Think of cryptocurrency as digital cash. You can send it, spend it, or hold it like money. NFTs? They’re not money. They’re digital collectibles - like owning a one-of-a-kind baseball card, but on the blockchain. Both use blockchain technology, but that’s where the similarity ends. If you’ve ever wondered why someone would pay $10,000 for a JPEG while Bitcoin trades in the tens of thousands, the answer lies in fungibility.

What Makes Cryptocurrency Different

Cryptocurrencies like Bitcoin and Ethereum are fungible. That means every unit is identical and interchangeable. One Bitcoin is exactly the same as another Bitcoin. You can split it into smaller pieces - down to eight decimal places (called satoshis). You can send 0.003 BTC to a friend, and it’s just as valid as sending 1 BTC. This is why they work as money: they’re designed to be exchanged, stored, and used for payments. They run on token standards like ERC-20 on Ethereum or the native Bitcoin protocol. These standards make sure every coin behaves the same way. Transactions are recorded on a public ledger, so anyone can see who sent what to whom. But the coins themselves don’t carry extra data - no history of who owned them before, no special traits. They’re pure value. That’s why crypto markets move based on supply, demand, and macro trends. When inflation rises, Bitcoin often goes up. When regulators crack down, prices drop. It’s like gold or stocks - driven by economic forces, not uniqueness.What Makes NFTs Unique

