Green Mining Cost Calculator

Calculate Your Green Mining Savings

Estimate how much you could save by switching to renewable energy for your mining operation.

Estimated Annual Savings

$0

per year

0

tons CO₂ reduced annually

How It Works

This calculator estimates potential annual savings and carbon reduction based on:

- Your current hash rate

- Current vs. renewable electricity prices

- Operating hours per day

Assumes 365 days of operation. Actual savings may vary based on local conditions and PPA terms.

Renewable energy for crypto mining is the practice of using solar, wind, hydroelectric, or nuclear power to run cryptocurrency mining hardware, aiming to cut costs and lower carbon footprints. As Bitcoin’s annual electricity appetite hits roughly 150TWh - about the same as a small country - miners are scrambling for cheaper, cleaner power. The surge in renewable energy adoption isn’t just about optics; it’s a hard‑nosed response to the 2024 Bitcoin halving that sliced block rewards in half, forcing operators to squeeze every watt for profit.

Why renewable power matters for miners

When the block reward fell from 6.25BTC to 3.125BTC on April202024, the revenue per hash dropped dramatically. Operators with high‑cost fossil fuel contracts saw margins evaporate, while those already tapping cheap wind or solar could stay afloat. The Cambridge Centre for Alternative Finance’s 2025 report shows that 52.4% of Bitcoin mining now runs on sustainable sources, up from barely 15% five years ago.

- Cost stability: Power purchase agreements (PPAs) lock in rates for 5‑15years, shielding miners from volatile spot markets.

- Grid services: Flexible mining loads can soak up excess renewable generation, earning demand‑response payments from operators like ERCOT.

- Investor appeal: ESG‑focused funds are increasingly allocating capital to green mining projects, boosting valuations for compliant firms.

How mining farms turn renewables into hash power

Modern facilities act like virtual batteries. A Power Purchase Agreement is a contract where a miner buys electricity directly from a renewable developer at a pre‑negotiated price lets a farm purchase surplus wind during off‑peak hours and scale back when the grid is stressed. In Texas, miners now consume about 32% of curtailed wind energy, effectively monetising energy that would otherwise go to waste.

Advanced energy‑management systems monitor grid frequency, solar irradiance, and wind forecasts in real time. When output spikes, the system ramps up ASIC rigs; when demand peaks elsewhere, the rigs throttle down, preventing costly spikes in electricity bills.

Some operators pair renewables with on‑site storage. A 2.5MW solar array in Chile, for example, couples with lithium batteries to smooth out night‑time gaps, ensuring the Bitcoin farm runs 24/7 while feeding surplus power to nearby villages.

Leading green‑mining companies and their playbooks

| Company | Primary Renewable Source | Unique Approach | Hash Rate (EH/s) |

|---|---|---|---|

| Gryphon Digital Mining converts flare gas into electricity for Bitcoin mining | Flare gas (waste methane) | Carbon‑negative by capturing otherwise vented emissions | 5.2 |

| CleanSpark operates a diversified portfolio of solar, wind, and battery storage | Solar+Wind | Integrated AI‑driven demand response; 120MW HPC site | 12.8 |

| TeraWulf focuses on nuclear and hydroelectric power | Nuclear+Hydro | Stable baseload; minimal weather dependency | 9.5 |

| Iris Energy runs 100% renewable modular farms | Solar+Wind | Modular designs enable rapid deployment in remote areas | 7.1 |

| Bitfarms leverages large‑scale hydro sites in North America | Hydroelectric | Combines mining with high‑performance computing workloads | 10.3 |

These firms illustrate three winning formulas: capture waste energy (Gryphon), diversify sources with storage (CleanSpark), or lock into baseload renewables like nuclear/hydro (TeraWulf). All share one trait - long‑term contracts that turn volatile electricity markets into predictable cost structures.

