Smart Contract Hack Loss Calculator

Estimated Impact

Enter values and click calculate to see estimated loss.

Estimated Loss

When a piece of code can move millions of dollars without a human signing a transaction, a single mistake can become a multi‑million‑dollar disaster. The record of smart contract hacks reads like a crime novel: secretive actors, massive sums, and lessons that reshaped the whole crypto ecosystem.

Quick Takeaways

- The DAO exploit (2016) sparked Ethereum’s first hard fork.

- Cross‑chain bridges account for roughly 40% of total crypto‑hack losses.

- Nation‑state actors such as the Lazarus Group have targeted DeFi for profit.

- Formal verification, bug‑bounty programs, and insurance are now industry standards.

- Future attacks will likely leverage AI, but better tooling will keep individual loss sizes lower.

Smart contract hack is a security breach where attackers exploit vulnerabilities in self‑executing blockchain contracts, siphoning funds without needing a centralized intermediary. Understanding the historical incidents that defined this threat helps developers, investors, and regulators avoid repeating costly mistakes.

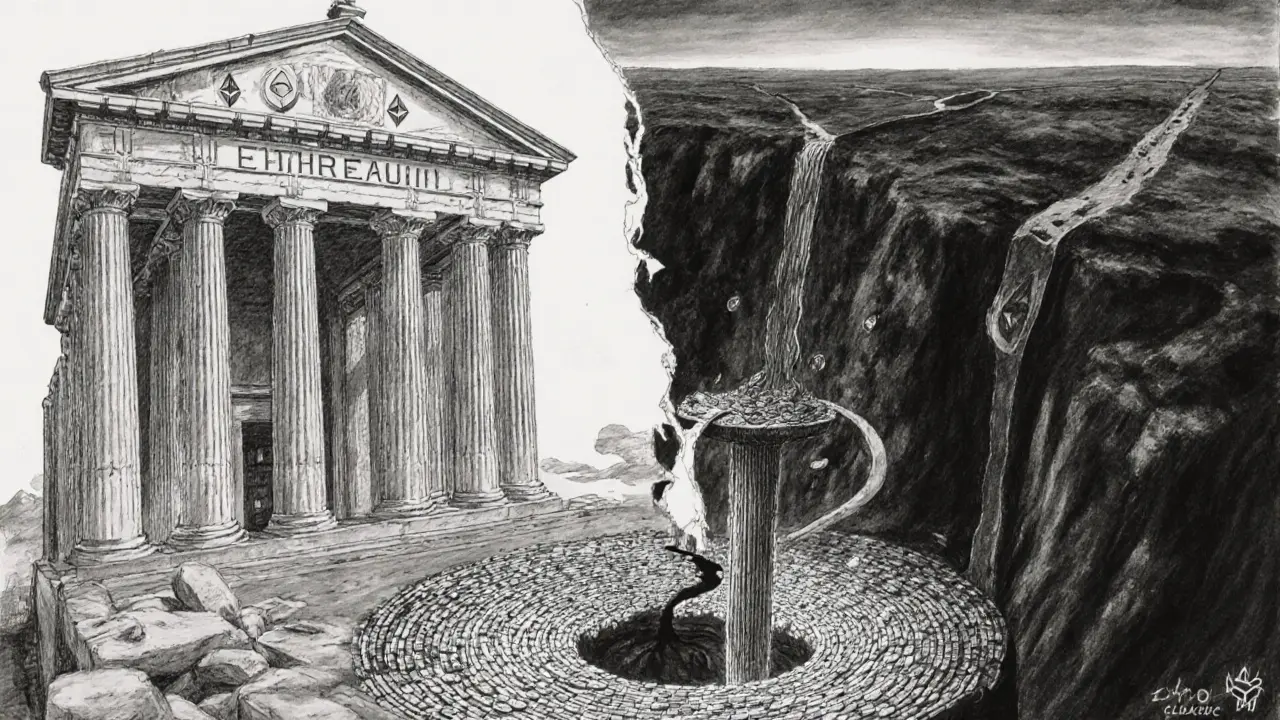

The DAO - The First Major Breach

The DAO was a decentralized autonomous organization built on Ethereum in 2016 that raised over $150million in Ether. A recursive call bug let an attacker pull out roughly $50million worth of Ether. The fallout forced the community to execute a controversial hard fork, creating two chains: Ethereum (ETH) and Ethereum Classic (ETC). The event proved that even highly scrutinized contracts could hide lethal flaws.

