Blockasset (BLOCK) isn’t just another cryptocurrency. It’s a utility token built for one specific purpose: to power sports betting and fan engagement on the BlockBet platform. If you’ve ever wondered how a crypto coin can tie into UFC fights, athlete endorsements, or cashback on bets, BLOCK is designed to do exactly that. But here’s the catch-it’s not for everyone. Its value, usability, and even its price depend heavily on whether you’re a sports fan who bets online or just someone chasing the next crypto gem.

What Blockasset (BLOCK) actually does

Blockasset (BLOCK) is the fuel behind BlockBet, a Web3 sportsbook and casino platform. Unlike Bitcoin or Ethereum, which are general-purpose blockchains, BLOCK exists to make betting on sports more interactive. When you place a bet using BLOCK on BlockBet, you get 20% cashback in the same token. That’s far higher than the 5-10% cashback most traditional betting sites offer. For someone who bets regularly, that adds up fast.

But it’s not just about cashback. Blockasset also runs an Athlete Launchpad, where fans can buy tokens tied to real athletes like UFC fighters Alex Pereira and Darren Till. Owning these tokens doesn’t give you ownership of the athlete-but it does unlock exclusive content, behind-the-scenes access, and special promotions tied to their fights. If you’re a UFC fan, this is a rare chance to feel more connected to the action.

The platform’s media arm has already generated over 200 million views through UFC- and ESPN-licensed content. That’s not marketing fluff-it’s real traction. People are watching, and BLOCK is how they engage.

How BLOCK works across blockchains

One of BLOCK’s biggest technical advantages is its multi-chain support. It runs on Solana (SPL), Binance Smart Chain (BEP-20), and Ethereum (ERC-20). That means you can hold it in Phantom (for Solana), MetaMask (for Ethereum), or Trust Wallet (for BSC). This flexibility helps users avoid high gas fees on Ethereum or slow transactions on other networks.

But here’s where things get messy. Many new users pick the wrong network when sending or depositing BLOCK. Blockasset’s own data shows 42% of new users send tokens to the wrong chain, causing delays or lost funds. Always double-check: if you’re using MetaMask, you’re likely on Ethereum. If you’re on Solana, use Phantom. Mixing them up breaks the transaction.

There’s also no single official wallet. Blockasset doesn’t control your keys-you do. That’s good for security, bad for beginners. If you lose your seed phrase, your BLOCK is gone forever.

Tokenomics: Supply, distribution, and buybacks

There’s a major discrepancy in supply numbers between CoinMarketCap and CoinGecko. CoinMarketCap says the total supply is 312.23 million BLOCK. CoinGecko says it’s 325.88 million. This kind of mismatch is rare among established tokens and raises questions about transparency.

The token distribution looks like this:

- 25% - Ecosystem development

- 25% - Reserves

- 12.5% - Advisory & partnerships

- 12.5% - Liquidity pools

- 11% - Team

The 25% set aside for reserves is a red flag for some analysts. Delphi Digital pointed out that there’s no clear vesting schedule for these tokens. If the team decides to dump them all at once, the price could crash. That’s a risk you don’t see with top-tier gaming tokens like CHZ.

On the positive side, Blockasset has executed 12 consecutive weekly buybacks since September 2025, removing over 2.8 million BLOCK from circulation. That’s a sign they’re trying to reduce supply and support price-but it’s not enough to offset the low trading volume.

Price, market cap, and liquidity problems

As of late 2025, BLOCK trades between $0.0003 and $0.0095, depending on the exchange. That’s a massive range. CoinLore says $0.000302. CoinMarketCap says $0.00951. Why the difference? Because BLOCK isn’t listed on major exchanges like Binance or Coinbase. It’s mostly traded on smaller platforms like Gate.io and LBank.

That leads to low liquidity. The 24-hour trading volume is only around $17,000. Compare that to Chiliz (CHZ), which trades over $38 million daily. Low liquidity means big price swings. If someone sells 500,000 BLOCK at once, the price could drop 30% in minutes.

Market cap is listed at $1.56 million by CoinMarketCap. That’s tiny. Blockasset holds just 0.037% of the blockchain sports betting market. Stake.com and BC.Game, by comparison, control over 40% combined. BLOCK is a niche player in a niche market.

Who uses BLOCK and where?

