Why mining pool fees aren’t just a number

You plug in your ASIC, connect to a mining pool, and see a fee listed as 2%. It seems small. But that 2% isn’t just a charge-it’s your slice of profit, cut before you even see it. And not all pools charge the same way. Some charge 0% on one payment method, 4% on another. Some hide fees in transaction handling. Others charge extra for dashboards or faster payouts. If you’re mining Bitcoin, your pool’s fee structure can mean the difference between breaking even and making a steady income.

How mining pool fees actually work

Miners don’t find blocks alone anymore. Too many people are mining, and the difficulty is too high. So you join a pool-a group of miners working together. When the group finds a block, the reward gets split based on how much hash power each miner contributed. The pool takes a cut. That’s the fee.

But here’s what most beginners miss: the fee isn’t always a flat percentage. It depends on how the pool pays you. There are three main methods:

- PPLNS (Pay Per Last N Shares): You get paid based on shares submitted in the last N shares before a block is found. No guarantees. If the pool has bad luck, you get nothing for days. But if they hit a block, you get a big payout. Fees are usually low-sometimes 0%.

- PPS (Pay Per Share): You get paid immediately for every valid share you submit, regardless of whether the pool finds a block. It’s stable, but the pool takes more risk, so they charge more-often 3-4%.

- FPPS (Full Pay Per Share): This is the sweet spot for most miners. You get paid for your shares plus a share of the transaction fees from the block. Fees are typically 2-2.5%. Most top pools use this.

Don’t just look at the fee percentage. Look at how the fee is applied. A 1.5% FPPS fee can be better than a 0% PPLNS fee if your pool goes weeks without a block.

The top 5 pools in 2025 and what they charge

As of mid-2025, these five pools control over 80% of Bitcoin’s hashrate. Here’s what they charge, and why it matters.