DeFi’s Explosion and the Rise of Cross‑Chain Bridges

When decentralized finance (DeFi) took off in 2020, developers introduced new ways to move assets across blockchains. These bridges promised seamless swaps but multiplied the attack surface.

Cross-chain bridge is a protocol that locks assets on one chain and issues wrapped equivalents on another, enabling inter‑ledger transactions. The most notorious bridges-Wormhole, Nomad, Binance BNB Bridge, and Ronin-have collectively suffered losses exceeding $2billion.

Biggest Hacks by Loss

| Year | Target | Loss (USD) | Primary Vector |

|---|---|---|---|

| 2022 | Ronin Network | $625million | Compromised validator keys (Lazarus Group) |

| 2021 | Poly Network | $611million | Faulty access control on proxy contracts |

| 2022 | Binance BNB Bridge | $569million | Improper signature verification |

| 2022 | Wormhole Bridge | $326million | Minting wETH without collateral after update |

| 2022 | Nomad Bridge | $190million | Unprotected upgrade function exploited by many users |

Each incident shares a pattern: a complex contract interaction, insufficient testing, and a rush to launch without a full security audit.

Common Attack Vectors

- Reentrancy: The attacker repeatedly calls a vulnerable function before the previous execution finishes, draining funds (as seen in The DAO).

- Flash‑loan abuse: Borrowers take out uncollateralized loans, manipulate market prices, and repay within the same transaction.

- Oracle manipulation: Feeding false price data to smart contracts that rely on external feeds, leading to profitable liquidations.

- Governance attacks: Gaining control of voting power to change contract parameters or approve malicious upgrades.

- Upgrade/initializer bugs: Misnamed constructors or unprotected upgrade functions that let anyone become the owner (e.g., Rubixi).

Evolution of Security Practices

The community responded by building robust tooling. OpenZeppelin now provides audited libraries, standardized patterns, and a public bug‑bounty platform. Formal verification tools (e.g., Certora, MythX) attempt to mathematically prove contract correctness before deployment.

Professional audit firms-Trail of Bits, ConsenSys Diligence, OpenZeppelin-charge $100k‑$500k per comprehensive review, and many projects allocate up to 20% of their development budget to security.

Regulatory and Community Impact

Major hacks triggered regulatory crackdowns. The U.S. Treasury sanctioned addresses tied to the Ronin attack, while the EU’s MiCA framework now mandates operational resilience for crypto service providers. Japan tightened exchange security after the Coincheck loss.

Community sentiment shifted toward self‑custody. Reddit threads and Twitter polls show a spike in hardware‑wallet adoption after each large breach, and user‑driven insurance pools began emerging in 2023.

Lessons Learned & Future Outlook

Three takeaways dominate the historical record:

- Never skip a formal audit. Even well‑funded teams missed simple mistakes.

- Design bridges with multiple safety checks. Multi‑signature withdrawals, time‑locks, and on‑chain governance vetoes have reduced bridge‑related loss ratios.

- Prepare for AI‑augmented threats. As attackers adopt machine learning to discover zero‑day bugs, defenders must incorporate automated static analysis and runtime monitoring.

By 2025, insurers expect to cover up to 70% of DeFi protocol losses, though premiums remain high. The next wave of exploits will likely target novel interoperability layers, so ongoing vigilance, open‑source libraries, and community‑driven bug bounty programs remain the best defense.

Frequently Asked Questions

What caused the Ronin Network hack?

Attackers stole validator private keys, allowing them to approve fraudulent withdrawals from the bridge. The exploit was traced to the Lazarus Group, a North‑Korean state‑backed hacking collective.

How does a cross‑chain bridge work?

A bridge locks assets on the source chain, records the event, and mints a wrapped representation on the destination chain. When the user wants to move back, the wrapped token is burned, and the original assets are released.

Can audits guarantee safety?

Audits dramatically reduce risk but cannot guarantee absolute safety. New attack vectors (e.g., flash‑loan combos) can emerge after a code review, so continuous monitoring and bug‑bounty incentives are essential.