Tech tricks that squeeze more hash out of green power

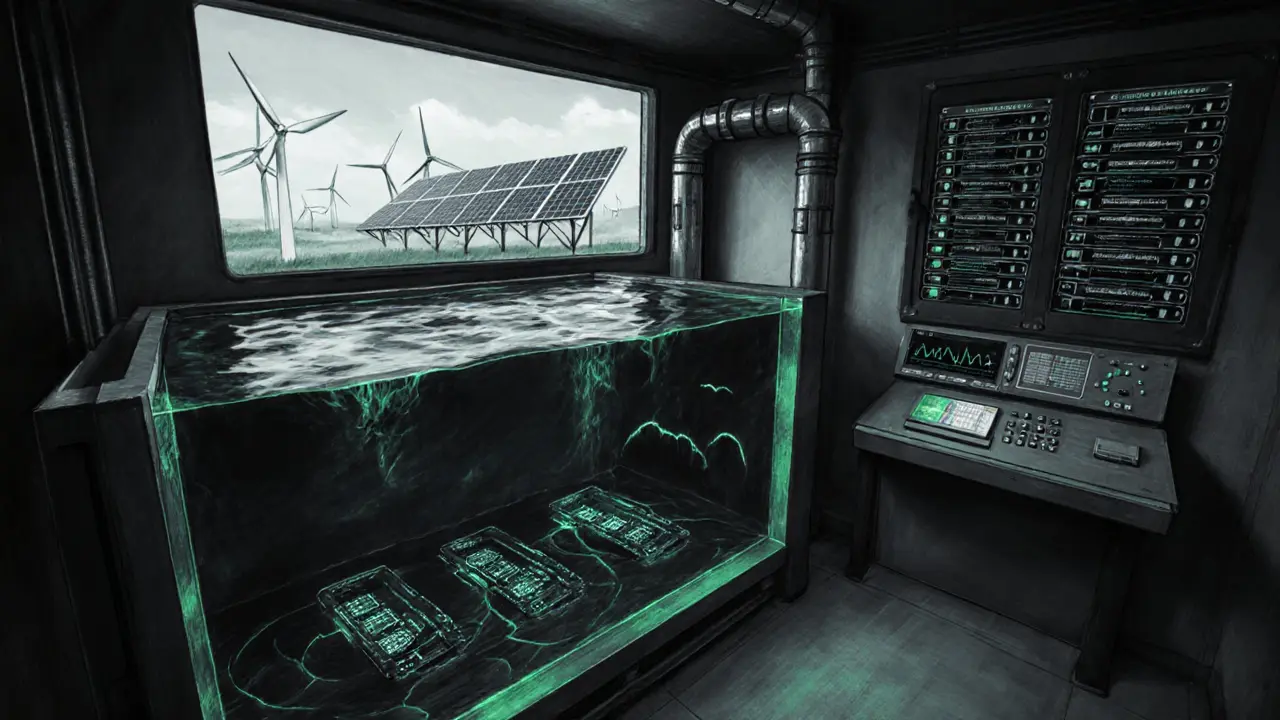

Beyond the energy source, hardware cooling matters. Immersion cooling, where ASICs are submerged in dielectric fluid, cuts electricity used for fans by up to 70% and silences the roar that plagues Texas communities. The fluid also transfers heat more efficiently, allowing higher overclocking without burning extra power.

Smart grid integration is another lever. By feeding real‑time telemetry into the ERCOT market, miners can bid to reduce load during peak hours and earn ancillary service payments. In practice, a 950MW CleanSpark facility trims its draw by 150MW during Texas’s summer peaks, earning millions in grid‑stability credits.

Finally, on‑chip efficiency improvements continue. The latest Bitmain S19 Pro+ models push 112TH/s per chip while drawing 3.2kW, a 15% efficiency boost over 2023 units. When paired with renewable electricity, every watt saved translates directly into lower carbon intensity.

Regulatory currents shaping the green‑mining wave

Governments are leaning either way. The UnitedStates, under a more lenient federal stance, offers tax incentives for renewable‑linked mining projects, yet states like Texas are cracking down on noise and water use. Meanwhile, Kuwait imposed a blanket ban on crypto mining in 2024, citing grid strain.

