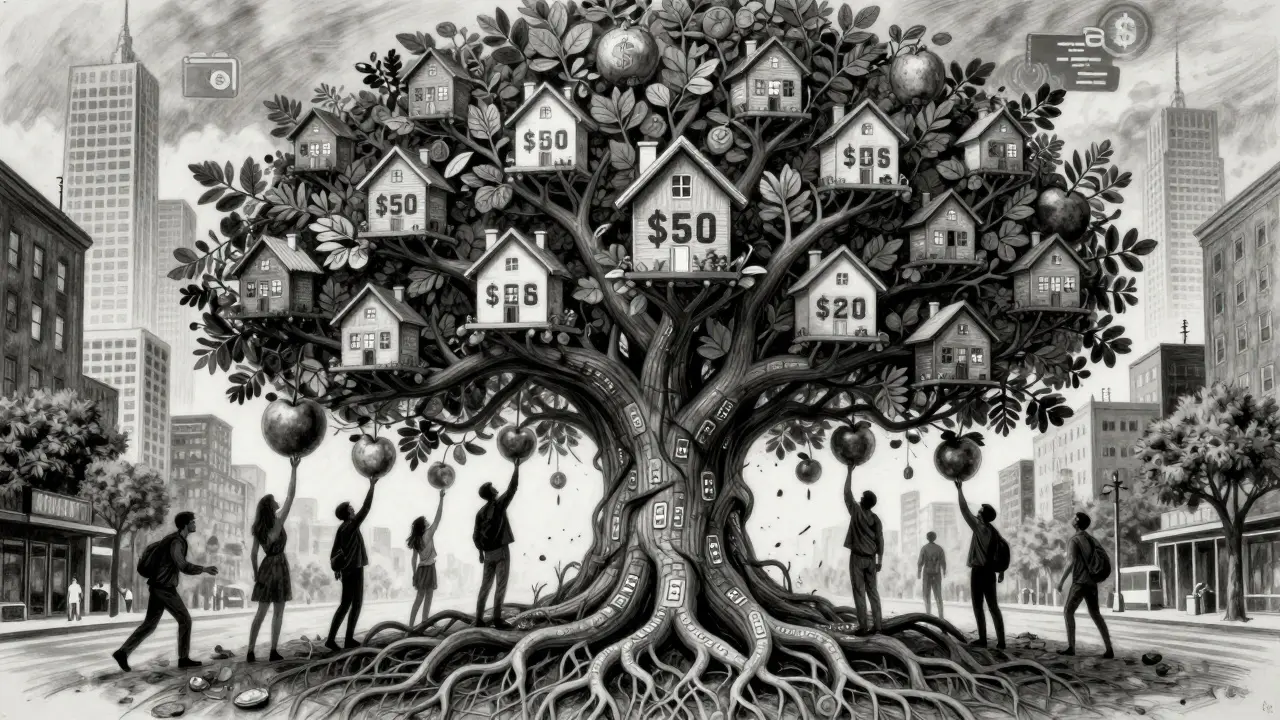

Buying a house used to mean saving for years, dealing with agents, waiting weeks for closing, and paying thousands in fees. Now, you can own a piece of a property in Detroit or Atlanta with just $50-and get rental income paid out daily. This isn’t science fiction. It’s happening right now on blockchain real estate platforms.

What Exactly Is a Blockchain Real Estate Platform?

A blockchain real estate platform turns physical property into digital shares you can buy, sell, and trade like stocks. Instead of owning an entire house or apartment building, you own a fraction of it-called a token. These tokens live on a blockchain, which acts like a public, unchangeable ledger that tracks who owns what. Every transaction is recorded permanently, reducing fraud and speeding up transfers. This isn’t about crypto speculation. It’s about making real estate more accessible. Traditional real estate is illiquid-you can’t easily sell half your house. But with tokenization, you can sell your $200 share of a rental property in minutes. Platforms like Propy, RealT, and Lofty.ai handle the legal, technical, and financial layers so you don’t have to.How It Works: From Property to Token

Here’s the step-by-step reality:- A property owner or developer partners with a blockchain platform to tokenize their asset.

