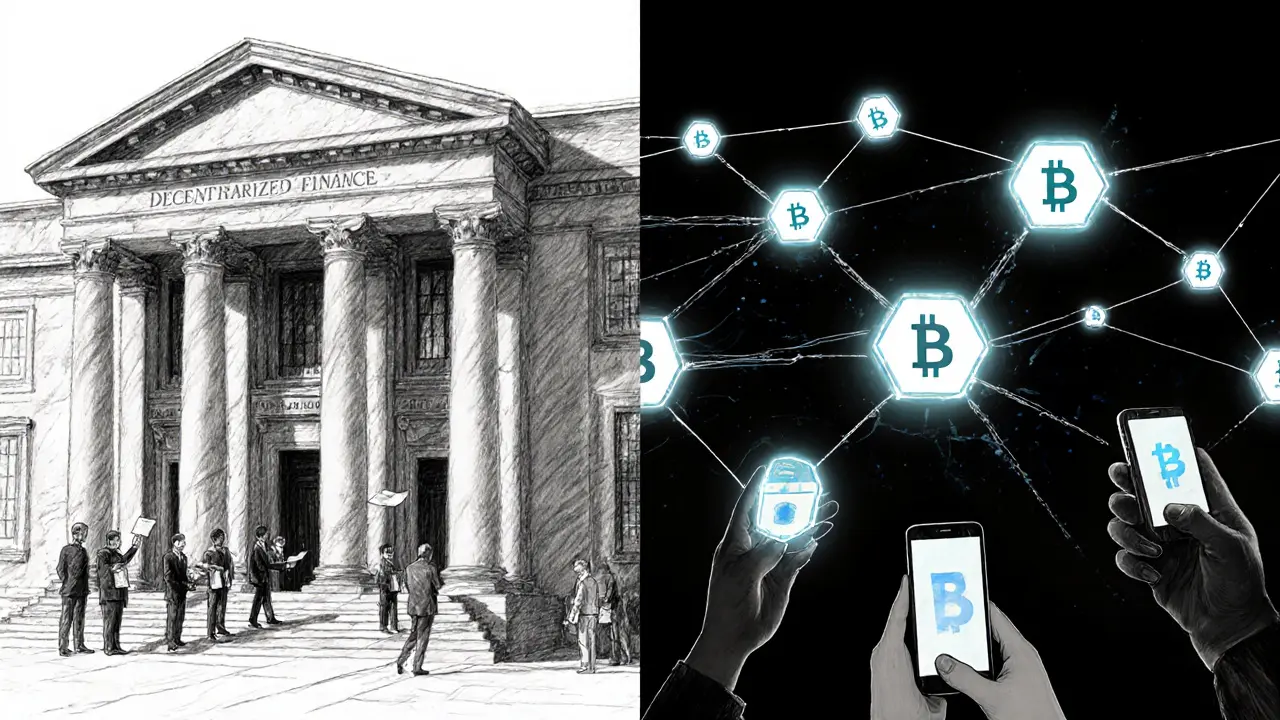

Explore how decentralized finance (DeFi) will reshape payments, lending, and asset tokenization by 2025, covering technology, adoption drivers, use cases, and remaining challenges.

Decentralized Finance: A Practical Overview

When working with Decentralized Finance, a financial ecosystem built on public blockchains that runs without banks or brokers. Also known as DeFi, it lets anyone lend, borrow, trade, or earn yield directly from a wallet.

The engine behind Smart Contracts, self‑executing code that automatically enforces agreement terms on a blockchain is what makes DeFi possible. These contracts power Liquidity Pools, shared token reserves that enable instant swaps and automated market making. By depositing assets into a pool, users earn a share of transaction fees, creating a passive income stream. This simple model fuels Yield Farming, the practice of moving assets across multiple pools to chase higher returns. Yield farming, in turn, drives token price dynamics and incentivizes new projects to launch innovative reward schemes.

One of the hottest side effects of this rapid growth is the rise of Crypto Airdrops, free token distributions used to bootstrap communities and reward early adopters. Airdrops often require users to hold certain assets, stake tokens, or complete simple on‑chain actions. They serve as both marketing tools and genuine wealth‑building opportunities, especially for participants who already engage with liquidity pools or yield farms. Recent examples include the LOCGame token drop and the Galaxy Adventure chest distribution, both of which illustrate how DeFi incentives intertwine with gaming and NFT ecosystems.

Understanding DeFi also means watching the broader security landscape. Historical smart contract hacks, validator slashing events, and hard fork splits show that code bugs or governance disputes can erase value in seconds. Articles on validator rewards, PoS economics, and hard fork impacts highlight why robust audit processes and diversified exposure are essential for anyone navigating this space. Keeping an eye on privacy protocols—like Monero or Zcash—adds another layer of nuance, especially for users who value transaction anonymity while interacting with DeFi platforms.

Regulatory shifts and regional restrictions play a big role too. From Nigeria’s exchange bans to OFAC sanctions on North Korean crypto networks, the legal environment can affect where and how DeFi services are accessed. Meanwhile, sustainable mining efforts and renewable energy adoption are reshaping the underlying infrastructure that supports blockchain networks, indirectly influencing transaction costs and network security.

All these pieces—smart contracts, liquidity pools, yield farming, airdrops, security events, and regulation—form a tightly knit web that defines today’s decentralized finance landscape. Below, you’ll find a curated collection of deep dives, reviews, and guides that unpack each element, from validator economics to the latest DeFi‑focused exchange reviews. Dive in to see how these concepts play out in real‑world projects and discover actionable insights you can apply right now.decentralized finance