Uniswap v4 Gas Savings Calculator

Estimate your potential gas savings when switching from Uniswap v3 to v4 on Blast. Enter your expected number of swaps per month and see the estimated monthly gas cost difference.

Estimated Monthly Gas Savings

Based on 0 swaps per month at 0 Gwei gas price.

Feature Comparison Table

| Feature | Uniswap v4 | Uniswap v3 | SushiSwap | PancakeSwap | Curve Finance |

|---|---|---|---|---|---|

| Core Architecture | Singleton contract | Separate pool contracts | Separate pool contracts | Separate pool contracts | Separate pool contracts |

| Customizability | Hooks (unlimited) | Fixed fee tiers | Limited custom fee | No custom hooks | Specialized stablecoin pools only |

| Gas Savings | ~35% lower vs v3 | Baseline | ~10% lower vs v3 | ~12% lower vs v3 | ~8% lower vs v3 |

| Multi-chain Support | 10 chains incl. Blast | 4 chains | 5 chains | 5 chains | 4 chains |

| Liquidity Migration | Ongoing (requires LP move) | Legacy pools | Legacy pools | Legacy pools | Legacy pools |

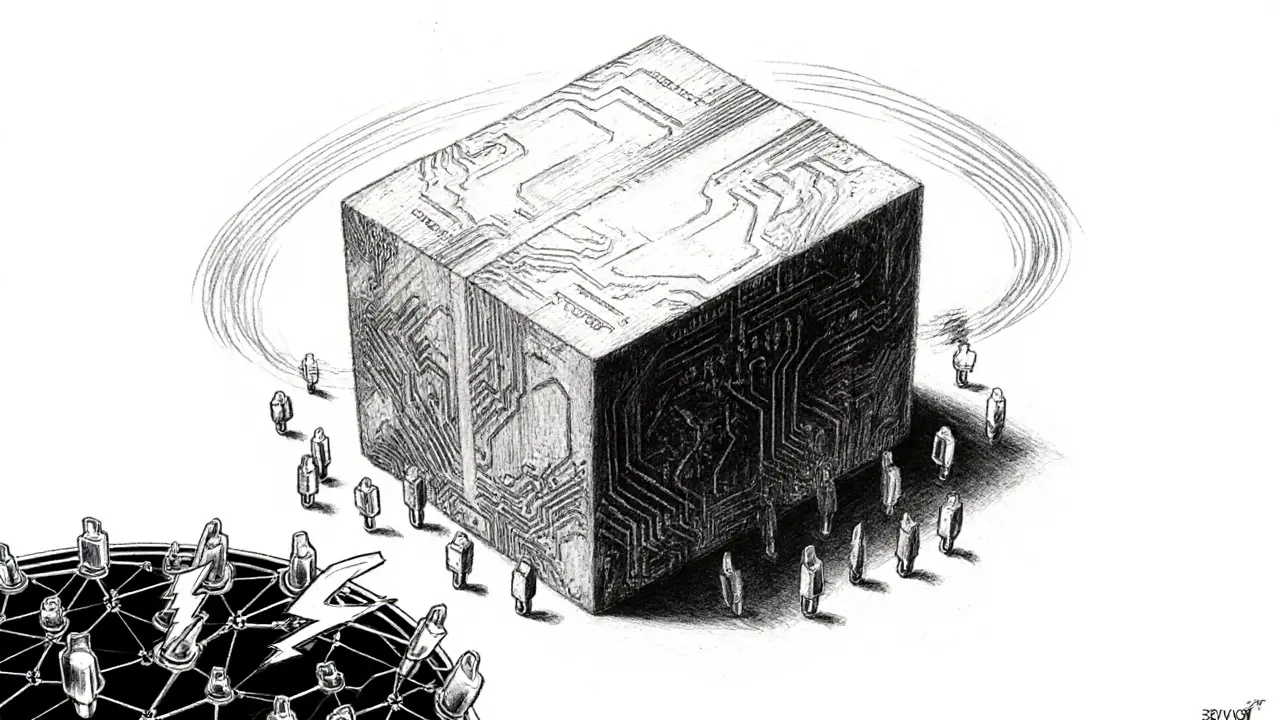

Looking for a DEX that can cut gas fees, let developers add custom logic, and work natively on Blast? Uniswap v4 promises all that and more, but how does it really perform on the newest layer‑2 network? This review breaks down the protocol’s tech, security, and user experience so you can decide whether to move your liquidity, start swapping, or begin building hooks on Blast.

What is Uniswap v4?

