CrescentSwap is a niche Arbitrum-based DEX focused on trading Moonlight MNLT and other native tokens. Low fees, no KYC, but thin liquidity and no support. Best for experienced DeFi users, not beginners.

Crypto Trading: Tools, Risks, and Strategies

When talking about crypto trading, the practice of buying, selling, or swapping digital assets on blockchain‑based platforms. Also known as digital asset trading, it blends market analysis, technology awareness, and risk management into a single activity. Crypto trading isn’t just about chasing price moves; it requires a clear view of the infrastructure that makes each trade possible, the incentives that can boost returns, and the threats that can wipe out positions in seconds.

Key Factors Shaping Crypto Trading

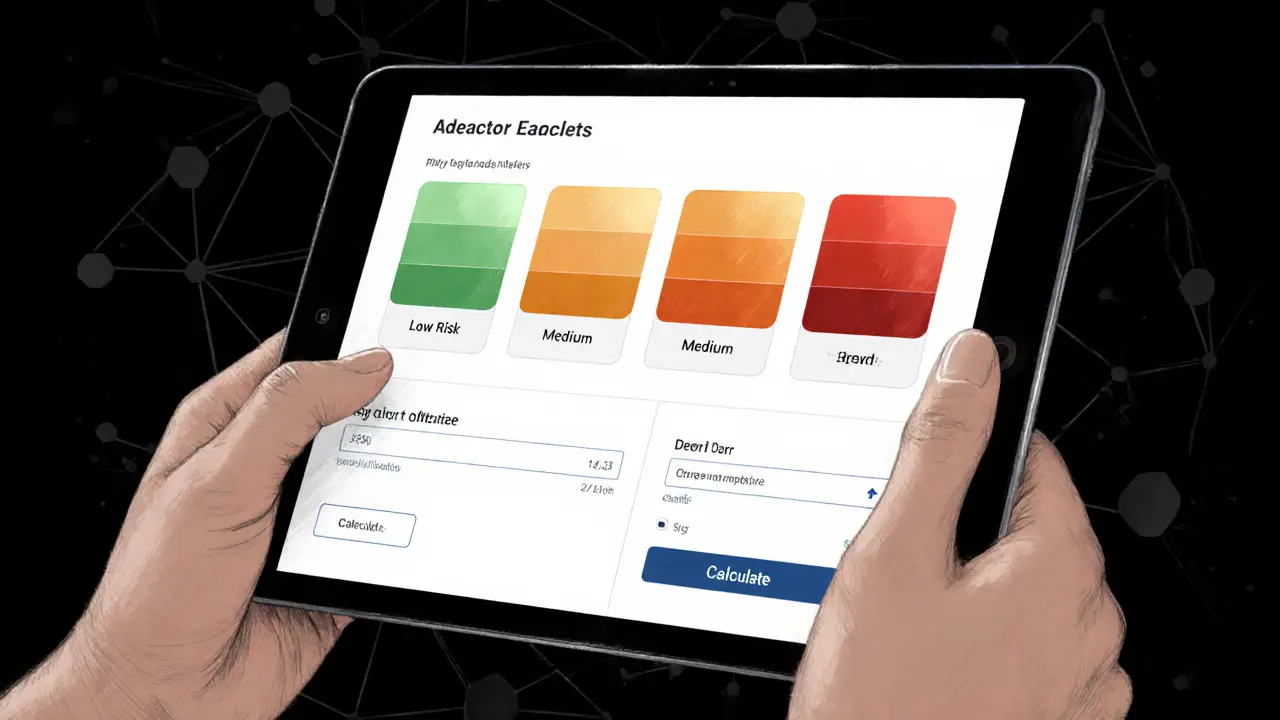

One of the biggest decisions any trader faces is choosing a crypto exchange, a platform where users deposit funds, access order books, and execute swaps. Exchanges differ on fees, security protocols, available assets, and user experience, so matching the right one to your strategy can mean higher net profits and lower exposure to hacks. Another hot topic for traders is the airdrop, a free distribution of tokens to eligible wallets, often used to reward early adopters or promote new projects. Understanding eligibility rules, claim timing, and market impact helps you turn airdrops into genuine upside rather than a fleeting curiosity. Both exchange selection and airdrop tracking are essential parts of the broader crypto trading ecosystem, creating a feedback loop where better tools lead to smarter moves and vice versa.

Underpinning all these activities are the smart contract, self‑executing code that runs on a blockchain to enforce the terms of a trade or token distribution. A single bug or vulnerability can trigger a massive loss, as past exploits have shown. That’s why traders need to stay aware of blockchain security, the set of practices and technologies designed to protect assets from hacking, fraud, and protocol failures. From audit reports to real‑time monitoring tools, security insight directly influences trade decisions, especially when dealing with high‑leverage products or newly launched tokens. Likewise, proof‑of‑stake incentives, privacy protocols, and regulatory shifts all feed into the risk matrix that every trader must evaluate. By tying together exchange choice, airdrop awareness, and smart contract safety, you build a resilient trading approach that adapts to the fast‑moving crypto landscape. Below you’ll find a curated collection of articles that dive deeper into each of these pillars, offering practical tips, data‑driven analysis, and real‑world examples to help you trade smarter.

A detailed KyberSwap Elastic (Polygon) review covering its concentrated liquidity model, fee tiers, the 2023 security breach, user experience, and how it stacks up against Uniswap V3 and SushiSwap.