Nigeria Crypto Withdrawal Risk Calculator

Calculate Your Withdrawal Risk

Input your withdrawal details to see if your transaction might trigger a bank compliance check or account freeze.

Key Takeaways

- Since Dec2023 Nigerian banks can process crypto‑to‑fiat withdrawals, but only for SEC‑licensed exchanges.

- All transactions must go through electronic channels; cash‑out at a branch is prohibited.

- Banks impose undisclosed daily/weekly limits and conduct strict AML/KYC checks.

- Unlicensed platforms or large, irregular withdrawals can trigger account freezes by the EFCC.

- Keeping thorough records, using licensed exchanges, and diversifying bank relationships smooths the withdrawal experience.

When you try to move crypto to fiat in Nigeria, Banks in Nigeria are financial institutions regulated by the Central Bank of Nigeria that must follow strict guidelines for processing cryptocurrency‑related transactions play a pivotal role. The journey from a digital wallet to a Naira‑funded bank account looks simple on the surface, but behind the scenes a web of regulations, compliance checks, and risk controls determines whether your money lands safely or gets blocked.

Regulatory Landscape Shaping Bank Behaviour

The turning point came on 22December2023 when the Central Bank of Nigeria (CBN) the country’s monetary authority that sets banking policy and supervises financial institutions issued the “Guidelines on Operations of Bank Accounts for Virtual Asset Service Providers.” These rules lifted the outright ban that had been in place since February2021 and opened the door for banks to interact with licensed crypto platforms.

In March2025 President Bola Ahmed Tinubu signed the Investments and Securities Act 2025 (ISA2025) legislation that classifies digital assets as securities and places them under the oversight of the Securities and Exchange Commission. The Securities and Exchange Commission (SEC) Nigeria’s market regulator responsible for licensing crypto exchanges and enforcing AML/KYC standards now issues licenses to exchanges such as Luno, allowing them to operate bank accounts and process withdrawals.

Because the SEC has expanded enforcement powers, the Economic and Financial Crimes Commission (EFCC) the agency tasked with fighting money laundering and financial fraud in Nigeria can obtain court orders to freeze accounts linked to unlicensed activities. Their September2024 action against 22 accounts holding USDT sales on Bybit and KuCoin illustrates how quickly banks will act on regulator directives.

