Learn what modular blockchains are, how they split core functions, and why they boost scalability compared to traditional monolithic designs.

Modular Blockchains: A Clear Guide to the New Architecture

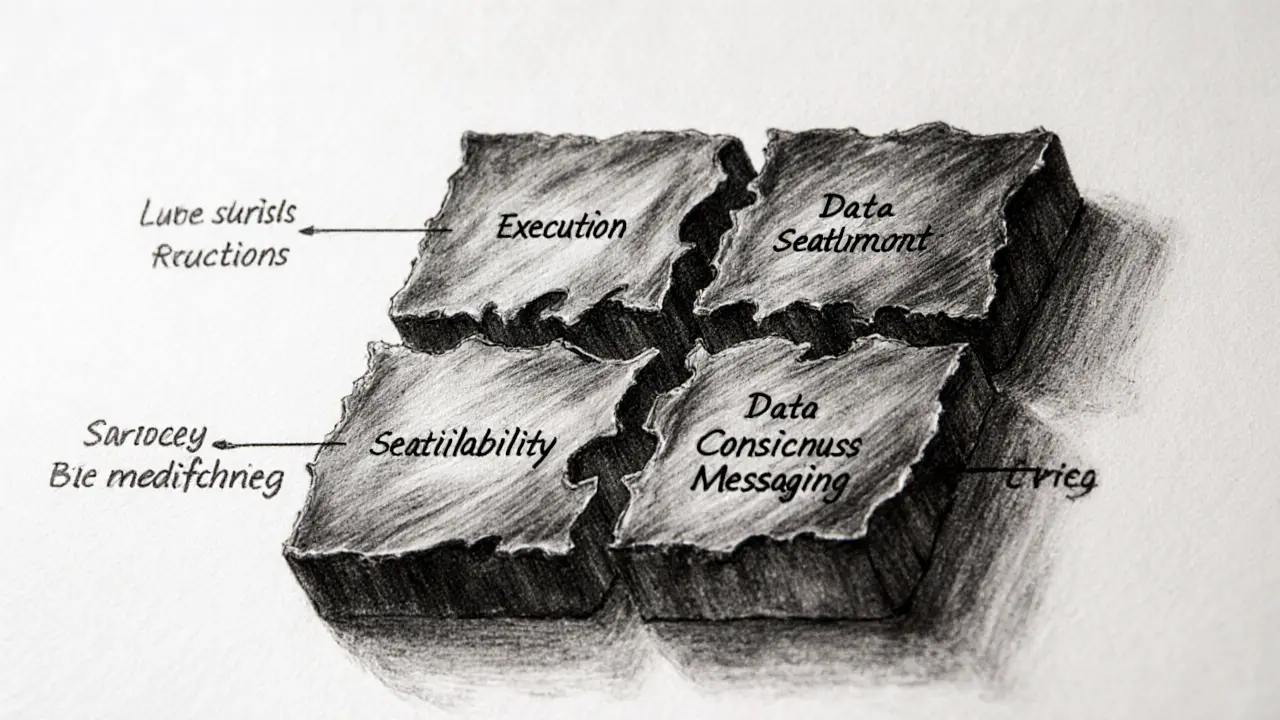

When working with modular blockchains, a design that splits the blockchain into separate layers for execution, consensus and data availability. Also known as layered blockchains, this approach promises faster transaction speeds, cheaper fees and easier upgrades. By decoupling these functions, developers can pick the best tools for each job – a concept that shows up everywhere from DeFi swaps to NFT airdrops.

Key Building Blocks That Make Modular Chains Work

The first piece of the puzzle is Proof of Stake, the consensus mechanism that lets validators lock up tokens to secure the network and earn rewards. Proof of Stake requires a reliable data availability layer, otherwise validators can’t confirm that information is correct. That’s where the Data Availability Layer, a specialized network that stores and serves transaction data to the execution layer comes in. With the data layer handling storage, Rollups, off‑chain aggregators that bundle many transactions into a single proof can focus on crunching numbers fast and cheap. Together these three elements create a chain that separates execution from data storage, allowing each part to scale independently.

Modular designs also change how we think about Hard Forks, protocol upgrades that split a blockchain into two versions. In a monolithic chain a hard fork can disrupt all users, but with modularity only the affected layer needs to upgrade. This reduces risk for token holders and makes it easier for projects like DeFi platforms, NFT airdrop organizers, and gaming tokens (e.g., 1MillionNFTs or LOCGame) to stay compatible. The posts on SwapStats illustrate this: validator reward models, airdrop mechanics, and smart‑contract security all benefit from a clear separation of duties.

Putting it all together, modular blockchains enable faster swaps, smoother airdrop claims, and more resilient networks. If you’re curious about how validator economics shape PoS incentives, why rollups are the backbone of modern DEXs, or how a hard fork might affect your token holdings, the collection below covers everything from tokenomics to real‑world case studies. Dive in to see how each piece fits into the bigger picture and what it means for traders, developers, and investors alike.