Swiss banks lead in regulated crypto services with secure custody, institutional-grade security, and proactive regulation. Learn how they handle crypto assets safely under FINMA oversight.

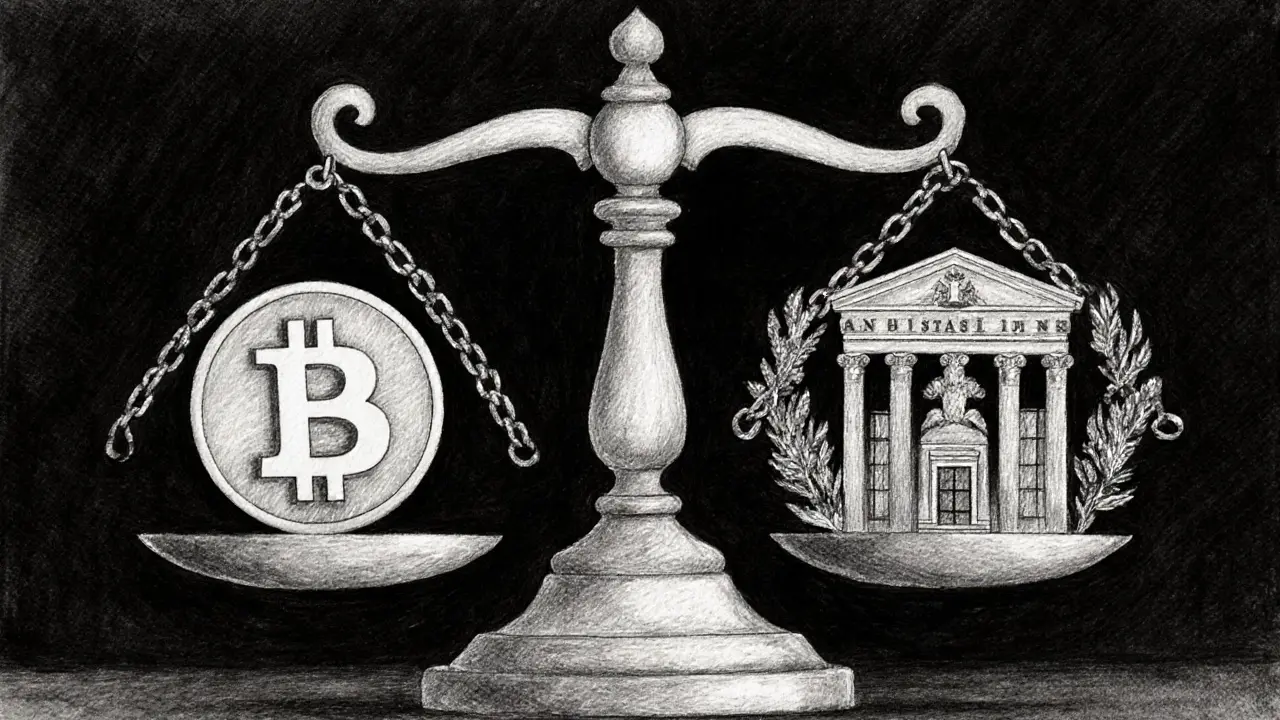

Swiss Crypto Banking: The New Frontier for Digital Wealth

When working with Swiss crypto banking, the blend of Switzerland’s banking tradition with crypto asset services, offering secure custody, compliance‑ready wallets, and tailored investment products. Also known as Swiss crypto banking services, it bridges fiat and digital wealth.

Crypto exchanges, platforms where users buy, sell, and trade digital tokens are a key pillar of this ecosystem. Swiss banks partner with reputable exchanges to let clients move funds in and out without leaving the regulated environment. This partnership reduces friction, keeps AML checks in place, and gives traders the confidence of a traditional bank’s insurance backing.

Regulatory compliance, the set of laws, AML/KYC rules, and licensing requirements that financial institutions must follow drives every service a Swiss crypto bank offers. From FATF guidance to FINMA’s licensing framework, banks design custody solutions that satisfy both Swiss law and global standards. The result is a trusted gateway for institutional investors who can’t risk the gray‑area services of offshore providers.

Why It Matters for Investors

Swiss crypto banking isn’t just a buzzword; it’s a practical answer to the security concerns that haunted early crypto adopters. By storing private keys in insured vaults, offering multi‑signature custody, and providing granular reporting for tax authorities, these banks turn crypto into a legitimate asset class. Swiss crypto banking therefore attracts high‑net‑worth individuals who seek the stability of Swiss banking while accessing the upside of digital assets.

Wealth management, personalized advisory services that allocate assets across traditional and crypto portfolios expands under this model. Advisors can now suggest token‑based exposure alongside stocks, bonds, and real estate, all within a single statement. This integrated view simplifies portfolio rebalancing, tax planning, and risk monitoring for clients who want a holistic financial picture.

DeFi also finds a foothold in Swiss crypto banking. DeFi, decentralized finance protocols that operate without intermediaries offers yield‑generating products that banks can wrap in custodial wrappers. By providing audited access to lending pools, staking services, and synthetic assets, Swiss banks let users earn crypto yields without exposing them to raw smart‑contract risk.

The synergy between these entities creates a virtuous cycle: crypto exchanges feed liquidity, regulatory compliance builds trust, wealth managers add strategic depth, and DeFi injects innovation. Together they form a robust infrastructure that supports both retail traders and institutional players looking to diversify into digital assets.

In practice, a client might open a Swiss crypto‑ready account, move BTC from a major exchange into the bank’s cold‑storage wallet, let a wealth manager allocate 10 % of the portfolio to a curated DeFi yield fund, and receive a quarterly report that satisfies Swiss tax authorities. This end‑to‑end workflow illustrates how the ecosystem removes the old pain points of custody, reporting, and legal exposure.

Below you’ll find a curated set of articles that break down each piece of the puzzle. From detailed exchange reviews and airdrop safety tips to deep dives on tokenomics and staking economics, the collection gives you the knowledge you need to navigate Swiss crypto banking confidently.