Crypto Adoption Comparison Tool

India's Rank

1st

Overall Index Score

US Rank

2nd

Overall Index Score

Adoption Metrics Comparison

| Metric | India | United States |

|---|---|---|

| Overall Index Rank | 1st | 2nd |

| Retail Rank | 1st | 3rd |

| DeFi Rank | 1st | 4th |

| CeFi Rank | 1st | 2nd |

| Institutional Rank | 1st | 1st |

| YoY Transaction Volume Growth | 69% | 49% |

| Bitcoin On-Ramps (FY 2024-25) | $4.6 trillion | $2.9 trillion |

Key Insights

- India leads in all segments: retail, DeFi, CeFi and institutional

- India's transaction volume grew by 69% YoY vs 49% in US

- India's adoption is broader and more resilient

- Strong UPI infrastructure supports seamless crypto on-ramps

Why India Leads

- Massive UPI ecosystem (9 billion monthly transactions)

- Thriving fintech sector with over 800 startups

- Youthful developer community driving innovation

- Mobile-first culture enabling easy adoption

Interactive Analysis

Based on the data, India's comprehensive approach to crypto adoption gives it a significant edge over the US. While the US excels in institutional products like spot Bitcoin ETFs, India's strength lies in its broad-based participation across all segments.

The 69% year-over-year growth in India versus 49% in the US shows rapid momentum in the Indian market, suggesting strong underlying demand and infrastructure readiness.

Key Takeaways

- India tops the 2025 Chainalysis Global Crypto Adoption Index in every category - retail, CeFi, DeFi and institutional.

- Massive UPI usage, a thriving fintech scene and mobile‑first culture create a ready‑made platform for crypto.

- Young developers, small businesses and large banks are all part of the same ecosystem.

- Regulators impose heavy taxes, yet adoption keeps climbing, hinting at an upcoming policy shift such as a Bitcoin reserve.

- Compared with the United States, India shows broader participation across all market segments.

Crypto adoption in India is now the most comprehensive cryptocurrency market on the planet, according to the 2025 Chainalysis Global Crypto Adoption Index. While many countries focus on a single segment-usually institutional investors-India’s growth spans retail traders, decentralized finance (DeFi) users, centralized finance (CeFi) platforms and large‑scale institutions. This article explains how a combination of digital‑payment infrastructure, a tech‑savvy population and an evolving regulatory stance propelled the country to the top, and why the momentum is likely to continue.

India’s Position in the Global Crypto Landscape

Chainalysis Global Crypto Adoption Index 2025 ranked India first in five sub‑categories: Overall Index Score, Retail, CeFi, DeFi and Institutional. The Asia‑Pacific region, driven largely by India, recorded a 69% year‑over‑year increase in on‑chain transaction volume, rising from $1.4trillion (July2024) to $2.36trillion (June2025). By contrast, North America grew 49% and Europe 42% over the same period. These numbers show that India isn’t just a large market-it’s a fast‑growing one.

The country’s dominance is reinforced by a diverse user base. Retail investors account for the biggest share, but CeFi platforms (crypto exchanges, lending services) and DeFi protocols also enjoy mass adoption. Institutional participants-including banks, asset managers and corporate treasuries-have entered the space, making the market robust against shocks.

Digital‑Payment Foundations: The Role of UPI and Fintech

Unified Payments Interface (UPI) has processed over 9billion transactions per month in 2024, creating a habit of instant digital payments among Indian consumers. This habit translates seamlessly to crypto on‑ramps, where users can fund wallets with a few taps on the same apps they already trust.

The fintech ecosystem-home to over 800 startups, from eRupi to Razorpay-provides the API layers needed for smooth crypto integration. These platforms have already built bridges to major exchanges, allowing fiat‑to‑crypto conversion without leaving the app. The result is a frictionless experience that lowers the barrier for first‑time buyers.

Grassroots Momentum: Youth, Communities and Small Business

College campuses are now incubators for blockchain hackathons, with students learning to write Solidity contracts and build NFTs. At the same time, small towns across Maharashtra, Karnataka and West Bengal see farmers and artisans using crypto to receive payments from overseas buyers, bypassing costly remittance channels.

