Tornado Cash was sanctioned by the U.S. government for enabling money laundering, then un-sanctioned after a court ruled code can't be blocked. But its creator is still facing criminal charges. Here's what really happened-and what it means for crypto privacy today.

Crypto Regulations, DeFi, and Meme Coins in November 2025: What Happened and What It Means

When you look at the crypto world in crypto regulations, government rules that control how exchanges, banks, and users interact with digital assets. Also known as digital asset oversight, these rules are now shaping who can trade, where, and under what conditions. In November 2025, regulators didn’t just watch—they acted. Japan’s FSA tightened its grip with mandatory 95% cold storage, while the Philippines SEC blacklisted 15 exchanges for operating without licenses. Meanwhile, the U.S. court overturned Tornado Cash’s sanction, but its creator still faces prison. This isn’t about ideology—it’s about control. And the crypto industry is scrambling to keep up.

Behind the headlines, DeFi lending protocols, platforms that let you lend crypto for interest or borrow against it without banks. Also known as decentralized finance platforms, they’re changing how money moves. Anzen Finance’s USDZ offered 16% APY by backing its stablecoin with private credit loans, not cash. That’s riskier than USDC, but it’s real yield in a world where traditional banks pay less than 1%. At the same time, platforms like Aave and Compound kept running, proving that decentralized lending isn’t going away—it’s just getting more complex. And then there’s the flip side: meme coins. Baby Moo Deng, Jager Hunter, and HarryPotterTrumpSonic100Inu weren’t projects—they were distractions. No team, no utility, no future. Just hype, pump-and-dumps, and wallets emptied by people chasing fast money.

