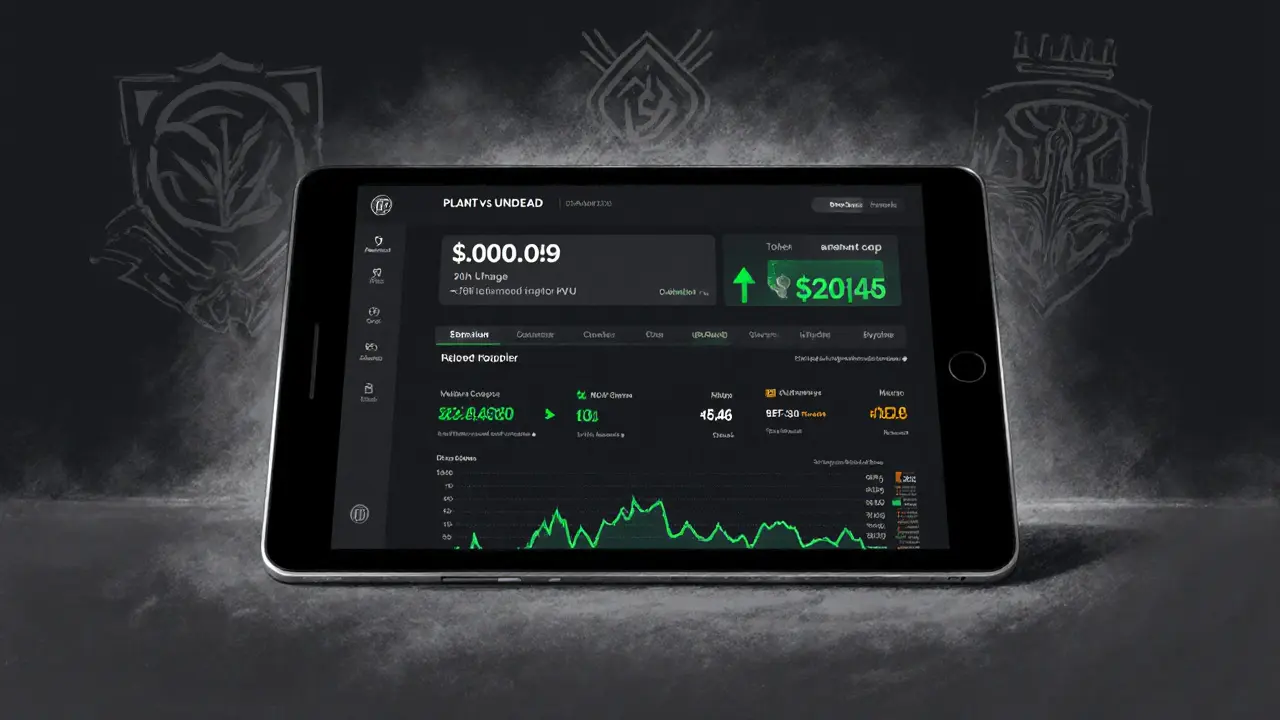

PVU Token Price Tracker

Current Price

Market Cap

24h Volume

Supply Info

Token Performance Overview

Compare PVU with Leading Tokens

| Token | Platform | Supply | Market Cap | Price |

|---|---|---|---|---|

| PVU | BNB Smart Chain | 300M (Unlimited) | $300K | $0.0009 |

| AXS | Ethereum / Ronin | 270M (Capped) | $1.2B | $4.30 |

| SAND | Ethereum | 1B (Capped) | $1.8B | $0.90 |

Ever wondered what the buzz around Plant vs Undead token is all about? It’s a crypto‑powered twist on the classic tower‑defense game that lets you earn real value while you play. In this guide we’ll break down the tech, the token economics, the current market snapshot, and what you need to know before you jump in.

Key takeaways

- Plant vs Undead (PVU) is a BEP‑20 token on the BNB Smart Chain that powers a free‑to‑play tower‑defense game.

