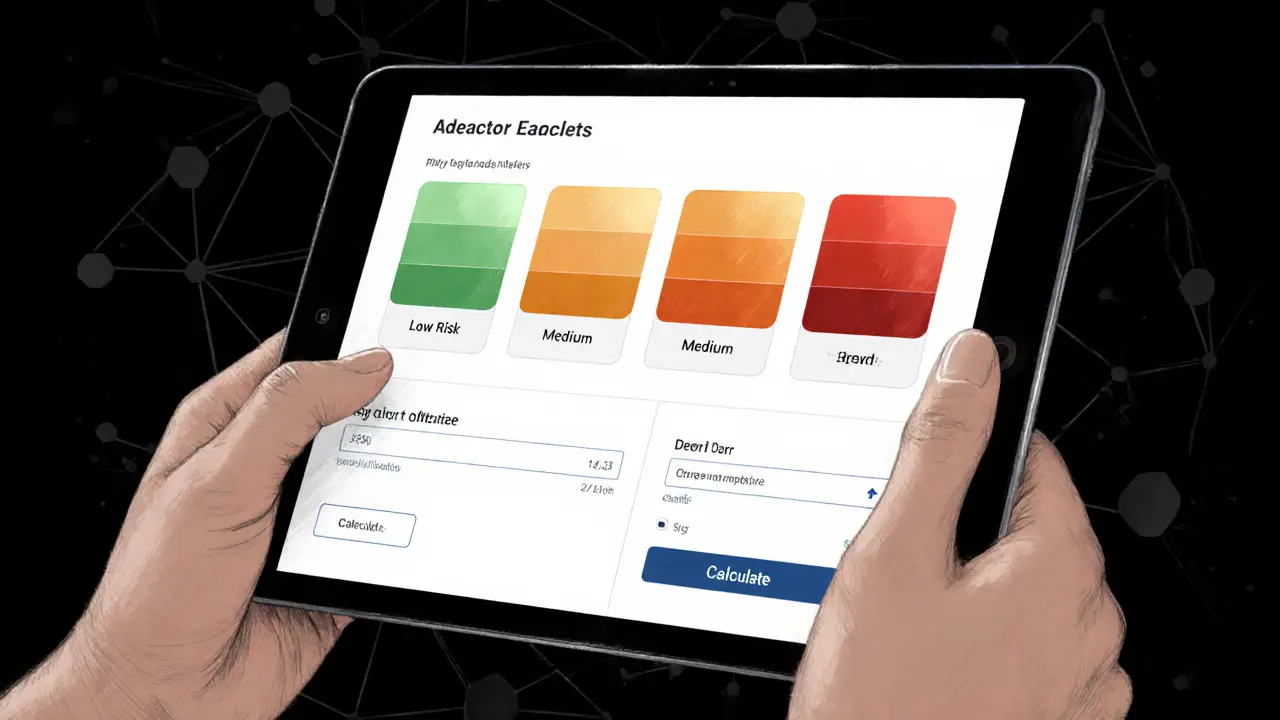

KyberSwap Elastic Fee Tier Calculator

KyberSwap Elastic offers five distinct fee tiers: 0.008%, 0.01%, 0.03%, 0.04%, and 1%. Each tier balances potential earnings against risk exposure.

Potential Monthly Earnings

Risk Assessment

When exploring decentralized finance on Polygon, KyberSwap Elastic is a tick‑based AMM that offers concentrated liquidity and multi‑chain aggregation on the Polygon network. This KyberSwap Elastic review breaks down what the platform does, how its fee model works, why the November2023 exploit still matters, and whether it can compete with the likes of UniswapV3 or SushiSwap.

Quick Take

- Concentrated liquidity on Polygon gives lower slippage for active traders.

- Five fee tiers (0.008%‑1%) let LPs fine‑tune earnings versus risk.

- November2023 exploit exposed a critical math bug; $56M was lost.

- Multi‑chain aggregation is a unique advantage, but security concerns limit adoption.

- For casual swaps, Elastic works; for large LP positions, consider more battle‑tested DEXs.

What is KyberSwap Elastic?

Polygon is a Layer‑2 scaling solution for Ethereum that provides fast, cheap transactions. Built on this network, KyberSwap Elastic launched in 2022 as the next‑gen version of the original KyberDMM protocol (now called KyberSwap Classic). Founders Loi Luu - a Ph.D. researcher from the Ethereum Foundation - and Victor Tran designed a tick‑based market maker that lets liquidity providers (LPs) concentrate assets within custom price ranges, similar to UniswapV3.

Fee Structure and Liquidity Mechanics

The platform offers five distinct fee tiers: 0.008%, 0.01%, 0.03%, 0.04%, and 1%. LPs pick a tier that matches their risk appetite and expected volatility. Lower fees attract more volume but generate smaller returns; higher fees compensate LPs for providing liquidity to less‑traded pairs.