What is reentrancy and why is it dangerous?

Reentrancy occurs when a contract calls an external address before updating its own state. If the external contract calls back into the original function, it can repeat the withdrawal logic and drain funds, as happened with The DAO.

Are there any reliable DeFi insurance options?

By late 2024, platforms like Nexus Mutual and InsurAce began offering coverage for smart‑contract failures, but premiums can reach 5‑10% of the insured amount, and payouts are still subject to claims validation.

Oh great, another reminder that DeFi is just a playground for the shadowy elites who pull strings behind every smart contract.

They’re probably using the same back‑door they left in the DAO to skim whatever they want.

What a surprise that a bridge could be so badly coded – it’s almost as if nobody bothered to check the code at all.

Guess we’ll just keep trusting the next “secure” upgrade while the whales grin.

Nice breakdown, bro – the numbers are clear.

Just remember to double check the input fields next time.

Can you even imagine the chaos when the DAO got ripped off it was like the internet exploding with panic.

The world stopped for a heartbeat watching the ETH disappear into thin air.

Everyone pretended they knew why it happened but none of them had a clue.

Those hacks show why we need solid audit trails and clear upgrade processes.

Make sure any bridge you use has multi‑sig controls and a timelock.

It’s also a good idea to keep a small reserve in a cold wallet just in case.

Never trust a single validator with all the keys.

Stay safe out there.

Seeing those loss numbers really hits hard, especially for folks who put their savings on the line.

It’s easy to feel angry at the developers who missed the bugs, but we also have to own our own risk.

Learning from each breach helps the whole ecosystem get stronger.

Take a breath and keep researching before you jump into the next project.

The universe balances itself; when a bridge falls, the market feels the ripple.

Perhaps the next iteration will learn humility before diving into another treasure chest.

Keep stacking knowledge, the next smart contract you audit could save billions.

Every hack is a lesson in disguise, and each lesson pushes us toward a more resilient future.

Let’s use these insights to build stronger safeguards and keep the community thriving.

Sure, these hacks are “big”, but the real problem is the hype machine that sells dreams while ignoring basic security.

People keep throwing money at shiny tokens without reading a single line of code.

From a risk management perspective the systemic vulnerabilities observed across these incidents underscore the necessity for robust governance frameworks and immutable audit trails.

Implementing formal verification coupled with comprehensive threat modeling can mitigate exposure to adversarial exploitation.

The DAO hack taught us that recursive call patterns can be deadly if not properly guarded.

It also highlighted the importance of immutable contract logic and the danger of over‑relying on external calls.

Ronin’s breach showed how validator key management is a critical attack surface.

Storing private keys offline and using multi‑signature schemes can drastically reduce that risk.

Poly Network’s loss reminded us that proxy contracts must enforce strict access controls.

An upgrade mechanism without proper authentication is essentially an open door for attackers.

Binance Bridge’s failure demonstrated that signature verification must be rigorously tested against edge cases.

A single malformed signature can authorize the minting of massive amounts of wrapped tokens.

Wormhole’s incident revealed the perils of rushed deployments without thorough audit of state transitions.

The minting logic was bypassed, allowing unchecked creation of assets.

Nomad’s exploit was a textbook case of an unprotected upgrade function being abused.

Incorporating timelocks and community review can prevent unilateral changes.

Across all these events the common thread is insufficient defensive depth and lack of redundancy.

Layered security, formal verification, and continuous monitoring are the pillars that can safeguard future contracts.

By internalizing these lessons we can build a more trustworthy DeFi ecosystem for everyone.

One thing that often gets overlooked is the role of community bounty programs in catching bugs before they go live.

Encouraging white‑hat hunters with generous rewards can surface vulnerabilities that internal audits miss.

Make sure to set clear scopes and payout structures so participants know what’s expected.

Wow, another post glorifying “learning from failure” 🤦♂️ as if the victims are just there for our entertainment.

If you actually cared about security you’d stop shilling every new bridge without demanding real proof-of‑concept audits first.

Stop the hype and start demanding accountability 🙄.

Life’s like a blockchain – sometimes you get forked, sometimes you get reorged, but the chain keeps moving forward.

Take these hacks as the rough patches that shape a stronger, wiser network.

Keep believing in the power of collective improvement.