Explore how decentralized finance (DeFi) will reshape payments, lending, and asset tokenization by 2025, covering technology, adoption drivers, use cases, and remaining challenges.

DeFi Future: Insights, Trends, and What’s Coming Next

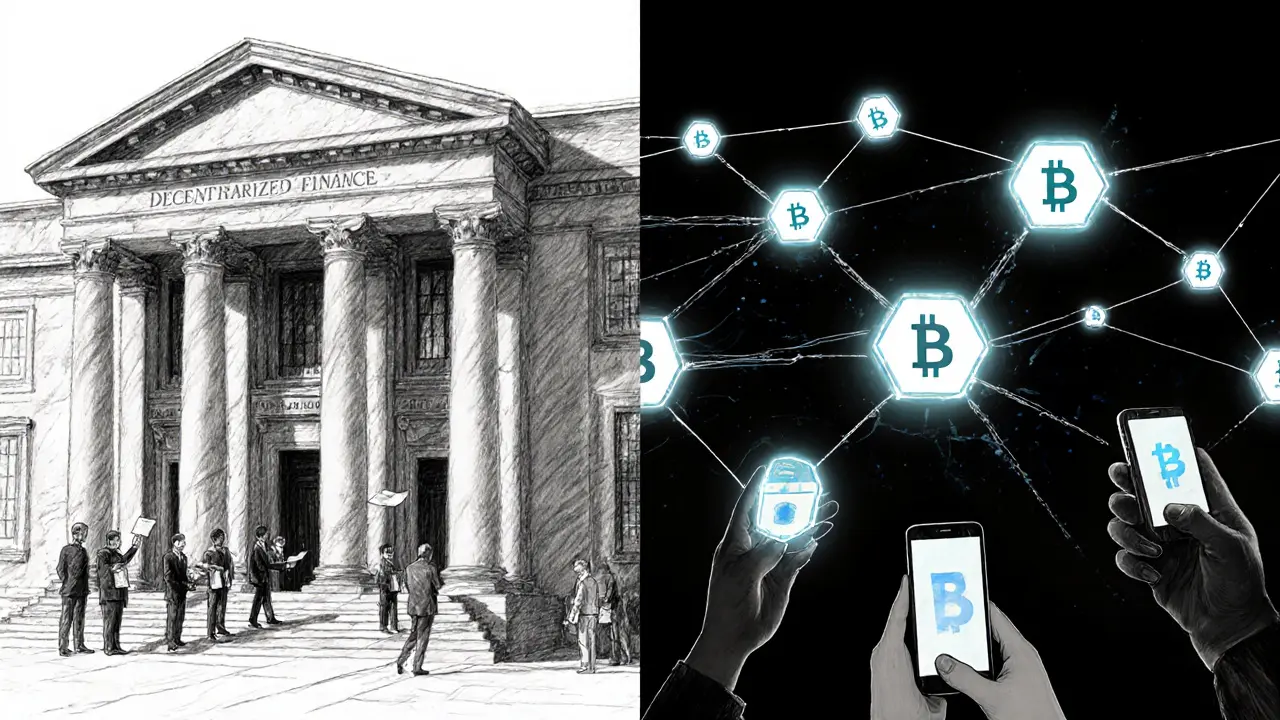

When you hear DeFi Future, the evolving landscape of decentralized finance that blends blockchain tech, new tokenomics, and next‑gen financial services. Also known as Decentralized Finance outlook, it captures the direction of protocols, incentives, and user adoption as the space matures, you’re actually looking at a big, interconnected system. DeFi future isn’t a single product; it’s a collection of ideas, markets, and tools that together rewrite how we think about money.

One core pillar is Decentralized Finance, a set of blockchain‑based services that replace traditional banks and brokers. It brings lending, swapping, and yield‑generating strategies to anyone with a wallet. Another critical piece is Proof of Stake, a consensus model where validators lock up tokens to secure the network and earn rewards. PoS shapes the economics of many DeFi protocols, tying network security directly to token holders’ interests. A third driver is the Airdrop, free token distribution used to bootstrap community participation and spark network effects. Airdrops have become a go‑to marketing tool, but they also influence price dynamics and governance participation.

Why Security and Incentives Matter

Smart contract security stands out as the fourth entity that can’t be ignored. Smart contract security, the practice of auditing and hardening code to prevent hacks and exploits is the foundation that lets users trust DeFi services. When a contract is weak, even the most attractive yields crumble. This is why the DeFi future requires robust security audits, bug bounty programs, and community vigilance. In practice, you’ll see the space balancing three forces: higher validator rewards (a PoS incentive), broader airdrop reach (to grow user bases), and tighter smart contract safeguards (to keep capital safe). These forces interact in real time, shaping everything from token price curves to governance proposals.

Below you’ll find a curated set of articles that dive deep into each of these threads. Whether you’re curious about validator economics in 2025, want to dissect recent airdrop mechanics, or need a crash‑course on protecting your assets, the collection gives you actionable insights. Let’s explore how the DeFi future is being built right now.