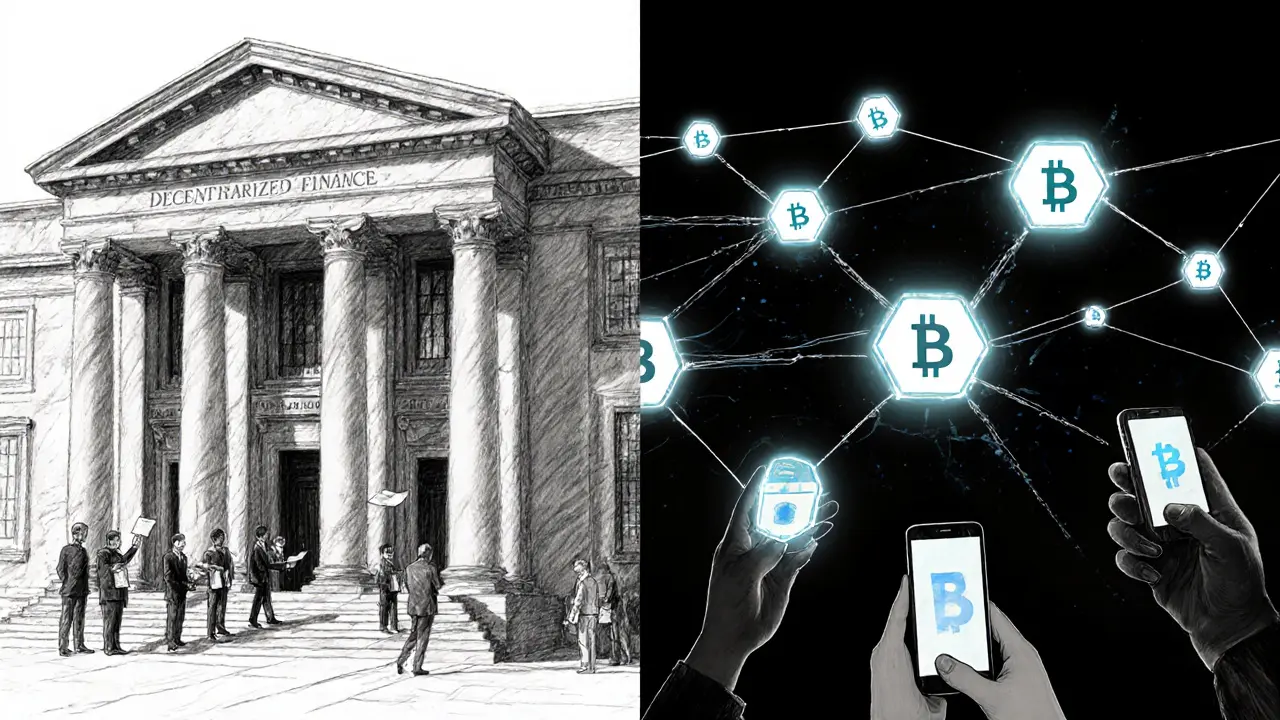

Explore how decentralized finance (DeFi) will reshape payments, lending, and asset tokenization by 2025, covering technology, adoption drivers, use cases, and remaining challenges.

Blockchain Finance: Real‑Time Data, Airdrops, and DeFi Insights

When you talk about Blockchain Finance, the ecosystem where decentralized protocols, token swaps, and on‑chain analytics intersect to create new financial products. Also known as crypto finance, it powers everything from yield farms to cross‑chain bridges. blockchain finance isn’t a buzzword; it’s a set of tools that let anyone trade, lend, or earn on public ledgers without a middle‑man.

One cornerstone of this space is Proof of Stake, a consensus method where validators lock up tokens to secure the network and earn rewards. Proof of stake influences blockchain finance by shaping validator incentives, slashing rules, and staking pool dynamics – all of which affect the yields you see on DeFi dashboards. Another hot topic is Smart Contract Hacks, security breaches that exploit vulnerable code in automated agreements. Understanding past hacks helps traders pick safer platforms and developers patch loopholes before they cost billions. Finally, Crypto Airdrops, free token distributions used to bootstrap communities and reward early adopters, are a practical way to grow a wallet while testing new protocols.

Why Blockchain Finance Matters Today

Blockchain finance encompasses token swapping, liquidity provision, and on‑chain lending – all of which happen in seconds, 24/7. Because every transaction is recorded on a public ledger, you can track real‑time swap volumes, spot emerging trends, and compare exchange performance without relying on opaque reports. This transparency fuels the rise of analytics hubs that pull data from Ethereum, Solana, and emerging Layer‑2 solutions, giving traders a clear edge.

DeFi platforms also rely on privacy protocols to protect user identities. Coins like Monero or Zcash implement zero‑knowledge proofs and ring signatures, offering anonymity that traditional finance can’t match. When you combine privacy with high‑speed swaps, you get a financial system that respects both speed and secrecy – a rare combo in the legacy world.

Staking rewards are another driver. Validators earn fees, commissions, and occasional slashing penalties, creating a risk‑reward profile that mirrors stock dividend yields. Knowing how validator commissions work lets you compare staking pools and decide whether a network’s economics suit your risk tolerance.

Airdrop strategies have evolved beyond simple token giveaways. Projects now require community actions – like tweeting, joining Discord, or providing liquidity – turning promotions into network effects. Understanding the eligibility criteria for airdrops such as the LOCGame CoinMarketCap event or the Galaxy Adventure Chest drop can add dozens of dollars to a portfolio without extra capital.

Security remains the biggest concern. Historical smart contract hacks – from the DAO incident to more recent cross‑chain bridge attacks – illustrate how a single vulnerability can wipe out billions. Learning from these events helps you vet protocols, read audit reports, and set proper risk limits before committing funds.

Regulation is catching up, too. Nations like Nigeria have banned certain exchanges, while OFAC sanctions target illicit crypto networks. Staying aware of compliance rules protects you from frozen assets and ensures you can move funds across borders without legal hassles.

All these pieces – staking economics, privacy tools, airdrop mechanics, security lessons, and regulatory updates – form the backbone of blockchain finance. Together they create a dynamic, data‑rich environment where informed traders can thrive.

Below you’ll find a hand‑picked collection of articles that dive deeper into each of these areas. Whether you’re hunting the next airdrop, dissecting validator reward models, or learning how hard forks reshape token economics, the posts ahead give you the actionable insights you need to navigate the fast‑moving world of blockchain finance.