Swiss Crypto Bank Comparison Tool

Matching Swiss Crypto Banks

Results based on your selected criteria

Choose filters to see matching banks

Switzerland isn't just famous for its chocolate and mountains-it's a global leader in Swiss crypto banking. But how do Swiss banks manage to offer secure crypto services while staying compliant? The answer lies in their proactive regulatory approach and institutional-grade security measures. Let's explore how these banks handle cryptocurrency custody and services safely.

Switzerland's Regulatory Edge in Crypto Banking

When it comes to cryptocurrency, Switzerland has set the global standard for regulation. Instead of creating entirely new laws for digital assets, Swiss authorities apply existing financial market legislation with clear guidance from FINMA is Switzerland's financial market regulatory authority that provides clear guidelines for cryptocurrency services under existing financial legislation.. This technology-neutral approach allows banks to offer services like custody, trading, and staking under strict oversight. Unlike other countries struggling with unclear rules, Switzerland's framework has been in place for over five years, giving banks a head start in building compliant solutions.

Leading Swiss Crypto Banks and Their Services

Bitcoin Suisse is a pioneer in institutional custody, offering its proprietary Bitcoin Suisse Vault with cryptographic and physical security measures. The platform supports over 40 blockchain protocols and allows staking on 10 major networks including Ethereum and Solana.

Sygnum Bank expanded its services in August 2025 to include custody, trading, and lending for the SUI token. This move made regulated investors in Switzerland able to hold, trade, and borrow against SUI under Swiss financial regulations.

Amina Bank became the first regulated bank globally to support the Sui blockchain's native token, offering both trading and custodial services. The bank also provides specialized banking packages for startups and stablecoin rewards programs for EURC and USDC holdings.

Swissquote offers crypto trading and investment products tailored for retail clients, focusing on seamless integration with traditional banking services.

| Bank | Key Services | Supported Tokens | Security Features |

|---|---|---|---|

| Bitcoin Suisse | Custody, trading, staking, API access | 40+ blockchains, 10 staking protocols (ETH, SOL, ADA, etc.) | Physical and cryptographic security, keys in Switzerland, EMP protection |

| Sygnum Bank | Custody, trading, lending, staking | SUI, ETH, BTC, and others | Regulated under Swiss law, institutional-grade security |

| Amina Bank | Custody, trading, staking, lending, startup banking | SUI (first regulated bank to support), stablecoins | Regulated, GDPR-compliant, AML/KYC measures |

| Swissquote | Trading, investment products | BTC, ETH, major altcoins | Traditional banking security standards, retail-focused |

Institutional-Grade Security Measures

Swiss crypto banks prioritize security above all else. Bitcoin Suisse's custody experts use predictive threat assessment to stay ahead of cyber threats. Their systems are designed to withstand electromagnetic pulse interference, ensuring assets remain safe even during extreme events. All banks comply with GDPR for data privacy and implement strict KYC and AML checks to prevent financial crime. This level of security is why institutions trust Swiss banks for crypto custody.

Market Activity and Institutional Demand

When Sygnum and Amina announced SUI token support in August 2025, trading volume doubled to 36.45 million tokens daily compared to the previous average of 14.31 million. The SUI price rose 4% to $3.82 as buyers defended a key support zone between $3.72 and $3.74. This market response shows strong institutional demand for regulated crypto access through Swiss banking channels.

