When you hear "AML" in crypto, it’s not about buying low and selling high. It’s about stopping criminals from turning stolen money into clean Bitcoin. AML stands for Anti-Money Laundering-a set of rules designed to make sure digital currencies aren’t used to hide illegal cash. Think drug deals, hacking, corruption, or even terrorist funding. If someone steals $10 million in crypto, AML systems are meant to trace it, freeze it, and stop it from disappearing into the blockchain.

Why AML Matters in Crypto

Crypto was built to be private, borderless, and free from banks. That’s great for users-but also a gift for criminals. Unlike traditional banks, crypto doesn’t always require your name to send money. But that anonymity doesn’t mean chaos. Governments and regulators stepped in because the numbers started to add up. In 2022, Chainalysis found that $14 billion in cryptocurrency transactions were linked to illegal activity. That’s up from just $3.5 billion in 2018. And while that’s only 0.15% of all crypto transactions, the impact is huge. Criminals use crypto to move money fast, across countries, without paper trails. That’s why AML rules became non-negotiable for any crypto platform that wants to stay legal. The real goal? Protect the system. If crypto becomes a tool for crime, banks, governments, and regular users will reject it. AML isn’t about killing privacy-it’s about making sure privacy doesn’t become a shield for theft.How AML Works in Crypto

AML in crypto isn’t guesswork. It’s a system built on four key parts:- Know Your Customer (KYC): Before you can trade on most exchanges, you must prove who you are. That means uploading a passport or driver’s license and a recent utility bill. No ID? No trading.

- Transaction Monitoring: Every crypto transaction is tracked. If someone sends $5,000 to a wallet linked to a sanctioned country, the system flags it. Tools like Chainalysis and Elliptic scan blockchain data in real time, looking for patterns that match known criminal behavior.

- Enhanced Due Diligence (EDD): High-risk users-like those from countries with weak financial controls or those making huge, frequent trades-get extra scrutiny. Their activity is watched 24/7.

- The FATF Travel Rule: This is the big one. If you send more than $1,000 (USD equivalent) from one exchange to another, the sender’s and receiver’s names and account info must be shared. It’s like sending a wire transfer-except it’s on the blockchain.

Global Rules, Different Approaches

AML rules aren’t the same everywhere. Countries have their own flavors:- European Union: The 5AMLD (2020) and 6AMLD (2023) forced all exchanges to register, verify users, and report suspicious activity. The new MiCA regulation (coming full force in December 2024) makes AML part of the core legal framework for all crypto services.

- United States: FinCEN has treated crypto businesses as money transmitters since 2013. That means they must follow the same AML rules as banks. In 2023, FinCEN clarified that even some DeFi apps could be classified as money transmitters if they control user funds.

- Switzerland: Took a balanced approach. FINMA gave clear guidelines in 2019, classifying crypto assets by type and matching AML rules to risk level. It’s why many crypto firms set up shop there.

- China: Banned crypto exchanges entirely in 2017. No KYC, no AML-just no trading.

