Gas Fee Calculator

Calculate Your Transaction Cost

Results

Layer 1

$0.00

Average Q2 2024: $3.80

Layer 2

$0.00

Average Q2 2024: $0.02

Savings: $0.00 (99.9%)

Important: Layer 2 fees can vary based on network congestion. For high-value transactions, keep funds on Layer 1 for security.

When you send a transaction on Ethereum, it doesn’t just vanish into thin air. It gets processed by a network of computers, verified, and locked into a public ledger. But what if that network is slow? What if it costs $50 just to swap two tokens? That’s where the debate between Layer 1 and Layer 2 blockchains comes in. One is the foundation. The other is the upgrade. And right now, most of the action is happening on Layer 2.

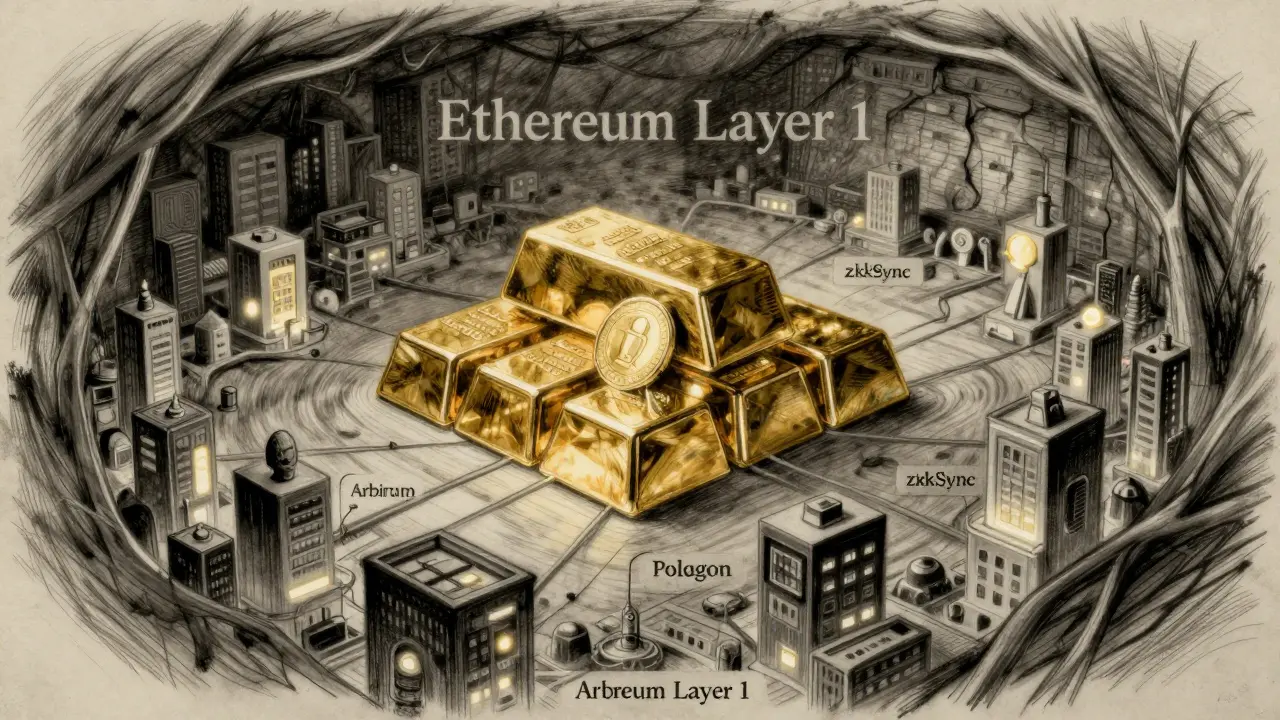

What Is a Layer 1 Blockchain?

