Learn what smart contract access control vulnerabilities are, see real‑world hacks like the DAO and Parity attacks, and discover best‑practice patterns, tools, and checklists to secure your contracts.

Smart Contracts – Everything You Need to Know

When you hear smart contracts, self‑executing code that runs on a blockchain without a middleman. Also called programmable contracts, they lock in rules and trigger actions automatically once conditions are met. This core idea fuels most of today’s crypto innovation.

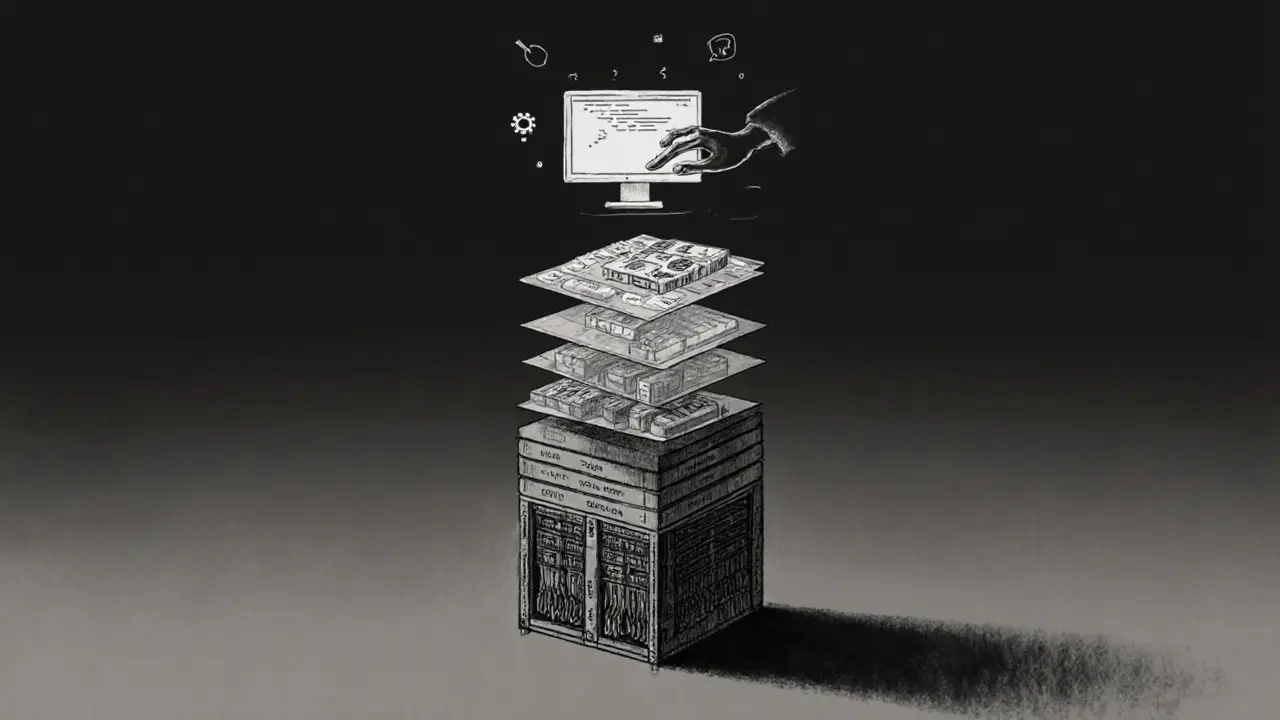

But smart contracts don’t float in a vacuum. They sit on a blockchain, a distributed ledger that guarantees immutability and consensus. The blockchain provides the trusted environment where contracts execute, and it supplies the native token that pays for gas fees. On top of that, DeFi, short for decentralized finance, builds entire lending, borrowing, and trading ecosystems using those contracts. Finally, validator rewards, the incentives paid to network participants who secure the chain, are often distributed through smart contracts, linking economics directly to code.

Why smart contracts matter today

Smart contracts enable DeFi platforms to offer bank‑like services without a central authority. They also power token sales, NFT minting, and automated market makers. However, their power comes with risk. Recent smart contract hacks, like the cross‑chain bridge attacks of 2024, showed that a single flaw can drain millions. Those incidents taught the community to demand formal audits, formal verification, and bounty programs. They also pushed developers to adopt privacy protocols—tools like zero‑knowledge proofs that hide transaction details while keeping contracts verifiable.

Another piece of the puzzle is the hard fork. When a blockchain undergoes a hard fork, the underlying protocol changes, and smart contracts may need to be upgraded or migrated. Compatibility issues can arise, especially for contracts that rely on specific opcode versions. A well‑planned fork includes clear migration paths, so users don’t lose access to their assets. This dynamic illustrates how smart contracts, blockchain upgrades, and validator incentives are tightly linked.

Beyond security, smart contracts shape token distribution models. Many of today’s airdrops—like the upcoming Galaxy Adventure Chest NFT drop—use contracts to verify eligibility, snap‑capture wallet snapshots, and disperse tokens automatically. Understanding the contract logic helps participants avoid scams and claim rewards efficiently. Likewise, tokenomics of new projects, such as validator‑driven staking pools, are encoded in contracts that dictate reward rates, slashing conditions, and fee structures.

All these threads—blockchain foundations, DeFi use cases, validator economics, hack retrospectives, fork strategies, and airdrop mechanics—come together in the articles below. Whether you’re a trader looking to gauge risk, a developer curious about secure patterns, or just someone who wants a clear picture of how code runs money, you’ll find practical insights across the collection.

Ready to dive deeper? Browse the posts to see real‑world examples, detailed guides, and up‑to‑date analysis that build on the concepts we’ve just covered.

A clear, layer‑by‑layer guide to the Web3 technology stack, covering infrastructure, protocols, scaling, tooling, and dApp development.