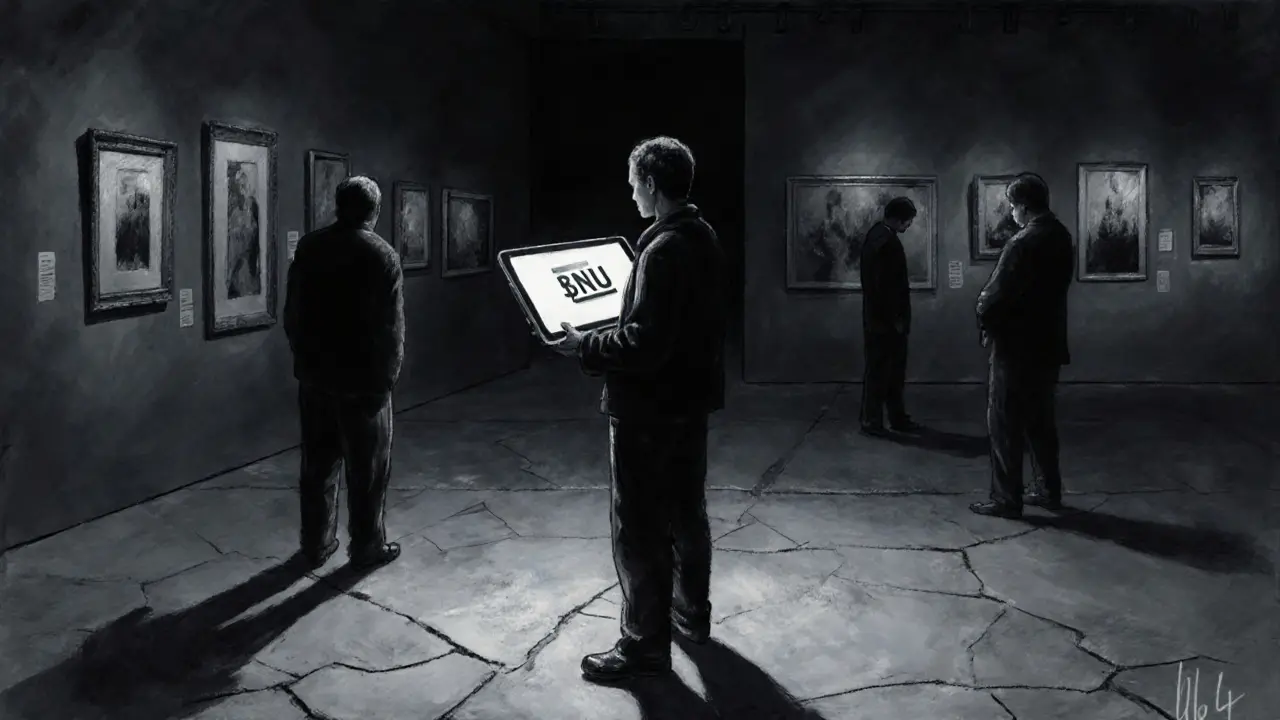

The ByteNext BNU airdrop gave 25 tokens to 1,000 participants in July 2025, but the token is now nearly worthless with zero trading volume. Learn what happened, why it failed, and what to do if you still hold BNU.

Binance Smart Chain: What It Is, How It Works, and What’s Really Happening on BSC

When you hear Binance Smart Chain, a blockchain built by Binance to run decentralized apps faster and cheaper than Ethereum. Also known as BSC, it’s one of the most used blockchains for DeFi, memecoins, and airdrops—but also one of the most crowded with scams. Unlike Ethereum, which prioritizes security over speed, BSC uses a Proof-of-Staked-Authority system that lets it process transactions in under 3 seconds and charge pennies in fees. That’s why so many projects launch there: it’s easy, fast, and cheap to deploy a token.

But that same speed and low cost makes it a magnet for fraud. Over half the tokens listed on BSC have zero trading volume, no team, and no real use. You’ll find BEP-20 tokens, the standard token format for Binance Smart Chain, used by everything from legitimate DeFi protocols to fake meme coins like HarryPotterTrumpSonic100Inu and Dynamic Trust Network—both dead, both scams. These aren’t bugs in the system; they’re features. BSC doesn’t vet projects. It just runs them. And that’s why users need to be extra careful. The same chain that powers real DeFi apps like PancakeSwap also hosts hundreds of tokens that vanish overnight.

Binance exchange, the world’s largest crypto platform, created BSC to keep users inside its ecosystem—and it works. Traders love the low fees, and developers love the quick launch. But BSC isn’t just about trading. It’s where airdrops happen, where new wallets get tested, and where most beginners first interact with DeFi. That’s why you’ll see so many posts here about crypto exchanges, platforms that connect to BSC to offer trading, staking, or airdrop claims like Bitay, Dexfin, and mSamex—some real, most not. And why you’ll find guides on how to spot fake airdrops, how to avoid rug pulls, and why a token with a $0 price and no volume is still being pushed on social media.

What you’ll find below isn’t a list of top BSC projects. It’s a cleanup crew’s report. Every post here digs into something that went wrong—or almost went wrong—on BSC. From airdrops that didn’t exist, to exchanges with zero transparency, to stablecoins that promise 16% APY but hide their real backing. This isn’t hype. It’s hard facts from people who’ve seen the same patterns repeat. If you’re using BSC, you need to know what’s real and what’s just noise. The chain doesn’t care if you lose money. But you should.