Think of Layer 1 as the ground floor of a building. It’s the original network that handles everything on its own: consensus, security, and transaction processing. Bitcoin and Ethereum are the two biggest examples. Bitcoin, launched in 2009, uses Proof-of-Work to confirm transactions. Ethereum switched to Proof-of-Stake in 2022, which cut its energy use by over 99%. But even with that upgrade, Ethereum still only handles 15 to 30 transactions per second.

That’s not enough for millions of users. During the NFT boom in early 2022, Ethereum fees spiked to $200 per transaction. People couldn’t even pay to mint a digital artwork. That’s not a bug-it’s a design limit. Layer 1 networks are built for security and decentralization, not speed. Bitcoin takes 60 minutes to fully confirm a transaction. Ethereum takes 12 to 15 seconds per block, but finality can take 5 to 10 minutes. For everyday use, that’s too slow.

Layer 1s have strengths, though. They don’t rely on anyone else. Bitcoin has around 15,000 public nodes. Ethereum has over 835,000 validators. That’s a massive amount of distributed trust. If you want the most secure, censorship-resistant system, Layer 1 is still the gold standard.

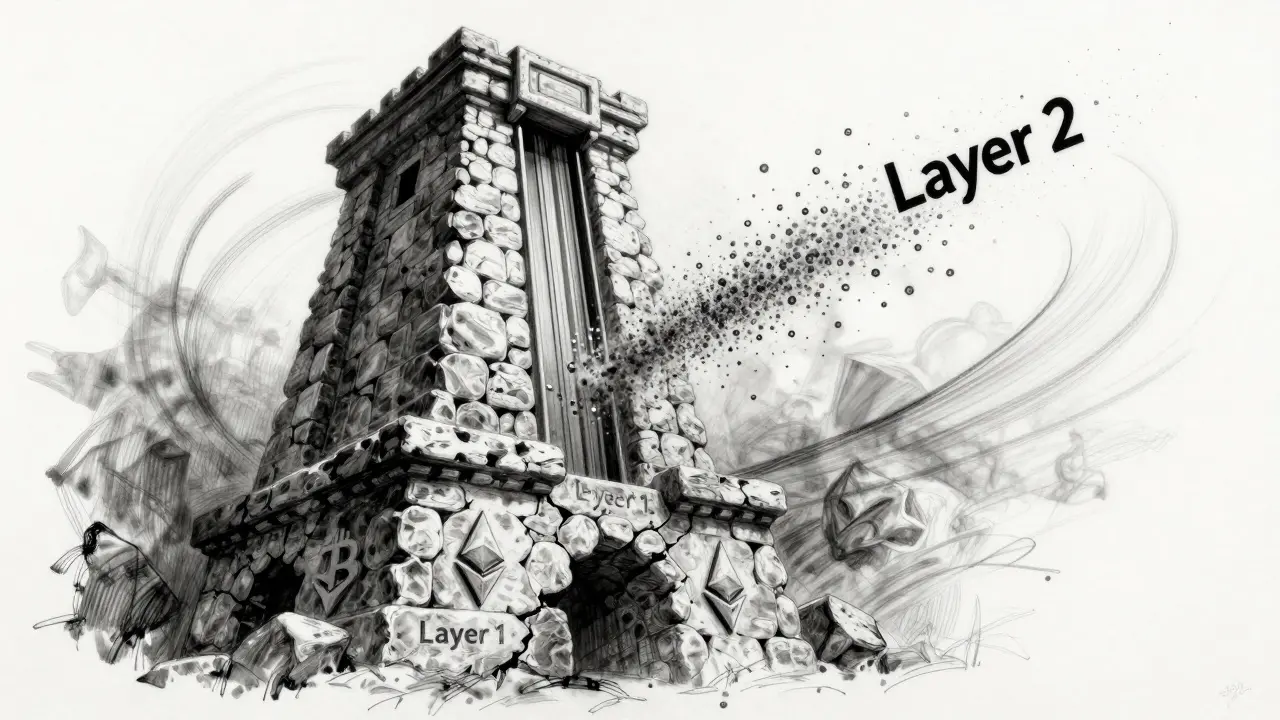

What Is a Layer 2 Blockchain?

