Crypto Exchange Trustworthiness Calculator

This calculator helps you evaluate crypto exchanges based on critical factors like trading volume, liquidity, transparency, and user trust. The higher your score (out of 100), the more trustworthy the exchange is.

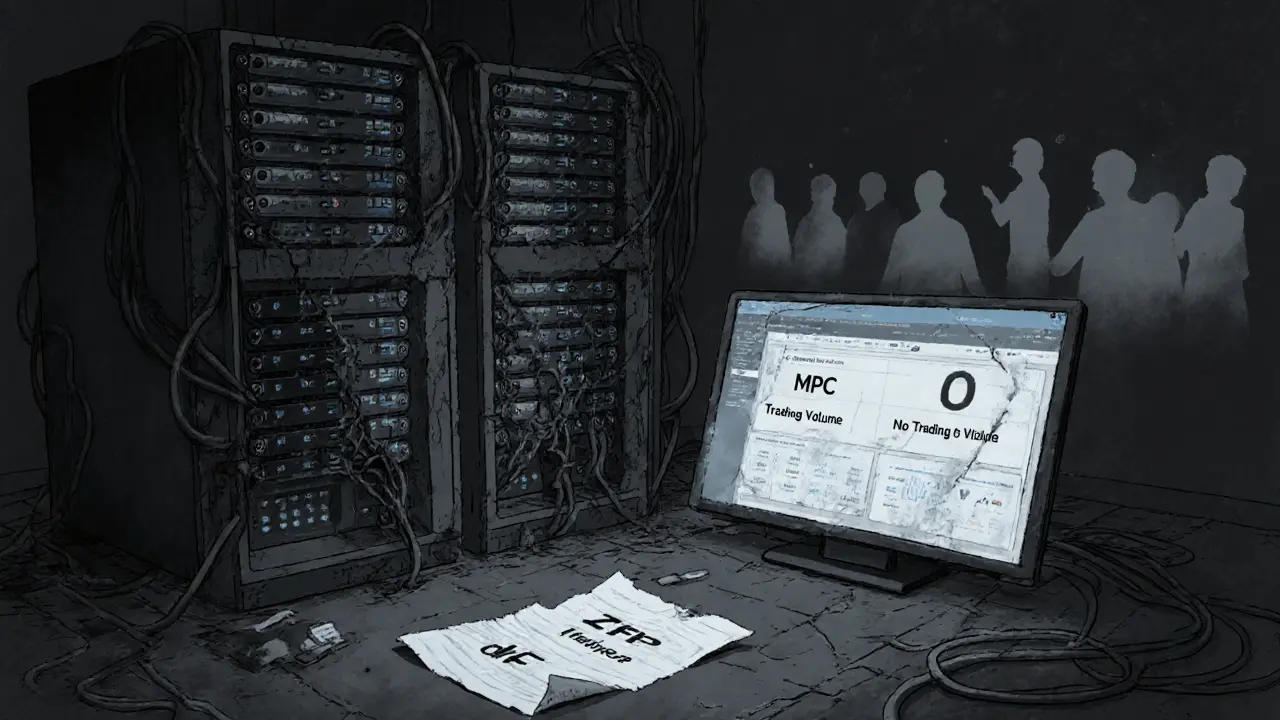

If you’re looking at Dexfin as a new crypto exchange to use in 2025, you’re probably wondering if it’s legit, safe, or even worth trying. The platform claims to be the best of both worlds: the security of a decentralized exchange (DEX) with the speed of a centralized one. It says it uses MPC (Multi-Party Computation) and ZKP (Zero-Knowledge Proofs) to make trading faster without giving up control of your funds. Sounds great, right? But here’s the problem - Dexfin doesn’t actually function like a real exchange yet.

What Dexfin Claims vs. What It Actually Offers

Dexfin’s website says it’s a “one-stop solution” for buying, storing, and managing digital assets. It promotes its native token, DXF, as a way to cut trading fees by 50% and vote on new coin listings. That sounds useful - until you dig deeper.

There’s no public trading volume. No liquidity data. No verified user base. CoinMarketCap lists Dexfin as “Untracked,” meaning it doesn’t report any real trading activity. That’s not a glitch - it’s a red flag. Real exchanges like Uniswap or PancakeSwap move billions daily. Dexfin? Nothing. Not even a trickle.