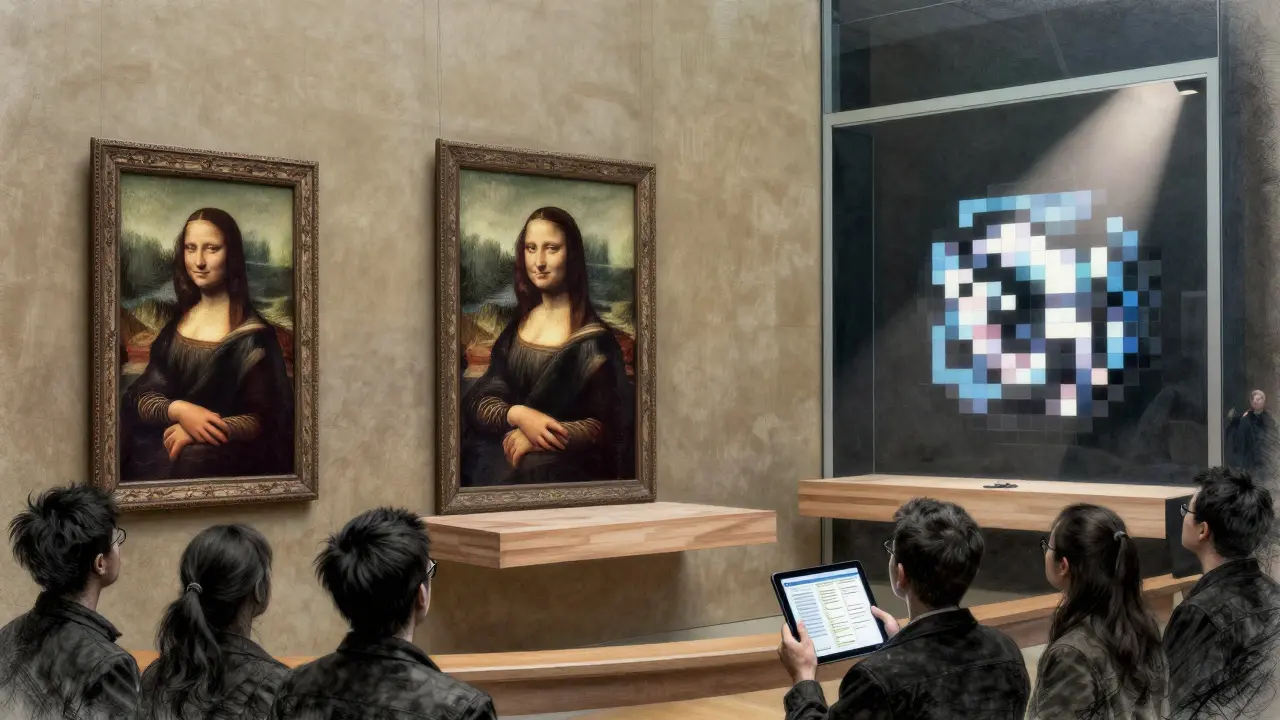

NFTs, or non-fungible tokens, are the opposite. Each one is unique. You can’t swap an NFT for another and expect the same value. Think of it like owning the original Mona Lisa versus a print. The print might look the same, but only one is the real thing. NFTs use standards like ERC-721 or ERC-1155 on Ethereum. These standards embed unique identifiers and metadata into each token. That metadata can include the artist’s name, creation date, file format, or even a link to the digital artwork. No two NFTs are alike. And unlike crypto, you can’t split an NFT into smaller parts. It’s all or nothing. This uniqueness is why NFTs are used for digital art, music, virtual land, game items, and even event tickets. When Beeple sold his artwork “Everydays: The First 5000 Days” for $69 million at Christie’s, he wasn’t selling a file. He was selling proof of ownership of a one-of-a-kind digital asset - verified on the blockchain.Ownership Isn’t What You Think

Here’s where people get confused. Buying an NFT doesn’t mean you own the copyright or the right to use the image. You own the token that proves you bought it. The artist still holds the intellectual property. You can’t legally print it on t-shirts or sell it as your own unless the creator gives you permission. This is different from buying a physical painting. If you buy an original Picasso, you can hang it in your home, loan it to a museum, or even destroy it. With an NFT, you can display the image in your digital wallet or on a website, but you can’t claim ownership of the underlying content. The artist can still make copies, sell prints, or license it to others. Some NFT projects do offer extra rights - like the Bored Ape Yacht Club, which lets owners use their ape for commercial projects. But that’s a bonus, not the rule. Always check the terms before buying.

How Value Is Created

Crypto value comes from adoption, scarcity, and network effects. Bitcoin has value because millions use it, miners secure it, and companies accept it. Its supply is capped at 21 million, which creates scarcity. NFT value comes from different factors: scarcity, creator reputation, community hype, and utility. A single NFT from a famous artist like Pak or Beeple can sell for millions because collectors believe it’s rare and culturally significant. A random NFT of a cartoon monkey might be worthless unless it’s part of a popular collection with active users. Marketplaces like OpenSea and Rarible drive NFT prices based on what buyers are willing to pay. There’s no central pricing. One day, a pixelated ape might sell for $50,000. The next, it could drop to $500 if interest fades. That’s why NFT markets are far more volatile than crypto markets.Liquidity and Trading

Crypto is liquid. You can trade Bitcoin on dozens of exchanges 24/7. The market is deep, with billions changing hands daily. Even smaller coins like Solana or Cardano have strong trading volumes. NFTs? Not so much. Most NFTs sit in wallets, unsold. Only popular collections have active buyers. If you want to sell a rare NFT, you might wait weeks - or never find a buyer. And if you do, you’ll pay gas fees (Ethereum transaction costs) that can range from $1 to over $200 during peak times. Wash trading is also common. Some sellers buy their own NFTs to create fake demand. Chainalysis found that 18% of NFT trading volume in 2022 was fake. That doesn’t happen with Bitcoin. You can’t fake how many people are trading it.Real-World Use Cases

Cryptocurrencies are being used as money. PayPal lets users pay with Bitcoin. El Salvador accepts Bitcoin as legal tender. Companies like MicroStrategy hold billions in Bitcoin as a treasury asset. NFTs are being used as proof of ownership in new ways. FIFA sold 3.2 million NFT tickets for the 2022 World Cup. Nike’s .SWOOSH platform lets users buy digital sneakers that can be worn in virtual worlds. Propy sold a house in Ukraine for $22 million using an NFT as the deed. These aren’t just collectibles - they’re functional tools for proving ownership in digital spaces. Some musicians, like Grimes and Snoop Dogg, release songs as NFTs and earn royalties every time they’re resold. Smart contracts can automatically pay creators 5-10% on secondary sales - something impossible in the traditional art world.