Layer 2 is like adding an express elevator to that same building. It doesn’t replace the ground floor-it uses it. Layer 2 solutions sit on top of Layer 1 blockchains and handle most of the transaction workload off-chain. They bundle hundreds or thousands of transactions into one single proof, then post that proof to the main chain. This is how they get so much faster and cheaper.

Take Arbitrum One, an Ethereum Layer 2. It can process 2,000 to 4,000 transactions per second. That’s over 100 times faster than Ethereum’s base layer. Fees? Around $0.02 per transaction. Polygon zkEVM? 2,000 TPS. StarkNet? Up to 9,000 TPS. And fees are often under a penny.

There are three main types of Layer 2s:

- State channels (like Bitcoin’s Lightning Network): Two parties open a channel, transact privately, then settle on-chain once.

- Sidechains (like Polygon PoS): Separate blockchains connected to Ethereum with their own validators. Faster, but less secure.

- Rollups (like Arbitrum, Optimism, zkSync): The most popular. They bundle transactions and post compressed data to Ethereum. Two flavors: Optimistic Rollups (assume transactions are valid unless challenged) and zk-Rollups (use cryptographic proofs to prove validity).

Rollups are where the real innovation is. zk-Rollups like zkSync Era finalize transactions in 10 to 60 minutes. Optimistic Rollups like Arbitrum take up to 7 days to fully finalize because of the fraud-proof window. That delay is a trade-off for lower complexity.

Security: Layer 1 vs Layer 2

Layer 1s are secure because they’re decentralized. Thousands of independent nodes verify every block. Bitcoin’s network is so large, it’s nearly impossible to attack.

Layer 2s inherit security from their parent chain-but with caveats. Rollups are safer than sidechains because they rely on Ethereum’s security. But they still need operators to post data. If a single operator goes rogue or gets hacked, things can go wrong.

Remember the $625 million Nomad Bridge hack in 2022? Or the $613 million Ronin Bridge hack in 2022? Those weren’t attacks on Ethereum. They were attacks on the bridges connecting Layer 2s to Layer 1s. That’s the new vulnerability: cross-chain communication. Layer 2s aren’t inherently less secure than Layer 1s-but the bridges, wallets, and sequencers that connect them often are.

As of 2024, Layer 2s have 37% higher bridge-related security risks than Layer 1s, according to UC Berkeley’s Blockchain Research Lab. That’s not because the tech is broken-it’s because it’s new, and the attack surface is growing.

