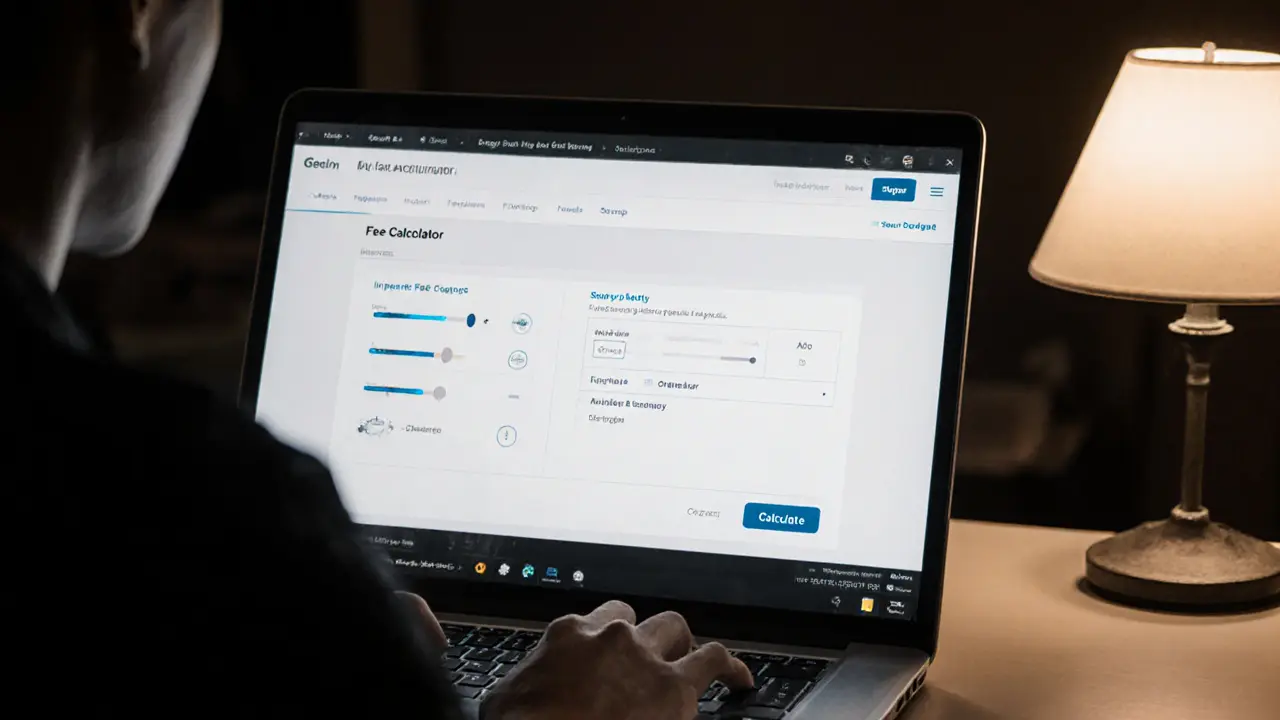

ADEN Crypto Exchange Fee Calculator

Estimate Your Trading Costs

ADEN offers zero maker fees and a tiny 0.0009% taker fee. Use this calculator to estimate your potential costs based on trade volume and frequency.

Estimated Monthly Trading Costs

ADEN's Fee Advantage: With zero maker fees and only 0.0009% taker fees, ADEN is among the cheapest decentralized exchanges. This calculator helps illustrate how much you could save compared to traditional exchanges with higher fees.

Fee Comparison Table

| Exchange | Maker Fee | Taker Fee | KYC Required | Gas Cost |

|---|---|---|---|---|

| ADEN | 0% | 0.0009% | No | Gasless |

| Kraken Pro | 0% (high-volume) | 0.02%-0.16% | Yes | Standard on-chain |

| Uniswap v4 | 0.3% (swap fee) | 0.3% | No | Ethereum gas |

When you hear about a new crypto exchange, the first questions are usually: Is it cheap enough? Is it safe? And can I actually trade what I want without a headache? ADEN crypto exchange tries to answer all three by delivering a decentralized platform focused on derivatives, zero maker fees and a gas‑free experience. Launched in July 2025 and registered in Seychelles, ADEN aims to be the go‑to place for traders who want perpetual futures without the KYC hoops of traditional venues.