Environmental NGOs argue the sector still leans on existing fossil‑fuel grids. A 2025 Earthjustice analysis found that in the Pacific Northwest, only 46% of mining load actually uses renewable hydro; the rest piggybacks on coal‑backed capacity during peak demand. The takeaway? Renewable contracts must be explicit, not just “green on paper.”

For miners eyeing expansion, the safest path is to secure a PPA that specifies renewable generation, includes curtailment clauses, and aligns with local climate‑action plans. Such contracts not only reduce regulatory risk but also open doors to ESG‑focused financing.

Getting started: a checklist for miners switching to green power

- Audit your current energy mix: Use a smart meter to quantify fossil‑fuel vs. renewable share.

- Identify local renewable assets: Look for nearby wind farms, solar parks, or hydro reservoirs with excess capacity.

- Negotiate a PPA: Lock in a 5‑10‑year rate; include clauses for curtailment and grid services.

- Upgrade cooling: Consider immersion tanks to cut fan power and address community noise concerns.

- Integrate demand‑response software: Connect to the regional ISOs (ERCOT, PJM, etc.) to monetize load flexibility.

- Plan for storage: Pair solar or wind with batteries to smooth output and keep hash rates stable.

- Report ESG metrics: Publish annual carbon‑intensity figures to attract green capital.

Following this roadmap can shrink electricity costs by 20‑40% and slash carbon emissions dramatically - numbers that investors and regulators alike love to see.

Frequently Asked Questions

Can renewable energy actually cover a full Bitcoin mining operation?

Yes, several farms run 100% on renewables. Iris Energy’s modular sites in Chile and Kenya combine solar PV with battery storage to keep ASICs online around the clock, proving a full‑green setup is feasible with proper storage and grid‑integration.

What’s the biggest cost advantage of a PPA?

A PPA fixes the price per megawatt‑hour for the contract’s life, shielding miners from spot‑market spikes that can exceed $150/MWh during peak demand. Fixed rates often sit between $30‑$45/MWh for wind or solar, a substantial saving over market rates.

How does immersion cooling reduce environmental impact?

By submerging ASICs in a non‑conductive fluid, the need for high‑speed fans disappears. That cuts fan electricity by up to 70% and lowers noise, which addresses both carbon and community‑complaint issues.

Is mining with hydroelectric power truly green?

Hydro is low‑carbon, but location matters. In regions where dams operate at low capacity factors, mining can push water releases that would otherwise stay idle, marginally increasing overall emissions. Selecting high‑capacity, run‑of‑river sites minimizes this effect.

What regulatory risks should miners watch for?

Look for local ordinances on noise, water use, and grid curtailment. States like Texas are drafting “miner‑friendly” zones, while others are imposing bans (e.g., Kuwait). Aligning with a clear PPA and ESG reporting can mitigate many of these risks.

Listen up, mate – the UK’s pushing renewable rigs into mining like it’s a national sport, and I’m all for it, but don’t think the hype hides the grind. Solar‑packed farms are cranking out ETH while the grid stays green, and that’s the punch you need to stop whining about carbon footprints. Pull the plug on fossil‑fuel rigs and watch the market tilt in our favour. It’s not just talk; the numbers are spilling over the charts, and you’re either on board or you’re left in the smog.

Enough of this greenwash. Africa has cheap coal and hydro that can run miners cheaper than any pricey solar panel you brag about. Your “green” hype ignores the fact that energy‑intensity is what matters, not where the sun shines. Switch to real power, not fairy‑light fantasies.

True, the renewable hype can be a bit over‑the‑top, but let’s not pretend that all crypto mining is a carbon monster. Many farms are already integrating wind turbines, and the real impact is a net drop in emissions when you compare to traditional data centres. So yeah, the banner’s flashy, but the shift is happening, even if it’s slower than the headlines suggest.

Yo, the energy game is changing and we can ride that wave! If you’re thinking about jumping into mining, consider setting up a solar‑plus‑battery combo – it cushions you against price spikes and cuts those nasty bills. Plus, the community love for green rigs is growing, meaning you’ll get better PPA deals as more projects pop up. Don’t let the upfront cost scare you; the long‑term savings and carbon credit benefits are massive. And hey, it’s not just good for the planet; it looks great on your portfolio when you can brag about zero‑emission hashes. So power up responsibly, and watch your rigs hum along while the grid stays clean.