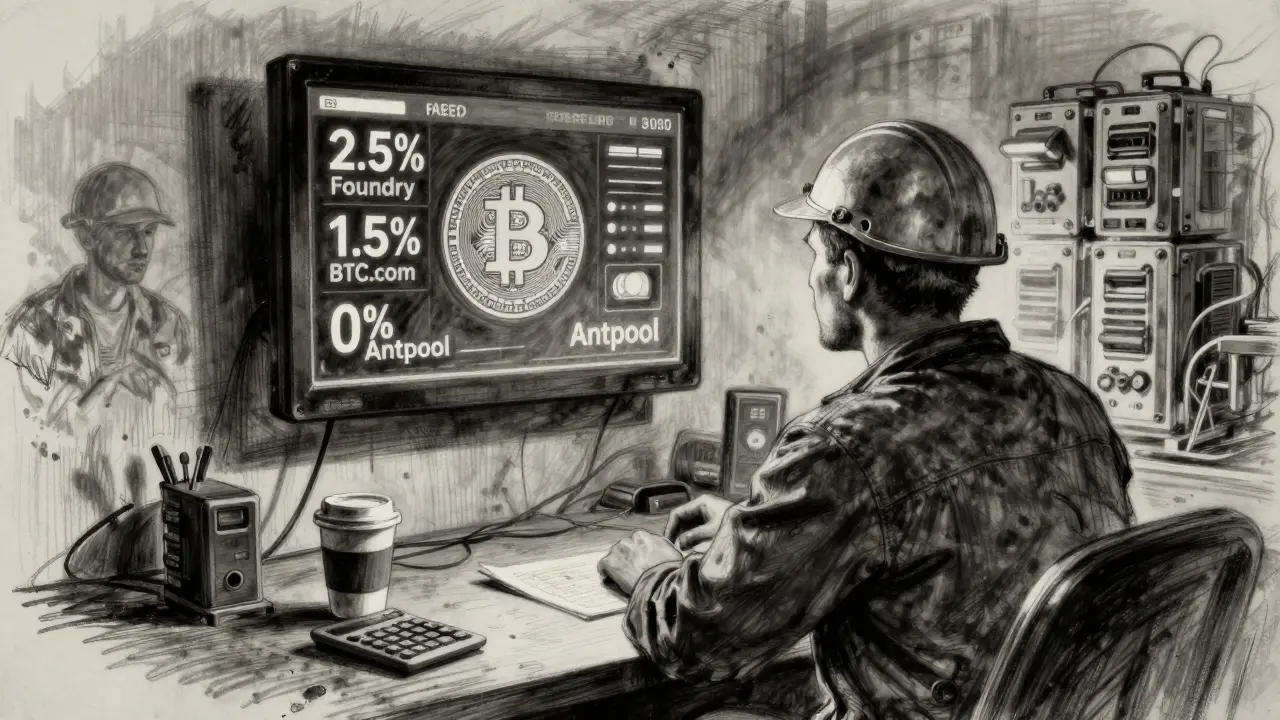

Foundry USA - 2.5% FPPS fee Foundry USA is the largest pool, with over 26% of the network’s hash rate. Their fee is higher than most, but they make up for it with reliability and transparency. They break down exactly how much goes to infrastructure, transaction fees, and profit. No surprises. Miners who care about steady income and clear reporting prefer them. They also offer tiered fees-miners contributing over 1 EH/s get a 0.5% discount. If you’re serious, this is the pool most institutional miners use.

Antpool - 0% for PPLNS, 4% for PPS+

Antpool gives you a choice: go low-risk with 4% PPS+, or high-risk with 0% PPLNS. This is a gamble. If you’re mining with a small rig and can’t afford to wait weeks for a payout, 4% is steep. But if you’re running a large farm and can handle volatility, 0% is tempting. The problem? Antpool’s PPS+ payouts are inconsistent. Transaction fees swing wildly, so your “4%” might feel like 5% or 6% in practice. Many miners switch to Foundry or Poolin after a few months.

Poolin - 2% standard, 2.5% for premium features Poolin is popular for its clean interface and low base fee. They’ve kept their standard FPPS fee at 2% since late 2024. But they’ve started charging extra for advanced tools-like real-time hashrate graphs or automated payout alerts. If you just want to mine and get paid, stick with the base 2%. Don’t upgrade unless you’re actively optimizing. Their minimum payout is 0.001 BTC, and they pay daily. For most home miners, this is the best balance of cost and convenience.

BTC.com - 1.5% FPPS BTC.com offers the lowest base fee among the top pools. They include transaction fees in every payout, and their fee structure is simple: 1.5%, no tricks. They also comply with U.S. regulatory standards, which means they show real-time fee breakdowns. This transparency helped them gain 12% more users in Q1 2025. If you hate hidden fees and want a straightforward setup, BTC.com is a top pick.

F2Pool - 2.5% FPPS F2Pool charges the same 2.5% as Foundry USA, but their minimum payout is 0.005 BTC-five times higher than most. That means if you’re mining with a small rig, you might wait days or even weeks to get paid. On the plus side, they support over 40 cryptocurrencies, so if you mine Ethereum or Litecoin too, this is the only pool you’ll need. But for Bitcoin-only miners, the higher payout threshold and same fee as cheaper pools make it less attractive.

What no one tells you about fees

Here’s the dirty secret: the fee percentage is rarely the biggest cost.

Electricity is. If your power bill is $0.12 per kWh and you’re mining with an Antminer S21, your daily cost is about $12. A 2% fee on a $50 daily reward? That’s $1. That’s less than your phone charger. But if you’re on $0.20/kWh power? Suddenly, every 1% fee matters more.

Also, watch out for hidden fees:

- Minimum withdrawal thresholds: If a pool requires 0.005 BTC to withdraw, and you only earn 0.002 BTC per day, you’re stuck. Your coins are locked. Foundry USA, BTC.com, and Poolin all allow 0.001 BTC-smaller rigs can cash out weekly.

- Payout frequency: Daily payouts are standard. But some pools (like Slush Pool) pay every time you hit a balance threshold-even if it’s mid-day. That’s useful if you’re reinvesting in more hardware.

- Transaction fee allocation: Some pools (like Antpool’s PPS+) don’t include transaction fees in payouts unless you pay extra. Others (like BTC.com) automatically include them. That’s worth 0.5-1.5% extra income over time.

How to pick the right pool for your setup

There’s no “best” pool. Only the best for you.