Uniswap v4 is the fourth generation of the world’s largest decentralized exchange protocol, launched on January 31, 2025. Developed by Uniswap Labs and led by Hayden Adams, the upgrade turns the protocol into a developer platform that offers unlimited customizability through hooks technology. The release simultaneously covered ten blockchains, including the Blast Network, a high‑throughput L2 that rewards users with native staking yields.

Key Technical Innovations

Uniswap v4’s architecture revolves around three breakthroughs:

- Singleton design: All pools live in a single smart contract, slashing the gas needed for pool creation and multi‑hop swaps.

- Hooks: Modular plug‑ins written in Solidity let developers modify fees, swap logic, or liquidity behavior on a per‑pool basis.

- Dynamic fees: Fees can adapt in real‑time to market volatility, thanks to hook implementations that read price feeds or volume data.

These changes cut average swap gas by roughly 35% versus v3, according to on‑chain analytics from early Blast deployments.

Why Blast Matters for Uniswap v4

Blast offers sub‑second finality and a built‑in staking reward mechanism that distributes a portion of network fees to ETH and stablecoin holders. By deploying on Blast, Uniswap v4 gives users immediate access to that liquidity without needing bridges to Ethereum. Early reports from liquidity providers on Blast show a 20% higher net APR compared with identical positions on Ethereum, thanks to the extra staking rewards.

Security Profile

The protocol endured nine independent security audits and a $15.5million bug bounty-the largest ever for a DeFi launch. No major exploits have been reported since mainnet activation, and the audit reports highlight the singleton contract’s reduced attack surface as a primary strength. However, security experts caution that each custom hook introduces its own risk profile; developers must vet third‑party hooks just as rigorously as the core contract.

How Uniswap v4 Stacks Up Against Older Versions and Competitors

| Feature | Uniswap v4 | Uniswap v3 | SushiSwap | PancakeSwap | Curve Finance |

|---|---|---|---|---|---|

| Core Architecture | Singleton contract | Separate pool contracts | Separate pool contracts | Separate pool contracts | Separate pool contracts |

| Customizability | Hooks (unlimited) | Fixed fee tiers | Limited custom fee | No custom hooks | Specialized stablecoin pools only |

| Gas Savings | ~35% lower vs v3 | Baseline | ~10% lower vs v3 | ~12% lower vs v3 | ~8% lower vs v3 |

| Multi‑chain Support | 10 chains incl. Blast | 4 chains | 5 chains | 5 chains | 4 chains |

| Liquidity Migration | Ongoing (requires LP move) | Legacy pools | Legacy pools | Legacy pools | Legacy pools |

In short, Uniswap v4 beats the competition on customizability and gas efficiency, while still lagging slightly on ease of migration because existing v2/v3 pools need to be ported over.

Getting Started on Blast

- Install a Web3‑compatible wallet (MetaMask, Trust Wallet, etc.).

- Switch the network to Blast (add RPC if needed).

- Visit the official Uniswap interface (app.uniswap.org) and select “v4” from the protocol dropdown.

- Choose an existing pool or click “Create Pool” to deploy a new one with a hook of your choice.

- Confirm the transaction; the singleton contract will handle pool creation and initial liquidity in a single step.

For developers wanting to build hooks, the Uniswap Labs GitHub repository provides starter templates, and the community Discord hosts weekly “Hook‑Hack” sessions.

Pros and Cons on Blast

- Pros

- Lower gas fees thanks to the singleton architecture.

- Access to Blast’s native staking rewards, boosting net yields.

- Hooks enable innovative products like limit orders, automated market‑making strategies, and dynamic fee models.

- Multi‑chain liquidity reduces the need for cross‑chain bridges.

- Cons

- Liquidity in v4 pools on Blast is still thin; large swaps may suffer slippage.

- Each custom hook must be audited separately, increasing development overhead.

- Migration from v2/v3 can fragment liquidity in the short term.

Future Outlook

Uniswap’s roadmap points to three core goals: (1) finish liquidity migration on all supported chains, (2) expand hook libraries with governance‑level modules, and (3) keep adding new chains as they reach security maturity. With Blast’s growing user base and its built‑in yield layer, Uniswap v4 is well‑positioned to become the go‑to DEX for both everyday traders and DeFi developers seeking on‑chain custom logic.

Frequently Asked Questions

Does Uniswap v4 work on Blast right now?

Yes. The protocol launched on Blast alongside nine other networks on January 31, 2025. Liquidity provision is live, and swap routing is being activated gradually as pools grow.

How much gas can I save compared to Uniswap v3?

