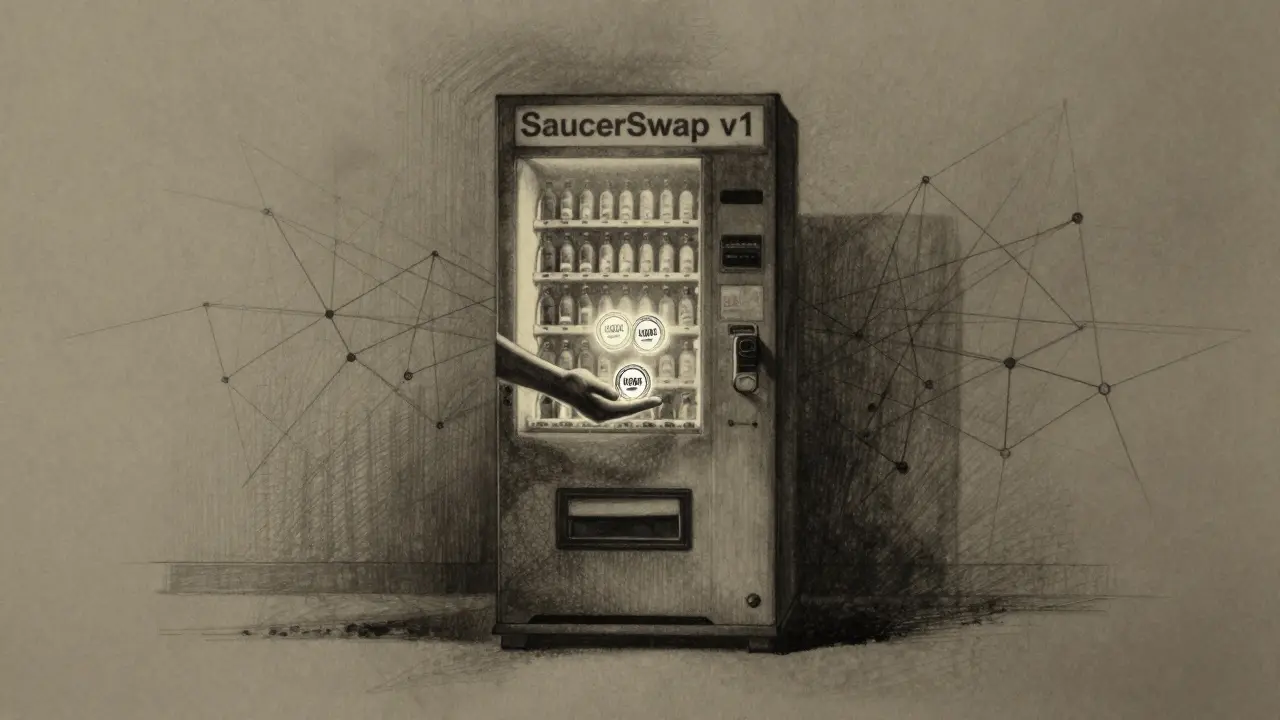

SaucerSwap v1 is a fast, low-cost decentralized exchange on Hedera Hashgraph, ideal for trading Hedera-native tokens with near-zero fees and zero MEV attacks. But its limited token list and outdated UI make it niche - not mainstream.

SaucerSwap v1: What It Was, Why It Mattered, and What Came After

When SaucerSwap v1, a decentralized exchange built on the BNB Chain that let users swap tokens without intermediaries, using automated market makers and liquidity pools. Also known as SaucerSwap, it was one of the earliest DEXs on BNB Chain to offer yield farming with real rewards, not just hype. Launched in early 2021, it wasn’t the biggest—but it was one of the most practical. While Uniswap dominated Ethereum and PancakeSwap stole the spotlight, SaucerSwap v1 carved out a quiet niche for traders who wanted low fees, fast swaps, and simple farming without complex governance tokens.

It didn’t need a flashy team or a whitepaper full of jargon. Users just needed a BNB Chain wallet, some BNB for gas, and a token they wanted to trade. The platform’s fee structure was straightforward: 0.25% per swap, with 0.17% going straight to liquidity providers. That made it attractive for small traders who were tired of paying 0.3% on other platforms. And unlike some DeFi projects that launched with empty pools, SaucerSwap v1 had real liquidity from day one, thanks to early incentives that rewarded users for adding BNB-BUSD, BNB-WBNB, and other core pairs.

What made SaucerSwap v1 stand out wasn’t just the tech—it was timing. It arrived right when BNB Chain was gaining traction, and users were looking for alternatives to Ethereum’s high fees. It didn’t try to be everything. No NFT marketplace. No staking vaults. No token launches. Just swaps, farms, and a clean interface. That simplicity attracted a loyal group of users who valued reliability over noise. But as DeFi got louder, SaucerSwap v1 didn’t evolve fast enough. New DEXs like Trader Joe and PancakeSwap v3 rolled out advanced features: concentrated liquidity, multi-chain support, and better analytics. SaucerSwap v1 stayed the same. By late 2022, most of its volume had drained to newer platforms.

The legacy of SaucerSwap v1 lives on in how it shaped expectations. It proved you didn’t need a massive team or a $100M VC backing to build something useful on BNB Chain. It showed that users would stick with a DEX if it just worked—no drama, no tokenomics games. Today, you won’t find many people actively using SaucerSwap v1. But if you dig into the early days of BNB Chain DeFi, you’ll see its fingerprints everywhere: in the fee structures, the farming models, the focus on liquidity incentives. The platform may be gone, but its blueprint isn’t.

Below, you’ll find posts that dig into similar DEXs, liquidity models, and the rise and fall of early DeFi projects. Some are still alive. Others are dead. All of them tell the same story: in crypto, the tools that solve real problems last longer than the ones that just chase trends.