Compare that to dYdX, which handles over $1.2 billion in 24-hour volume, or Uniswap, which controls more than half of the AMM DEX market. Dexfin doesn’t appear in any of the top 10 DEX rankings from Koinly, WhalePortal, or DeFi Llama. Why? Because it’s not being used. If no one’s trading on it, the “speed and security” claims are just marketing.

No Technical Proof, No Transparency

Dexfin says it uses advanced cryptography like MPC and ZKP to secure user funds. That’s impressive - if it were true. But there’s zero public documentation. No whitepaper. No GitHub repo. No technical breakdown of how the system works. That’s not normal for any serious crypto project, especially one claiming to be decentralized.

Uniswap publishes its smart contract code. dYdX shares its StarkWare Layer 2 architecture. Even smaller DEXs like Osmosis or SushiSwap have open-source code you can audit. Dexfin? Silence. You’re being asked to trust a black box with your crypto. That’s the opposite of what decentralization stands for.

And the DXF token? It’s supposed to be the heart of the ecosystem. But CoinCodex says there’s “no price data available to produce a price prediction.” Why? Because there’s no trading history. No exchanges list it. No wallets show holdings. CoinDataFlow claims DXF could hit $0.076 by 2029 - but that’s based on zero real data. It’s a guess wrapped in a chart.

No Users, No Reviews, No Community

Real exchanges have users. Real projects have communities. Dexfin has neither.

Check Trustpilot. No reviews. Reddit? No threads. Twitter? No active followers. YouTube? Zero tutorial videos. Compare that to Uniswap, which has over 4,200 reviews on CoinGecko with a 4.2/5 rating. Or dYdX, which has more than 120 YouTube tutorials and 350,000 Twitter followers. People are talking about those platforms because they’re using them.

When you can’t find a single real user story, forum post, or video walkthrough, that’s not a quiet launch - it’s a ghost town. No one’s on it. No one’s testing it. No one’s complaining about bugs or praising features. That’s because there’s nothing to complain about - it’s not live.

How It Stacks Up Against Real Alternatives

Let’s say you want to trade crypto without handing over your keys. Here are your actual options in 2025:

- Uniswap: Best for general swaps. $4B+ TVL. Works with MetaMask. Zero KYC.

- PancakeSwap: Top on BNB Chain. Low fees. Great for new tokens.

- dYdX: Best for leveraged trading. Up to 20x. Institutional-grade order books.

- Curve: Best for stablecoins. Near-zero slippage.

- Apex Omni: New favorite for copy trading and grid bots. Fees as low as 0.02%.

All of these have real volume, active communities, documented features, and public audits. Dexfin? None of that. Even if you believe its tech claims (which you can’t verify), it offers nothing these others don’t - and worse, it doesn’t even deliver the basics.

Why Dexfin Isn’t the Future - It’s a Warning

The crypto market in 2025 is crowded. Over $18.7 billion is locked in DEXs. New platforms rise every month - but only the ones with real users, real liquidity, and real transparency survive.

Dexfin doesn’t just lag behind. It’s invisible in the data. It’s absent from analyst reports by Messari and Delphi Digital. It doesn’t show up in regulatory discussions, even though centralized exchanges like Bybit are getting squeezed by MiCA rules in Europe. That’s because Dexfin isn’t a threat - it’s not even on the radar.

And here’s the scariest part: if you buy DXF tokens now, you’re buying into vapor. No exchange lists it. No wallet supports it. No one’s trading it. If you can’t sell it tomorrow, it’s worthless. And if Dexfin shuts down? Your tokens vanish with it.

Bottom Line: Avoid Dexfin - Stick With Proven Platforms

Dexfin is not a crypto exchange you should use in 2025. It’s not a scam in the traditional sense - there’s no clear evidence of theft or fraud. But it’s also not a functioning product. It’s a website with buzzwords, empty promises, and zero proof.

If you want to trade crypto securely and reliably, go where the users are. Use Uniswap. Try dYdX. Explore PancakeSwap. These platforms have years of data, millions of users, and transparent tech. You can audit them. You can test them. You can trust them.

Dexfin? Save your time and your crypto. Don’t gamble on a platform that doesn’t exist yet - and may never exist.