A recent survey of 5,000 Indian crypto users revealed that 62% started trading because they already used digital wallets for everyday purchases. The same study showed that 48% of small business owners accept stablecoins (USDT, USDC) alongside cash, citing price stability and instant settlement as key benefits.

Institutional Adoption and Regulatory Balance

Institutional investors have been quick to set up crypto desks, attracted by the high on‑ramps-Bitcoin alone drew $4.6trillion of fiat between July2024 and June2025, double any other asset. Major banks are experimenting with custody solutions, while asset managers are filing for crypto‑linked mutual funds.

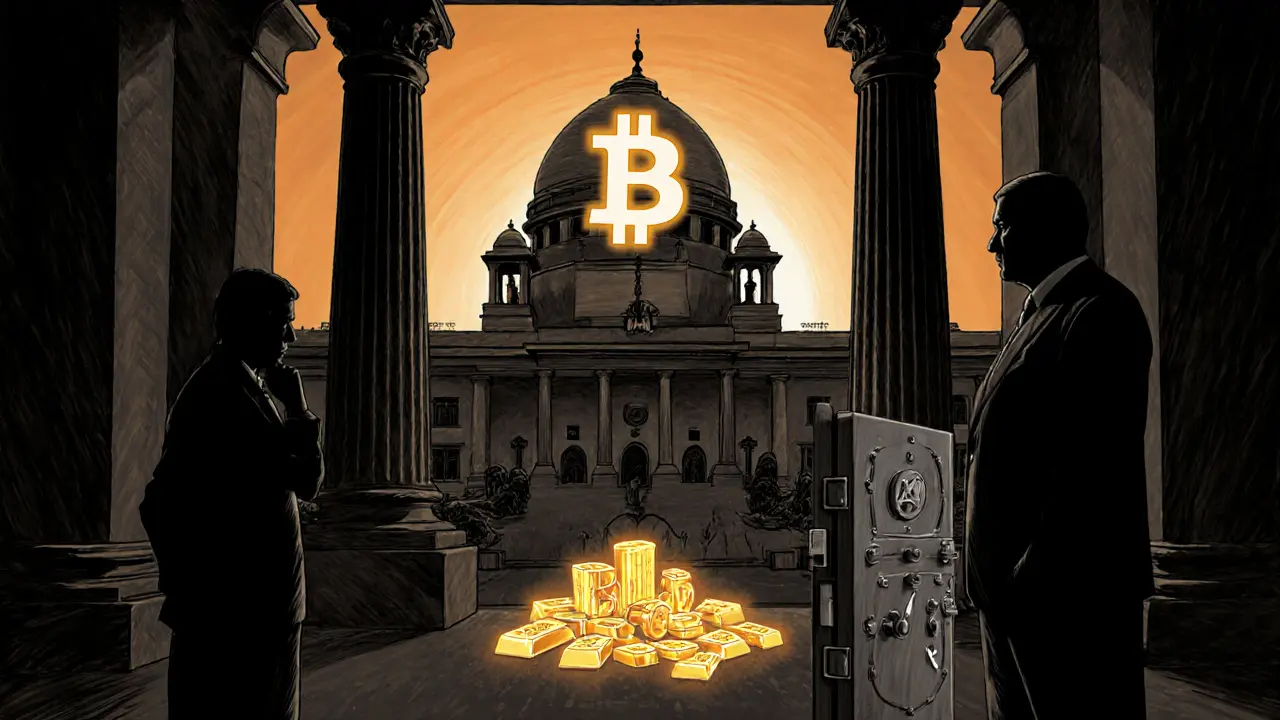

The regulatory environment remains a paradox. On one hand, India imposes a 30% tax on crypto gains and a 1% TDS (tax deducted at source) on transactions, among the world’s harshest regimes. On the other hand, regulators have recently hinted at a more supportive stance, with the Ministry of Finance reportedly exploring a sovereign Bitcoin reserve. This potential reserve could act as a hedge against fiat volatility and signal official endorsement.