Elastic also embeds a Reinvestment Curve that automatically compounds earned fees back into the pool, boosting capital efficiency. However, because liquidity sits in narrow price bands, LPs must monitor price movements closely. If the market price drifts out of their chosen range, the position becomes inactive and stops earning fees - a phenomenon known as “out‑of‑range” risk.

The November2023 Exploit

Security is the biggest story in Elastic’s history. In November2023 a white‑hat style exploit targeted the computeSwapStep() function that calculates price steps across ticks. CertiK flagged a rounding‑error bug that let an attacker craft a swap amount of 244,080,034,447,359,999,999 to force an incorrect price boundary. The attacker siphoned roughly $48.7M, while automated bots grabbed another $6.6M.

KyberSwap’s response recovered about $5.7M from front‑running bots and $706K from locked assets, but the loss still totals $56M affecting 2,367 liquidity providers. The incident shattered community confidence, causing a sharp drop in Twitter followers and a surge of withdrawal warnings.

User Experience Before and After the Attack

Before the exploit, users praised the platform for its non‑custodial nature, zero‑KYC onboarding, and the ability to earn fees through concentrated liquidity. Swapping required only a wallet connection (MetaMask, Trust Wallet, etc.) and a token approval transaction - a friction level comparable to Uniswap.

Post‑exploit sentiment shifted dramatically. Forum threads now carry warnings about fund safety, and many LPs have moved their capital to platforms with longer audit histories. Nevertheless, the basic swap UI remains clean, and newcomers can still trade three coins across four pairs on Polygon with an average spread of 0.882%.

How Elastic Stacks Up Against Competitors

| Feature | KyberSwap Elastic | Uniswap V3 | SushiSwap |

|---|---|---|---|

| Concentrated Liquidity | Yes (tick‑based) | Yes | No (uses constant product) |

| Multi‑chain Aggregation | Yes (7+ chains) | No (Ethereum only) | Limited (via Trident on selected chains) |

| Fee Tiers | 5 (0.008‑1%) | 3 (0.05‑0.30‑1%) | Fixed 0.30% |

| Security Audits | Audit completed; exploit in 2023 | Multiple audits, no major loss | Audits, minor bugs only |

| Average Spread (Polygon) | 0.88% | ~1.1% | ~1.3% |

While Elastic’s aggregation gives better rates on less‑liquid assets, Uniswap V3’s stronger security track record and deeper liquidity pools often make it the safer choice for large trades.

Pros and Cons

- Pros

- Low transaction fees on Polygon (under $0.01 per swap).

- Five fee tiers let LPs tailor risk/reward.

- Cross‑chain aggregation reduces slippage on exotic pairs.

- Reinvestment Curve automates fee compounding.

- Cons

- Security breach in 2023 exposed a critical math flaw.

- Liquidity providers must actively manage ranges; higher operational overhead.

- Limited token selection on Polygon (only 3 coins, 4 pairs).

- Community trust still recovering; fewer new LPs joining.

Is KyberSwap Elastic Worth Using in 2025?

If you’re a casual trader looking for cheap swaps on Polygon, Elastic still offers a sleek UI and competitive spreads. For LPs, the platform can be profitable if you understand concentrated liquidity, pick the right fee tier, and stay on top of price movements.

However, if security is your top priority or you need deep liquidity for large orders, you may prefer UniswapV3, SushiSwap, or a centralized exchange with strong insurance funds. The decision ultimately hinges on how much you trust the platform’s ongoing remediation efforts and whether the multi‑chain aggregation advantage outweighs the residual risk.

Frequently Asked Questions

How does KyberSwap Elastic differ from KyberSwap Classic?

Elastic replaces the constant‑product AMM of Classic with a tick‑based model that lets LPs concentrate liquidity in narrow price bands, offering lower slippage and higher capital efficiency.

Can I trade assets from other chains on Elastic?

Yes. Elastic aggregates liquidity from Ethereum, Binance Smart Chain, Avalanche, Fantom, Arbitrum, Optimism, and several other networks, routing the best rate to the user.

What should I do if I already have funds in an Elastic pool?

Monitor the price range of your position. If the market drifts outside, consider withdrawing or rebalancing to a new range. Keep an eye on official announcements for any new security patches.

Has KyberSwap performed any audits since the 2023 exploit?

The team commissioned a follow‑up audit in early 2024, which confirmed the removal of the computeSwapStep() flaw. However, no public audit report has been released, so users should stay cautious.

Are there any fee rebates or incentives for new LPs?

Occasionally KyberSwap runs liquidity mining campaigns that grant KNC rewards. Check the official blog or Discord for the latest incentive programs.

KyberSwap's Elastic is overhyped, nothing special.

