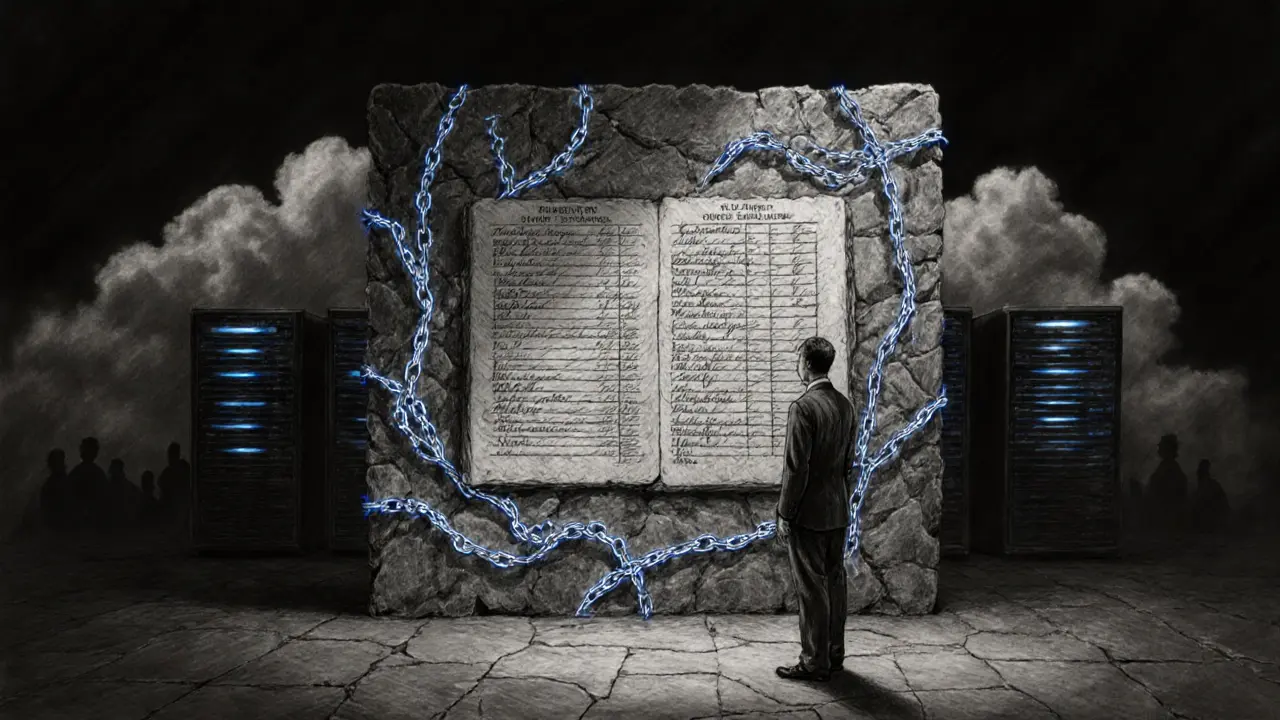

Blockchain-as-a-Service lets businesses use blockchain technology without managing the infrastructure. Learn how it works, who uses it, and why it's changing supply chains, finance, and logistics - without needing a crypto expert.

Blockchain Deployment: How Real Projects Launch and Why Most Fail

When you hear blockchain deployment, the process of launching a blockchain-based application or token on a live network. Also known as mainnet launch, it's not just about writing code—it's about getting people to use it, trust it, and keep using it. Most projects skip the hard parts: building real demand, securing liquidity, and surviving the first 30 days after launch. You see a new token, think it’s the next big thing, and jump in—only to find zero trading volume, no team, and a wallet full of worthless tokens. That’s not bad luck. That’s a failed blockchain deployment.

Real DeFi protocols, decentralized financial systems that run on blockchains without intermediaries. Also known as on-chain finance, it like Aave or Compound don’t just drop a token. They start with locked liquidity, clear incentives, and audits that actual traders check. Compare that to the crypto exchanges, platforms where users trade digital assets, often without proper oversight. Also known as DEXs or CEXs, it like Bitroom or Dexfin—no volume, no reviews, no transparency. They deploy a website, a whitepaper full of buzzwords, and hope someone buys in before the team vanishes. That’s not innovation. That’s a scam waiting for a ticker symbol.

And then there’s the smart contracts, self-executing code on blockchains that automate transactions and rules. Also known as on-chain logic, it—the backbone of every real project. A bad contract? Your tokens can be drained. A rushed deployment? The code gets hacked before the first user even connects their wallet. Look at the BNU airdrop or the LNR NFT giveaway. They looked official. They had CoinMarketCap listings. But no one could trade them. No one wanted them. Why? Because the deployment was built for hype, not utility.

Successful blockchain deployment doesn’t need a celebrity endorsement or a viral meme. It needs users who actually need the service. GPUnet didn’t promise moonshots—it gave people a way to rent GPU power for AI work. Samoyedcoin didn’t claim to be the future of finance—it taught beginners how to use Solana. These projects didn’t launch to make money. They launched to solve a tiny, real problem. And that’s why they lasted.

What you’ll find below aren’t just reviews. They’re autopsies. You’ll see how a token like USDZ backs its value with real loans, how Cardano’s Midnight airdrop actually worked, and why the HarryPotterTrumpSonic100Inu coin is a graveyard marker—not a investment. These aren’t guesses. They’re facts pulled from live data, trading volumes, and wallet activity. If you’re tired of chasing ghosts, this is where you start looking for real signals.