- The property is appraised, legally verified, and split into hundreds or thousands of digital shares (ERC-20 or ERC-3643 tokens).

- Investors buy these shares using stablecoins like USDC, not cash or credit cards.

- Smart contracts automatically distribute rental income to token holders-usually monthly or even daily.

- Ownership records are stored on the blockchain, accessible to anyone with the right wallet.

Top Platforms in 2025: Who’s Leading and Why

Not all platforms are built the same. Here’s how the leaders stack up:| Platform | Blockchain | Min Investment | Transaction Fee | Key Strength | Limitation |

|---|---|---|---|---|---|

| Lofty.ai | Permissioned Ethereum | $50 | 3% | Daily rental payouts, easy app | Only operates in North America |

| RealT | Ethereum (ERC-20) | $10 | 0% | $29M+ paid in rent, 65K+ investors | 80% of properties in just two cities |

| Propy | Ethereum | $100 | 2.5% | Global transactions in 27 countries | Complex for non-crypto users |

| Blocksquare | Polygon | $100-$500 | 2.9% | Low gas fees, mobile-friendly | Slow customer support |

| Brickblock | Ethereum | $1,000 | 3.5% | Tokenized bonds with fixed returns | High minimums, limited liquidity |

Lofty.ai stands out for beginners. Its app lets you buy shares, see rental income arrive daily, and track your portfolio without needing to understand wallets or gas fees. RealT wins for long-term income seekers-its average annual returns range from 6% to 16%. Propy is the only one with real cross-border use, having closed deals in Germany, Canada, and the UAE.

Why This Matters: The Real Benefits

The biggest shift isn’t tech-it’s access. Before blockchain, real estate investing was for the wealthy. Now, someone earning $45,000 a year can invest $100 in a rental property and earn passive income. That’s democratization. Here’s what’s changing:- Lower barriers: No more $200,000 down payment. Entry points start at $50.

- Faster transactions: Closing used to take 30-45 days. On blockchain, it’s under 15 minutes.

- Lower fees: Traditional agents charge 5-6%. Blockchain platforms charge 1-3%.

- Transparency: You can see every transaction, rent payment, and ownership change on-chain.

- Liquidity: You’re not stuck. You can sell your share anytime the market is open.

The Risks: What No One Tells You

This isn’t risk-free. If you’re thinking of jumping in, know the downsides:- Regulatory uncertainty: The SEC now says any token representing property ownership is a security. Platforms without full compliance got shut down in 2025. Over 17 platforms received cease-and-desist orders.

- Wallet risks: If you lose your private key, you lose your investment. There’s no customer service to recover it.

- Concentration risk: RealT’s portfolio is 70% in Detroit and Atlanta. If those markets crash, your returns drop.

- Scams: In January 2025, a fake Miami property token on StackerNews stole $2.3 million from 47 investors. Poor KYC was to blame.

- Liquidity gaps: Just because you can sell doesn’t mean someone will buy. Some tokens sit unsold for weeks.

Who’s Investing? And Why?

The typical investor on these platforms isn’t a Wall Street banker. According to Republic’s 2025 survey, 63% are millennials aged 28-43. They’re tech-savvy, distrust traditional finance, and want passive income they can track on their phones. Average investment size? $3,200. Most hold for over a year. They’re not day-trading. They’re building long-term wealth. Institutional players are catching up too. BlackRock launched its first tokenized real estate fund in April 2025 with $450 million in assets. JPMorgan’s Onyx platform processed $1.2 billion in tokenized property deals in Q1 2025. This isn’t a fringe trend anymore-it’s becoming infrastructure.

What You Need to Get Started

If you want to try this, here’s what you actually need:- A crypto wallet (MetaMask is used by 78% of users).

- USDC stablecoins (buy them on Coinbase, Kraken, or Binance).

