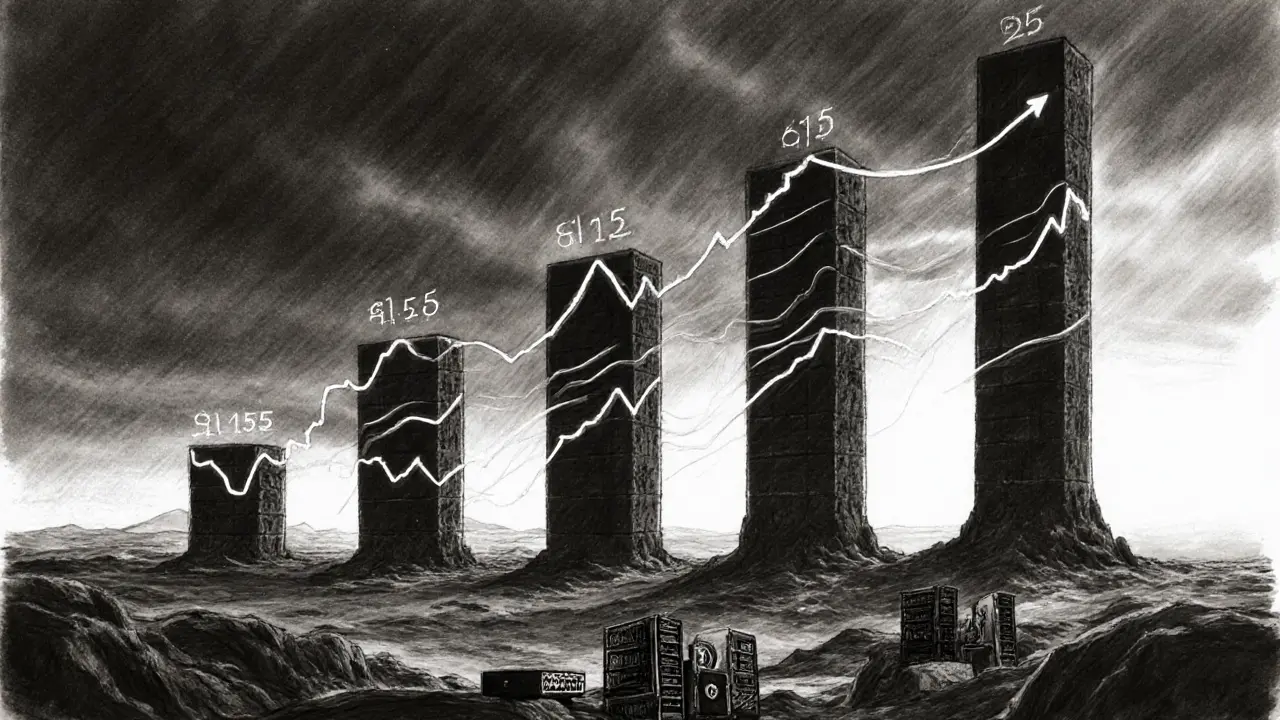

Bitcoin Halving Timeline & Price Tracker

Next Halving Projection

Date: March 26, 2028

Reward: 1.5625 BTC/block

Inflation Rate: Below 0.3%

Current Market Status

Block Height: 740,000

Time Until Next Halving: 4.2 years

Historical Halving Events

| Halving # | Date | Block Height | Reward (BTC) | Price 180 days after | Inflation Rate |

|---|---|---|---|---|---|

| 1 | Nov 28, 2012 | 210,000 | 25 | +$126.24 (1,092%) | ~4.8% |

| 2 | Jul 9, 2016 | 420,000 | 12.5 | +$1,002.92 (122%) | ~2.4% |

| 3 | May 2020 | 630,000 | 6.25 | +$14,849.09 (69%) | ~1.2% |

| 4 | Apr 2024 | ~740,000 | 3.125 | +150% YTD | ~0.6% |

Inflation Rate Trend

Mining Impact Summary

- Hash rate typically dips 5-10% post-halving

- Efficiency improves as weak miners exit

- Transaction fees become larger revenue component

- Final halving around 2140 will end block rewards

Key Insights

- Historical data shows strong post-halving bull markets

- Price increases vary based on macroeconomic conditions

- Mining profitability adjusts over time through efficiency gains

- Inflation rates continue to decline with each halving

When Bitcoin first launched in 2009, its creator embedded a built‑in scarcity rule that would shape the entire ecosystem: every 210,000 blocks the block reward is cut in half. This Bitcoin halving event isn’t a marketing gimmick; it’s a hard‑coded monetary policy that reduces new supply, nudges miner economics, and historically precedes major price moves. In this deep dive we’ll walk through each halving to date, unpack the price reactions, examine mining profitability shifts, and look ahead to the next scheduled cut.