Is Dexfin a real crypto exchange?

No, Dexfin is not a functioning crypto exchange. While it has a website and claims to offer trading, it has no verifiable trading volume, no liquidity, no user base, and is listed as “Untracked” on CoinMarketCap. There is no evidence it processes real trades or holds user funds.

Can I buy DXF tokens on major exchanges?

No, DXF tokens are not listed on any major exchange like Binance, Coinbase, or Kraken. They are not available on any decentralized exchange either. CoinCodex confirms there is no trading data available for DXF, meaning you cannot buy or sell it legitimately.

Does Dexfin have a wallet or app?

There is no official Dexfin wallet or mobile app. The platform claims to let you store assets, but there are no verified download links, no app store listings, and no public wallet addresses. Any app claiming to be Dexfin is likely fake or malicious.

Why does Dexfin claim to use MPC and ZKP?

MPC and ZKP are legitimate security technologies used by real platforms like Polygon and zkSync. Dexfin uses these terms to sound advanced, but it has published no technical documentation, code, or audits to prove it actually uses them. This is a common tactic used by projects with no real product to appear credible.

Should I invest in Dexfin’s DXF token?

No. Investing in DXF is extremely risky because there is no market for it. No exchanges list it. No wallets support it. Any price projections (like $0.076 by 2029) are pure speculation with zero data backing them. If Dexfin disappears, your tokens become worthless.

What are better alternatives to Dexfin?

For decentralized trading, use Uniswap, PancakeSwap, or dYdX. For low fees and advanced tools, try Apex Omni. For stablecoin swaps, Curve is the best. All of these have real volume, active communities, public code, and years of user data. They’re proven. Dexfin is not.

This is the most terrifying thing I’ve seen all year-like walking into a store that says ‘FREE MONEY’ but the lights are off, the doors are locked, and there’s a sign that says ‘We’re coming soon’… for three years.

DXF? There’s no wallet, no trades, no nothing. It’s not a scam-it’s a ghost story with a whitepaper.

I’m not even mad, I’m just… disappointed. Like someone spent six months building a Ferrari out of cardboard and then asked me to invest in the brand.

The absence of verifiable trading volume, public smart contract audits, or even a GitHub repository constitutes a fundamental breach of trust in the decentralized finance ecosystem.

Furthermore, the purported utilization of MPC and ZKP without any accompanying technical documentation is not merely misleading-it is a gross violation of the transparency principles upon which blockchain technology is predicated.

Investors must exercise extreme diligence and refrain from engaging with entities that exhibit zero empirical evidence of operational functionality.

Dexfin doesn’t just fail to deliver-it performs a symphony of red flags in perfect, dissonant harmony.

No liquidity? Check.

No whitepaper? Check.

No GitHub? Check.

No user reviews, no social traction, no wallet, no token listings-just a polished landing page with buzzwords like MPC and ZKP tossed in like confetti at a funeral.

It’s not a DeFi project. It’s a psychological experiment in gullibility, dressed in crypto-speak and sold as the future.

Meanwhile, Uniswap’s code is audited by 200 developers, dYdX’s contracts are open for inspection, and Curve’s stablecoin pools move billions daily.

Dexfin? It’s a PowerPoint deck with a domain name.

And if you’re buying DXF, you’re not investing-you’re donating to a fantasy.

Why do people keep falling for this? I swear, the crypto space is just one big emotional dumpster fire.

I lost $12k on a dog coin last year and I still didn’t trust a platform with zero volume.

This isn’t investing-it’s therapy for people who hate reality.

If you’re reading this and still thinking about buying DXF… I’m not judging you.

I’m just gonna go cry in the shower now.

The absence of verifiable data, public documentation, and community engagement renders any claims regarding Dexfin’s functionality speculative at best.

Given the established precedents of transparent, audited decentralized exchanges, the burden of proof remains unmet.

Prudent actors in this space ought to defer to platforms with demonstrable operational histories and verifiable technical infrastructure.

Okay, so imagine this: You’re at a party. Someone walks up to you, wearing a tuxedo made of glitter and duct tape, holding a golden toaster, and says, ‘This toaster can predict the future, and I’ve got a limited-time offer on toaster tokens-only $500, and if you buy now, you get a lifetime supply of toast.’