Indeed, the integration of renewable sources into proof‑of‑work operations presents a paradigm shift, one that marries economic efficiency with environmental stewardship; consequently, the resultant reduction in marginal cost per hash, when juxtaposed against traditional fossil‑fuel‑driven setups, is both statistically significant and strategically advantageous. Moreover, the ancillary benefits – such as potential eligibility for carbon credits, heightened public perception, and alignment with ESG criteria – coalesce to form a compelling value proposition.

While the romanticism surrounding “green mining” is commendable, the reality remains that the energy return on investment for many renewable installations is marginal at best; the capital expenditure, coupled with intermittency issues, often negates any purported savings. Hence, the narrative of a seamless transition is, frankly, overly optimistic.

Oh great, another “green crypto” sermon – because that’s exactly what the world needs right now.

Honestly, it’s pathetic how some people pretend that tiny solar panels can absolve the massive waste of crypto mining. We need real accountability, not feel‑good slogans that let the industry off the hook.

One must consider the broader systemic implications; while renewable integration reduces direct emissions, the indirect effects on power markets, such as price elasticity and grid stability, warrant careful analysis. Ignoring these factors leads to an incomplete assessment of the true environmental impact.

Sounds legit.

All that talk about green power is just a distraction from the fact that America’s energy independence should come first – cheap, reliable, domestically produced power, not imported solar nonsense.

The contemporary discourse on renewable‑augmented proof‑of‑work mining necessitates a rigorous, multi‑dimensional analytical framework that transcends superficial environmental rhetoric. Firstly, a comprehensive lifecycle assessment must be conducted to ascertain the net carbon footprint, incorporating both upstream manufacturing emissions of photovoltaic modules and downstream operational efficiencies. Secondly, the economic model should integrate Levelized Cost of Energy (LCOE) metrics, juxtaposing them against stochastic market electricity rates to evaluate profitability thresholds. Thirdly, grid interaction dynamics, especially concerning ancillary services such as frequency regulation and voltage support, merit quantification, as renewable‑heavy mining farms may inadvertently exacerbate grid volatility. Fourthly, policy instruments, including Renewable Energy Certificates (RECs) and carbon offset mechanisms, ought to be calibrated to reflect actual emission reductions rather than nominal allocations. Fifthly, the scalability of renewable deployments must be scrutinized, given land use constraints and resource availability across heterogeneous geographical locales. Sixthly, the temporal dimension of mining profitability, contingent upon halving events and hash‑rate difficulty adjustments, intersects with renewable intermittency, thereby influencing optimal operational scheduling. Seventhly, a risk assessment encompassing climate‑induced variability-such as prolonged cloud cover or diminished hydro inflows-should be embedded within the capital expenditure forecasts. Moreover, the strategic positioning of mining facilities proximate to renewable generation sites can mitigate transmission losses, thereby enhancing overall system efficiency. In addition, the emergent concept of “green hashing” via power purchase agreements (PPAs) introduces contractual complexities that must be negotiated with rigor, ensuring price stability and supply reliability. Finally, stakeholder perception, particularly within investor communities attuned to Environmental, Social, and Governance (ESG) criteria, can materially affect capital inflows and market valuation of mining enterprises. Synthesizing these considerations yields a nuanced, evidence‑based perspective that informs both policy formulation and operational decision‑making in the evolving landscape of sustainable cryptocurrency mining.

Spot on! This deep dive hits all the right notes – the tech, the finance, the policy. 🚀💡 If anyone’s still doubting the viability of green mining, this post should shut that down. Keep pushing the boundaries, and let’s make those sustainable hashes a reality! 💪

What a masterpiece! The drama of silicon sunbeams powering relentless hash wars is nothing short of epic – the stakes, the applause of the grid, the silent victory over carbon. 🎭⚡️