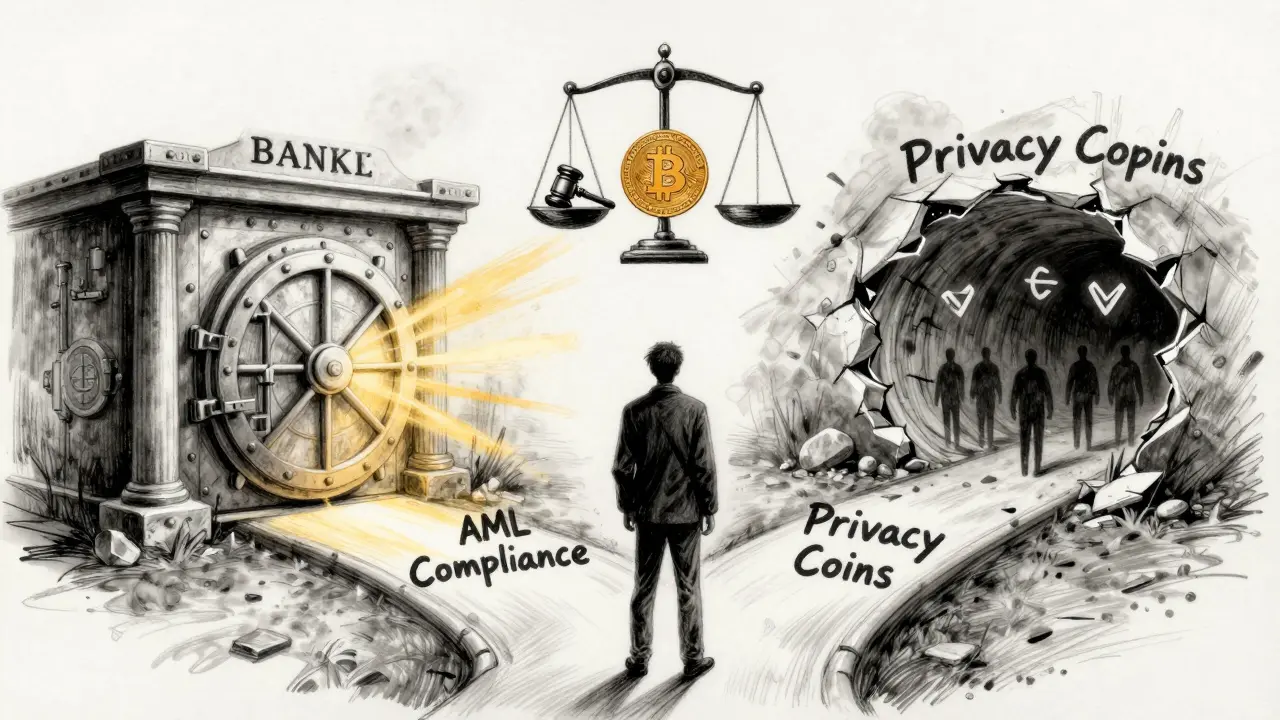

The Big Challenge: DeFi and Privacy Coins

Here’s where things get messy. AML works best when there’s a central company in charge-like Coinbase or Binance. But what about decentralized exchanges (DEXs) like Uniswap or PancakeSwap? No company. No ID checks. No way to freeze accounts. In 2022, criminals stole $1.9 billion from DeFi protocols. Most of it? Gone forever. Why? Because there’s no one to call. No customer service. No compliance team. That’s the biggest loophole in crypto AML today. Then there are privacy coins. Monero and Zcash are designed to hide transaction details. In 2022, Monero accounted for just 0.4% of all crypto volume-but 81% of all illicit crypto value. That’s because you can’t trace it. Mixers (tools that shuffle crypto between wallets to hide origins) are used in 1.1% of all transactions. Small percentage? Yes. But that’s still billions in hidden cash. Some experts say DeFi and privacy coins are the future. Others say they’re the Achilles’ heel of crypto adoption. Until there’s a way to enforce AML without killing decentralization, this tension won’t go away.What Happens If You Don’t Comply?

Failing AML isn’t just a fine. It’s a death sentence for a crypto business. In 2022, Bitcoin was used to evade sanctions on Iran. Around $150 million in crypto flowed through exchanges that didn’t check their users. The result? U.S. regulators shut down the platforms. Fines hit millions. Executives faced criminal charges. In India, authorities investigated crypto transactions linked to Hamas’s military wing in late 2023. In South Korea, criminals stole 400 million won (about $300,000), then moved it through 48 different wallets to hide it. All of it was caught because of AML monitoring. For crypto companies, the risks are clear:- Fines from regulators (up to millions)

- Loss of banking relationships (banks cut ties if you’re high-risk)

- Reputation damage (users leave if they think you’re unsafe)

- Criminal liability for executives

The Future: Privacy Without Posing Risk

The biggest question isn’t whether AML will stay. It’s how it will evolve. Right now, most AML tools are blunt. They block everything that looks suspicious-even if it’s just a normal user sending money to a friend in another country. That’s why 63% of crypto firms say false positives are a nightmare. Staff spend hours checking alerts that turn out to be harmless. The next wave? Privacy-preserving tech. Zero-knowledge proofs (ZKPs) are one solution. They let you prove you’re compliant-without showing your identity or transaction history. Projects like TRISA and OpenVASP are testing this now. Imagine sending $10,000 in crypto and proving you did KYC-without anyone seeing your name, wallet, or source of funds. That’s the future. The market for crypto AML tools is exploding. It hit $1.2 billion in 2023 and is expected to grow to $4.7 billion by 2028. That’s because regulators aren’t backing down. They’re doubling down.What You Need to Know

If you’re a regular user:- Expect to verify your ID on any major exchange.

- Don’t use mixers or privacy coins unless you understand the legal risks.

- Keep records of where your crypto came from. If you’re ever asked, you’ll need to prove it’s legal.

- Start with FATF guidelines. They’re the global standard.

- Use proven tools like Chainalysis or Elliptic for monitoring.

- Plan for 3-6 months to build a full AML system.

- Don’t ignore jurisdictional differences. What’s legal in Switzerland might be illegal in the U.S.

What does AML stand for in cryptocurrency?

AML stands for Anti-Money Laundering. In cryptocurrency, it refers to the rules and systems that prevent criminals from using digital assets to hide or clean money gained from illegal activities like theft, fraud, drug trafficking, or terrorism.

Is AML required for all crypto exchanges?

Yes, in most major jurisdictions. Exchanges and custodial wallet providers are classified as Virtual Asset Service Providers (VASPs) under FATF guidelines. They must comply with KYC, transaction monitoring, and the Travel Rule. Countries like the U.S., EU, and Switzerland enforce this legally. Some places, like China, banned exchanges entirely instead.

What is the FATF Travel Rule for crypto?

The FATF Travel Rule requires crypto exchanges to share the sender’s and receiver’s name, account number, and wallet address when transferring funds above $1,000 (USD equivalent). It’s designed to close the gap between traditional finance and crypto, making it harder to move large sums anonymously.

Do privacy coins like Monero break AML rules?

Yes, they make AML enforcement nearly impossible. Monero hides sender, receiver, and amount by design. In 2022, it accounted for just 0.4% of all crypto transactions but 81% of illicit crypto value. Many exchanges avoid listing privacy coins, and regulators are pushing to restrict them. Some countries already ban them outright.

Can DeFi platforms be AML-compliant?

It’s very hard. DeFi platforms have no central operator, so they can’t verify users or freeze accounts. While 43% now screen users at on-ramp points (like when buying crypto with fiat), enforcement stops there. Without intermediaries, AML tools can’t track transactions fully. This remains the biggest gap in crypto compliance today.

How much does AML compliance cost for a crypto business?

For most crypto businesses, AML compliance costs between 5% and 15% of total operational expenses. Startups often spend more because they need to build systems from scratch. Costs include software (like Chainalysis), legal advice, staff training, and ongoing monitoring. Smaller firms may pay $50,000-$200,000 upfront to get compliant.

What happens if I use a crypto mixer?

Using a mixer is a red flag for regulators and exchanges. Even if your crypto came from a legal source, mixing it makes it look suspicious. Many exchanges will freeze your account or report you to authorities if they detect mixer usage. In some countries, using a mixer can be considered a criminal act, especially if the funds are linked to illegal activity.