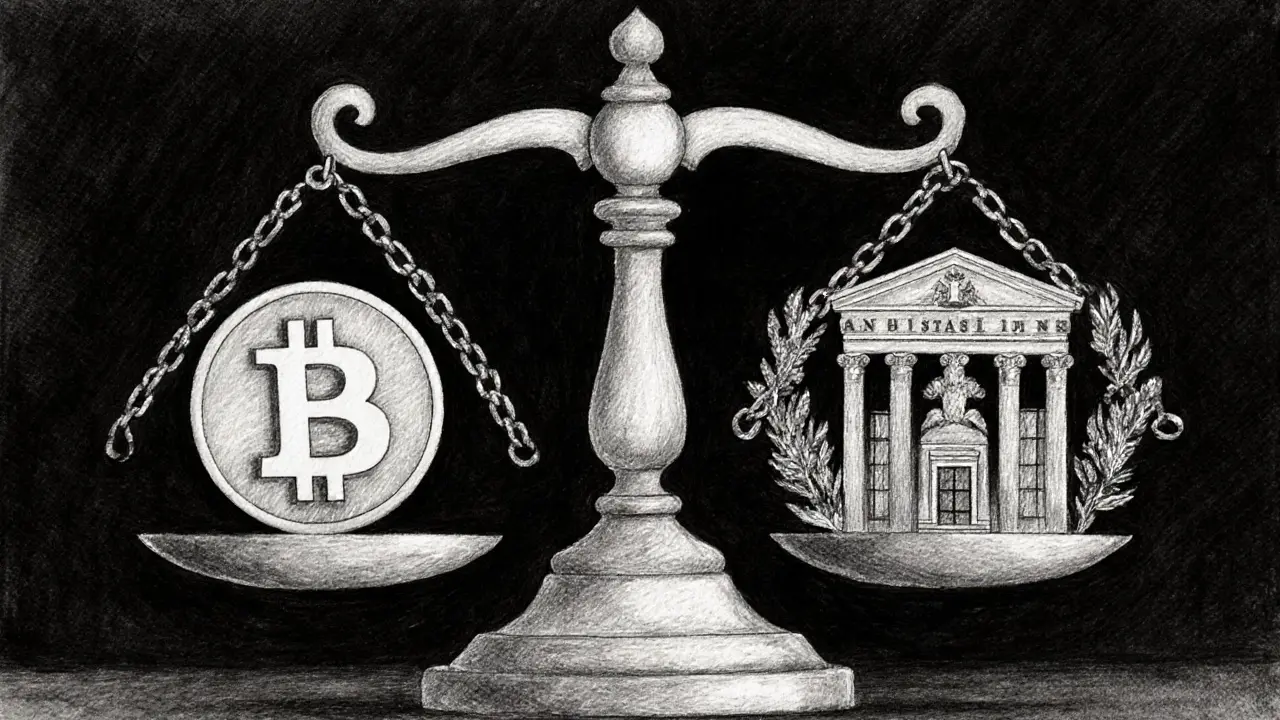

Swiss vs. US Regulatory Approach

The United States issued joint regulatory statements in 2025 emphasizing that banks must only offer crypto-asset safekeeping that is 'safe and sound' and comply with all applicable laws. However, Switzerland had already established these principles years earlier. While US regulators merely reiterated existing rules, Switzerland focused on proactive regulation, allowing banks to develop mature, compliant crypto service offerings. This regulatory head start gives Swiss banks a clear advantage in the global market.

Client-Centric Service Offerings

Swiss banks tailor services to different client needs. Amina Bank offers specialized banking packages for startups and scale-ups, while Bitcoin Suisse provides institutional-grade custody for large investors. Retail clients can access crypto services through user-friendly platforms with 24/7 self-service options. These banks blend traditional banking with crypto functionality, creating a seamless experience for all users.

Future Trends in Swiss Crypto Banking

Swiss banks are expanding into new blockchain ecosystems and tokens while maintaining strict regulatory compliance. They're using data analytics to create personalized financial products and implementing omnichannel banking experiences across digital and physical channels. Industry projections show continued growth in institutional adoption, with banks diversifying portfolios and revenue streams to mitigate economic volatility. International partnerships will also play a key role in addressing global challenges and seizing cross-border opportunities.

Frequently Asked Questions

Are Swiss banks safe for cryptocurrency custody?

Yes, Swiss banks like Bitcoin Suisse and Sygnum implement institutional-grade security measures including cryptographic and physical safeguards, redundant backups against cyberattacks and hardware damage, and strict compliance with Swiss financial regulations. Their custody solutions ensure keys never leave Switzerland, providing a secure environment for digital assets.

What tokens do Swiss banks support?

Leading Swiss banks support a wide range of tokens. Bitcoin Suisse covers over 40 blockchain protocols and hundreds of crypto assets, including staking for major networks like Ethereum, Solana, and Cardano. Sygnum and Amina Bank added SUI token support in 2025, while Swissquote focuses on popular assets like Bitcoin and Ethereum for retail clients. The exact list varies by institution but continues to grow as new blockchains emerge.

How does Swiss regulation compare to the US?

Switzerland established clear crypto regulations over five years ago using a technology-neutral approach, applying existing financial laws to digital assets. The US issued joint statements in 2025 reiterating existing principles but hasn't created specific frameworks yet. This regulatory clarity allows Swiss banks to innovate safely while US institutions remain cautious due to uncertainty, giving Switzerland a clear edge in the global market.

Can individuals use Swiss crypto banking services?

Yes, Swiss banks cater to both individual and institutional clients. Bitcoin Suisse offers a Crypto Account with 24/7 self-service access for retail users, while Amina Bank provides user-friendly platforms for everyday banking with crypto features. However, some services like institutional custody are tailored for larger investors. Most banks require standard KYC checks for all clients regardless of account type.

What security measures do Swiss banks use?

Swiss banks use a multi-layered security approach. Bitcoin Suisse's Vault includes cryptographic and physical safeguards, redundant backups against cyberattacks and hardware damage, and EMP protection. All banks comply with GDPR for data privacy, implement strict KYC and AML checks, and invest heavily in cybersecurity infrastructure. Keys for custody services are stored exclusively in Switzerland, ensuring no single point of failure.

Ever wonder why the world trusts Swiss banks with crypto? It's like they have an invisible shield that the rest of us can't see.

Maybe the secret is that they keep the keys under a mountain, away from prying eyes.

One could say the whole system is a giant illusion, but it works for now.

The idea of Swiss regulation feels almost too perfect, as if someone already decided the outcome.

We just watch the gears turn, hoping the machine doesn't grind us.

It's a quiet reassurance that something larger is watching over the crypto.

