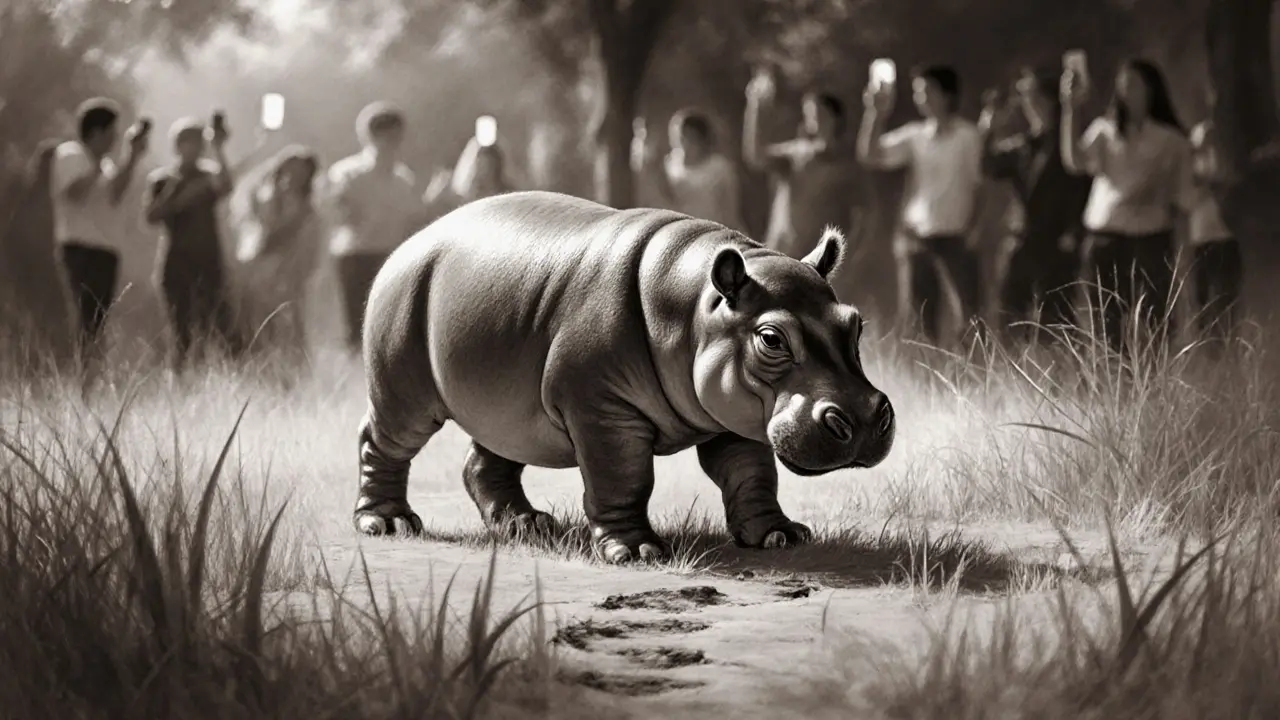

Baby Moo Deng (BABYDENG) is a meme coin on Solana named after a viral hippopotamus. It has no utility, no team, and no long-term value - just hype and extreme price swings. Buy only if you can afford to lose it.

Crypto Meme Tokens: What They Are, Why They Rise, and How They Crash

When you hear crypto meme tokens, digital assets born from internet jokes with no real utility but massive community-driven demand. Also known as memecoins, they’re not built to solve problems—they’re built to go viral. Unlike Bitcoin or Ethereum, they don’t need whitepapers or teams. They need memes, Reddit threads, and Twitter hype. And somehow, that’s enough to make some of them worth millions—even billions.

Take Dogecoin, the original memecoin that began as a parody of Bitcoin in 2013. Also known as DOGE, it had no roadmap, no limits on supply, and no serious developers—but it had a community that refused to let it die. Today, it’s still used for tipping, charity drives, and small payments because people believe in it more than any technical feature. Then came Samoyedcoin (SAMO), Solana’s first memecoin designed not to make money, but to teach new users how to navigate Web3. Also known as SAMO, it didn’t promise riches—it promised access. And that’s why it stuck. Meanwhile, tokens like Jager Hunter (JAGER), a BNB Chain token that pays holders every 10 minutes if they hold at least 146 billion tokens. Also known as JAGER, it turns holding into a game of numbers, not logic. These aren’t investments. They’re social experiments with wallets.

But here’s the catch: most memecoins die fast. HarryPotterTrumpSonic100Inu, a token with a name designed to crash any search engine. Also known as BTC meme coin, it has zero trading volume, no team, and no future—yet someone once paid for it. The same goes for BNU, FOTA, and Zenith Coin airdrops that vanished overnight. These aren’t bugs—they’re features of the system. Meme tokens thrive on attention, and when the attention fades, so does the price. There’s no hidden algorithm, no secret formula. It’s just people buying because they think someone else will buy next.

What you’ll find below isn’t a list of winners. It’s a graveyard of hype, a field of experiments, and a few rare cases where a joke became real. Some posts show you how to spot the scams. Others explain why a token with 146 billion supply still has buyers. And one? It’s a warning label in the shape of a Shiba Inu.