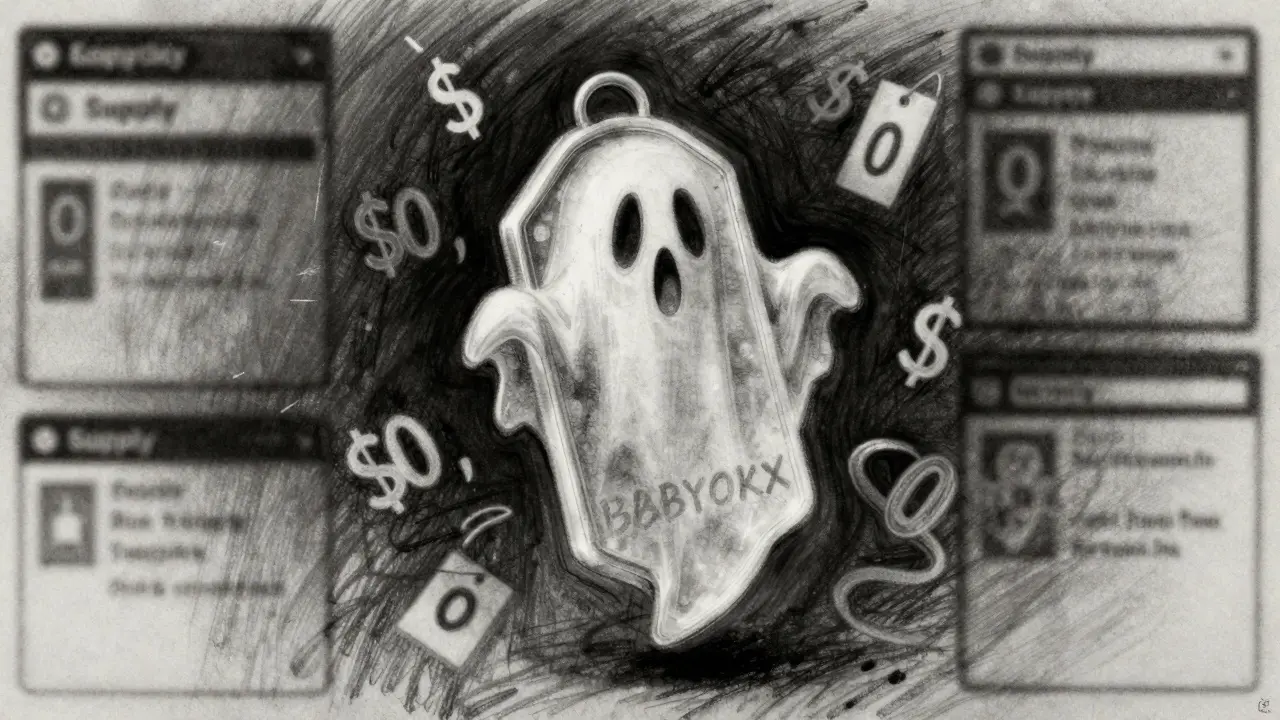

BABYOKX is a zero-volume crypto token with no team, no utility, and no real trading activity. Despite fake price listings, it's essentially worthless and serves as a cautionary example of speculative crypto noise.

BabyOKX token: What It Is, Why It Matters, and What You Should Know

When you hear about BabyOKX token, a meme coin built on the BNB Chain that gained attention through social media hype rather than technical innovation. It’s one of hundreds of tokens that pop up with flashy names, no team, and zero real use case—yet still attract traders chasing quick gains. This isn’t unique. Crypto is full of tokens like Baby Moo Deng, a Solana-based meme coin named after a viral hippo with no roadmap or development, or Jager Hunter, a BNB Chain token that pays holders every 10 minutes if they hold billions of tokens. These aren’t investments. They’re bets on attention, not value.

What makes BabyOKX token stand out isn’t its tech—it’s how it mirrors the pattern of every failed meme coin that came before it. No whitepaper. No team. No utility. Just a name that sounds like a copycat of a bigger exchange, hoping you’ll confuse it with OKX. That’s the game. These tokens thrive on FOMO, not fundamentals. They’re listed on tiny DEXs with thin liquidity, meaning one big seller can crash the price in seconds. And when the hype fades? The token becomes a ghost—like the BNU airdrop, a token given to 1,000 people that’s now worth nearly nothing, or the HarryPotterTrumpSonic100Inu, a coin with zero trading volume and a name designed to confuse. They’re not bugs in the system. They’re the system.

There’s a reason why posts about crypto mixers, regulatory capital rules, and on-chain tracing dominate this site. Because behind every meme coin is a real-world problem: money laundering, unregulated exchanges, and retail investors losing everything to noise. BabyOKX token doesn’t solve anything. It just adds to the noise. But understanding it? That helps you see the pattern. You’ll find posts here that break down how DeFi lending works, how exchanges like Tokenlon and CrescentSwap operate, and why Japan and the Philippines are cracking down on unlicensed platforms. These aren’t just guides—they’re shields. They teach you how to tell the difference between a token that’s trying to build something, and one that’s just trying to take your money.

Below, you’ll see real analysis of tokens that have no future—and the platforms, rules, and technologies that actually matter. You won’t find hype. You’ll find facts. And that’s the only edge you need in crypto today.