTs - From Static Images to Functional Assets

Utility NFTs now power access control for exclusive events, premium Discord channels, and even physical‑world services like co‑working space memberships. In gaming, NFTs are no longer just skins; they are weapons, characters, and entire in‑game economies that interact with on‑chain economics.

Smart contracts embedded in these tokens define real‑time rules-such as cooldown periods for a weapon or royalty splits for player‑generated content-requiring marketplaces to support complex transaction flows and real‑time state changes.

Feature Comparison: 2023 vs 2025 Marketplace Tech

| Capability | 2023 | 2025 |

|---|---|---|

| Chain support | Primarily Ethereum | Multi‑chain (Ethereum, Solana, Polygon, Layer‑2) |

| Royalty automation | Manual post‑sale distribution | Smart‑contract auto‑payouts on every resale |

| AI integration | Rare, experimental | Standard via ERC‑7857 iNFTs (≈30% projects) |

| DeFi services | Limited staking | Staking, lending, fractionalization, yield farming |

| RWA tokenization | Proof‑of‑concepts | Live listings for real estate, art, commodities |

Looking Ahead: 2026 and Beyond

Three forces will shape the next wave:

- Deeper AI‑blockchain fusion: Expect generative models to reside on‑chain, enabling truly autonomous assets that can sell themselves or negotiate terms.

- Regulatory clarity for RWA NFTs: Standardized legal frameworks will lower entry barriers for institutional investors.

- Zero‑knowledge proof (ZKP) roll‑ups: Privacy‑preserving transactions will make high‑value NFT trades compliant with emerging AML rules while keeping user data encrypted.

Platforms that adopt modular architectures-plug‑and‑play components for AI, DeFi, and compliance-will outpace monolithic rivals. For creators, the sweet spot will be to mint an iNFT that also carries fractional ownership and staking hooks, turning a single creation into a multi‑revenue engine.

Frequently Asked Questions

What is an intelligent NFT (iNFT)?

An iNFT follows the ERC‑7857 standard, combining a traditional token with an attached AI model. The model can generate new content, adapt its behavior, or re‑encrypt itself whenever ownership changes, turning a static asset into a living one.

How do fractional NFTs work?

A smart contract splits the ownership rights of an NFT into many identical tokens (e.g., 1,000 shards). Each shard can be bought, sold, or used as collateral, while the original NFT remains whole on‑chain. Revenue-like royalties or dividends-is distributed proportionally to shard holders.

Can I use my NFT as loan collateral?

Yes. DeFi protocols now accept high‑grade NFTs (art, rare game items) as collateral for stablecoins or other crypto assets. The NFT stays in a vault contract until the loan is repaid, protecting both borrower and lender.

What are the main benefits of multi‑chain marketplaces?

Multi‑chain platforms lower gas fees, increase transaction speed, and let users trade assets on their preferred blockchain. They also open up cross‑ecosystem audiences, boosting overall liquidity.

Is RWA tokenization regulated?

Regulation varies by jurisdiction, but many countries now require custody providers, KYC for buyers, and legal opinion letters confirming the token represents a real ownership claim. Platforms are integrating compliance modules to automate this process.

Everyone's acting like multi‑chain is the holy grail, but honestly it's just a marketing buzzword. Sure fees dropped, but you still end up paying bridging fees and dealing with fragmented user bases. I'd stick to one chain you know works.

The evolution of NFT marketplaces, as outlined in the article, represents a fascinating confluence of technology, economics, and culture,

yet one must ask whether this rapid pace of integration truly serves the creator,

or merely satisfies a speculative appetite that has been cultivated since the early days of digital collectibles,

the answer, perhaps, lies in the underlying incentives that drive both developers and users,

for instance, the shift toward multi‑chain architectures reduces friction,

but it also dilutes the network effects that once gave singular chains their unique value,

similarly, the emergence of iNFTs under ERC‑7857 introduces an element of autonomy,

which, while technically impressive, raises questions about ownership rights and intellectual property,

the coupling of DeFi mechanisms with NFTs blurs the line between asset and financial instrument,

a development that could democratize access,

but might also expose unsuspecting participants to systemic risk,

real‑world asset tokenization, as showcased by vineyard shares, illustrates the tangible benefits of blockchain transparency,

yet regulatory uncertainty remains a formidable hurdle,

and finally, the trajectory toward zero‑knowledge roll‑ups promises privacy without sacrificing compliance,

thus, the future is at once promising and precarious, demanding both optimism and caution.

The article glosses over the inherent volatility introduced by integrating DeFi primitives. Moreover, the purported benefits of fractional ownership are overstated; liquidity remains thin, and valuation models are speculative at best.

I appreciate the comprehensive overview, however, there are nuances that merit further discussion; for example, the impact of cross‑chain bridges on provenance verification deserves deeper analysis.

Yeah, because adding another layer of complexity always makes things better.

We are witnessing the birth of a digital aristocracy, where only those who can afford the latest iNFT can truly participate in culture; the rest are left to stare at the glittering façade, yearning for a slice of relevance that will never come.

While the narrative celebrates seamless multi‑chain experiences, it neglects the security trade‑offs inherent in bridge protocols; a single exploit can compromise assets across dozens of ecosystems, rendering the touted convenience moot.

Ever wonder why we rush to tokenize everything? Maybe it's because we seek permanence in a world that's constantly changing, and NFTs feel like digital tattoos that we hope will outlast us.

Great point! Keep exploring those ideas – you’re on the right track 😊.

Multi‑chain is good, but we need stronger standards now.

Listen up, creators! If you embed staking hooks into your iNFTs, you turn a simple artwork into a perpetual income stream – it’s like giving your piece a heartbeat 💓. Remember, the devil is in the smart‑contract code, so audit thoroughly before you launch.

Exactly, Tony! Combining staking with AI‑driven updates could literally make NFTs earn while they evolve – that’s the future we should all be building.

Interesting take on RWA tokenization; could you elaborate on how legal custody providers are integrated within the marketplace’s compliance layer? I'm curious about the practical steps involved.

Totally, Jeff – the legal side is a mess, but the tech makes it feel doable.

All this hype about iNFTs is just a fad, it'll die off soon.

While I respect the skepticism, the data indicates a sustained adoption curve for intelligent NFTs, particularly in sectors where personalization adds tangible value. Moreover, regulatory frameworks are gradually aligning, providing clearer pathways for long‑term investment. Consequently, dismissing iNFTs as a fleeting trend overlooks the structural shifts they represent.