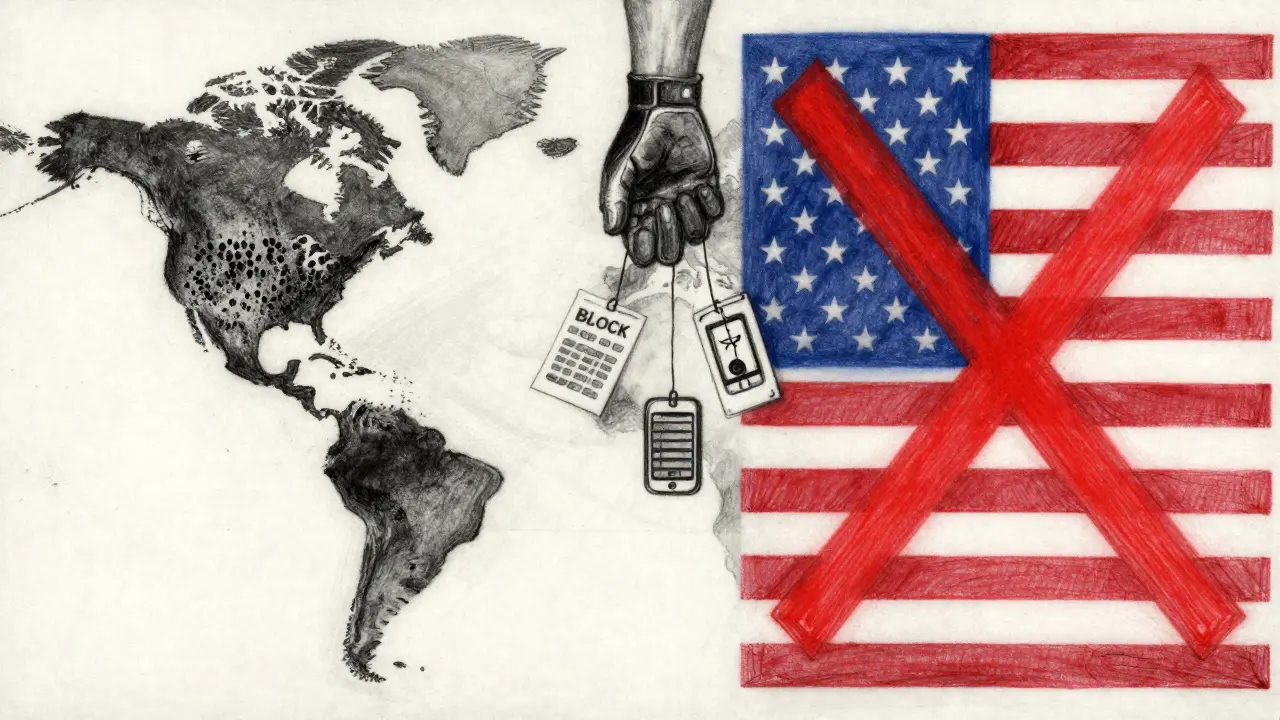

Blockasset’s user base isn’t global. It’s concentrated in Southeast Asia (38.5%) and Latin America (29.1%). These regions have high crypto adoption and strong sports betting cultures, but strict gambling laws in the U.S., U.K., and Australia mean BlockBet blocks users from 87 countries. If you’re in the U.S., you can’t use it-no matter how much you like MMA.

Users are mostly male (82.7%) and between 25 and 34 years old. They’re not casual investors-they’re bettors. Reddit threads and Trustpilot reviews show people love the athlete access and cashback, but hate slow withdrawals (8.2 hours on average) and customer service that takes over 48 hours to reply.

The mobile app also crashes during big events like UFC 308. That’s a serious flaw for a platform built around live betting.

How does BLOCK compare to Chiliz (CHZ)?

Chiliz (CHZ) is the obvious comparison. It’s the go-to fan token for soccer clubs like FC Barcelona and Juventus. But CHZ doesn’t let you bet. It lets you vote on team merch, jersey designs, or even stadium snacks. It’s more about fandom than finance.

Blockasset flips that. You don’t vote-you bet. And you get cashback. That’s a stronger financial incentive. But CHZ has 187x the market cap and is listed on Binance, Coinbase, and Kraken. BLOCK isn’t on any of them.