You look around. No one else is buying. No one’s eating toast. The kitchen is empty. The toaster doesn’t even plug in.

But you’re like, ‘Wait, what if… what if it’s real?’

That’s Dexfin.

It’s not even a Ponzi scheme-it’s performance art about capitalism’s last gasp.

And the DXF token? It’s not a currency. It’s a mood. A collective sigh.

They’re not building a platform.

They’re building a meme.

And we’re all just the punchline.

Okay but like… why does this keep happening? Like, I get it-people want to believe in the next big thing.

But you can’t just slap ‘MPC’ and ‘ZKP’ on a website and call it DeFi.

It’s like saying you invented a flying car because you drew one in MS Paint and named it ‘SkyWing X1’.

DXF doesn’t even have a blockchain address. That’s not ‘early stage’-that’s ‘not even started’.

And the fact that people are still buying into this? I’m just… emotionally exhausted.

It’s not even greed. It’s desperation.

And I’m tired of watching it happen over and over again.

also dxfs ‘price’ is ‘$0.0000000001’ on some sketchy site that looks like it was made in 2015 😭

just buy uni or pancake and go touch grass 🌿

I really hope people take this review seriously.

It’s heartbreaking to see how easily we’re drawn to shiny promises, especially when we’re hungry for innovation.

But real progress? It’s quiet.

It’s audited code. It’s community calls. It’s GitHub commits at 3 a.m. It’s users actually trading.

Dexfin isn’t just behind-it’s not even on the track.

Let’s not punish the crypto space by funding vaporware.

Let’s support what’s real.

And if you’re building something? Show us the code. Let us see the wallets. Let us feel the liquidity.

That’s how trust is built-not with buzzwords.

With transparency.

Thank you for this incredibly thorough breakdown.

It’s rare to see someone so clearly articulate the difference between marketing and substance in crypto.

Dexfin’s silence speaks volumes: no code, no volume, no community.

Real innovation doesn’t hide behind vague claims-it invites scrutiny.

Uniswap, dYdX, Curve-they all welcome audits, GitHub issues, and public feedback.

Dexfin? It’s a haunted house with a ‘For Sale’ sign.

Don’t buy the house.

Just walk away.

And if you’ve already invested? You’re not alone.

But you’re not stuck.

You can still exit.

And you should.

With love and care,

Kyung-Ran 💙

also dxfs ‘website’ looks like it was made in canva by someone’s cousin 😅

stay safe out there babes 💕

There’s a philosophical question here, buried under all the red flags.

What does it mean to ‘exist’ in a decentralized world?

If a platform has no users, no trades, no code, no audits-but a website and a token name-does it exist?

Or is it merely a potentiality?

A shadow of a thing, waiting for someone to believe it real?

And if belief is the only currency it accepts… then what are we really trading?

Not crypto.

But hope.

And hope, when unanchored to reality, is the most dangerous asset of all.

Let me ask you this: Who owns the domain for Dexfin? Who registered it? Who controls the backend?

What if this is a honeypot? What if the MPC system is just a front for harvesting private keys?

What if ZKP is just a distraction while they drain wallets through a backdoor in the UI?

They don’t need to steal your crypto directly.

They just need you to think it’s real.

And then… you give it to them willingly.

That’s not a scam.

That’s psychological warfare.

And they’re winning.

Zero liquidity ≠ innovation.

Zero audits ≠ security.

Zero community engagement ≠ disruption.

Dexfin is the epitome of ‘vaporware dressed in blockchain semantics.’

Real DeFi doesn’t need hype-it needs testnet activity, GitHub commits, and on-chain metrics.

Until Dexfin can show a single verified transaction, it’s not a platform.

It’s a cautionary tale in the making.

And if you’re still considering DXF… you’re not just risking capital.

You’re validating a lie.

Wait, I just checked-there’s a YouTube video titled ‘Dexfin Review 2025’ with 12 views… and 11 of them are from the same IP.

One of them is a guy named ‘DexfinSupportBot’.

They’re not even trying anymore.

I feel bad for the intern who had to make that video.

Also, the thumbnail is a blurry image of a rocket… with a cat sitting on it.

That’s the future of crypto now.

Good luck, everyone.