Ask yourself:

- How much hash power do you have? Under 100 TH/s? Go for low minimum payout and daily payments-Poolin or BTC.com. Over 1 EH/s? Foundry USA’s tiered fee saves you money.

- Can you handle volatility? If you need steady income to pay bills, avoid 0% PPLNS. Stick with FPPS. PPLNS is for speculators.

- Do you care about transparency? Foundry USA and BTC.com show exactly where your fee goes. Antpool and F2Pool don’t. If you’re uncomfortable with “black box” math, pick the transparent ones.

- Are you mining other coins? F2Pool is your only real option if you mine Ethereum, Litecoin, or Zcash alongside Bitcoin.

Most home miners should start with Poolin or BTC.com. Both have low fees, low payout thresholds, and daily payouts. If you’re scaling up, switch to Foundry USA. If you’re a gambler with a big farm, try Antpool’s 0% PPLNS-but track your earnings for 30 days first.

What’s changing in 2025

Pool fees aren’t static. They’re evolving.

In April 2025, Poolin started lowering fees to 1.5% during high-transaction-fee periods. Foundry USA introduced tiered pricing for large miners. Slush Pool now offers a 0.2% discount if you use renewable energy-something more pools are likely to copy.

Regulators are watching. The SEC’s 2024 guidelines forced pools like BTC.com to add real-time fee calculators. Expect more disclosure requirements by late 2025. Pools that hide fees or use complex structures will lose miners.

Also, decentralization is back in fashion. Ocean Pool, backed by Jack Dorsey’s Block Inc., charges variable fees based on community votes. It’s small now-only 0.39% of the network-but if it grows, it could force bigger pools to lower fees to compete.

Final tip: Track your actual earnings

Don’t trust the pool’s website. Use tools like WhatToMine or MinerStat to track your real net income. Plug in your hashrate, power cost, and pool fee. Run the numbers weekly.

One miner in Texas switched from Antpool (4% PPS+) to BTC.com (1.5% FPPS) and saw his monthly income jump from $312 to $387-even though his hardware didn’t change. That’s a 24% increase from one simple switch.

Miners who check their numbers every week make more. Miners who pick a pool and forget it? They lose.

What to do next

Step 1: Calculate your daily electricity cost. Use your utility bill. If you don’t know, Google “Bitcoin mining power calculator.”

Step 2: Pick 2 pools from the list above that match your setup.

Step 3: Run a 7-day test on each. Don’t mine full power-just 20%. Track your payouts. See which one pays more after fees.

Step 4: Switch to the winner. Don’t wait for “perfect.” Just pick better.

Are 0% mining pool fees really free?

No. A 0% fee usually means you’re on a PPLNS payment system, where you only get paid when the pool finds a block. That can mean days or weeks without income. The pool isn’t charging you directly, but you’re paying in unpredictability. If you need steady cash flow, 0% isn’t free-it’s risky.

Which mining pool has the lowest fee in 2025?

BTC.com has the lowest standard fee at 1.5% FPPS. Poolin also offers 2% for basic mining, and Antpool offers 0% under PPLNS-but only if you can handle long payout gaps. For consistent, transparent, and low fees, BTC.com is the best choice for most miners.

Do mining pool fees change over time?

Yes. In 2025, several pools introduced dynamic fees. Poolin lowers its fee to 1.5% when Bitcoin transaction fees spike. Foundry USA gives discounts to miners with over 1 EH/s. Some pools now charge extra for analytics dashboards or priority support. Always check your pool’s official blog for updates.

Should I switch pools if my current one has a 2.5% fee?

Not necessarily. A 2.5% fee is standard for FPPS, and pools like Foundry USA offer reliability, daily payouts, and transparency that make up for the higher rate. If your current pool pays you consistently, has a low minimum withdrawal, and doesn’t hide fees, staying is fine. Only switch if you find a pool with the same or better payout structure at a lower fee.

Can I mine without a pool?

You can, but you shouldn’t. The chance of an individual miner finding a Bitcoin block is less than 1 in 10 billion per day. Even with a top-tier ASIC, you might wait 10 years to earn one block. Pools make mining viable by combining hash power. Solo mining is only for academic experiments or massive industrial farms with hundreds of ASICs.

Also, their transparency dashboard? Chef's kiss.