When you sell or trade cryptocurrency in Australia, you’re not just moving digital assets-you’re triggering a taxable event. The Australian Taxation Office (ATO) treats crypto as property, not currency. That means every time you sell, trade, spend, or even pay a network fee with crypto, you might owe capital gains tax (CGT). It’s not complicated if you understand the rules, but it’s easy to mess up if you assume it works like regular bank transfers.

What Counts as a CGT Event?

You don’t need to cash out to crypto to AUD to trigger tax. Any disposal counts. That includes:- Selling crypto for Australian dollars

- Trading one crypto for another (like ETH for SOL)

- Using crypto to buy goods or services

- Gifting crypto to someone who isn’t your spouse

- Paying transaction fees in crypto

Even paying a $5 network fee in Bitcoin counts. If you bought that Bitcoin for $300 and it’s worth $400 when you use it to pay the fee, you’ve made a $100 capital gain. That’s taxable. Most people don’t realize this until they get an ATO letter.

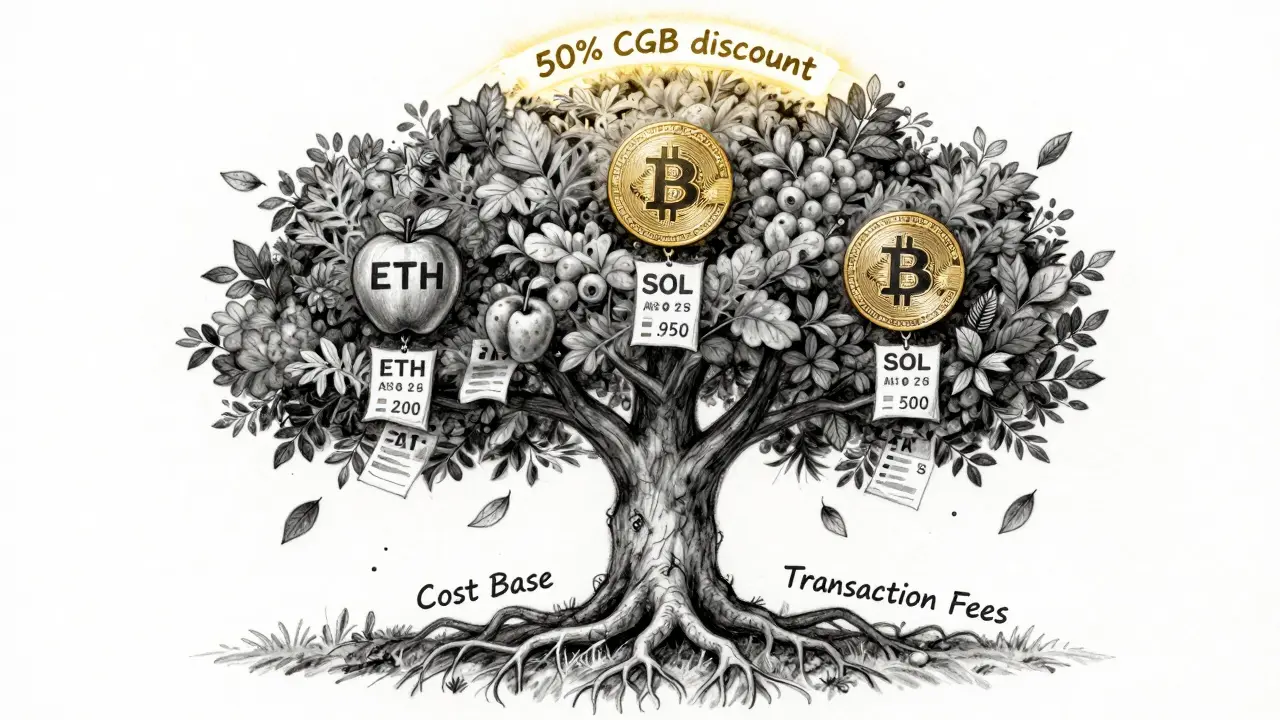

The 50% CGT Discount-Your Biggest Advantage

The biggest relief in Australia’s crypto tax system is the 50% CGT discount. If you hold your crypto for more than 12 months before selling or trading it, you only pay tax on half the gain. The other half is tax-free.Let’s say you bought 1 ETH for $2,500 in March 2024. You sell it in May 2025 for $4,000. Your gain is $1,500. Because you held it over 12 months, you only pay tax on $750. If you’re in the 37% tax bracket (income between $45,001 and $120,000), your tax bill drops from $555 to $277.50. That’s a $277.50 saving just for waiting.

