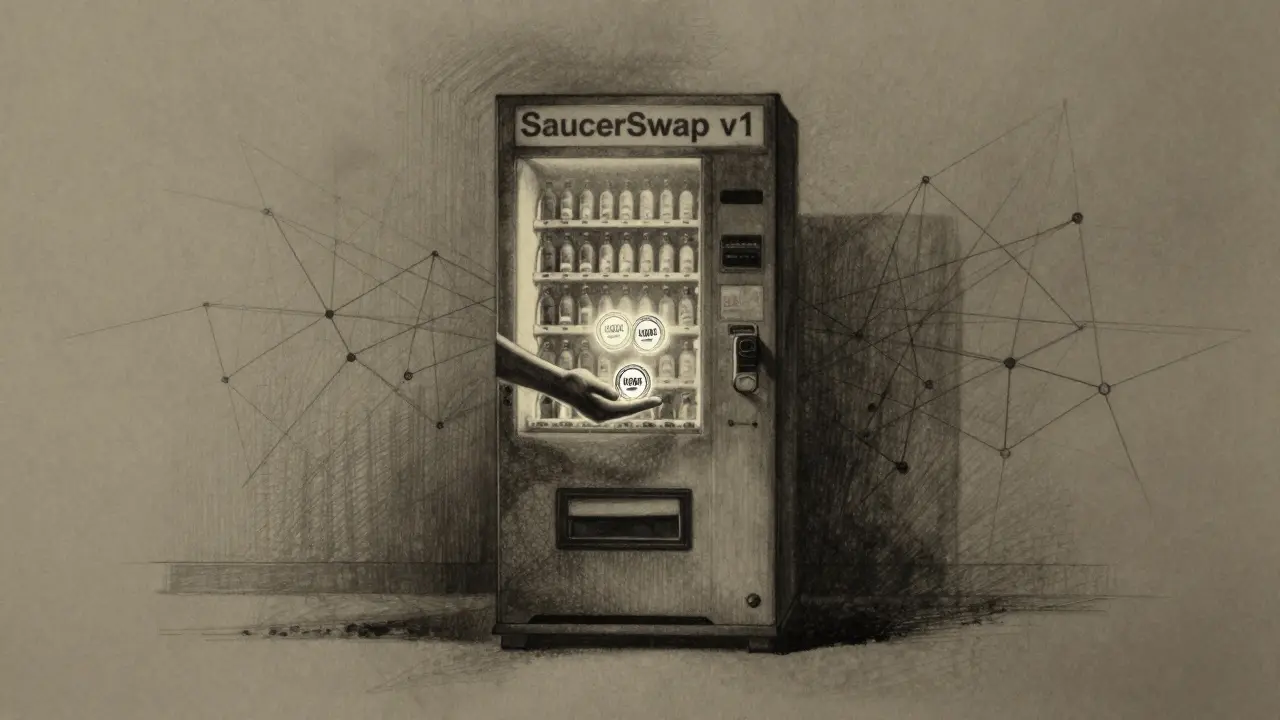

SaucerSwap v1 is a fast, low-cost decentralized exchange on Hedera Hashgraph, ideal for trading Hedera-native tokens with near-zero fees and zero MEV attacks. But its limited token list and outdated UI make it niche - not mainstream.

SaucerSwap Review: Is This PancakeSwap Alternative Worth Trying?

When you're looking for a SaucerSwap, a decentralized exchange built on the BNB Chain that lets users swap tokens without intermediaries. Also known as SaucerSwap Finance, it's one of the most active DEXs on Binance Smart Chain, offering low fees and built-in yield farming features. Unlike centralized platforms, SaucerSwap gives you full control over your funds—you connect your wallet, trade directly, and keep your keys. But it’s not just another clone of PancakeSwap. It has its own quirks, rewards, and risks.

SaucerSwap works by letting you trade tokens using liquidity pools, where users like you deposit pairs of crypto (like BNB and SAUCE) to earn trading fees. It also runs a unique reward system called SAUCE tokens, the native governance and reward token of SaucerSwap, distributed to liquidity providers and stakers. These aren’t just empty tokens—they’re used to vote on upgrades, claim bonuses, and even earn extra yield through staking. But here’s the catch: SAUCE rewards can be volatile, and many users chase high APYs without realizing how quickly token prices can drop. That’s why some call it a high-risk, high-reward playground rather than a safe long-term investment.

Compared to PancakeSwap, the dominant DEX on BNB Chain with deeper liquidity and more token options, SaucerSwap has thinner pools and fewer supported tokens. That means slippage can be higher on larger trades, and some newer coins might not even be listed. But SaucerSwap makes up for it with faster reward cycles and a simpler interface for new users. It’s also one of the few DEXs that automatically compounds your staking rewards—no manual claiming needed. If you’re active on BNB Chain and want to farm yield without jumping between platforms, this could save you time and gas.

But don’t assume it’s for everyone. If you’re new to DeFi, the lack of customer support, no KYC, and zero insurance on smart contracts can be scary. There’s no help desk if something goes wrong—just a community Discord and a GitHub repo. And while SaucerSwap has been around since 2021 and hasn’t been hacked, that doesn’t mean it’s immune to exploits. Always check the audit reports, verify contract addresses, and never invest more than you’re willing to lose.

Below, you’ll find real user experiences, breakdowns of its fee structure, comparisons with other BNB Chain DEXs like CrescentSwap and Thruster v2, and deep dives into how its reward system actually performs over time—not just the hype numbers you see on the dashboard. Whether you’re trying to earn passive income, test new tokens, or just want to know if SaucerSwap is worth your time, the posts here cut through the noise and show you what’s real.