Swiss banks lead in regulated crypto services with secure custody, institutional-grade security, and proactive regulation. Learn how they handle crypto assets safely under FINMA oversight.

Regulated Cryptocurrency Banks

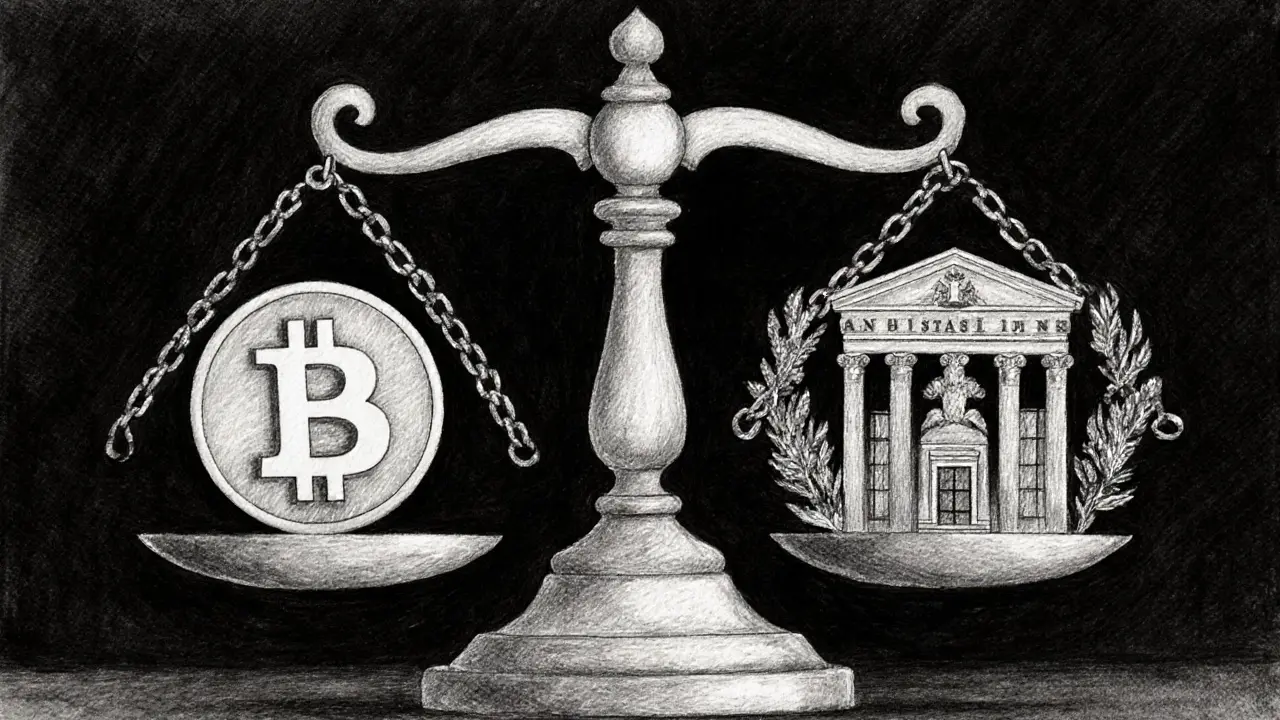

When working with Regulated Cryptocurrency Banks, financial institutions that are licensed to offer crypto services under official banking regulations. Also known as crypto‑friendly banks, they blend traditional banking with digital asset custody. These banks act as a bridge between the old‑school world of deposits and the fast‑moving world of tokens. In practice, a regulated crypto bank will keep your fiat safe while also holding your Bitcoin, Ether, or stablecoins in a secured vault that follows the same audit standards as a traditional ledger. Because they operate under a central bank’s supervision, they must meet the same capital‑adequacy ratios, risk‑management protocols, and consumer‑protection rules that your regular savings account follows.

One of the biggest engines that powers a regulated crypto bank is its partnership with crypto exchanges, platforms where users trade digital tokens. The exchange supplies liquidity and price discovery, while the bank provides the fiat on‑ramp and off‑ramp that users need to move money in and out of the ecosystem. This relationship creates a seamless flow: you can deposit dollars at the bank, instantly trade them for USDC on the exchange, and hold the stablecoin in the same account without ever leaving the bank’s dashboard. The bank’s compliance team also monitors these transactions to ensure they obey banking regulations, laws that govern how banks can operate, including licensing, capital requirements, and consumer protection set by national authorities.

Compliance isn’t just a checkbox; it’s the backbone of trust. Regulated crypto banks must implement robust AML/KYC procedures, processes that verify user identities and monitor suspicious activity to prevent money laundering. These checks happen every time you open an account, place a large trade, or withdraw cash. By doing so, the bank protects you from fraud and satisfies regulators who want to keep illicit funds out of the financial system. At the same time, the bank can offer services like crypto‑backed loans, interest‑bearing accounts, and even custodial solutions for institutional investors, all while staying within the legal framework.

Because regulated banks can hold both fiat and stablecoins, they play a crucial role in crypto‑to‑fiat withdrawals, the process of converting digital assets back into traditional money. Imagine you earned wages in Bitcoin and need to pay rent in dollars. Your regulated crypto bank will convert the Bitcoin to a stablecoin like USDC, settle the trade on a partnered exchange, and then transfer the dollars to your checking account—all under the watchful eye of regulators. This built‑in conversion reduces the need for third‑party services that might be less transparent or more costly. It also means you can enjoy the speed of crypto while keeping the safety net of bank insurance where it applies.

The collection of articles below dives deep into each of these pieces. You’ll find a review of crypto‑friendly banks that have secured licenses in Europe and the U.S., a comparison of how different exchanges integrate with banking partners, an analysis of recent AML rule changes, and practical guides on moving funds between crypto and fiat without hiccups. Whether you’re a trader looking for a reliable on‑ramp, an investor curious about regulated custody, or just someone who wants to understand how traditional finance is adapting to digital money, the posts ahead give you the facts, the tools, and the confidence to make informed decisions.