Discover why no verified Moonpot (POTS) airdrop exists, how to spot scams, and a step‑by‑step safety checklist for crypto giveaways.

Moonpot POTS Airdrop: Everything You Need to Know

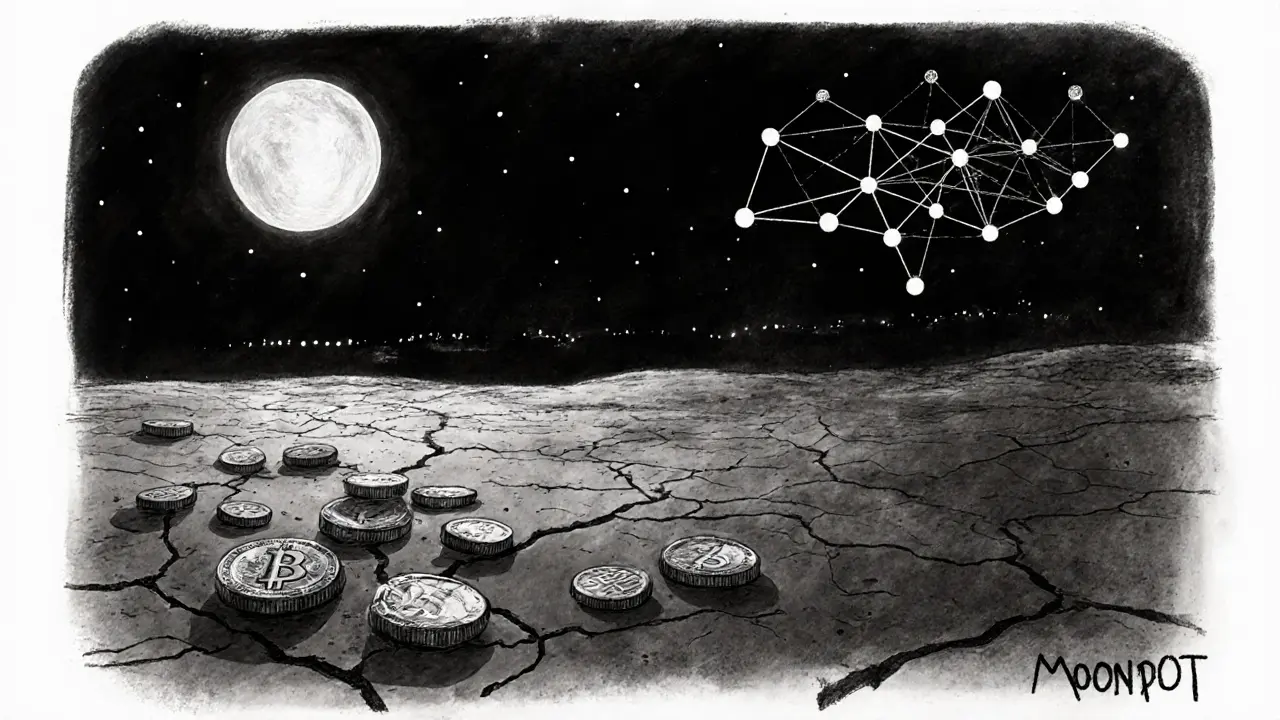

When exploring Moonpot POTS airdrop, a community‑driven token giveaway launched by the Moonpot platform. Also known as POTS distribution, it aims to reward early users and boost liquidity. The program is built on the Moonpot, a multi‑chain DeFi launchpad that hosts yield farms, token sales and community events. The native POTS token, an ERC‑20 utility coin used for governance and reward payouts is the actual asset you receive. Moonpot POTS airdrop therefore combines three core ideas: a free token allocation, a DeFi‑centric ecosystem, and a gamified participation model.

Why the Moonpot POTS Airdrop Matters

First, the airdrop serves as a liquidity catalyst. By handing out POTS tokens to a broad user base, Moonpot injects instant demand into its farms, which can lower price slippage and improve APY calculations. Second, eligibility requirements create a merit‑based filter. Users must have completed at least one stake on Moonpot, linked a wallet, and passed a basic KYC check. This eligibility‑driven approach weeds out bots and aligns rewards with genuine participants. Third, the distribution influences tokenomics. The airdrop supplies roughly 5 % of the total POTS supply, impacting circulating volume and, consequently, market perception. Finally, the event showcases best practices for airdrop safety: verifying official announcements, avoiding phishing links, and tracking claim status on Moonpot’s dashboard.

Understanding the mechanics helps you avoid common pitfalls. Many airdrop scams masquerade as official projects, promising “free tokens” in exchange for private keys or seed phrases. Moonpot’s official channels always require only a wallet address and a signature transaction—no secret data. The platform also publishes a transparent claim timeline, typically a 30‑day window, after which unclaimed tokens revert to the treasury. Keeping an eye on the deadline prevents missed rewards and reduces the chance of fraudulent copycats. Moreover, tax considerations matter; in most jurisdictions, airdropped tokens are treated as taxable income at fair market value on the day of receipt. Keeping a simple spreadsheet of claim dates and valuations can save headaches later.

Beyond safety, the airdrop opens doors to deeper DeFi participation. Holding POTS unlocks voting rights in Moonpot’s governance portal, letting you shape future farm parameters, fee structures, and new launchpad projects. It also grants access to exclusive yield farms that require POTS staking as a prerequisite. This creates a virtuous loop: the more you engage, the more POTS you earn, and the more influence you gain. For traders, the immediate market reaction can provide short‑term arbitrage opportunities—especially if the airdrop triggers a spike in trading volume on decentralized exchanges. Monitoring on‑chain analytics tools like SwapStats can reveal real‑time volume spikes, liquidity shifts, and price trends after the claim period ends.

If you’re ready to claim, the process is straightforward. First, connect a compatible wallet (MetaMask, Trust Wallet, or WalletConnect) to the Moonpot claim portal. Second, verify your eligibility by confirming you have at least one completed stake on the platform. Third, click the “Claim POTS” button, sign the transaction, and wait for confirmation. The transaction fee is typically a few dollars in gas, depending on network congestion. After the claim, the POTS tokens appear in your wallet instantly; you can then add the token contract address to see the balance. For those who miss the window, Moonpot often runs a secondary “retro‑claim” round, but it’s best to act fast.

In short, the Moonpot POTS airdrop is more than a free token drop—it’s a strategic tool that fuels liquidity, rewards genuine users, and expands the DeFi community. By understanding eligibility, claim steps, tokenomics, and safety practices, you can maximize the benefit while staying clear of scams. Below you’ll find a curated collection of articles that dive deeper into related topics such as crypto tax, airdrop scams, tokenomics of other projects, and how to evaluate DeFi rewards. Whether you’re a beginner curious about how airdrops work or an experienced trader looking for the next edge, the posts ahead will give you practical insights to navigate this space confidently.