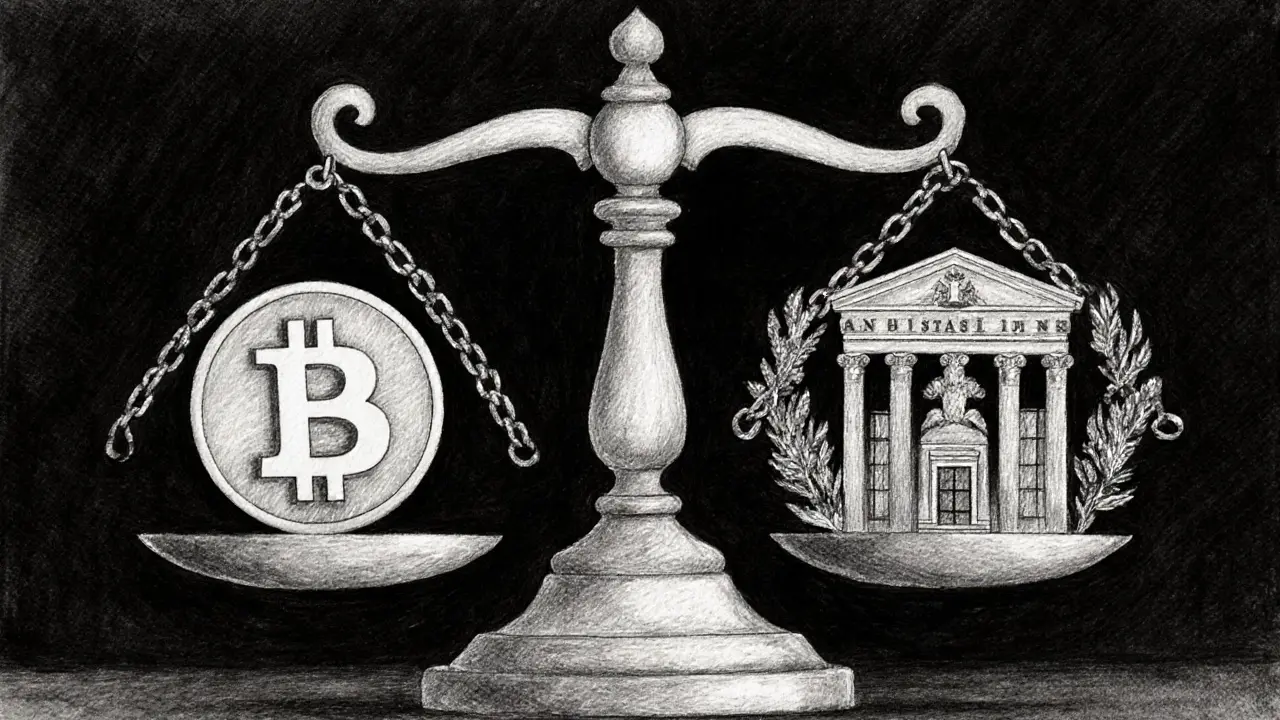

Swiss banks lead in regulated crypto services with secure custody, institutional-grade security, and proactive regulation. Learn how they handle crypto assets safely under FINMA oversight.

Institutional Crypto Services: The Backbone of Professional Crypto Trading

When navigating Institutional Crypto Services, the suite of tools, platforms, and regulatory frameworks that enable large‑scale traders to move, store, and manage digital assets efficiently. Also known as crypto institutional solutions, these services institutional crypto services bridge the gap between retail hype and serious asset management. Crypto Exchanges, regulated venues where institutions execute high‑volume trades provide the primary gateway, while Liquidity Providers, firms that supply deep order books and low‑slippage execution ensure that big orders don’t tank the market. Custodial Solutions, secure storage services that meet audit and insurance standards protect assets from theft and regulatory fallout. Together, these components form a network where compliance frameworks enforce AML/KYC rules, risk dashboards monitor exposure, and settlement layers guarantee that trades settle on time. In short, institutional crypto services encompass compliance, execution, and custody, each influencing the other to create a reliable trading ecosystem.

Why Professionals Choose Dedicated Services Over DIY Tools

Think of a hedge fund that trades $500M in Bitcoin every day. That fund can’t rely on a meme‑coin wallet or a generic exchange with sketchy support. It needs robust compliance to pass regulator audits, deep liquidity to avoid price impact, and insured custodians to satisfy investors. Our collection of guides shows exactly how these pieces fit together. For example, the Azbit and Excalibur reviews break down fee structures, security protocols, and geographic restrictions—critical data for compliance officers. The liquidity‑focused articles on Rewardable and Quantum Swap illustrate how tokenomics affect slippage and order execution, helping traders decide which pool to tap. Meanwhile, the custodial deep‑dive in the public‑private key guide explains key management best practices that institutional vaults adopt, from hardware security modules to multi‑sig policies. Each post reinforces the core idea that institutional crypto services are not a single product but a layered stack that must work in harmony.

Below you’ll find a curated set of articles that walk you through exchange reviews, airdrop safety checks, staking economics, and security incidents—everything a professional needs to assess risk, optimize execution, and stay compliant. Whether you’re building a trading desk, evaluating a new liquidity partner, or tightening your custody strategy, these resources give you the practical context to make informed decisions. Dive in and see how the right institutional crypto services can turn volatility into opportunity.