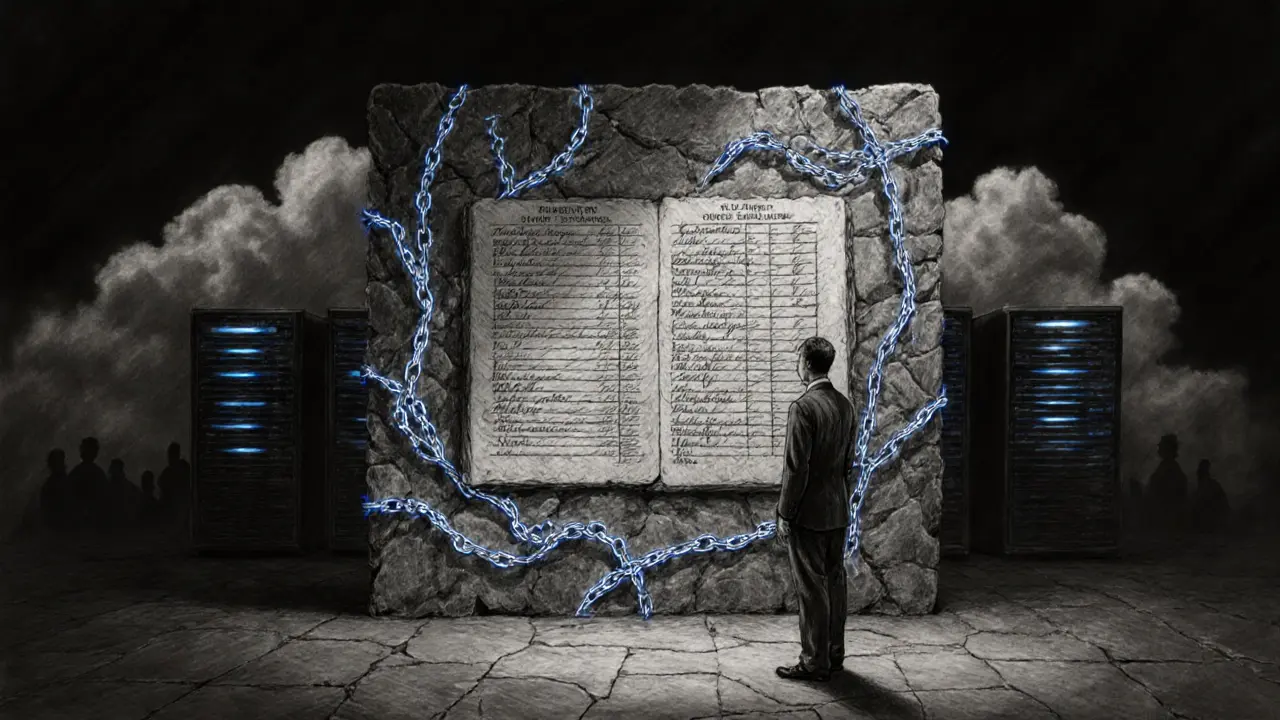

What ties all this together? blockchain scalability, how blockchains handle more transactions without slowing down or costing more. Also known as network performance solutions, it’s the silent backbone of everything else. If Ethereum couldn’t handle Layer 2 rollups, none of these DeFi apps or meme coins would exist. If Bitcoin still relied only on Proof of Work without sidechains, mining wouldn’t be legal in Russia to bypass sanctions. Scalability isn’t a tech buzzword—it’s the reason any of this works at all. And in November 2025, the gap between what’s possible and what’s practical got wider. Exchanges like mSamex and Bitroom vanished into thin air because they skipped transparency. Others, like Nash and Tokenlon, stayed alive by being simple, secure, and honest.

What you’ll find here isn’t a list of headlines. It’s a record of what actually happened. From the failed BNU airdrop to the real-world impact of ECDSA signatures, from how on-chain tracing catches criminals to why DCA still beats lump sum for most people. No fluff. No hype. Just facts, risks, and what you need to know before you next click "invest."

CrescentSwap is a niche Arbitrum-based DEX focused on trading Moonlight MNLT and other native tokens. Low fees, no KYC, but thin liquidity and no support. Best for experienced DeFi users, not beginners.

Japan's FSA enforces the world's strictest crypto exchange rules, from 95% cold wallet mandates to securities-level oversight. Learn how licensing, taxation, and new FIEA rules shape the market in 2025.

Regulatory capital requirements ensure banks survive financial shocks. In 2025, these rules are being tested by blockchain and DeFi - which operate without capital buffers. Learn how Basel III works, why crypto is changing the game, and what’s coming next.

Cryptocurrency scalability solutions like Layer 1 upgrades and Layer 2 Rollups are helping blockchains handle thousands of transactions per second. Learn how Ethereum, Bitcoin, and others are solving speed and cost issues without sacrificing security.

Tokenlon is a decentralized crypto exchange offering flat 0.30% fees, no KYC, and LON token discounts. Ideal for self-custody users who want simple, secure token swaps without third-party control.

ECDSA secures Bitcoin and Ethereum transactions using elliptic curve cryptography. Learn how it works, why Bitcoin uses SHA-256 and Ethereum uses Keccak-256, and why randomness is critical to its security.

On-chain crypto transaction tracing uses blockchain transparency to track funds across networks. Learn how heuristics, rules, and AI detect illicit flows-and where tracing still fails.

Baby Moo Deng (BABYDENG) is a meme coin on Solana named after a viral hippopotamus. It has no utility, no team, and no long-term value - just hype and extreme price swings. Buy only if you can afford to lose it.

Blockchain-as-a-Service lets businesses use blockchain technology without managing the infrastructure. Learn how it works, who uses it, and why it's changing supply chains, finance, and logistics - without needing a crypto expert.

Nash crypto exchange offers a secure, non-custodial way to buy and spend crypto with fiat in Europe. With a debit card, IBAN account, and 1% purchase fee, it's ideal for safety-focused users-but low liquidity limits large trades.

Jager Hunter (JAGER) is a BNB Chain meme coin that rewards holders with automatic payouts every 10 minutes if they hold at least 146 billion tokens. Learn how it works, its risks, and whether it's worth your money.