TL;DR

- Four halvings have occurred (2012, 2016, 2020, 2024); each slashed block rewards by 50%.

- Price typically surged within 180days after a halving, with gains ranging from ~1,000% to over 7,000%.

- Miner hash rate dips temporarily, then recovers as only the most efficient operations survive.

- The next halving is projected for March262028, cutting rewards to 1.5625BTC.

- Supply inflation drops from ~4.8% in 2012 to under 1% after 2024, reinforcing Bitcoin’s deflationary narrative.

What is a Bitcoin Halving?

Bitcoin is a decentralized digital currency that relies on a proof‑of‑work blockchain. Its protocol defines a Bitcoin halving as the event that occurs every 210,000 blocks-roughly every four years-where the block reward paid to miners is reduced by 50%.

The mechanism is immutable: changing it would require a hard fork that creates a brand‑new coin. Because the schedule is known years in advance, market participants can plan around the supply shock, even though price outcomes still depend on demand dynamics.

Timeline of Halving Events

| Halving # | Date (approx.) | Block Height | Reward (BTC) | Price 180days after | Inflation Rate |

|---|---|---|---|---|---|

| 1 | 28Nov2012 | 210,000 | 25 | $126.24 | ~4.8% |

| 2 | 9Jul2016 | 420,000 | 12.5 | $1,002.92 | ~2.4% |

| 3 | May2020 | 630,000 | 6.25 | $14,849.09 | ~1.2% |

| 4 | 19‑20Apr2024 | ~740,000 | 3.125 | Data still forming (mid‑2024 trend shows ~+150% YTD) | ~0.6% |

Price Movements After Each Halving

Analyzing price alone can be misleading because each halving happened under very different macro conditions. Still, the data shows a clear pattern of post‑halving rally.

- 2012: Bitcoin rose from roughly $10.6 pre‑halving to $126.2 within six months-a 1,092% jump.

- 2016: From $450 to over $1,000 in the same window, roughly +122%.

- 2020: A massive surge from $8,800 to $14,849 (+69%) in just 180days, then exploded to $69,000 a year later.

- 2024: Early data shows the market reacting to tighter supply with a 150% YTD gain, though full 180‑day figures are still pending.

Experts attribute these moves to a supply shock meeting increasing demand-a classic economic scenario. However, they caution that external factors-COVID‑19 stimulus in 2020, institutional inflows in 2016, broader crypto hype cycles-also play huge roles.

Mining Economics: How Halvings Reshape the Network

Mining profitability is directly tied to the block reward. When the reward halves, a miner’s revenue drops by 50% unless the price rises enough to offset the loss.

Historical observations:

- Immediately after each halving, the network hash rate dips by 5-10% as less efficient miners exit.

- Within 3-6months, the hash rate rebounds, often surpassing pre‑halving levels, driven by economies of scale and newer ASIC hardware.

- The 2020 halving coincided with a sharp price increase, allowing miners to maintain margins despite the reward cut.

- In 2024, early reports show a modest hash‑rate dip of ~4% followed by a quick recovery as large mining pools upgraded to the latest generation of chips.

Long‑term, halvings push the industry toward greater efficiency and consolidation, which arguably strengthens network security because the remaining miners have deeper financial commitment.

Supply Dynamics and Inflation Rate

Each halving reduces Bitcoin’s yearly inflation rate, measured as the proportion of new BTC added to the total supply.

- After the 2012 halving, inflation fell from ~4.8% to ~2.4%.

- Post‑2016, it slid to ~1.2%.

- After 2020, the rate is under 1%.

- By the 2024 cut, it sits around 0.6%, the lowest yet.

This steadily declining inflation is a core argument for Bitcoin as a store of value, mirroring how gold’s supply growth slows over time.

Projecting the Next Halving (2028)

Based on the current average block time of 9minutes48seconds, analysts at Gemini estimate the next halving will happen on 26March2028. The reward will shrink to 1.5625BTC per block, pushing the annual inflation rate below 0.3%.

