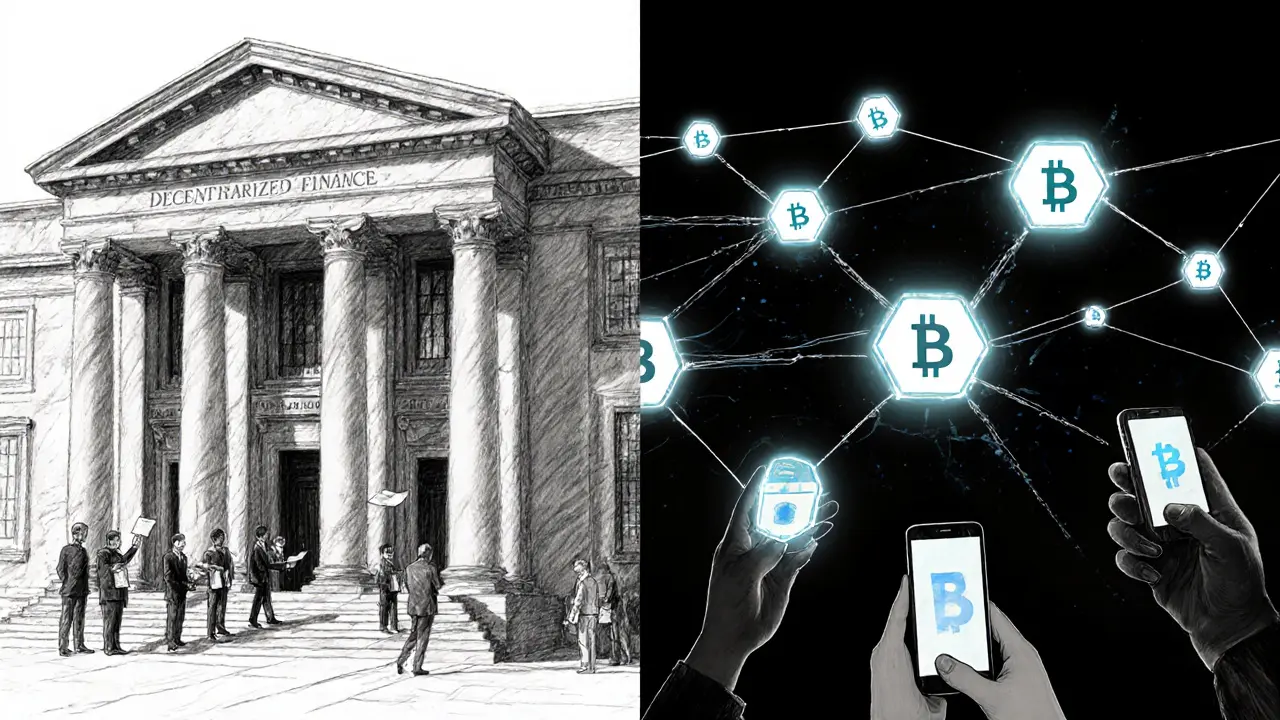

Explore how decentralized finance (DeFi) will reshape payments, lending, and asset tokenization by 2025, covering technology, adoption drivers, use cases, and remaining challenges.

Crypto Lending

When exploring crypto lending, the practice of borrowing or lending digital assets through blockchain‑based platforms. Also known as crypto borrowing, it lets users earn interest on idle tokens or unlock liquidity without selling. DeFi, a decentralized finance ecosystem that powers peer‑to‑peer loans provides the infrastructure, while smart contracts, self‑executing code that enforces loan terms on‑chain automate collateral checks, repayments, and liquidation. Together they create a permissionless credit market that operates 24/7 across dozens of blockchains.

How It Works and Why It Matters

At its core, crypto lending requires collateral, crypto assets locked in a smart contract to secure a loan. Borrowers deposit tokens like ETH or stablecoins, receive a loan in another asset, and pay interest set by the platform or market forces. Interest rates can be fixed or algorithmic, often influenced by supply‑demand dynamics and the overall health of the crypto lending market. Yield farming adds a layer of complexity: lenders can stake their supplied assets in liquidity pools to earn additional rewards, turning a simple loan into a multi‑stream revenue source. Platforms such as Aave, Compound, and newer Layer‑2 solutions optimize gas costs and offer credit scores built on on‑chain behavior, making the process more efficient and accessible.

Risk management is a major focus. Smart contracts eliminate traditional paperwork but expose users to code vulnerabilities, flash‑loan attacks, and oracle manipulation. Proper collateralization ratios, liquidation penalties, and diversified exposure help mitigate these threats. Regulatory headlines keep evolving, with some jurisdictions classifying crypto loans as securities while others embrace them as fintech innovation. Understanding the legal landscape helps lenders and borrowers stay compliant and protect their assets. Our collection of articles dives into related topics—validator rewards, hard forks, and exchange security—because each factor can impact loan pricing, platform reliability, and overall market confidence.

Below you’ll find a curated set of posts that explore the broader ecosystem around crypto lending. From deep dives into PoS incentives to reviews of emerging exchanges, we’ve gathered insights that help you make smarter lending decisions and stay ahead of market shifts.