This discount is why most Australian crypto investors hold for over a year. A University of Sydney survey in January 2025 found 78% of investors deliberately wait past the 12-month mark to qualify. It’s not just smart-it’s financially essential if you’re not in the lowest tax bracket.

What If You Hold Less Than 12 Months?

No discount. Full tax. Your entire gain gets added to your taxable income and taxed at your marginal rate-plus the 2% Medicare levy.Same example: You bought ETH for $2,500 in March 2024. You sell it in January 2025 for $4,000. Gain is still $1,500. But because you held it less than a year, you pay tax on the full $1,500. At 37%, that’s $555. Plus $30 in Medicare levy. Total: $585. That’s more than double what you’d pay if you waited just 30 more days.

This is where traders get burned. If you’re buying and selling weekly, you’re not getting the discount. And if the ATO thinks you’re running a business-because you’re doing 100+ trades a year-you might be taxed as ordinary income with no discount at all. The ATO’s 2025 compliance program is actively targeting these cases.

Cost Base: The Most Overlooked Part

Your capital gain isn’t just sale price minus purchase price. You need to calculate your cost base. That includes:- What you paid for the crypto (in AUD)

- Transaction fees paid to buy it

- Any costs to transfer or store it (like hardware wallet fees)

Example: You buy 0.5 BTC for $30,000. You pay a $50 exchange fee. Your cost base is $30,050. Later, you sell it for $35,000. Your gain is $4,950-not $5,000. That $50 matters. And if you use crypto to pay a network fee? That’s another cost base calculation. If you spend 0.01 BTC (worth $500) to pay a fee, and you bought that 0.01 BTC for $400, you’ve made a $100 capital gain. Again-taxable.

42% of Australian crypto users struggle with cost base tracking, according to a CoinLedger survey. Most use spreadsheets at first. Then they switch to software like Koinly or CoinTracker after getting burned.

What About Airdrops, Staking, and Mining?

These aren’t CGT events. They’re ordinary income. That means they’re taxed at your full marginal rate when you receive them, not when you sell.Example: You get 100 $SOL from an airdrop. At the time it lands in your wallet, SOL is worth $150. You report $15,000 as income. Later, you sell it for $200 each. Your gain is $5,000, but now it’s a capital gain-so you can use the 50% discount if you hold it over 12 months.

Staking rewards work the same way. If you earn 0.5 ETH from staking, you pay income tax on its AUD value when you receive it. Then, when you sell it, you pay CGT on any gain above that value.

The ATO’s 2024 court case Commissioner of Taxation v Bitcoin Trader confirmed mining rewards are assessable income. That precedent now applies to all earned crypto. Don’t assume rewards are tax-free.

The $10,000 Personal Use Exemption-A Trap

Many people think buying coffee with crypto under $10,000 is tax-free. It’s not. The exemption only applies if the crypto was acquired specifically for personal use-not as an investment.Example: You bought Bitcoin in 2020 because you thought it would go up. In 2025, you spend $8,000 worth of it on a new laptop. That’s not personal use. You bought it to invest. So you pay CGT on the gain.

But if you bought Bitcoin in 2025 specifically to pay for a holiday in Bali, and you spent it all on flights and hotels? That’s personal use. No tax. But proving intent is hard. The ATO doesn’t care what you say-you need records showing you bought it to spend, not to sell.

Record Keeping: 15-20 Hours a Year

The ATO requires you to keep records for 5 years. That means:- Date of each purchase and sale

- Value in AUD at the time

- What you received or gave up

- Transaction IDs and exchange names

- Wallet addresses involved

Doing this manually takes 15-20 hours a year. Most people use software. In 2025, 67% of Australian crypto users rely on tools like Koinly, CoinTracker, or CryptoTaxCalculator. These connect to exchanges, auto-import transactions, calculate gains, and generate ATO-ready reports.

Why not use the ATO’s free calculator? It’s basic. It doesn’t handle DeFi swaps, NFT trades, or multi-chain transactions. If you’re doing anything beyond simple buys and sells, you need professional software.