Quick Take

- Zero maker fees and a tiny 0.0009% taker fee make ADEN one of the cheapest dDEXs.

- Offers USDT‑ and USDC‑margined perpetual futures on six major blockchains.

- Gasless trading removes on‑chain transaction costs, but you still need a compatible wallet.

- Liquidity is shared with ASTER via Orderly Network, giving decent depth but volume remains low.

- No KYC, no registration - great for privacy, less appealing to institutions.

What Is ADEN?

ADEN is a decentralized derivatives exchange that lets users trade perpetual futures backed by stablecoins. It launched on July 23, 2025 and operates on the Orderly Network infrastructure, sharing its orderbook with ASTER. The platform’s claim to fame is a gasless model and a CEX‑style UI while keeping settlement fully on‑chain.

Core Features and How They Work

ADEN’s design revolves around three pillars: multi‑chain access, stablecoin‑margined contracts, and ultra‑low fees.

- Multi‑chain support: Traders can pick from BNB Chain, Arbitrum, Optimism, Base, Ethereum and Solana. Each network provides its own liquidity pool, meaning you can chase the best price or lowest latency without leaving the platform.

- USDT‑ and USDC‑perpetual futures: Both stablecoins serve as collateral, letting you go long or short on a range of crypto assets with up to 10× leverage (depending on the market). Using stablecoins protects you from the volatility that typically accompanies margin funding.

- Zero maker, 0.0009% taker fee: ADEN advertises a 0% maker fee and a minuscule taker fee, undercutting most centralized exchanges (except for high‑volume tiers on Kraken Pro).

- Gasless trading: The platform batches transactions off‑chain and settles them in a single on‑chain commit, so users never pay gas directly. The cost is baked into the tiny taker fee.

- No KYC: Connect any WalletConnect-compatible wallet and start trading instantly.

Liquidity and Execution Speed

Liquidity on ADEN comes from its partnership with Orderly Network, which aggregates order flow from ASTER. This shared orderbook gives ADEN decent depth for popular pairs like BTC/USDT, but because the platform is only a few months old, total daily volume remains modest. On CoinMarketCap the listing shows as “Untracked”, meaning there isn’t enough public data yet to calculate reliable volume metrics. For traders who need massive order books, the platform may feel thin compared to Kraken’s $30B‑plus daily turnover.

Security and Trust Considerations

Being a decentralized exchange, ADEN never holds user funds in a custodial wallet. Your private keys stay in your own wallet, which eliminates the risk of a hack stealing exchange‑level balances. However, you inherit the responsibility of safeguarding those keys. The platform’s codebase is open‑source and has been audited by an unnamed firm, but no public audit report has been released as of October 2025.

In the broader market, incumbents like Kraken boast a ten‑year track record, AAA CER security rating and a perfect CoinGecko trust score. ADEN’s short history means it hasn’t survived a market crash yet, so risk‑averse users may be cautious.

Fee Comparison

| Exchange | Maker Fee | Taker Fee | KYC Required | Gas Cost |

|---|---|---|---|---|

| ADEN | 0% | 0.0009% | No | Gasless |

| Kraken Pro | 0% (high‑volume) | 0.02%‑0.16% | Yes | Standard on‑chain |

| Uniswap v4 | 0.3% (swap fee) | 0.3% | No | Ethereum gas |

Even with its ultra‑low taker rate, ADEN can’t beat Kraken’s zero‑maker tier for big whales, but for the average retail trader the fee gap is still noticeable.

User Experience: UI, On‑boarding & Support

The front‑end looks surprisingly familiar if you’ve used Binance or Coinbase Pro. You get candlestick charts, order book depth, and a classic order entry panel. Because everything is on‑chain, you’ll see a “Connect Wallet” button instead of a “Login” form. Once connected via WalletConnect, your wallet address becomes your account ID.