Thank you for providing such a comprehensive overview of the regulatory framework and security protocols employed by the Swiss institutions.

I appreciate the clear delineation between the services offered by Bitcoin Suisse, Sygnum, Amina Bank, and Swissquote, which facilitates a better understanding for readers from varied backgrounds.

The integration of GDPR compliance appears to reinforce the robustness of custodial processes, ensuring data privacy alongside asset security.

Swiss banks are clearly ahead of the game, offering real custody and staking options without the usual legal headaches.

They’ve set a benchmark that other jurisdictions should try to meet.

Looks like another marketing hype to me.

Ah, indeed, the Swiss have once again reinvented the wheel by merely applying existing financial statutes to digital assets, a feat of unprecedented originality.

One can only marvel at the sheer ingenuity required to label such a straightforward approach as “proactive regulation.”

The so‑called “security measures” are just a glossy veneer over a system that still hinges on centralized key storage; anyone with a foothold in the Swiss banking network could theoretically exfiltrate assets.

This false sense of safety is nothing but a trap for unwary investors who trust the branding over real decentralization.

Actually, the EMP protection mentioned for Bitcoin Suisse’s vault is a real thing – they use Faraday cages to shield hardware from electromagnetic pulses.

Also, the staking on SUI at Sygnum works by locking tokens in a smart contract that’s audited, so the risk is lower than you might think.

Just keep in mind that KYC processes can take a few days, so plan accordingly. Definately double‑check the documentation.

From a philosophical standpoint, the Swiss model exemplifies a synthesis of traditional fiduciary prudence and emergent blockchain technology, thereby constructing a paradigm wherein trust is algorithmically enforced while still anchored in centuries‑old legal doctrine 📜🔐.

The confluence of regulatory clarity and technical robustness invites a re‑examination of the very nature of custody, suggesting that the future of asset security may lie not in anonymity but in transparent, state‑sanctioned oversight.

This synthesis, however, raises ontological questions about the balance between individual sovereignty and collective regulatory frameworks.

Well said! It’s encouraging to see how the Swiss approach can bridge those philosophical gaps and give both retail and institutional users peace of mind.

Honestly, this whole “Swiss superiority” narrative is just another piece of hype designed to distract us from the real problems plaguing crypto – namely, the centralization of power and the erosion of true financial freedom.

The notion that Switzerland has achieved a flawless equilibrium between regulation and innovation is, in my estimation, a romanticized myth perpetuated by market strategists seeking validation.

While the regulatory framework is undeniably mature, it is not immune to the same geopolitical forces that compromise the autonomy of any sovereign financial system.

One must consider that the very banks lauded for their cryptographic safeguards also operate within a fiduciary paradigm that prioritizes institutional profit over decentralized ideals.

Moreover, the emphasis on physical security-EMP protection, hardened vaults, and the like-does little to address the underlying vulnerabilities inherent in the software layers that manage private keys.

These software layers are frequently updated, patched, and occasionally compromised, a reality that even the most sophisticated hardware cannot fully mitigate.

In addition, the compliance obligations imposed by FINMA, though clear, create a labyrinthine bureaucracy that may stifle rapid innovation and entrench existing power structures.

The consequence is a double‑edged sword: on one side, investors receive a veneer of safety; on the other, they are subtly coerced into relinquishing a degree of sovereignty.

The market's reaction to Sui token integration, as cited in the article, underscores a speculative frenzy that may be more reflective of hype cycles than genuine, sustainable demand.

Such spikes in trading volume often precede periods of volatility, where the very regulatory assurances become a source of contention among participants.

Furthermore, the regulatory head start that Switzerland enjoys does not guarantee future dominance, especially as other jurisdictions accelerate their own legislative initiatives.

We must also recognize that regulatory clarity can be a double‑standard tool, selectively applied to favor well‑connected entities while marginalizing nascent, community‑driven projects.

Consequently, the celebrated Swiss model may inadvertently perpetuate a hierarchy that runs counter to the decentralization ethos that originally motivated blockchain development.

It is therefore incumbent upon both policymakers and market participants to critically evaluate whether the pursuit of compliance is being leveraged as a means of consolidating influence.

Only through such introspection can the industry hope to reconcile the tension between security, accessibility, and the preservation of fundamental financial freedoms.

In sum, admiration for Swiss crypto banking should be tempered with a rigorous assessment of its broader systemic implications.

While everyone praises the Swiss model, it's crucial to remember that any system built on trust can become a breeding ground for complacency, and we must stay vigilant.

Indeed, the fiduciary‑centric architecture you described aligns with what we term “regulatory encapsulation”-a paradigm where compliance layers become the primary interface for user interaction 😊. This encapsulation, while enhancing legitimacy, often abstracts the underlying cryptographic mechanisms, making it essential for developers to maintain transparency behind the compliance veneer.

I hear the concerns raised about centralization and security, and it’s heartening to see the community engage in thoughtful dialogue about balancing innovation with protection.

We must uphold the principle that ethical standards supersede mere technological advancement; without a moral compass, even the most secure systems can become instruments of exploitation.