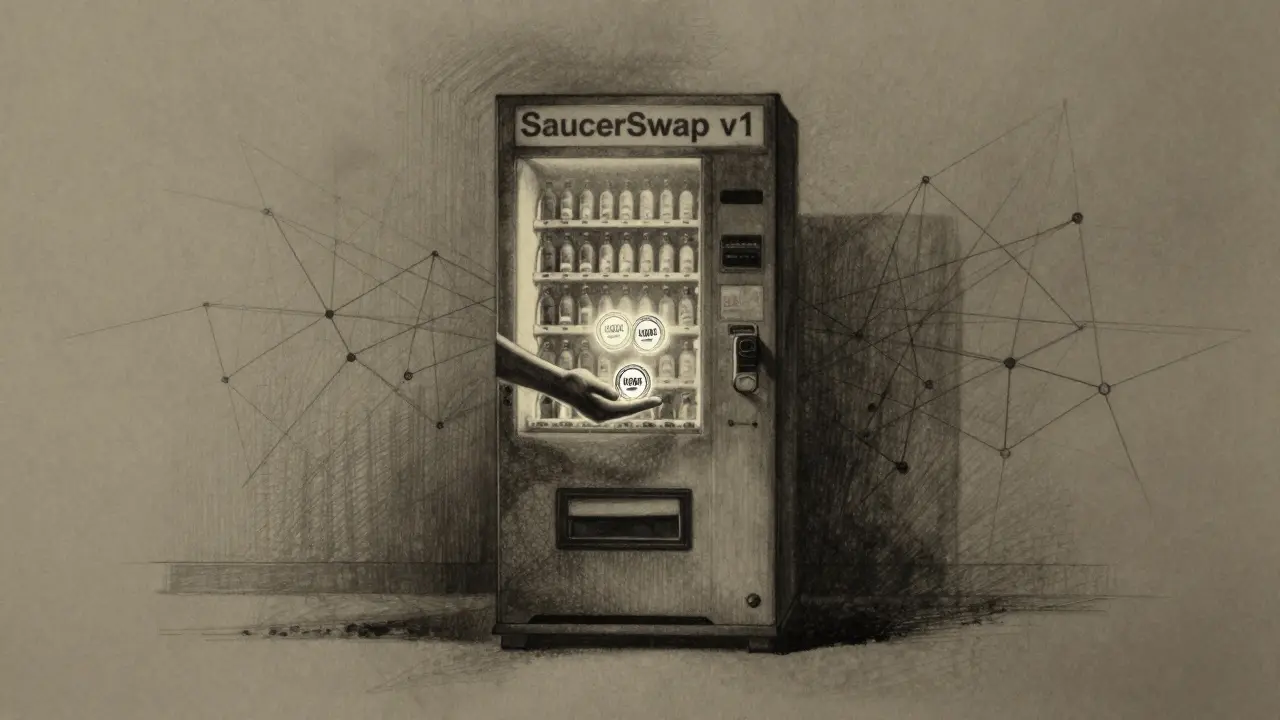

SaucerSwap v1 is a fast, low-cost decentralized exchange on Hedera Hashgraph, ideal for trading Hedera-native tokens with near-zero fees and zero MEV attacks. But its limited token list and outdated UI make it niche - not mainstream.

Hedera DEX: What It Is, How It Works, and What You Need to Know

When you hear Hedera DEX, a decentralized exchange built on the Hedera Hashgraph network. Also known as Hedera-based DEX, it lets users swap tokens without intermediaries—using a consensus system that’s faster and cheaper than traditional blockchains. Unlike Ethereum DEXes that struggle with high fees and slow confirmations, Hedera DEX runs on a network designed for speed: transactions settle in under three seconds, and fees are pennies. This isn’t theory—it’s what traders and developers use daily.

The core of Hedera DEX is the HBAR token, the native cryptocurrency of the Hedera network, used for paying transaction fees and securing the network through staking. HBAR isn’t just a currency—it’s the fuel that keeps the whole system running. You don’t need to be a crypto expert to use it: if you’ve swapped tokens on Uniswap or PancakeSwap, you already understand the basics. But Hedera adds something new: no front-running, no gas wars, and no stuck transactions. That’s why projects like Swirlds and DappRadar built their DEXes here instead of on congested chains.

What makes Hedera DEX stand out isn’t just speed—it’s the underlying tech: Hedera Hashgraph, a consensus algorithm that uses gossip protocol and virtual voting to achieve finality without mining. This isn’t Proof of Work or even Proof of Stake. It’s a different kind of blockchain entirely. That means no energy waste, no mining rigs, and no 10-minute wait times. For traders, this translates to reliable swaps even during market spikes. For developers, it means building apps that users won’t abandon because of lag or cost.

Real users aren’t just testing Hedera DEX—they’re using it. From token launches with zero gas fees to stablecoin swaps that cost less than a coffee, the network handles real volume. You’ll find DEXes like Mover, Swirlds, and Hedera Swap live right now, serving traders who care about speed and cost, not hype. And unlike meme coin chains where liquidity vanishes overnight, Hedera’s structure encourages long-term participation through staking and governance.

So if you’ve been frustrated by Ethereum fees, Solana outages, or BSC spam, Hedera DEX offers a quiet alternative: fast, cheap, and built to last. Below, you’ll find real reviews, breakdowns of top DEXes on Hedera, and deep dives into how HBAR powers it all—no fluff, no guesswork, just what works.