What does that mean for investors and miners?

- Investors: Supply becomes even tighter, so if demand continues to rise, price pressure could intensify.

- Miners: Profitability will hinge more on transaction fee revenue, prompting a shift toward fee‑optimizing strategies and possibly more reliance on layer‑2 solutions.

Because the halving schedule is public, forward‑looking funds often price this scarcity into models years ahead, but market sentiment can still swing dramatically with regulatory news or macro‑economic shocks.

Key Takeaways for Traders, Investors, and Miners

- Halvings are predictable supply events, not guarantees of price spikes.

- Historical data shows strong post‑halving bull runs, but each cycle’s magnitude varies with external conditions.

- Mining profitability squeezes after a halving, rewarding the most efficient operations and often leading to short‑term hash‑rate dips.

- Inflation rates plummet with each cut, reinforcing Bitcoin’s narrative as digital gold.

- Preparation for the 2028 halving should start now: diversify mining hardware, consider fee‑revenue models, and keep an eye on macro‑economic trends.

Frequently Asked Questions

What exactly triggers a Bitcoin halving?

The Bitcoin protocol automatically cuts the block reward in half each time the blockchain reaches 210,000 new blocks. No human action is required; it’s hard‑coded into the software.

Why do prices usually rise after a halving?

A halving reduces the flow of new Bitcoin into the market, tightening supply. If demand stays the same or grows, basic economics predict upward price pressure. History shows demand often spikes because the event attracts media attention and speculative buying.

How does a halving affect miner revenue?

Miner revenue from block rewards drops 50% instantly. To stay profitable, miners rely on higher Bitcoin prices, lower electricity costs, or more efficient hardware. Over time, transaction fees become a larger share of total revenue.

When is the next halving expected?

Current projections place the next halving on 26March2028, when the block reward will fall to 1.5625BTC per block.

Will Bitcoin ever stop inflating?

Yes. After the final halving around the year 2140, block rewards will drop to zero. Miners will then earn only transaction fees, and the total supply will be capped at 21million BTC.

Understanding the historical pattern of Bitcoin halvings gives you a clearer view of how supply, price, and mining dynamics intertwine. While past performance isn’t a guarantee of future results, the predictability of the halving schedule remains a unique tool for anyone navigating the crypto market.

Wow, this deep dive into Bitcoin’s halving saga is like a vibrant tapestry of numbers and narratives, weaving together supply shocks, miner drama, and price fireworks. The way you highlighted the inflation dip from 4.8% all the way down to under 0.3% really paints a crystal‑clear picture of Bitcoin’s deflationary charm. I love how you broke down each halving’s price jump with those juicy percent gains – it makes the data feel alive rather than dull spreadsheet rows. Also, the mining impact summary is a gem; pointing out the hash‑rate dip and the shift toward fee revenue helps newcomers grasp the ecosystem’s evolving economics. Thanks for the thoroughness and the engaging style – it’s both educational and entertaining!

Listen up, this whole “crystal‑clear picture” nonsense is overblown – the market doesn’t care about your pretty charts, it reacts to real‑world panic and hype. Your “vibrant tapestry” spiel sounds like a marketing copy, not a hard‑core analysis. Stop sugar‑coating the risk!

Honestly, halving events aren’t the silver bullet some claim. Prices can tank just as fast, and miners in Nigeria are feeling the squeeze – cheap electricity doesn’t save you when rewards drop in half.

While the previous comment raises valid concerns, a comprehensive examination of historical data demonstrates a consistent post‑halving appreciation trend. It is essential to contextualize these movements within broader macro‑economic conditions, including monetary policy shifts and institutional adoption cycles. Moreover, the resilience of the mining sector, powered by technological advances in ASIC efficiency, mitigates the immediate revenue shock described.

Yo, I’m not buying the hype that each halving automatically means a moon run. The 2024 numbers are still shaky, and if the next bull on‑ramp stalls, we could see a prolonged correction instead.

actually, dont forget that transaction fees are gonnna become a bigger part of miner revs, especially after 2028 when block rewards get real tiny. diversifying your mining ops now can help you survive the next cut.

Great points all around! Just a heads‑up: while the halving reduces supply, the demand side is what truly drives price spikes. Keep an eye on institutional inflows and regulatory news – they can amplify or dampen the effect.

