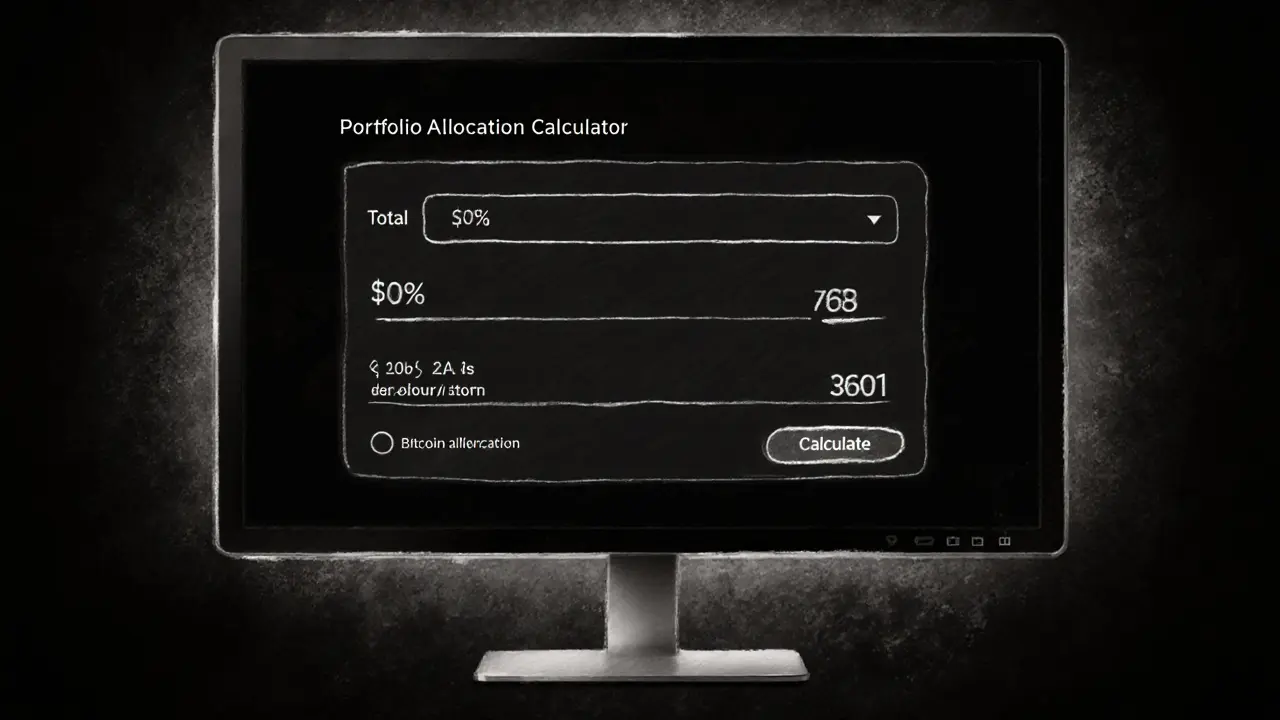

Learn the optimal Bitcoin allocation for crypto portfolios, compare institutional guidelines, and get step‑by‑step tips for sizing, rebalancing, and avoiding common pitfalls.

Rebalancing in Crypto and DeFi

When talking about Rebalancing, the systematic adjustment of asset allocations to match a target distribution. Also known as portfolio rebalancing, it helps investors and liquidity providers stay aligned with risk goals despite price swings. In practice, rebalancing means selling assets that have grown too large and buying those that have shrunk, so the overall mix mirrors the original plan. This process is crucial for decentralized finance where token prices can swing wildly in minutes, and it directly impacts the health of Liquidity Pools, shared reserves that enable instant token swaps on DEXs.

Effective rebalancing doesn’t happen in a vacuum; it interacts with several other entities. A Token Swap, the act of exchanging one cryptocurrency for another on a DEX or centralized exchange provides the mechanical tool to move value between assets without leaving the blockchain. Staking Rewards, the periodic payouts given to validators or delegators for securing a proof‑of‑stake network add a layer of complexity: as rewards accumulate, the proportion of the staked token in a portfolio grows, often triggering a rebalancing need. Meanwhile, Market Volatility, rapid price fluctuations driven by news, airdrops, hard forks, or regulatory changes creates the pressure that makes rebalancing worthwhile. For example, a sudden airdrop announced in a validator reward post can inflate a token’s price, while a hard fork split may introduce a new asset that needs to be factored into the allocation. The semantic triple “Rebalancing requires token swaps” and “Staking rewards influence rebalancing frequency” illustrate how these pieces fit together.

Putting theory into practice means using a clear rebalancing framework. First, define a target allocation—say 50% ETH, 30% SOL, 20% USDC—and set a tolerance band (e.g., ±5%). Second, monitor real‑time data from tools like SwapStats to spot when a pool or portfolio drifts outside the band. Third, execute token swaps or add/remove liquidity to bring the mix back in line, accounting for any staking rewards that have piled up. Fourth, review upcoming events such as validator reward schedule updates, airdrop announcements, or protocol upgrades, because they can alter the optimal timing of a rebalance. By following these steps, traders can protect themselves from over‑exposure, liquidity providers can keep pool ratios healthy, and developers can design smarter automated bots. Below you’ll find a curated set of articles that dive deeper into each of these aspects, from validator economics to hard‑fork impacts, giving you concrete examples to apply today.