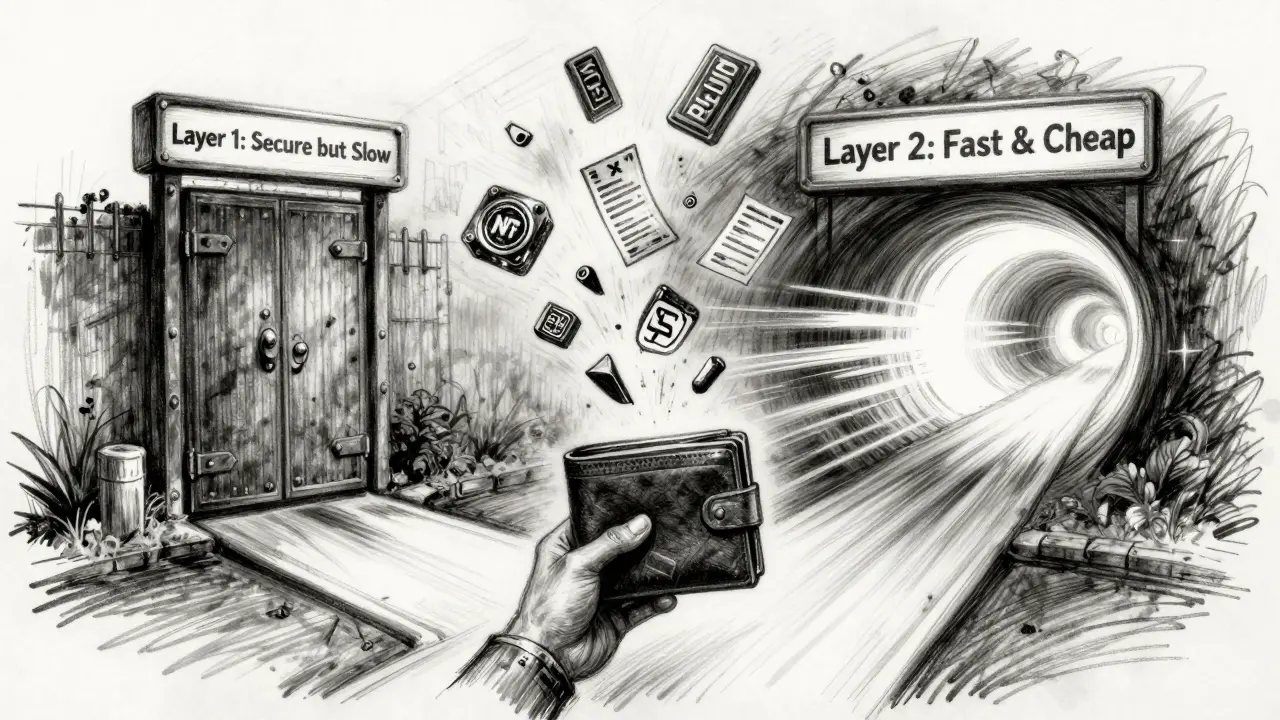

Cost and Speed: The Real Difference

Here’s the clearest reason Layer 2s are winning: cost.

In Q2 2024, the average transaction fee on Ethereum Layer 1 was $3.80. On Arbitrum? $0.02. On Polygon? $0.0005. That’s not a 90% saving-it’s a 99.9% saving. For developers, that’s the difference between building a dApp and abandoning it. One Reddit user said deploying a dApp on Arbitrum dropped their gas costs from $15,000 to $150 for 1,000 transactions.

Speed matters too. If you’re buying an NFT, you don’t want to wait 10 minutes for your transaction to confirm. Layer 2s make that instant. Even zk-Rollups with 60-minute finality are faster than waiting for Ethereum’s 10-minute blocks plus 6 confirmations.

And it’s not just users. Enterprises are switching too. Deloitte’s 2024 survey found 62% of companies use Layer 2s for customer-facing apps-like loyalty programs or digital receipts-because they can’t afford $15 per transaction. They keep Layer 1 for final settlement, where security matters more than speed.

Decentralization: Who’s Really in Charge?

Layer 1s are decentralized by design. Bitcoin’s nodes are run by individuals, companies, and universities around the world. Ethereum’s validators are spread across 100+ countries.

Layer 2s? Not so much. Most rollups start with a single sequencer. That’s the operator who orders and bundles transactions. Until recently, Optimism had just one sequencer. Arbitrum did too. That’s a single point of failure. If that operator goes offline, transactions stop.

That’s changing. Optimism decentralized its sequencer in June 2024. StarkNet and zkSync are moving toward permissionless sequencers. But many Layer 2s still operate with only 10 to 50 validators. Polygon PoS uses 100. That’s far fewer than Ethereum’s 835,000.

So yes, Layer 2s are faster and cheaper-but they’re also more centralized. That’s the trade-off. You’re giving up some decentralization for performance. And for many users, that’s a fair deal.

What’s Next? The Future of Layer 1 and Layer 2

Layer 1 isn’t dead. It’s evolving. Ethereum’s Dencun upgrade in March 2024 slashed Layer 2 data costs by 90%. That’s why rollup fees dropped from $0.50 to $0.05. It’s like building a better highway so more cars can flow.

Meanwhile, Layer 1s like Core DAO are trying to blend both worlds. Core uses a hybrid consensus called “Satoshi Plus,” which borrows Bitcoin’s security while running its own fast chain. It’s not pure Layer 1 or Layer 2-it’s something new.