- Its total supply is 300million tokens, with an “infinite” max supply that can affect long‑term price.

- As of October2025 the token trades around $0.0009 with a market cap under $300k and modest daily volume.

- The game blends NFTs (digital plants) with play‑to‑earn mechanics, letting players farm, battle, and stake PVU.

- Liquidity is limited; the token mainly lives on BNB‑based DEXes and a handful of small CEXs.

What is Plant vs Undead (PVU)?

When you hear about Plant vs Undead (PVU) a blockchain‑based cryptocurrency that fuels a tower‑defense play‑to‑earn game, you’re looking at a token built on the BNB Smart Chain Binance’s low‑fee, high‑throughput blockchain. The token follows the BEP‑20 token standard for assets on BNB Smart Chain and is identified by the smart‑contract address 0x31471e0791fcdbe82fbf4c44943255e923f1b794. Launched on July42021, the project’s goal is to turn the familiar Plants‑vs‑Zombies gameplay into a decentralized economy where each plant is an NFT non‑fungible token representing a unique in‑game asset that can be bought, sold, or staked for PVU rewards.

How the game works

The core experience is a multiplayer tower‑defense match‑up: Players plant digital flora to fend off waves of undead attackers. Each plant NFT comes with stats (damage, cooldown, rarity) that affect battle outcomes. Winning battles or completing daily quests rewards you with PVU, which can be withdrawn to a web‑3 wallet, used to buy new NFT plants, or supplied to DeFi pools for interest.

Because the game is free‑to‑play, you don’t need to own PVU or NFT plants to start; you can earn a starter plant by completing a tutorial. However, owning higher‑tier NFTs boosts your earning rate, creating a classic play‑to‑earn incentive loop.

Token economics at a glance

- Total supply: 300million PVU (initial mint).

- Maximum supply: Unlimited - new tokens can be minted for rewards and liquidity.

- Market cap (Oct2025): roughly $296k (CoinDesk).

- 24‑hour volume: $24k-$53k across major trackers, indicating low liquidity.

- Key technical indicators (CoinCodex):

- 50‑day SMA: $0.000882

- 200‑day SMA: $0.000937

- 14‑day RSI: 51.09 (neutral)

The “infinite” max supply means each new reward or liquidity incentive dilutes existing holdings. Compare that to tokens like Axie Infinity (AXS), which has a capped supply and a larger market cap, and you’ll see why PVU’s price upside is limited without strong demand growth.

Why the BNB Smart Chain matters

Choosing BNB Smart Chain a blockchain known for low transaction fees and fast block times over Ethereum reduces the cost of minting NFTs and swapping tokens. A typical PVU transaction costs a few cents in BNB, compared with $5‑$20 on Ethereum during peak congestion. This makes the game more accessible to casual players, but it also ties PVU’s ecosystem to the health of the BNB network. If Binance tightens regulations or users migrate to newer layer‑1s, PVU could see reduced activity.

Current market performance (Oct2025)

Various trackers show slightly different numbers, but the consensus price hovers around $0.0009. Below is a quick snapshot:

| Source | Price (USD) | 24‑h Volume (USD) | Market Cap (USD) |

|---|---|---|---|

| CoinDesk | 0.000382 | 53,130 | 296,945 |

| CoinMarketCap | 0.0008932 | 24,414 | ≈300,000 |

| Kriptomat | €0.000770 | - | - |

| CoinCodex | 0.00091 | - | - |

The spread in reported volume suggests limited depth on centralized exchanges; most trading happens on BNB‑based DEXs where slippage can be high for larger orders.

How to get started

- Set up a BNB‑compatible web3 wallet (MetaMask, Trust Wallet, or Binance Chain Wallet).

- Buy BNB on a major exchange and transfer it to your wallet to cover gas fees.

- Swap BNB for PVU on a BNB DEX (e.g., PancakeSwap) using the contract address

0x31471e0791fcdbe82fbf4c44943255e923f1b794. - Connect your wallet to the Plant vs Undead web portal, claim a starter plant NFT, and start playing.