Comparative Snapshot: India vs. United States

| Metric | India | United States |

|---|---|---|

| Overall Index Rank | 1️⃣ | 2️⃣ |

| Retail Rank | 1️⃣ | 3️⃣ |

| DeFi Rank | 1️⃣ | 4️⃣ |

| CeFi Rank | 1️⃣ | 2️⃣ |

| Institutional Rank | 1️⃣ | 1️⃣ |

| YoY Transaction Volume Growth | 69% | 49% |

| Bitcoin On‑Ramps (FY 2024‑25) | $4.6trillion | $2.9trillion |

The table shows that while the United States leads in certain institutional products (e.g., spot Bitcoin ETFs), India outperforms across the board in participation depth. This broad base reduces reliance on a single market segment, making Indian adoption more resilient.

Key Players Shaping the Ecosystem

- Bharat Web3 Association - a coalition of startups, academia and policy advisors working to standardize crypto practices.

- eRupi - a government‑backed digital rupee pilot that integrates crypto‑compatible wallets.

- Circle - provider of USDC, now actively partnering with Indian exchanges for stablecoin liquidity.

- PayPal - entering the Indian market with its PYUSD stablecoin, expanding the range of fiat‑backed options.

Future Outlook: From Reserve to Regulation

Analysts expect that the rumored Bitcoin reserve could become a reality by late 2025, positioning crypto as a sovereign asset class. Even if the reserve materializes, it won’t erase tax obligations; rather, it will likely bring clearer reporting standards and possibly lower the effective tax rate for long‑term holdings.

On the technology front, India’s talent pool continues to grow. By 2027, estimates suggest over 150,000 developers will be proficient in Solidity, Rust and other blockchain languages, fueling home‑grown DeFi protocols that could rival global players.

For users, the practical takeaway is simple: if you can make a UPI payment, you can likely move crypto in the same interface. As the ecosystem matures, expect tighter KYC/AML layers, but also more user‑friendly bridges that turn everyday digital payments into crypto transactions.

Quick Checklist for Stakeholders

- Retail investors: Use UPI‑linked wallets for instant on‑ramps; monitor tax filing deadlines.

- Businesses: Accept USDT/USDC for cross‑border trade; consider crypto‑based payroll for remote talent.

- Institutions: Explore custody services; track regulatory updates on the Bitcoin reserve.

- Policymakers: Balance fiscal revenue with ecosystem growth; provide clear guidelines for stablecoin usage.

Frequently Asked Questions

Why does India rank first in the Chainalysis adoption index?

India leads because adoption is spread across every segment-retail, CeFi, DeFi and institutional-backed by a massive UPI ecosystem, a vibrant fintech sector and a youthful developer community.

How do taxes affect crypto users in India?

Gains are taxed at 30% plus a 1% TDS on each transaction. The tax applies whether you trade on an exchange or hold crypto in a personal wallet, so users need to maintain detailed records for filing.

Can I use UPI to buy Bitcoin directly?

Many Indian exchanges now integrate UPI for instant fiat‑to‑crypto conversion, meaning a few clicks in your banking app can move funds into Bitcoin or stablecoins.

What is the proposed Bitcoin reserve?

The government is reportedly studying a sovereign Bitcoin holding that could act as a hedge and signal official acceptance. Details on size, custody and legal framework are still under review.

Are stablecoins safe to use in India?

Stablecoins like USDT and USDC are widely accepted and provide price stability, but users should verify the issuer’s audit reports and be aware of regulatory guidance on AML/KYC compliance.

What future trends should I watch in India’s crypto space?

Key trends include possible official Bitcoin reserves, deeper integration of crypto with the digital rupee, expansion of DeFi protocols built locally, and tighter but clearer regulatory frameworks that could lower compliance costs for businesses.

India's crypto surge just proves the West is lagging behind.