On the Layer 2 side, the race is on to become the most trusted, scalable, and open platform. Arbitrum leads in market share with 32.1%, followed by Optimism at 24.7%. But new players like Base (Coinbase’s Layer 2) and zkSync are catching up fast.

By 2026, Gartner predicts 70% of enterprise blockchains will use Layer 2 for daily transactions. By 2030, experts believe Layer 1s will become settlement layers-like banks settling payments between credit card networks-while Layer 2s become the user-facing apps we interact with every day.

Which Should You Use?

If you’re a developer building a dApp? Start on a Layer 2. You’ll save thousands in gas fees and get faster user onboarding.

If you’re holding crypto long-term? Keep your main balance on Ethereum or Bitcoin. Use Layer 2s for trading, swapping, or gaming.

If you’re moving funds between layers? Be careful. Bridges are still risky. Always check the security audit status. Don’t send large amounts until you’ve tested with a small one.

And if you’re just starting out? Use a wallet like MetaMask with built-in Layer 2 support. It’ll auto-switch you to Arbitrum or Polygon when you make a transaction-no need to think about it.

The future isn’t Layer 1 or Layer 2. It’s both. Layer 1 is the vault. Layer 2 is the ATM. You need both to make the system work.

Is Layer 2 safer than Layer 1?

Layer 1s are generally safer because they’re fully decentralized and don’t rely on third-party operators. Layer 2s inherit security from their parent chain, but they introduce new risks-especially through bridges and centralized sequencers. Rollups are safer than sidechains, but they’re not as decentralized as Ethereum or Bitcoin. For most users, Layer 2s are safe enough for daily use, but large holdings should stay on Layer 1.

Can I use Layer 2 without understanding blockchain?

Yes. Wallets like MetaMask, Rainbow, and Coinbase Wallet now auto-detect when you’re on a Layer 2 and handle bridging for you. You can buy ETH on Coinbase, send it to your wallet, and start using Arbitrum or Polygon without ever typing a command. The complexity is hidden. You just need to know that moving funds between chains might take minutes-or up to a week for Optimistic Rollups.

Why do Layer 2s have withdrawal delays?

Optimistic Rollups require a 7-day challenge period so anyone can dispute a fraudulent transaction. If someone tries to cheat by submitting a fake batch, others can prove it wrong using fraud proofs. That’s why withdrawals take up to a week. zk-Rollups don’t need this-they use cryptographic proofs that are verified instantly. So if you need fast access to your funds, choose a zk-Rollup like zkSync or StarkNet.

Are Layer 2s better for NFTs and gaming?

Absolutely. NFT mints and in-game transactions happen hundreds of times per second. Ethereum Layer 1 can’t handle that. Platforms like Immutable X (a zk-Rollup) processed over 9,000 NFT mints per second during the Illuvium launch. Fees were pennies. On Ethereum, that would’ve cost millions in gas and crashed the network. Layer 2s made high-frequency, low-cost blockchain apps possible.

Will Layer 2s replace Layer 1s?

No. Layer 1s will remain the settlement layer-the final, secure anchor. Layer 2s will handle the volume. Think of Layer 1 as the Federal Reserve and Layer 2s as commercial banks. The Fed doesn’t process your coffee purchase, but it backs the system. Ethereum and Bitcoin will keep securing value, while Layer 2s handle the day-to-day transactions. The two work together.

What’s the biggest risk with Layer 2s right now?

Fragmentation. There are over 17 different Ethereum Layer 2s, each with its own smart contract environment, token standards, and bridge protocols. Moving assets between them can be confusing or risky. A user might send ETH to Arbitrum, then try to use it on zkSync and lose it. Interoperability is still a major challenge. Stick to the most established Layer 2s-Arbitrum, Optimism, zkSync, Polygon-and avoid experimental chains until they’ve proven stable.

Final Thoughts

Layer 1 and Layer 2 aren’t enemies. They’re partners. One gives you security. The other gives you speed. One is the bedrock. The other is the engine.