- If you want to earn extra, provide PVU to community liquidity pools or stake NFTs in the game’s DeFi module for interest.

Most users report a moderate learning curve: the game mechanics are familiar, but managing NFTs and gas fees requires a basic grasp of web3 concepts.

Comparison with other play‑to‑earn tokens

| Token | Platform | Standard | Supply | Market Cap (USD) | Price (USD) |

|---|---|---|---|---|---|

| PVU | BNB Smart Chain | BEP‑20 | 300M (unlimited max) | ≈300k | 0.0009 |

| AXS | Ethereum / Ronin | ERC‑20 | 270M (capped) | ≈1.2B | 4.30 |

| SAND | Ethereum | ERC‑20 | 1B (capped) | ≈1.8B | 0.90 |

PVU trails the giants in both market cap and liquidity. Its lower price makes entry cheap, but the upside is constrained unless the game drives a surge in active users or secures a major partnership.

Community, support, and future outlook

Community chatter is thin compared with AXS or SAND. Official channels (Discord, Telegram) have a few thousand members, and mainstream crypto news rarely covers updates. The project’s roadmap lists modest goals: occasional NFT drops, expanded DeFi staking options, and cross‑chain bridges to other BNB‑compatible chains. No significant partnership announcements have appeared in 2024‑2025, which raises questions about long‑term momentum.

Technical analysis from CoinCodex paints a neutral picture: the 14‑day RSI sits near 50 and volatility is under 2%. A bullish price target of $0.000989 for February2027 is posted, but the underlying assumptions are vague. In practice, price moves will likely follow broader BNB market trends and any spikes in game activity.

Risks you should weigh

- Inflationary supply: Unlimited token minting can dilute value.

- Liquidity crunch: Low daily volume may cause slippage on larger trades.

- Regulatory uncertainty: Gaming tokens face scrutiny in several jurisdictions.

- Competitive pressure: Newer play‑to‑earn games on faster layer‑2 chains may lure users away.

If you’re comfortable with speculative assets and enjoy the tower‑defense genre, PVU can be a fun side‑hustle. If you need a stable store of value, look for tokens with capped supplies and deeper markets.

Frequently Asked Questions

How do I buy PVU?

You need a BNB‑compatible wallet, some BNB for gas, and then you can swap BNB for PVU on a BNB DEX (e.g., PancakeSwap) using the contract address 0x31471e0791fcdbe82fbf4c44943255e923f1b794.

What can I do with PVU besides playing?

PVU can be staked in the game’s DeFi pool for interest, supplied to liquidity pools for trading fees, or held in a wallet as a speculative asset.

Is the token inflationary?

Yes. While the initial supply is 300million, the contract can mint additional tokens for rewards, meaning there is no hard cap.

What are the main competitors?

Major peers include Axie Infinity (AXS) on Ronin/Ethereum and The Sandbox (SAND) on Ethereum. They have larger markets, capped supplies, and more active communities.

Is PVU safe to store on a hardware wallet?

Yes. Because PVU is a standard BEP‑20 token, any hardware wallet that supports BNB Smart Chain (e.g., Ledger, Trezor) can hold it securely.

PVU? I’d rather skip that hype.