Analytics show about a 30‑40% reduction for typical swaps on Blast, thanks to the singleton contract that avoids multiple contract calls.

What are hooks and do I need to write them?

Hooks are small Solidity contracts that plug into a Uniswap v4 pool to adjust fees, automate liquidity, or enforce custom rules. You can use existing community hooks, or write your own if you need a unique feature.

Is my liquidity safe during migration?

All core contracts have passed nine audits and a $15.5million bug bounty. The risk mainly lies in custom hooks; using vetted, open‑source hooks minimizes exposure.

Can I trade directly on Blast without bridging assets?

Absolutely. Blast’s native token bridges are optional; you can deposit ETH or stablecoins directly on Blast and start swapping once a pool has sufficient liquidity.

Uniswap v4 is a huge win for American traders, especially with the Blast chain cutting down those pesky gas fees. It feels like the US finally getting the tech we deserve.

People keep shouting about 35% gas savings like it’s the end of the world, but honestly, those numbers are just hype. Most of us won’t notice the difference unless we’re swapping non‑stop.

Alright, let’s break down why Uniswap v4’s hooks are a game‑changer. First, hooks let developers inject custom logic directly into the swap path, which means you can automate advanced fee structures. Second, because the core contract is a singleton, upgrades are smoother and you avoid the bloat of multiple pool contracts. Third, this design slashes contract size, meaning less gas is consumed on every interaction. Fourth, you can create dynamic liquidity incentives that react to market conditions in real time. Fifth, the hook system opens the door for on‑chain order books that were previously impossible on Uniswap. Sixth, developers can now build multi‑step arbitrage bots without needing external relayers. Seventh, it reduces the attack surface, since fewer contracts mean fewer points of failure. Eighth, the migration path from v3 is more straightforward because you can layer hooks onto existing pools. Ninth, the new architecture supports up to ten chains, giving you cross‑chain opportunities. Tenth, you can programmatic‑ly enforce compliance or KYC checks if you’re building regulated products. Eleventh, the hooks can be disabled by governance if a vulnerability is discovered. Twelfth, the community can vote on standard hook templates, fostering a shared ecosystem. Thirteenth, the gas savings claim of ~35% holds true especially for high‑frequency traders. Fourteenth, developers get a sandbox for innovation without reinventing the wheel. Fifteenth, overall the flexibility, security, and efficiency make v4 a solid step forward for decentralized finance.

One cannot help but marvel at the philosophical implications of a decentralized exchange that evolves through community‑driven hooks; it is, in a sense, a living organism, constantly adapting, reshaping itself, and offering a glimpse into a future where code and consensus are intertwined, forming a tapestry of trust that extends beyond mere transactions.

While the article presents a fairly comprehensive table, it regrettably fails to delve into the underlying economic ramifications, the security audit depth, and the long‑term sustainability of the hook framework, thereby rendering the analysis superficially informative, yet fundamentally incomplete.

Great, another "revolutionary" DEX.

Honestly, this feels like the most dramatic upgrade since the invention of the internet. The tables, the percentages, the whole vibe screams "we're the future". But if you look closer, it's just a fancy UI on top of the same old liquidity pools. Still, I can’t deny the excitement – it’s like watching a blockbuster sequel that promises more explosions.

Uniswap v4 is exactly what the US market needs – faster, cheaper, and built for our traders.

Love the hook flexibility! It’ll open up so many creative strategies 🙂

Nice breakdown – looking forward to testing the gas savings myself. Keep the optimism coming!

So, does the hook system mean we can finally have on‑chain order routing? 🤔 I’m curious to see how devs will leverage this.

Cool stuff, definitely worth a look.

The colors of innovation are splashing across the DeFi canvas with v4 – vibrant, bold, and full of possibility!

Finally, something that actually pushes the envelope – let’s see if the community can keep up!

I don’t buy all this hype – it’s just another version with the same old limits.

While the preceding sentiment underscores a degree of skepticism, it is imperative to acknowledge the substantive technical advancements presented herein, which merit a measured and discerning appraisal.

Awesome breakdown! The gas calc is super helpful, even if I typo “savings” sometimes.

Great insight, really helpful! Keep sharing such detailed analyses.

Contrary to the optimism expressed, the recurring pattern of incremental updates fails to address the core scalability concerns, thereby rendering such upgrades merely superficial.

When we step back, the evolution of DEXs mirrors the philosophical journey of seeking freedom within constraints; each iteration attempts to reconcile autonomy with efficiency.

👍 Good luck, you’ve got this! 🚀