While the statistics are undeniably impressive, it is essential to contextualize them within the broader financial ecosystem. The United States continues to dominate in terms of institutional capital deployment, yet India’s retail participation outpaces it considerably. Moreover, the regulatory landscape, albeit stringent, provides a framework that could foster sustainable growth. Therefore, observers should refrain from simplistic rankings and instead examine the nuanced drivers of adoption.

People keep shouting about how “India is unstoppable,” but let’s not ignore the fact that high taxes still gnaw at profits for everyday traders.

Ths article righfully points out the role of UPI – it’s basically the backbone for quick on‑ramps, making crypto as easy as sending a text.

The rise of crypto in India is a multifaceted phenomenon that cannot be reduced to a single statistic.

First, the ubiquity of the Unified Payments Interface has created a digital‑first mindset among hundreds of millions of users.

Second, the country’s fintech ecosystem, with over 800 startups, continuously innovates bridges between fiat and crypto.

Third, the demographic dividend-young, tech‑savvy citizens-means that new users adopt without the inertia seen in older markets.

Fourth, regulatory ambiguity, while posing challenges, also fuels a sense of urgency among innovators to stay ahead of the curve.

Fifth, the sheer volume of on‑chain transactions-$4.6 trillion last year-demonstrates that liquidity is no longer a bottleneck.

Sixth, institutional interest is no longer a novelty; banks are piloting custody solutions and asset managers are filing crypto‑linked funds.

Seventh, the stablecoin market has blossomed, with USDT and USDC serving as de‑risking tools for merchants handling cross‑border payments.

Eighth, education initiatives on campuses, from hackathons to blockchain clubs, are building a pipeline of developers proficient in Solidity and Rust.

Ninth, the government’s exploration of a sovereign Bitcoin reserve could legitimize crypto in the eyes of traditional investors.

Tenth, despite a 30 % capital gains tax, many traders view crypto gains as a hedge against inflation and currency volatility.

Eleventh, the integration of digital rupee pilots with crypto‑compatible wallets further blurs the line between state‑issued and decentralized money.

Twelfth, global firms like Circle and PayPal are partnering with Indian exchanges, bringing deep‑liquidity pools to local users.

Thirteenth, the network effect is evident as more users attract more services, creating a virtuous cycle of adoption.

Fourteenth, the resilience of this ecosystem is highlighted by its continued growth even during macro‑economic headwinds.

Finally, as the regulatory narrative evolves, the expectation is that compliance costs will ease, paving the way for even broader participation.

Indeed-India’s meteoric climb, while dazzling; however, one must contemplate whether this velocity is sustainable, or merely a transient surge propelled by speculative fervor; the answer, perhaps, lies in the interplay of policy, infrastructure, and collective belief.

Sure, because “contextualizing” always magically solves the tax nightmare for the average Indian trader.

Honestly, the whole crypto hype feels like a circus, and India is the main performer juggling fire.

America should learn from India’s on‑ramps; we’re stuck in legacy banking while they’re sprinting ahead.

The observed surge aligns with a confluence of macro‑level liquidity injection, regulatory signaling, and network externalities, thereby catalyzing a pronounced uptick in on‑chain transaction throughput.

🔥 Great breakdown! This really captures why the ecosystem is buzzing. 🙌

Wow, the numbers are insane-India’s crypto scene is practically on fire! ;)

Let’s be real: if the US wants to keep up, we need to copy India’s UPI model yesterday.

Everything you wrote sounds like blind optimism; the underlying volatility and regulatory risk are far too downplayed.

Even with the challenges, the momentum is undeniable and could inspire other emerging markets to follow suit.

Interesting data! 🤔 How will the potential Bitcoin reserve affect the domestic banking sector?

Cool stats, never knew crypto was that big in India.

The kaleidoscope of fintech startups, blockchain devs, and eager retail investors paints a vibrant picture of India’s digital future.

Stop sleeping on India-if you’re not watching the crypto wave there, you’re missing the next big thing.

While the assertion that “America should learn” possesses rhetorical flair, it neglects the systemic constraints inherent to U.S. financial architecture; thus, a simplistic call for imitation is intellectually unsound.