Swiss banks lead in regulated crypto services with secure custody, institutional-grade security, and proactive regulation. Learn how they handle crypto assets safely under FINMA oversight.

Swiss Financial Regulation Crypto

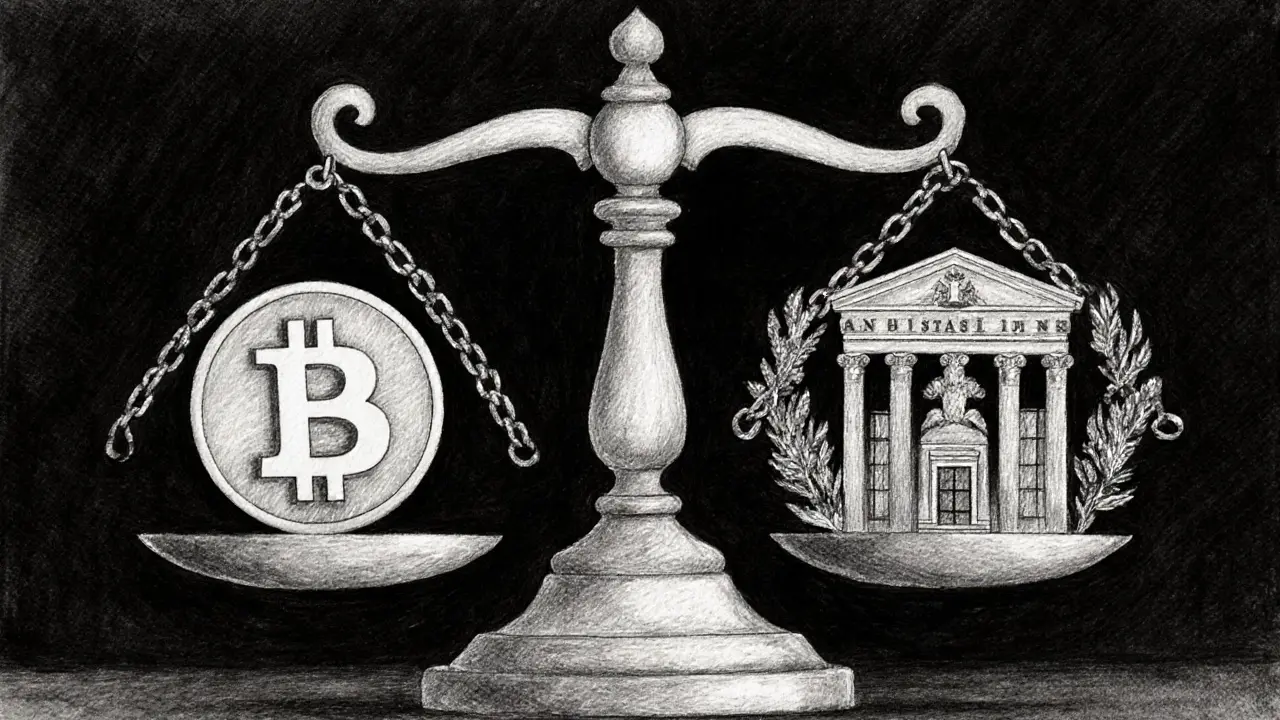

When dealing with Swiss financial regulation crypto, the set of rules that govern cryptocurrency activities in Switzerland. Also known as Swiss crypto regulation, it shapes everything from token offerings to exchange licensing. The authority behind most of this oversight is FINMA, Switzerland's financial market supervisory authority, which enforces standards and grants permits. Compliance also leans heavily on Anti-Money Laundering (AML), rules that prevent illicit funds from entering the financial system. Together, these entities create a framework that balances innovation with investor protection.

The backbone of the framework is Token classification, the process of categorizing crypto tokens as payment, utility, or asset tokens. Payment tokens are treated like foreign currency, utility tokens function as access keys to services, and asset tokens fall under securities law. This three‑tier system decides which licensing path a project must follow, what disclosure is needed, and how taxation is applied. For example, a payment‑token project may need a money‑transmitter license, while an asset‑token offering must publish a prospectus similar to a traditional IPO.

Key Pillars of Swiss Crypto Regulation

First, Swiss crypto regulation demands that any crypto exchange operating in the country obtain a FINMA license. The licensing process checks capital adequacy, governance structures, and AML procedures. Exchanges that meet these criteria enjoy a reputation boost and can attract institutional clients who trust regulated environments. Second, AML compliance is non‑negotiable. Firms must implement Know‑Your‑Customer (KYC) checks, transaction monitoring, and suspicious‑activity reporting. Failure to do so can result in hefty fines or license revocation. Third, token issuers must correctly classify their tokens before launching. Mis‑classification can trigger enforcement actions, forced refunds, or criminal investigations.

Swiss regulation also extends to service providers like custodians, wallet apps, and DeFi platforms. Custodians need to prove that they keep client assets segregated and insured against loss. Wallet apps, even if non‑custodial, are expected to embed AML filters for address monitoring. DeFi protocols face a gray area: if they operate without a central intermediary, FINMA may still require them to register if they effectively provide a service comparable to a licensed exchange or broker. This nuanced stance encourages developers to design transparent, compliant architectures from day one.

For investors, the regulatory landscape offers clear safety nets. Projects that have secured FINMA approval or published a prospectus are easier to vet, and AML‑compliant exchanges provide traceable transaction histories. Moreover, the token classification system lets investors quickly gauge a project's risk profile—asset tokens behave more like securities, while utility tokens often lack guaranteed returns. This clarity reduces speculative hype and fosters a more mature market where long‑term value can thrive.

Looking ahead, Switzerland is poised to refine its crypto rules further. Discussions around a dedicated “Digital Asset Service Provider” (DASP) license are ongoing, aiming to streamline compliance for emerging sectors like NFTs and GameFi. There are also talks about harmonizing Swiss standards with EU regulations to ease cross‑border trading. Keeping an eye on these developments helps traders, issuers, and service providers stay ahead of the curve.

Below you’ll find a curated collection of articles that dig deeper into each of these areas—FINMA licensing guides, AML best practices, token classification case studies, and real‑world exchange reviews. Dive in to see how the Swiss framework shapes the crypto world and what actionable steps you can take today.