By 2025, most people won’t even know they’re using a Layer 2. They’ll just open their wallet, swap tokens, and play games-without seeing a single gas fee. That’s the goal. And it’s already happening.

The real question isn’t which is better. It’s which one you need for what you’re doing. For holding? Layer 1. For spending? Layer 2. For the future? Both.

Been using Arbitrum for my NFT flips and honestly? Life changed. Fees are so low I forget I'm even on a blockchain. No more sweating over $20 gas fees just to mint a pixel art cat. Layer 2s are the reason I still even bother with crypto.

People act like Layer 2s are some kind of miracle. They’re just centralized middlemen with fancy marketing. You think you’re decentralized? You’re trusting a single sequencer. And don’t get me started on bridges-those are just honeypots for hackers.

Love how this post breaks it down. I used to think 'Layer 2' was just a buzzword. Now I get it-Layer 1 is like your savings account, Layer 2 is your debit card. You keep the big stuff safe, use the fast one for daily stuff. Also, zkSync is wild-my NFT mint took 12 seconds and cost 2 cents. Mind blown.

STOP. Just STOP. You people are giving up SECURITY for SPEED. That’s not innovation-that’s surrender. Ethereum is the last honest blockchain left. And you’re all running to some sketchy Layer 2 because you can’t wait 15 seconds to send $5 worth of ETH?!

Don’t let the haters scare you. Layer 2s are the future and they’re already here. I’ve built 3 dApps-two on Optimism, one on Polygon. Gas costs dropped from $10k to $80 for 50k transactions. That’s not a tweak-that’s a revolution. Keep building.

Wait-so you’re telling me I can actually USE blockchain without going bankrupt? Who knew? I thought crypto was just rich people playing with their money. Now I’m swapping tokens on Arbitrum like it’s Venmo. And I didn’t even need to read a whitepaper. 😅

Interesting. I’ve been watching this space for years. The tech is solid. But the community? Too many people treat Layer 2s like they’re immune to risk. They’re not. Just because fees are low doesn’t mean the code is perfect.

Layer 1 = soul. Layer 2 = body. Without the soul, the body’s just meat. But without the body… the soul just sits there crying in a vault 😭. I’m just here for the vibes and the 0.0001 ETH gas fees. Also, who else is using zkSync and feels like they’re in 2030?

For anyone new to this-don’t panic if you see 7-day withdrawal times. It’s scary at first, but it’s there to protect you. Once you understand why it’s there, it feels less like a delay and more like a safety net. I’ve lost friends to rushed bridge swaps. Don’t be them.

Y’all are acting like Layer 2s are the end-all-be-all… but what about decentralization?! You’re trading a thousand validators for TEN. That’s not progress-that’s regression. And don’t even get me started on Coinbase’s Base… it’s just a corporate sidechain with a blockchain sticker on it.

Layer 2s are fine. But don’t call them ‘decentralized.’ They’re not. They’re efficient. And efficiency isn’t the same as freedom. Also, ‘$0.02 gas’? Cute. But what happens when the sequencer goes offline? You’re stuck. And no one’s gonna help you.

I just use MetaMask and let it auto-switch to Polygon when I buy NFTs. Never thought about layers before. Now I know I’m not on Ethereum proper-but I don’t care. My wallet’s happy. My bank account’s happy. That’s all that matters.

Why are you all still using Ethereum? Core DAO is faster, cheaper, and uses Bitcoin’s security. You’re all stuck in 2022. Layer 2s are just bandaids. Real innovation is happening elsewhere. Also, your gas fees are still too high. Try Solana.

The real genius of this architecture is the division of labor. Layer 1 ensures trust. Layer 2 ensures scalability. It’s like how the U.S. Federal Reserve doesn’t handle your ATM withdrawals-but it backs the entire system. This isn’t a compromise. It’s evolution. And it’s working. We’re not losing decentralization-we’re optimizing it.