How the ATO Knows What You Did

The ATO doesn’t guess. They get data directly from exchanges. Since February 2025, major Australian platforms-Swyftx, CoinSpot, Independent Reserve-have been legally required to report all customer transactions over $10,000. That’s under the Tax Agent Services Act 2009.By 2026, they’ll integrate with the Digital Asset Data Exchange, which will track all crypto movements across wallets and exchanges. Compliance rates are expected to jump from 65% to over 85% by 2027.

Don’t think you’re invisible. If you traded on Binance or Coinbase, the ATO has ways to find you. They’ve already matched data from offshore platforms with Australian tax returns. If your bank shows a $20,000 deposit and you didn’t declare crypto gains, you’re on their radar.

What About Losses?

Capital losses can offset capital gains. If you lost $5,000 on an NFT and made $8,000 on Ethereum, you only pay tax on $3,000. You can even carry losses forward to future years.One investor used $35,000 in NFT losses to wipe out their crypto gains in 2024. That’s legal. That’s smart. But you have to report the losses. The ATO won’t assume you lost money-you need to show the transactions.

How Australia Compares to the Rest of the World

Australia’s system is harsh for traders but generous for long-term holders. Compare:- Portugal: No CGT on crypto for individuals

- Singapore: No tax on long-term crypto holdings

- Germany: Tax-free after one year (but only for private sales)

- United States: Long-term CGT rates 0-20%, but no discount for high earners

- Malaysia: Completely tax-free for individuals

Australia’s 50% discount is unique. It’s not the lowest tax rate, but it’s one of the most predictable. If you’re holding, you’re rewarded. If you’re trading, you’re penalized. That’s by design.

What’s Coming Next?

The ATO is watching DeFi and NFTs closely. In 2026, expect clearer rules on liquidity pools, yield farming, and NFT trading. The current framework treats them like crypto trades, but that’s messy.There’s talk of a centralized reporting system for all crypto transactions over $10,000. Treasury released an exposure draft in May 2025. If it passes, exchanges will have to report every single transaction above that threshold.

But the 50% CGT discount? That’s safe. Politically, it’s popular. EY’s tax leader Jane Kelly said in June 2025: “It’s unlikely to change before 2027.”

Final Advice: Plan, Don’t Panic

If you’re holding crypto in Australia:- Wait 12+ months before selling to get the 50% discount

- Track every transaction-even small fees

- Use crypto tax software if you do more than 5 trades a year

- Don’t assume personal use exemptions apply

- Report losses-they’re your friend

Don’t wait until April to start. Start now. Gather your transaction history. Know your cost bases. Understand your gains. The ATO isn’t going away. But with the right approach, you’re not just compliant-you’re saving thousands.

Do I pay tax if I just buy crypto and don’t sell?

No. Buying crypto with AUD is not a taxable event. You only pay tax when you dispose of it-sell, trade, spend, or gift it. Holding crypto without selling doesn’t trigger tax.

Can I use crypto losses to reduce my income tax?

Only against capital gains. You can’t use crypto losses to reduce your salary or business income. But you can use them to offset gains from other crypto sales, NFTs, or even shares. Losses can also be carried forward to future years.

Are staking rewards taxed?

Yes. Staking rewards are treated as ordinary income. You pay tax on their value in AUD when you receive them. Later, if you sell them, you pay capital gains tax on any increase in value since you received them.

What if I trade crypto on an offshore exchange like Binance?

You still owe tax in Australia. The ATO gets data from exchanges through international agreements and bank reporting. Even if you trade on Binance, Coinbase, or Kraken, your Australian tax obligations don’t disappear. The ATO has been matching offshore transactions with local tax returns since 2023.

Is there a tax-free threshold for crypto gains?

Yes. The $18,200 tax-free threshold applies to crypto gains like any other income. If your total taxable income-including crypto gains-is under $18,200, you pay no tax. But if your gains push you over that amount, you pay tax on everything above it.

Can I avoid tax by transferring crypto between my own wallets?

No. Transferring crypto between wallets you own doesn’t trigger a CGT event. But you still need to track the cost base and acquisition date. If you later sell it, the original purchase details still matter.

What happens if I don’t report my crypto gains?

The ATO can impose penalties up to 75% of the unpaid tax, plus interest. They’re actively matching data from exchanges and banks. If you’re caught, you’ll owe back taxes, penalties, and interest. Many people who avoided reporting in 2023-2024 are now getting letters. It’s not worth the risk.

