Blockchain-as-a-Service lets businesses use blockchain technology without managing the infrastructure. Learn how it works, who uses it, and why it's changing supply chains, finance, and logistics - without needing a crypto expert.

BaaS: What It Is and How It Powers Crypto and DeFi Platforms

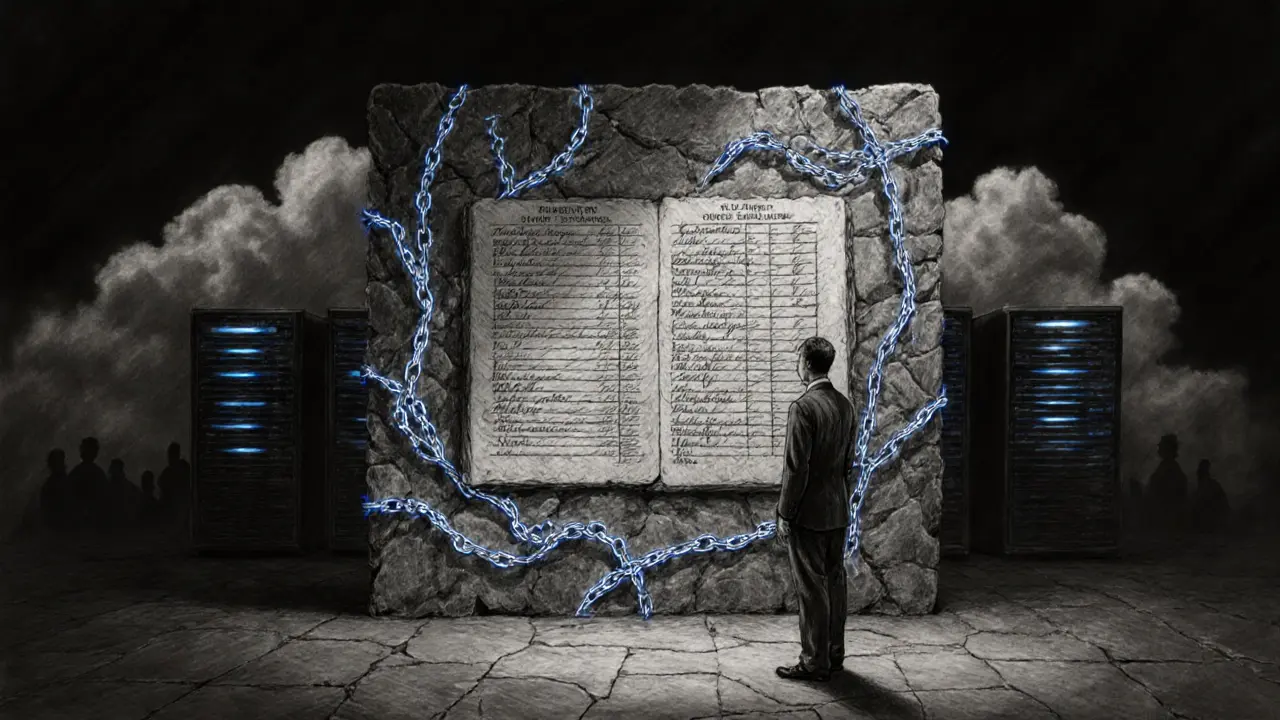

When you hear BaaS, Blockchain as a Service is a cloud-based platform that lets businesses deploy and manage blockchain networks without handling the underlying infrastructure. Also known as Blockchain as a Service, it’s the quiet engine behind many crypto exchanges, DeFi apps, and token launches you use every day. Think of it like renting a server farm—but instead of hosting a website, you’re running a blockchain that handles payments, smart contracts, or token swaps. Companies don’t need to hire blockchain engineers to set up nodes, secure networks, or sync ledgers. They just pick a provider, configure their rules, and go live. That’s why you see so many new crypto projects pop up fast: BaaS removes the technical wall.

But not all BaaS solutions are built the same. Some are built on Ethereum, others on BNB Chain or Solana. The choice affects fees, speed, and who can use the app. For example, Nash, a non-custodial exchange that lets Europeans buy crypto with fiat, likely uses BaaS to handle its wallet and trading layer without building its own chain from scratch. Same with Anzen Finance, the stablecoin issuer that runs on Ethereum and Layer-2 chains. They don’t need to reinvent the blockchain wheel—they plug into a trusted BaaS backbone and focus on their product: lending, staking, or compliance.

Here’s the catch: BaaS doesn’t fix bad ideas. You can build a meme coin on a top-tier BaaS platform and still end up with zero volume, like BNU, a token from ByteNext that was airdropped to 1,000 people and now trades at near zero. Or worse, like HarryPotterTrumpSonic100Inu, a coin with no team, no utility, and no trading activity. BaaS gives you the tools, but it doesn’t make your project smart. That’s still on you.

That’s why the posts here cover both sides: the platforms that use BaaS well—like Binance, which runs on its own infrastructure—and the ones that misuse it, like mSamex or Dexfin, which pretend to be real exchanges but have no users, no transparency, and no real blockchain backing. You’ll find guides on how to spot the difference, what to look for in a DeFi protocol’s tech stack, and why some airdrops (like Midnight NIGHT or SAND) actually deliver value while others (FOTA, KTN, Zenith Coin) are just noise.

If you’ve ever wondered how a new crypto app launches so quickly, or why some platforms vanish overnight, the answer often starts with BaaS. It’s not magic. It’s infrastructure. And understanding it helps you tell the real projects from the ones just renting a blockchain to look legit.