When examining the broader context of blockchain gaming, it becomes clear that tokenomics are not isolated from cultural adoption; the interplay between community enthusiasm and economic incentives shapes long‑term viability, and this is particularly true for projects built on the BNB Smart Chain, which offers low fees, fast finality, and a growing developer ecosystem. Moreover, the plant‑versus‑undead premise taps into a nostalgic archetype that resonates across demographics, from casual mobile players to seasoned crypto enthusiasts, thereby widening the potential user base. Yet, the infinite supply model introduces a dilution vector that must be counterbalanced by sustained demand, otherwise the token’s intrinsic value erodes over time. The current market cap of roughly $300 k suggests limited liquidity, which could hamper large trades and increase slippage, a factor that prudent investors often weigh heavily. Technical indicators, such as the 14‑day RSI hovering near 51, indicate a neutral momentum, neither overbought nor oversold, implying that price action may follow external catalysts rather than internal strength. In addition, the comparative analysis with capped tokens like AXS and SAND shows a stark disparity in market depth and institutional backing, further highlighting the need for differentiated utility. If the development team can deliver periodic NFT drops, cross‑chain bridges, and engaging seasonal events, user retention may improve, which in turn could drive token demand. Community sentiment, observed through Discord activity and social media chatter, remains modest but shows occasional spikes during promotional periods. Ultimately, the decision to allocate capital to PVU hinges on an investor’s risk tolerance, belief in the play‑to‑earn model, and confidence in the team’s ability to execute a roadmap that transcends mere token issuance.

The token’s infinite supply is a structural flaw; dilution will erode any speculative upside, making PVU a poor risk.

While the low entry price might attract newcomers, the limited liquidity and modest market cap suggest caution before allocating significant capital; it’s wise to diversify.

Oh great, another play‑to‑earn token that promises fun but delivers volatility.

Honestly, the hype around PVU feels like a drama series that never gets a good sequel; the token is stuck in a never‑ending loop of mediocre updates.

Respectfully, the assertion that PVU’s inflationary model precludes any future appreciation disregards potential network effects that could emerge from novel gameplay mechanics and strategic partnerships.

But if the community actually engages and the game scales, maybe the token’s value could find its own rhythm, like a plant growing against the undead odds.

Start small, test the waters, and you’ll see if it fits your play style 😊.

Don’t waste time on tiny tokens; focus on projects with real backing.

From an expert standpoint, the PVU ecosystem exemplifies the classic risk‑reward trade‑off inherent in emerging play‑to‑earn platforms: high volatility, potential for outsized gains, and a steep learning curve that separates the committed from the casual-proceed wisely! 😎

Honestly, if you’re not ready to ride the wave of crypto gaming, you’ll miss the fun, but you also won’t lose a fortune-win‑win.

It’s interesting to consider how the BNB Smart Chain’s low fees might lower entry barriers, yet the token’s liquidity constraints could still pose execution challenges for larger investors; what are your thoughts on bridging to other chains? 🤔

From a cultural perspective, games like PVU bring blockchain to a broader audience, blending familiar mechanics with new economic incentives.

PVU’s price will stay low forever; better look elsewhere.

In evaluating PVU, one must consider macro‑level trends within the decentralized gaming sector, the token’s supply dynamics, and the underlying utility derived from its NFT‑driven gameplay; each of these vectors contributes to a composite risk profile that is not easily reduced to a single price metric. Moreover, the projected inflationary pressure inherent to an unlimited supply necessitates sustained demand growth to offset dilution effects. Historical precedents within similar token ecosystems reveal that only those projects which achieve significant network effects and secure strategic partnerships can transcend the baseline market cap constraints observed herein. Accordingly, prospective investors should perform rigorous due diligence, encompassing on‑chain analytics, community sentiment, and the developmental roadmap’s feasibility. Until such factors coalesce favorably, any price appreciation remains speculative at best.

If you decide to jump in, start by acquiring a modest amount of BNB for gas, then swap on PancakeSwap; after that, explore staking options within the game’s DeFi pool to earn passive rewards while you learn the mechanics.

From a technical standpoint, PVU operates as a BEP‑20 asset governed by a mintable smart contract that leverages ERC‑4626‑compatible liquidity provision mechanisms; however, the absence of a supply cap coupled with suboptimal tokenomics introduces a negative drift in the token’s intrinsic value as per the discounted cash flow (DCF) model applied to its projected utility streams.

Remember, the journey in play‑to‑earn gaming is as much about personal growth as it is about financial returns; stay disciplined, keep learning, and enjoy the process 🚀.