Support is community‑driven. ADEN runs an official Telegram channel and a Discord server where developers and traders share tips. There’s no ticket system, no live chat, and no email support - which is typical for decentralized projects.

Pros and Cons at a Glance

- Pros

- Zero maker fees, sub‑0.001% taker fee.

- Gasless trades keep costs predictable.

- Multi‑chain access broadens liquidity sources.

- Non‑custodial - you hold your own keys.

- No KYC, great for privacy‑focused traders.

- Cons

- Low overall volume; slippage can be high on less‑traded pairs.

- Limited public audit information.

- No fiat on‑ramps; you must already own stablecoins.

- Absence of institutional‑grade compliance.

- Support is community‑based only.

Who Is ADEN Best Suited For?

If you are a seasoned trader comfortable with managing private keys and you want to trade USDT‑ or USDC‑collateralized futures without paying gas, ADEN is worth a look. It’s less compelling for beginners who need guided onboarding or for institutions that must meet KYC/AML standards.

Future Outlook

Regulators are gradually tightening rules around decentralized derivatives, especially in the EU and the US. ADEN’s Seychelles registration gives it a legal foothold, but cross‑border compliance will be an ongoing battle. The platform’s reliance on Orderly Network suggests future feature upgrades - possibly adding more asset classes or even options contracts.

Liquidity is the biggest hurdle. If ADEN can attract a consistent trader base and market‑making bots, its fee advantage could become a real competitive edge. Until then, it sits behind the heavyweight exchanges that dominate daily volume.

Frequently Asked Questions

Do I need KYC to trade on ADEN?

No. ADEN works completely on‑chain, so you just connect a WalletConnect‑compatible wallet and start trading.

What stablecoins can I use as margin?

Both USDT and USDC are supported for all perpetual futures on the platform.

How does gasless trading work?

ADEN batches user orders off‑chain, then posts a single transaction that settles all matched trades. Users never pay the underlying network gas directly; the cost is covered by the tiny taker fee.

Is my funds safe on a decentralized exchange?

Since you retain control of your private keys, the exchange cannot seize your assets. However, you are fully responsible for key management and any smart‑contract bugs could affect the platform.

What networks can I trade on?

ADEN supports BNB Chain, Arbitrum, Optimism, Base, Ethereum and Solana, giving you flexibility to pick the chain with the best latency or gas price (though gas is abstracted away for you).

ADEN's fee structure is genuinely eye‑catching for anyone dabbling in decentralized finance. The zero‑maker fee alone can shave a noticeable chunk off your cost basis when you provide liquidity. Pair that with the minuscule 0.0009 % taker fee, and even high‑frequency traders start to see real savings. Because there's no KYC, you retain full privacy-a feature many power users crave. The gasless design means you sidestep the usual Ethereum gas spikes that eat up profits. If you compare this to Kraken Pro’s 0.02‑0.16 % taker rates, the difference compounds quickly over time. Likewise, Uniswap’s flat 0.3 % swap fee feels like a tax in contrast. The calculator on the site does a decent job illustrating these savings, though it could benefit from more granular volume sliders. Also, keep in mind that while ADEN advertises gasless trades, you’ll still need to cover transaction costs on the underlying blockchain for withdrawals. That said, the net fee impact remains lower than most centralized platforms. From a security standpoint, ADEN leverages smart‑contract audits, but as with any DeFi protocol, there’s an inherent smart‑contract risk. Users should diversify and not lock all funds into a single exchange. Community support appears active, with frequent updates posted on their GitHub repo. In short, if you value low fees, privacy, and are comfortable with the modest on‑chain risk, ADEN is worth a serious look. Just remember to stay on top of any future fee adjustments that the team might roll out.