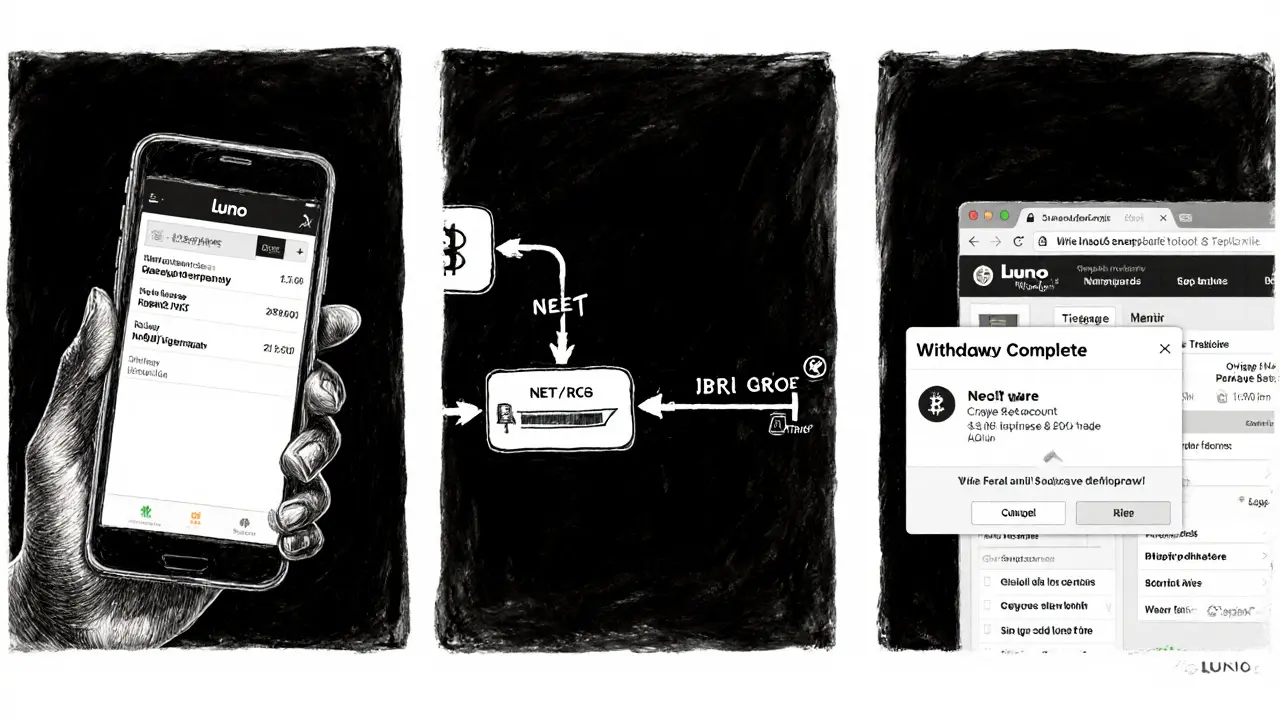

How Banks Process a Crypto‑to‑Fiat Withdrawal

Below is a step‑by‑step view of the typical flow when you use a SEC‑licensed exchange:

- Sell your cryptocurrency on the exchange platform (e.g., Bitcoin, Ethereum, USDT).

- The exchange converts the crypto into Nigerian Naira and creates a pending transfer request.

- The exchange’s bank account (already approved by the SEC) initiates an electronic transfer to your personal bank account via NEFT/RTGS.

- Your bank receives the inbound wire, runs its AML/KYC engine, and credits the amount-usually within 1‑4hours.

- You receive a notification; the funds appear in your online banking dashboard.

Key points to remember:

- Cash withdrawals at a branch are not allowed for crypto‑related deposits. All movements must stay digital.

- Banks keep “prudent” transaction caps that differ by institution and account tier. The caps are not publicly disclosed but are generally lower than limits for salary or rent payments.

- Every inbound crypto‑derived transfer triggers an enhanced due‑diligence flag. The bank may request proof of source-trade statements, screenshots, or a tax compliance certificate.

Risks, Red Flags, and Account Freezing

Even with a licensed exchange, banks can block or freeze your account if they spot suspicious patterns. Common triggers include:

- Large, sudden spikes in conversion volume (e.g., pulling ₦5million in a single day).

- Frequent withdrawals that deviate from your usual banking behaviour.

- Use of an exchange that lacks SEC licensing or has been flagged by the EFCC.

When a freeze occurs, the bank will usually notify you via email or SMS, citing a “regulatory compliance check.” You will be asked to submit supporting documents within a specified window. Failure to comply can lead to permanent closure of the bank relationship.

In 2024, the EFCC’s court‑ordered freeze of accounts tied to USDT sales resulted in a total freeze of roughly ₦548.6million. The action sent a clear signal: banks will promptly act on regulator orders, regardless of the amount involved.

Fees, Timelines, and Practical Experience

Licensed exchanges charge a modest fee-typically 0.5‑1% of the transaction value-plus a flat processing charge of about ₦150-₦300. The bank may add a standard inbound transfer fee, usually waived for electronic wires.

From a user’s perspective, the most common experience in 2025 looks like this:

- Withdrawal request submitted on Luno’s app.

- Processing time: 2hours on average, 30minutes during low‑traffic periods.

- Funds appear in the linked bank’s mobile app without hitches.

- Bank sends a short “AML verification” prompt; you upload a screenshot of the trade and a copy of your ID.

Fintech‑focused banks such as Kuda Bank a digital‑only bank in Nigeria known for quicker onboarding and crypto‑friendly policies tend to have higher limits and faster review cycles compared with legacy commercial banks.