Just a heads-up - if you're using DeFi protocols, make sure your software tracks gas fees as part of the cost base. I lost $1,200 last year because I forgot to include them. Koinly caught it after I imported my wallet history. Don't be like me.

Hold for a year. That's it. Simple.

I spent three weeks last year trying to manually track every single transaction across three wallets, four exchanges, and a handful of NFT mints. I had spreadsheets within spreadsheets, color-coded tabs, even footnotes explaining why I bought 0.002 ETH in April 2023 to pay for a Discord server fee. And then I realized - the ATO doesn’t care about your footnotes. They care about total gain. So I dumped it all into CryptoTaxCalculator, imported my wallet addresses, and in 45 minutes I had a full report with breakdowns by asset, date, and tax bracket. The software doesn’t just calculate - it educates. It shows you how much you saved by holding past 12 months. It flags when you accidentally used crypto to pay a fee and didn’t report it. It even reminds you to log your staking rewards as income on the day they hit your wallet. I used to think this was overkill. Now I think anyone who doesn’t use software is just asking for an audit.

It’s strange how we treat digital assets like property but forget they’re fundamentally different from houses or stocks. You can’t hold crypto in your hand. You can’t touch it. It’s just code, signed by keys, recorded on a ledger that exists nowhere and everywhere. And yet, we tax it like it’s land. The system works - but it feels like trying to measure wind with a ruler. The 50% discount is generous, sure. But why does the ATO assume intent? Why does buying Bitcoin for a holiday count as personal use only if you *say* so? There’s no objective line between investment and use. Only paperwork. And paperwork is just memory made visible.

Of course the ATO is watching. They’re just a puppet of the global banking cartel. You think they care about fairness? They care about control. Crypto was supposed to be free money - now they want to tax every click, every swap, every damn gas fee. And they’re forcing exchanges to hand over your data like it’s a police raid. This isn’t taxation - it’s digital surveillance with a receipt.

Bro, you're all missing the point. If you're doing more than 10 trades a month, you're running a business. The ATO will reclassify you as a trader. No CGT discount. Full income tax. And you'll owe GST on your trading profits too. I've seen it happen. People think they're investors. They're not. They're day traders. Wake up.

For those unfamiliar with the UK system - we have no CGT on crypto for private individuals if held under £50k annual gain. But we do tax staking as income. The Australian 50% discount is actually more favorable than ours for long-term holders. Still, the complexity of tracking cost bases across chains is brutal. I recommend using CoinTracker - their multi-chain support is unmatched.

Don’t let the fear of taxes stop you from investing. Use the tools. Track your stuff. Get help if you need it. The ATO isn’t your enemy - ignorance is. You’re not being punished. You’re being given a chance to play the game right. And if you do? You’re not just compliant - you’re winning.

The personal use exemption is a legal fiction. Intent is not recorded on-chain. There is no timestamped declaration of purpose when you buy Bitcoin. The ATO asks you to prove a mental state from years ago with transaction logs. That’s not law - that’s guesswork dressed in bureaucratic robes. If you bought it with the vague hope it might appreciate, you’re an investor. If you bought it to buy coffee, you’re not. But how do you prove that? You can’t. So the rule is meaningless. And that’s the problem with taxing abstract value.

Don't forget to log your wallet transfers between your own addresses. I thought they didn't count. Turns out they do for cost base tracking. I almost missed a $3k gain because I didn't record the date I moved ETH from Coinbase to Ledger. A tiny oversight. Big tax bill.

If you're new to crypto taxes, start with Koinly's free plan. Import your wallet, let it auto-classify your transactions, then review the summary. You’ll be shocked at how many small things you missed - like that 0.001 BTC you used to pay a wallet fee. That’s a $20 gain. Taxable. Don’t wait until April. Do it now. Your future self will thank you.

THE ATO IS COMING FOR YOU. I SAW A GUY GET AUDITED FOR SPENDING 0.005 BTC ON A PIZZA. THEY CALLED IT A 'DISPOSAL EVENT.' HE OWED $800 IN TAXES FOR A $3 PIZZA. I'M NOT KIDDING. THEY HAVE YOUR IP ADDRESS. THEY HAVE YOUR WALLET. THEY HAVE YOUR BANK STATEMENTS. YOU ARE NOT ANONYMOUS. YOU ARE NOT SAFE. YOU ARE BEING WATCHED. EVERY SWAP. EVERY FEE. EVERY TRANSACTION. THEY KNOW. THEY KNOW. THEY KNOW.