In accordance with prevailing market microstructure theory, the negligible maker fee ostensibly incentivizes liquidity provision, thereby potentially augmenting the depth of the order book on ADEN. Nevertheless, the 0.0009 % taker fee, albeit minimal, must be contextualized within the broader cost framework, including implicit gas expenditures. The absence of KYC, while advantageous for anonymity, raises compliance considerations under prevailing regulatory regimes, particularly the FATF guidelines for virtual asset service providers. Moreover, the purported gasless execution is contingent upon Layer‑2 scaling solutions, the security assumptions of which warrant rigorous scrutiny. From an algorithmic trading perspective, the fee model may confer modest arbitrage opportunities, yet the latency introduced by off‑chain settlement layers could attenuate such gains. Consequently, a comprehensive total‑cost‑of‑ownership analysis is indispensable prior to allocating capital to ADEN.

Yo, if you’re looking to keep more of your hard‑earned crypto, ADEN’s fee schedule is a breath of fresh air 🚀. Zero maker fees mean you can actually profit from providing liquidity instead of just paying to trade. The tiny taker fee keeps your profit margins intact, especially when you’re flipping tokens daily. Think of it like a philosophical principle: less friction equals more flow, and your assets keep moving without being bogged down. 💡️ Don’t forget to double‑check the gasless claim, but even with a small gas overhead you’re still ahead of most legacy exchanges. Stay disciplined, track your trades, and let the savings compound over time. Keep grinding, the market rewards the diligent! 💪

Honestly, the hype around ADEN feels overblown; the fee numbers look good on paper but the real‑world execution is still untested. If you’re not careful, you’ll end up losing more to hidden costs than you save.

Hey folks, I think ADEN could be a solid addition to your trading toolbox, especially if you value low fees and privacy. Give it a try and see how the savings stack up over a month.

Wow, you dug deep into the compliance maze, and that’s impressive! 🎨 I’d add that the community vibe around ADEN feels like a vibrant mural-every user adds a splash of color. While the fee model shines, the real masterpiece is the user‑friendly UI that makes swapping feel as smooth as silk. If you layer that with the gasless promise, you’ve got a pretty picture of efficiency. Just keep an eye on the underlying protocol updates; they can add new shades to the palette.

Stop sugar‑coating it-if the devs slip up, you’ll be left holding a busted canvas. The aggressive road to market dominance can scorch the very colors you admired.

Hold up, the “gasless” claim is just marketing fluff. You’ll still pay for network fees somewhere.

While the fee advantages presented are compelling, a prudent investor must also consider the liquidity depth of ADEN’s order books. If the market lacks sufficient participants, slippage could erode the nominal fee savings. Moreover, the platform’s reliance on smart contracts introduces counter‑party risk that traditional exchanges mitigate through custodial safeguards. Therefore, integrating ADEN into a diversified trading strategy, rather than treating it as a solitary solution, is advisable. Continuous monitoring of protocol updates and fee revisions will ensure that your cost‑benefit analysis remains accurate over time.

Honestly, all that fancy talk doesn’t change the fact you’ll still get burned by hidden fees. Keep it real.

Anyone thinking about jumping on ADEN should remember that the low fees are only part of the puzzle. You need to assess the security model, the team’s track record, and the overall ecosystem health before committing capital.

Indeed; the confluence of fee structures, security audits, and community governance creates a multifaceted landscape; a trader must navigate with both rigor and humility; otherwise, the allure of low fees may become a siren’s call leading to unforeseen peril.

The reality is that many of these “audits” are superficial; they’re often just check‑boxes for investors, and the actual code could still harbor vulnerabilities.

Let’s keep the conversation constructive; while there are risks, the innovative fee model does present opportunities for cost‑savvy traders.

Oh sure, because “innovation” always means safety-what could possibly go wrong?

Honestly, this whole ADEN thing feels like the crypto world’s version of a blockbuster movie-lots of hype, flashy effects, but at the end, you’re left wondering if the plot actually makes sense.

While your cinematic metaphor is entertaining, it obscures the substantive analysis required; the platform’s fee architecture merits objective scrutiny independent of sensationalist narratives.

At the end of the day, we’re just trying to find a balance between cost efficiency and trust, and that balance is something each of us must discover on our own.

Sounds good! 👍