Best Practices for a Smooth Withdrawal

Following these habits cuts down friction and avoids the dreaded freeze:

- Only use SEC‑licensed exchanges. Verify the license on the SEC website before signing up.

- Complete full KYC on both the exchange and your bank-photo ID, utility bill, and a clear source‑of‑funds declaration.

- Keep detailed records: trade confirmations, screenshots, and tax receipts. Store them in a cloud folder for easy retrieval.

- Withdraw amounts that fit your historical banking pattern. If you usually receive ₦200k per month, pulling ₦2m in one go will raise alarms.

- Spread large withdrawals across multiple banks if possible, to reduce exposure to a single institution’s risk appetite.

- Stay updated on regulatory news. The CBN, SEC, and EFCC publish bulletins that may change limits overnight.

Licensed vs. Unlicensed Exchanges - Quick Comparison

| Aspect | SEC‑Licensed Exchange | Unlicensed Exchange |

|---|---|---|

| Regulatory status | Approved by Nigeria’s SEC, can hold bank accounts | Operating without a license; illegal under ISA2025 |

| Bank withdrawal method | Electronic transfer (NEFT/RTGS) to verified bank accounts | No direct bank link; users rely on P2P or third‑party wallets |

| Transaction limits | Bank‑set caps, usually lower than salary payments but transparent | Unlimited in practice, but higher risk of freeze |

| Risk of account freeze | Low if KYC is complete and limits are respected | High - EFCC and banks frequently block funds |

| Fees | 0.5‑1% + small processing fee | Variable, often higher and hidden |

Frequently Asked Questions

Can I withdraw crypto cash at a bank branch?

No. Nigerian banks only accept electronic transfers for crypto‑derived funds. Cash withdrawals must come from regular salary or payment deposits, not from crypto conversions.

What are the typical limits on crypto withdrawals?

Limits vary by bank and account tier and are not publicly disclosed. In practice, most banks allow between ₦200,000 and ₦1,000,000 per day for crypto‑linked accounts, with higher caps possible after additional documentation.

If my account is frozen, what should I do?

Contact the bank’s compliance department immediately, provide trade statements, KYC documents, and any tax filings. If the freeze stems from an EFCC order, you may need legal counsel to discuss the court directive.

Do I need to pay taxes on crypto‑to‑fiat conversions?

The Federal Inland Revenue Service treats crypto gains as capital gains, though detailed legislation is pending. Keep records; once the Finance Bill passes, banks will likely report large conversions to tax authorities.

Which exchanges are currently SEC‑licensed?

As of October2025, Luno, Quidax, and Binance Nigeria (post‑licensing) are officially approved. Always verify the license on the SEC portal before transacting.

Next Steps & Troubleshooting

If you’re ready to withdraw, follow this quick checklist:

- Confirm the exchange’s SEC license (search the SEC’s public register).

- Update KYC on both the exchange and your bank - photo ID, proof of address, and a source‑of‑funds letter.

- Initiate the sale on the exchange, select “Bank Transfer,” and input your correct NIN‑linked account number.

- Monitor the transaction; if the bank flags it, respond within 48hours with the requested documents.

- For large withdrawals, split the amount across two banks or spread over several days.

Should a freeze occur, keep calm, gather all trade records, and engage the bank’s compliance team. If the issue escalates, consider consulting a fintech‑focused lawyer familiar with the ISA2025 framework.

By staying compliant, using licensed platforms, and keeping paperwork tidy, you can turn crypto into Naira with minimal hassle-turning the once‑shady cash‑out process into a routine banking activity.

Sure, because banks love crypto drama 🙄

While I appreciate the sarcasm, the CBN's recent guidelines actually mandate that only SEC‑licensed exchanges can process crypto‑to‑fiat withdrawals. This means if your platform isn’t on the official register, the bank will flag the transaction outright. It’s advisable to double‑check the licensing status before initiating a transfer.

Got my first withdrawal through Luno last week and it was smooth-just a couple of hours.