Staking rewards are income - yes. But here’s the nuance: if you stake via a centralized exchange, they often issue a 1099-style statement. If you stake on a DeFi protocol? You’re on your own. You need to track the exact timestamp and AUD value at the moment the reward hits your wallet. I use DeFiSaver + Koinly sync. It’s clunky, but it works. Don’t assume your exchange will do it for you.

In India, crypto is taxed at 30% with no deductions. No CGT discount. No cost base adjustments. Even transaction fees are not deductible. Australia’s system, despite its complexity, is far more rational. The 50% discount encourages long-term investment. That is good policy. Do not complain - appreciate.

you think you’re smart because you hold for a year? think again. the ato knows when you bought that coin. they know your wallet. they know your bank deposits. if you’re buying every time the price dips and selling every time it pumps? you’re a trader. no discount for you. and if you think you can hide it on binance? lol. they’ve already matched 12k australian users with offshore trades. you’re not special. you’re not hidden. you’re just late.

Biggest mistake I made? Not tracking my hardware wallet fee. I paid $15 in BTC to move coins to my Ledger. Thought it was just a fee. Turns out, I triggered a $200 capital gain because the BTC had appreciated. Koinly flagged it. I was horrified. Now I log every single outflow - even if it’s $0.50. It adds up. And honestly? It’s not that hard. Just spend 10 minutes a month updating your tracker.

One thing no one talks about: what if you inherit crypto? The ATO hasn’t clarified this yet. Is it a CGT event at the time of death? Or does the cost base transfer? I asked my accountant. He said ‘probably stepped-up basis like the US’ but he’s not sure. Don’t assume. Get advice before you inherit anything.

You got this. Seriously. It feels overwhelming at first - all these rules, all these numbers. But you don’t have to be perfect. You just have to be consistent. Start small. Track one asset. One month. Then add another. You’re not trying to be a tax lawyer. You’re trying to be smart with your money. And that’s already a win.

Why does the ATO care if I pay a network fee in crypto? It’s $5. I’m not making money. I’m just using the network. It’s like paying a toll. Why tax the toll? This feels like bureaucracy trying to squeeze blood from a stone.

I used to panic every time I sold a coin. Now I smile. Because I know the 50% discount is my secret weapon. I bought my first ETH in June 2023. I didn’t touch it until July 2024. That $1,200 gain? I only paid tax on $600. That’s like getting a free $600 gift from the government. I didn’t earn it. I just waited. And now? I’m planning my next hold. Not because I’m greedy. Because I’m wise.

The assertion that 78% of Australian crypto investors deliberately hold beyond 12 months is statistically dubious. The University of Sydney survey cited lacks methodological transparency - sample size, weighting, and response bias are unreported. Furthermore, the claim that the 50% CGT discount is 'financially essential' for non-low-income earners is normative, not empirical. One must question whether behavioral compliance is driven by tax optimization or by fear of audit. The ATO's data-sharing agreements with exchanges create a coercive environment that distorts rational economic behavior. This is not policy - it is surveillance economics disguised as taxation.

you think you're safe because you use a 'trusted' exchange? you're a fool. the ato doesn't need your exchange data. they just need your bank account. if you deposited $10k from binance and didn't declare it? they already have your name. they already have your ip. they already have your phone number. you're not hiding. you're just delusional. and when they come for you? you'll cry. and no one will care.

It is imperative to note that the cost base calculation must include all incidental expenses directly attributable to the acquisition and disposal of digital assets. This includes, but is not limited to, exchange fees, network transaction fees, and wallet transfer costs. Failure to include these elements constitutes an understatement of capital gain and may result in penalties under Section 284-75 of the Taxation Administration Act 1953. Professional advice is recommended for complex portfolios.

the discount is nice but honestly i just hold and ignore taxes until april then panic and pay whatever i owe

Wait - you’re all talking about the 50% discount like it’s magic. But what if you have losses? I lost $18k on NFTs last year. Then I sold ETH for a $20k gain. The ATO let me offset $18k. I only paid tax on $2k. That’s the real win. Don’t hide your losses. Report them. They’re your best friend.

That’s exactly what I did. I had $12k in NFT losses from 2023. Last year I sold some Bitcoin for $15k gain. Used $12k of the loss to wipe out the tax. Paid nothing. Just filed the forms. No one talks about this part. Losses are the hidden perk.