Indeed, the halving mechanism, as encoded in Satoshi’s original whitepaper, serves not merely as a supply‑control tool, but as a profound statement on the nature of scarcity in the digital age; it invites us to contemplate how trustless systems can self‑regulate, and, moreover, how market participants internalize these periodic shocks, adjusting expectations in a dance of anticipation and reaction.

Frankly, this analysis is a textbook example of over‑optimism; it cherry‑picks bullish data points while conveniently ignoring the myriad of bearish signals that have plagued Bitcoin since its inception, rendering the conclusions suspect at best.

I appreciate the thorough breakdown and the balanced tone. It’s valuable to see both the positive price trends and the acknowledged risks, which helps foster a more nuanced discussion among community members.

Oh great, another endless chart – because we totally needed more numbers to stare at.

This analysis reeks of hype, not substance.

With all due respect to the preceding remarks, one must question the foundational premise that halving events inherently engender price appreciation; historical anomalies and external macro‑economic disruptions demonstrate that correlation does not equate to causation.

Think about it: each halving is like a quiet breath before the market’s next sprint, a reminder that scarcity can be both a catalyst and a veil, depending on who’s watching.

Keep digging, you’re on the right track! 🌟

Stop pretending the next halving will magically fix everything – miners need real profit, not fairy tales.

While the exposition provides a commendable overview of the halving chronology, it neglects to address the stochastic volatility introduced by network hash‑rate elasticity and the ensuing difficulty adjustment lag, which are critical determinants of miner marginal cost curves and, consequently, the price elasticity of supply.

Even if the next halving feels like a storm, remember that every tempest reshapes the landscape, and the resilient miners will emerge stronger; keep the faith! 🚀

The Bitcoin halving saga reads like a grand epic, each chapter marked by a seismic shift in supply and sentiment. When the reward was slashed from 25 to 12.5 BTC in 2016, the market didn't just tremble-it roared, carving a new trajectory for digital gold. Fast forward to 2020, the third halving arrived amid a global pandemic, and the price surge that followed felt like a phoenix rising from economic ashes. Yet, it would be naive to attribute every bull run solely to the halving’s mechanical scarcity; macro‑factors, institutional adoption, and geopolitical turmoil all play starring roles. The data you compiled underscores a clear pattern: post‑halving price upticks, but with wildly varying magnitudes that reflect the broader financial climate. Moreover, the mining sector’s adaptive resilience is a story in itself, as older rigs bow out and cutting‑edge ASICs claim the throne. The transient dip in hash‑rate you noted is merely the market’s natural pruning process, weeding out inefficiency before a stronger, leaner network re‑emerges. As block rewards dwindle, transaction fees begin to shoulder more of the miners’ revenue, reshaping incentives toward scalability solutions like Lightning. This evolution underscores why developers must prioritize layer‑2 protocols, lest the network become a costly toll road for users. Looking ahead to 2028, the projected sub‑0.3% inflation rate could cement Bitcoin’s status as true digital scarcity, attracting the next wave of long‑term capital. However, the regulatory landscape remains a looming specter; any harsh policy shift could blunt the halving’s bullish effect. Investors should therefore balance optimism with caution, diversifying exposure while keeping an eye on on‑chain metrics such as MVRV and NVT. From a historical lens, each halving has been a catalyst, not a guarantee, and the market’s reaction is increasingly influenced by global financial narratives. In sum, the halving mechanism remains a brilliant design choice, but its power is amplified-or dampened-by forces beyond the code. Stay informed, monitor the ecosystem’s health, and remember that patience has always been the most valuable asset in crypto. The next halving may well be the turning point that finally aligns supply, demand, and mainstream acceptance into a harmonious crescendo.

The 2028 halving will be a decisive win for true Bitcoin believers; a moment to finally prove that decentralised scarcity can outshine fiat antics, and the markets will have no choice but to follow.

Frankly, most of these halving fanatics are just chasing hype, blinded by post‑its and ignoring the brutal reality that crypto remains an unregulated gamble.

I hear your concerns, and while the risks are real, the long‑term vision of a deflationary digital store of value still shines bright for those willing to stay the course.

Great breakdown! Quick question: how do you think the upcoming improvements in renewable mining energy sources will affect hash‑rate stability leading up to the 2028 halving? 🌱

Good point, Jeff – greener mining could definitely keep the network humming without spiking costs.

Looks like the community is gearing up for the next big shift.