CHZ is a brand. BLOCK is a tool. One is for fans. The other is for bettors.

Is BLOCK worth buying?

Here’s the reality check:

- If you bet on UFC or other sports regularly and want 20% cashback in crypto-BLOCK could save you money.

- If you’re into exclusive athlete content and live event access-BLOCK gives you that.

- If you’re looking for a crypto investment with growth potential-this is risky. The market cap is tiny, liquidity is low, and price predictions vary wildly.

- If you’re new to crypto-avoid it. The setup is confusing, support is slow, and mistakes cost money.

Analysts are split. Messari says the model is compelling. Delphi Digital says the reserve allocation is dangerous. TradingView’s charts show BLOCK trading below its 50-day average, which could mean a bounce-or a longer slide.

Long-term, Blockasset plans to expand beyond UFC into soccer and boxing. If they pull that off, and fix their app crashes and customer service, BLOCK could grow. But right now, it’s a high-risk, high-effort play for a very specific audience.

How to get started with BLOCK

If you’re still interested, here’s how to begin:

- Choose a wallet: MetaMask (Ethereum), Phantom (Solana), or Trust Wallet (BSC).

- Buy ETH, SOL, or BNB on a major exchange like Binance or Coinbase.

- Send your crypto to a decentralized exchange like Uniswap (Ethereum), Raydium (Solana), or PancakeSwap (BSC).

- Trade for BLOCK using the correct token contract (check Blockasset’s official site-don’t trust random links).

- Transfer BLOCK to your wallet and connect it to BlockBet.

Always test with a small amount first. And never send BLOCK from an exchange directly to BlockBet-always use your own wallet first.

What’s next for Blockasset?

Blockasset’s roadmap includes:

- Q1 2026: Redesigned mobile app to fix crashes during live events

- Expanding athlete partnerships to soccer and boxing

- More frequent buybacks to reduce supply

- Improving customer support response times

None of these are guaranteed. But if they deliver, BLOCK could become more than just a betting token-it could become a bridge between sports fans and Web3.

Right now, it’s a gamble. But for the right person-someone who bets on UFC, likes crypto, and doesn’t mind a little risk-it’s one of the few tokens that actually delivers real utility.

Is Blockasset (BLOCK) a good investment?

Blockasset isn’t a traditional investment. It’s a utility token for betting and fan access. If you bet on sports regularly, the 20% cashback can save you money. But if you’re looking to grow wealth, it’s high-risk. The market cap is under $2 million, liquidity is low, and price data is inconsistent across platforms. Don’t invest more than you can afford to lose.

Can I buy BLOCK on Coinbase or Binance?

No, BLOCK is not listed on Coinbase, Binance, or other major exchanges. You can only buy it on smaller platforms like Gate.io, LBank, or through decentralized exchanges like PancakeSwap or Raydium. This limits liquidity and makes it harder to enter or exit positions safely.

Why is the price of BLOCK so different on different sites?

Because BLOCK trades on low-volume exchanges, prices vary widely. CoinMarketCap, CoinGecko, and CoinLore pull data from different markets. Some reflect trades on Gate.io, others on LBank. With only $17,000 in daily volume, a single large trade can swing the price by 50% or more. Always check multiple sources and avoid trusting one price as definitive.

Is Blockasset legal in the United States?

No. BlockBet, the platform that uses BLOCK, blocks users from 87 countries, including the United States, due to gambling regulations. Even if you own BLOCK, you cannot legally use it for betting if you’re in the U.S. This limits its user base and growth potential significantly.

What happens if I send BLOCK to the wrong blockchain?

You could lose your tokens permanently. BLOCK exists on Solana, Ethereum, and Binance Smart Chain. If you send a Solana-based BLOCK to an Ethereum wallet, the transaction will go through, but the tokens will be stuck and unrecoverable. Always confirm the correct network before sending. Blockasset’s own data shows 42% of new users make this mistake.

How do I cash out my BLOCK tokens?

You can’t cash out BLOCK directly. First, transfer your BLOCK to a decentralized exchange like PancakeSwap or Raydium, then trade it for ETH, SOL, or BNB. From there, send it to a centralized exchange like Binance and sell for fiat (USD, EUR, etc.). Withdrawal times from BlockBet average 8.2 hours, and customer support often takes over 48 hours to respond, so plan ahead.