- Pass KYC verification (takes 3-5 business days).

- At least $50-$100 to invest.

- Patience. The first transaction will take 8-10 hours to figure out. The second? 15 minutes.

The Future: What’s Next?

By 2028, Deloitte predicts blockchain could cut commercial real estate costs by 40-60%. That means lower rents, higher returns, and more people owning property. New tech is emerging too. Libertum’s 2025 upgrade supports both security tokens and NFTs for unique properties. Reddio’s new blockchain handles 5,000 transactions per second-fast enough for mass adoption. Tectum Labs just launched quantum-resistant keys to protect against future hacking threats. And consolidation is happening. Propy was bought by ConsenSys. RealT was taken over by Fortress Investment Group. This isn’t a wild west anymore. It’s becoming a regulated, institutional market.Final Thought: It’s Not About Crypto. It’s About Ownership.

Blockchain real estate isn’t about Bitcoin or memes. It’s about giving people real control over tangible assets. It’s about turning a $2 million apartment building into 20,000 $100 pieces anyone can own. Yes, there are risks. Yes, it’s complex. But the old system-expensive, slow, and exclusive-is crumbling. The new one is faster, cheaper, and open to everyone. If you’ve ever dreamed of owning real estate but couldn’t afford it, this might be your chance. Not to get rich quick. But to build something real-step by step, share by share.Can I really buy a piece of a house with $50?

Yes. Platforms like Lofty.ai and RealT allow you to buy fractional shares of rental properties starting at $50. You don’t own the whole house-you own a tiny percentage of it. That share entitles you to a proportional slice of rental income and potential appreciation.

Are blockchain real estate platforms legal?

It depends. In the U.S., the SEC now treats any token representing ownership in real estate as a security. That means platforms must comply with federal securities laws-either through full registration or exemptions like Regulation D. Platforms without compliance have been shut down in 2025. Always choose platforms that show clear SEC compliance documentation.

Do I need to understand cryptocurrency to use these platforms?

You don’t need to be an expert, but you do need basic familiarity. You’ll need a crypto wallet (like MetaMask) and USDC stablecoins to invest. Most platforms have simplified apps, but you’ll still need to manage your own private keys. If you’re uncomfortable with that, wait until you’re ready.

How do I get paid rental income?

Rental income is distributed automatically via smart contracts. If you’re on Lofty.ai, you get paid daily. On RealT, it’s monthly. The money arrives in your crypto wallet as USDC. You can hold it, convert it to USD, or reinvest it.

What happens if the platform shuts down?

Your ownership tokens are stored on the blockchain, not on the platform’s servers. Even if Lofty.ai or RealT disappears, your tokens still exist. You can still transfer them to another wallet or sell them on a decentralized exchange. The property itself doesn’t vanish-it’s just harder to manage without the platform’s interface.

Is this better than REITs?

It’s different. REITs are managed funds that pool money to buy properties-you don’t know exactly what you own. With tokenized real estate, you know the exact property, location, and rent. You also get more direct control and often higher yields. But REITs are more liquid and regulated. Tokenized real estate offers transparency and ownership, but with more risk and complexity.

Can I use this outside the U.S.?

Yes, but with limits. Propy supports transactions in 27 countries. Vairt focuses on Europe. But most platforms are U.S.-focused due to regulatory clarity. If you’re outside the U.S., check local laws first. Some countries ban crypto real estate entirely.

This is just crypto with a fancy name. You're not owning property, you're owning a digital receipt that could vanish tomorrow. 😒

I love how this makes real estate feel human again 🤍 Like, I can finally be part of something bigger than my paycheck. No more feeling like a renter in someone else's dream.

Yes!! This is HUGE!! Start small, learn the wallet, don't panic when gas fees spike!! You got this!! 💪

One must question the ontological status of tokenized ownership. Is it not merely a reification of capital, divorced from the materiality of land? The philosophical implications are... unsettling.