That’s because Luno is one of the few exchanges that actually complied with the SEC licensing requirements. If you try the same with an unlicensed platform, expect the bank to freeze your account without warning.

For anyone still figuring out the process, keep a digital folder of all trade confirmations, screenshots, and your KYC documents. When the bank’s AML engine flags a withdrawal, you’ll need to upload these quickly to avoid a prolonged freeze. Also, remember that cash‑out at a branch isn’t allowed for crypto‑derived funds; everything stays electronic.

The regulatory environment in Nigeria has undergone a seismic shift since the CBN lifted the blanket ban on crypto‑related banking activity in late 2023. First, the Central Bank mandated that only exchanges holding a valid SEC license may interface with the banking system, effectively creating a whitelist of compliant platforms. This requirement forces crypto firms to undergo rigorous KYC and AML checks before they can even open a bank account. Second, the ISA2025 legislation reclassified many digital assets as securities, extending the SEC’s supervisory authority over their trading and settlement. Consequently, any inbound wire that originates from a crypto sale is automatically flagged for enhanced due‑diligence by the receiving bank. The banks themselves have instituted opaque daily and weekly caps, often ranging between ₦200,000 and ₦1,000,000, though the exact figures vary by institution and account tier. If you exceed these thresholds, the transaction is likely to trigger a compliance review, and the bank may temporarily freeze the account. Third, the EFCC now has the power to obtain court orders to freeze accounts tied to unlicensed exchanges or suspicious activity, as demonstrated in the September 2024 crackdown on USDT sales. In practice, this means that even a seemingly innocuous withdrawal can be halted if the exchange’s licensing status is questionable. To mitigate risk, always verify the exchange’s license on the SEC’s public registry before converting crypto to fiat. Additionally, maintain a meticulous record‑keeping system-trade confirmations, source‑of‑funds letters, and tax receipts stored in a secure cloud folder can dramatically speed up the bank’s verification process. It’s also wise to align your withdrawal patterns with your historical banking behavior; sudden spikes in volume are a red flag for AML engines. Diversifying across multiple banks can spread risk, especially if one institution imposes stricter limits than another. Finally, stay vigilant about regulatory updates; the CBN, SEC, and EFCC release bulletins that can alter limits or compliance requirements overnight. By adhering to these best practices, you can navigate the Nigerian crypto‑to‑fiat ecosystem with far fewer hiccups and avoid the dreaded account freezes.

That’s a solid rundown! I’d add that many fintech‑focused banks like Kuda have slightly higher caps and faster review cycles because they’re built around digital assets. Still, the core principle of keeping documentation ready remains the same.

Stick to licensed exchanges and you’ll avoid most headaches.

Honestly, the whole crypto‑to‑fiat drama feels like a reality TV show-banks are the judges, exchanges are the contestants, and the audience (us) just wants our money back without the drama. If you’re tired of the cliffhangers, just follow the script: licensed exchange, proper KYC, stay under the invisible caps, and you’ll get a happy ending.

But what if the caps are just a smokescreen for the banks to hoard crypto profits? 🤔💸

Good points all around. I’d suggest setting up alerts on your bank app for any incoming crypto‑derived transfers so you can respond quickly if they request documentation.

Exactly, and having those alerts can also help you spot any suspicious activity early, which is extra reassurance.

🚀💡 Pro tip: Keep a spreadsheet of your withdrawal dates, amounts, and which bank you used-makes it way easier to spot patterns and stay under the radar.

I was curious about the tax angle-does anyone know if these crypto‑to‑fiat conversions are currently being reported to the tax authorities?

From what i heard, the FIRS is still drafting clear rules, but large conversions over a certain threshold are likely to get flagged soon. Better keep those tax receipts handy!

Honestly, this whole crypto scene is a threat to our national financial stability. We need stricter bans, not just vague guidelines. 🇳🇬💪

While I understand the concerns about stability, the data shows that regulated crypto activity actually brings more transparency and tax revenue. Encouraging proper licensing and compliance is a better path than outright bans. 😊📊

The drama won’t end until someone stops the noise.