Wow, dissecting KyberSwap's Elastic feels like peeling an onion of hidden fees!

Those five fee tiers might look neat on paper, but the reality can sting like a bee when liquidity dries up.

The 1% high-risk tier is basically a gamble you shouldn't take lightly.

On the bright side, the low‑risk tiers could be a decent hedge if you keep a close eye on the market.

Overall, tread carefully and keep those alerts on. :)

Listen, the Elastic model is trying to sell you flexibility, but flexibility without discipline is just chaos.

Those medium‑risk tiers (0.03%‑0.04%) are where most users get burned because they think they’re safe.

If you’re not constantly rebalancing, you’ll end up out‑of‑range faster than you can say ‘impermanent loss’.

Bottom line: only dive in if you have the stamina to monitor it daily.

KyberSwap’s Elastic feels like a cultural mash‑up of traditional AMMs and concentrated liquidity.

It’s cool to see the fee calculator, but don’t let the UI lull you into a false sense of security.

Always vet the underlying pool composition before committing funds.

I’d say the risk tiers are just a marketing gimmick.

Allow me to articulate the multifaceted considerations inherent in deploying capital onto KyberSwap's Elastic architecture.

Firstly, the dichotomy between fee accrual and exposure to adverse price movement necessitates a rigorous quantitative analysis.

Secondly, one must account for the stochastic nature of trading volume, which directly influences revenue projections.

Thirdly, the protocol's governance mechanisms impose additional layers of operational risk that cannot be overlooked.

Moreover, the interplay between concentrated liquidity positions and slippage dynamics demands continuous recalibration.

Furthermore, the inherent latency in blockchain finality on Polygon introduces subtle but material execution risk.

In addition, the fee tier hierarchy, ranging from sub‑basis‑point rates to a 1% premium, reflects an underlying risk‑reward spectrum that must align with your portfolio's volatility tolerance.

Coupled with this, the smart contract audit reports, while reassuring, are not an absolute safeguard against future exploits.

Consequently, a holistic risk management framework integrating position limits, stop‑loss parameters, and periodic performance reviews is indispensable.

Equally important is the consideration of gas costs, which, although modest on Polygon, can erode marginal gains in low‑volume scenarios.

Simultaneously, the evolving competitive landscape, with emergent DEX aggregators, may impact KyberSwap's market share and thus fee generation potential.

Finally, the strategic decision to actively manage price ranges versus adopting a passive stance hinges on your operational bandwidth and expertise.

To summarize, engaging with KyberSwap Elastic is not merely a plug‑and‑play venture but a sophisticated endeavour requiring diligent oversight.

Proceed with caution, armed with data‑driven insights and a robust contingency plan.

Honestly, the whole fee‑tier thing feels like a pretentious attempt to sound technical.

Just pick the low‑risk tier and move on.

While the previous exposition was thorough, it fails to acknowledge the governance latency inherent in Elastic's upgrade cycle.

Furthermore, the risk assessment omitted a discussion on oracle dependencies, which constitute a non‑trivial attack vector.

Hence, prospective LPs should demand transparent governance provisions before allocating capital.

Philosophically speaking, the Elastic model mirrors the eternal tension between order and chaos.

One must accept impermanence while seeking stability.

Great breakdown! Keep it up! 😊

The 1% tier is a nightmare for anyone not ready to lose everything.

Stick to the low tiers if you value your capital.

From a systemic risk perspective, the composability of Elastic with ancillary protocols introduces cross‑protocol contagion risks.

Moreover, the fee distribution algorithm exhibits non‑linear scaling, which could amplify slippage under stress conditions.

Thus, prudent capital allocation should incorporate stress‑testing scenarios.

Hey folks, just a friendly reminder to keep an eye on your price ranges.

If you let them drift, you’ll earn almost nothing.

Set alerts, check the pool health weekly, and tweak as needed.

That way you stay in the sweet spot and maximize those low‑fee earnings.

Stay chill and stay profitable!

This review glosses over the glaring security holes.

You’re better off avoiding Elastic altogether.

Don't forget to diversify across multiple pools.

That reduces exposure to any single protocol hiccup.

Stay optimistic and keep learning!

Anyone else wonder how the fee calculator updates in real‑time?

Curious to see the code behind it! 😃

KyberSwap Elastic offers a nifty way to capture fees without being drowned in impermanent loss.

The tiered fee system is clever, giving traders flexibility to match their risk appetite.

Just remember that the high‑risk 1% tier can be a double‑edged sword – big rewards, big burns.

Overall, it’s a solid tool if you stay disciplined and monitor your positions.

Stop idolizing the platform; it’s just another playground for the greedy.

If you’re not ready to hustle, stay away.

I think the review missed the point about gas fees on Polygon.

They’re low but not zero, so factor them in.

Also, always double‑check the pool's depth before jumping in.