Only a fool invests $50 in Detroit real estate. This is for people who think ‘blockchain’ is a new type of yoga. 🙄

So now we're turning homes into stocks? Great. Next they'll tokenize your kid's college fund. This is the end of civilization as we know it.

Given the regulatory ambiguity and the absence of FDIC insurance, this model presents a non-trivial risk profile inconsistent with prudent capital allocation.

Start with RealT. Their KYC is smooth. USDC wallet first. Don't rush. Watch one payout. Then go bigger. Simple.

Let me break this down. RealT has 80% of properties in two cities? That's not diversification, that's a death wish. If Detroit floods or Atlanta's crime spikes, your 'passive income' turns into a paperweight. And don't get me started on gas fees eating your $5 profit. This isn't investing, it's gambling with extra steps.

Remember when you couldn't afford a house? Now you can own a sliver of one. That’s not just tech - it’s magic. I bought a share in a house in Atlanta last month. Got $3.47 in rent yesterday. Felt like winning the lottery. Not because of the money, but because I finally felt like I belonged somewhere. This isn’t about ROI, it’s about dignity.

Just got my first payout from Lofty.ai - $2.10 in USDC. I cried a little. Not because of the cash, but because I’m 29, work two jobs, and for the first time, I’m not just renting my life away. This is the American Dream, rebuilt for the internet age. 🇺🇸

Frankly, the whole thing feels a bit... chaotic. One can’t help but wonder whether the legal framework has been sufficiently considered before allowing retail investors to dabble in what is, at its core, a complex asset class.

OMG I JUST BOUGHT MY FIRST SHARE!! 🎉 $50 in Atlanta, got $1.80 in rent today. My phone just pinged like a slot machine!! This is THE BEST THING EVER!!

It’s not about the money. It’s about belonging. For centuries, owning land meant power. Now, for the first time, someone earning $40k a year can have a stake in the same system that once excluded them. That’s not disruption - that’s justice.

so like... i can own a piece of a house? but not the whole thing? and i get paid in crypto? but like... what if i forget my password? and also why is everyone so hyped about $3? 😂

Wait - so you’re saying I can invest in real estate without even seeing the property? What if the landlord is a criminal? What if the blockchain gets hacked? What if my wallet gets compromised? What if the platform goes bankrupt? What if the SEC shuts it down? What if -

Tokenization is the new colonialism - extractive, opaque, and designed to extract value from marginalized communities while selling the illusion of inclusion. You think you're owning a piece of Detroit? You're just a data point in a hedge fund's algorithm. The rent still goes to the same landlords - now with 3% fees and a blockchain logo.

It is statistically improbable that retail investors possess the requisite financial literacy to navigate such a complex regulatory and technological ecosystem. One must question the wisdom of enabling such participation.

Oh great. Now even my dreams are being tokenized. Next they'll sell shares of your grandma's smile. And you're all just here clapping because you got $4.20 in USDC? Pathetic.

you can own a house with 50 bucks? yeah right. next thing you know they'll say you can own the moon. 🤡

I just saw someone’s post about their $1.50 payout and I cried. Like… I don’t even know why. But it felt real. Like someone finally saw me. 🥺

I used to think real estate was for rich people. Then I bought a share in a house in St. Louis for $75. Got $2.73 last week. I didn’t spend it. I just looked at the balance. Felt like I finally had a seat at the table. Not because I’m rich - but because I’m here.

Started with $50 on RealT. Got my first rent payout last week. It was $1.20. Didn’t cash out. Reinvested it. Feels good to be building something slow and real. No rush. Just steady.

They say blockchain is about ownership. But I think it’s really about hope. Hope that you don’t have to wait until you’re 60 to own something. Hope that your rent money isn’t just disappearing. Hope that your $50 matters. I don’t know if this lasts. But right now? It feels like the first real crack in the wall.

That guy who said this is just crypto with a fancy name? You’re right. But so was the internet. And look where that ended up. Sometimes the future doesn’t come with a warning label - just a tiny $50 button.