Security and Risks

Crypto users worry about exchange hacks. In 2021, Poly Network lost $600 million in a single attack. But once crypto is in your own wallet - and you control the private key - it’s safe from third-party theft. NFT users face different risks. “Rug pulls” are common. A team launches a cool NFT project, collects millions in sales, then disappears. No one knows who’s behind it. Scammers also steal artwork and mint it as NFTs. Artists have reported their entire portfolios copied and sold without permission. Plus, if you lose your private key, your NFT is gone forever. There’s no “forgot password” button. No customer service can recover it.Who Uses These Technologies?

Crypto attracts investors, remittance users, and people in countries with unstable currencies. In Nigeria, Venezuela, and Argentina, crypto is used to protect savings from inflation. In the U.S., 128 million people own some form of cryptocurrency, according to Pew Research (2023). NFT users are mostly collectors, artists, gamers, and tech enthusiasts. Many are drawn to the idea of owning digital culture. On Reddit’s r/NFT community, creators report earning $50,000 to $500,000 from NFT sales - money they’d never make through galleries or streaming platforms. But the learning curve is steeper. OpenSea found that 68% of new NFT buyers spend at least two weeks researching before making their first purchase. Crypto users, by contrast, can buy Bitcoin on Coinbase in under an hour.The Future: What’s Next?

Cryptocurrencies are becoming infrastructure. Ethereum’s 2022 Merge cut energy use by 99.95%. Bitcoin’s Taproot upgrade improved privacy. Regulators are catching up - the EU’s MiCA law, effective in 2024, brings crypto under clear financial rules. NFTs are still finding their footing. They’re not just for art anymore. They’re being tested for concert tickets, car titles, academic credentials, and even voting rights. But without clear utility beyond speculation, many fear they’ll fade like the dot-com bubble. Grand View Research predicts crypto will grow at 12.5% annually through 2030. NFT growth is less certain - estimates range from 15% to 35%, depending on whether gaming and metaverse adoption picks up. One thing’s clear: crypto is here to stay. NFTs? Maybe. But only if they move beyond JPEGs and become useful tools - not just status symbols.Can NFTs be used as money like cryptocurrency?

No. NFTs are not designed to be used as money. Each NFT is unique and cannot be divided or exchanged on a one-to-one basis like cryptocurrency. You can’t pay for coffee with an NFT because there’s no standard value. Cryptocurrencies like Bitcoin or Ethereum are fungible - each unit is identical and accepted as payment. NFTs are collectibles or ownership certificates, not currency.

Do I own the artwork when I buy an NFT?

Not necessarily. Buying an NFT gives you proof of ownership of the token on the blockchain, but it doesn’t automatically transfer copyright or usage rights to the digital file. The artist usually keeps those rights unless explicitly stated in the NFT’s terms. For example, you can’t legally print an NFT artwork on T-shirts and sell them unless the creator grants you permission.

Why are NFT prices so volatile compared to cryptocurrency?

NFT prices depend on hype, scarcity, and community interest, not broad market trends. A single NFT might sell for $100,000 one day and $500 the next if interest fades. Cryptocurrency prices are driven by supply, demand, macroeconomics, and institutional adoption - factors that affect entire markets. NFTs are valued like rare collectibles, not currencies, making them far more unpredictable.

Can I buy a fraction of an NFT?

No, not natively. Each NFT is a single, indivisible token. You can’t split it like you can with Bitcoin (which can be divided into satoshis). However, some platforms allow fractional ownership through secondary systems - where multiple people buy shares of an NFT. But this isn’t built into the NFT standard itself and carries legal and technical risks.

Are NFTs regulated like cryptocurrency?

Not really. Cryptocurrencies are increasingly treated as financial assets - regulated under laws like the EU’s MiCA. NFTs mostly exist in a gray area. The U.S. SEC only steps in if an NFT is marketed as an investment contract. Most NFTs are treated as collectibles, not securities. But that could change if they start being used for fundraising or profit-sharing.

Which is safer: crypto or NFTs?

Crypto is generally safer because it’s more standardized and has been around longer. NFTs carry higher risks: rug pulls, plagiarism, fake marketplaces, and lost private keys. If you lose your crypto wallet password, you lose access - but at least the asset is real. With NFTs, you might lose both access and value if the project disappears or the file link breaks. Always verify the source and store NFTs in a secure wallet.