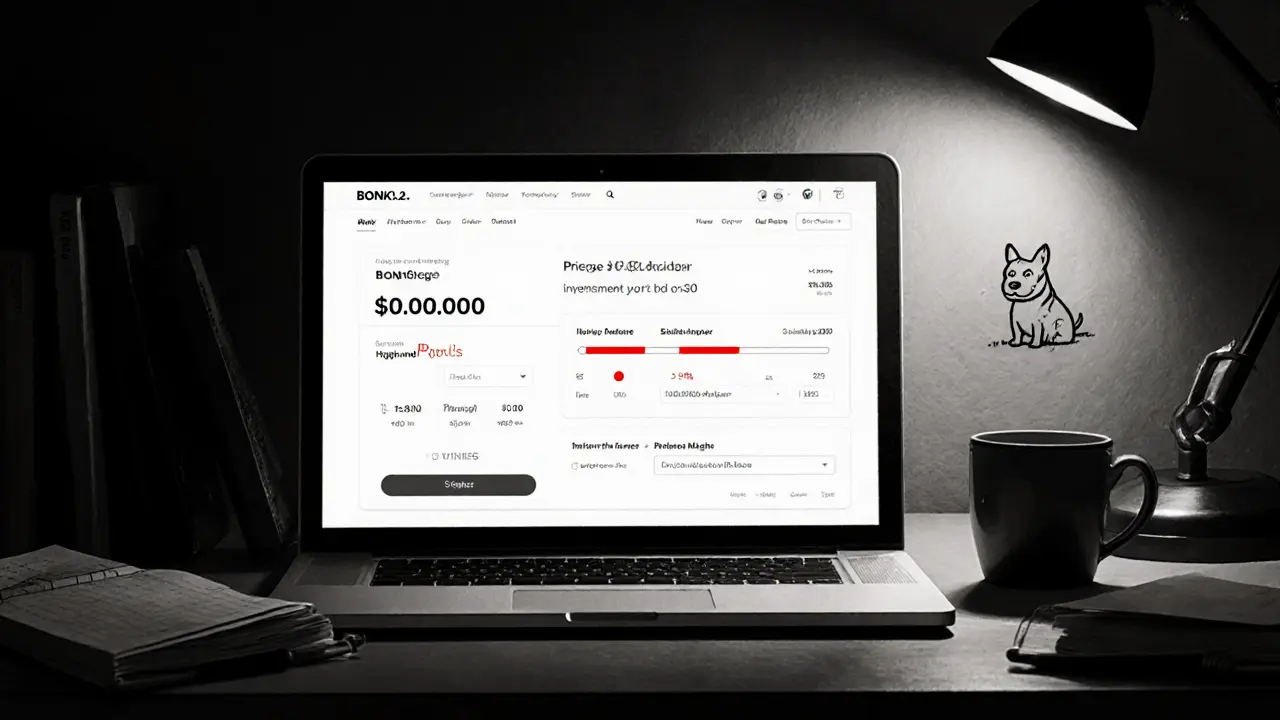

Bonk 2.0 (BONK2.0) Price & Risk Calculator

Current Market Data

Current Price: $0.0000000025687

Market Cap Rank: #7,759

24h Trading Volume: Near Zero

Risk Assessment

Volatility Level: Extremely High

Liquidity: Very Low

Speculative Nature: High

Investment Calculator

Risk Factors Summary

- High Volatility: Price can fluctuate dramatically with minimal trades

- Low Liquidity: Thin order books lead to significant slippage

- No Fundamentals: No verified development team or use case

- Manipulation Risk: Susceptible to pump-and-dump schemes

- Regulatory Risk: Potential for regulatory scrutiny

Quick Facts

- Bonk 2.0 (BONK2.0) is a low‑market‑cap crypto token with a price around $0.0000000026 (Sept2025).

- It ranks about #7,759 in market‑cap rankings and trades with near‑zero volume.

- Price forecasts vary wildly - from sub‑nano‑cent levels to a optimistic $0.00033 in 2025.

- Liquidity is extremely thin; even a small trade can swing the price dramatically.

- Buyable on a handful of niche DEXs; you’ll need a compatible wallet and beware of slippage.

Bonk 2.0 is a cryptocurrency token that appears to be a separate iteration of the original BONK meme‑coin, but with very limited publicly available information about its developers, roadmap, or native blockchain. While the original BONK launched on Solana in 2022, BONK2.0’s launch date and underlying tech stack are not clearly documented, making it a mystery‑coin that lives mostly in the speculation zone.

Because the token is classified as a micro‑cap token - a cryptocurrency with a market‑cap in the low millions or less - its price can explode or collapse on a single trade. That characteristic explains the extreme volatility patterns cited by analysts throughout 2025.

Current Market Snapshot

As of 24September2025, BONK2.0 traded at roughly $0.0000000025687 with a 24‑hour trading volumethat tapered close to zero, indicating almost no liquidity.. Its market‑cap places it at rank #7,759out of more than 20,000 listed cryptocurrencies.. Those numbers tell you the token is a fringe player, far from the mainstream radar.

Technical Characteristics & Volatility

Price charts show a series of sharp spikes and drops - a hallmark of low‑liquidity marketswhere a handful of orders can move the market 10‑20% in minutes.. In earlyJanuary2025 the token fell below a historic threshold for the first time since 2021, confirming a downtrend that technical models flagged with red‑zone alerts.

Several analysis firms rely on AI‑assisted technical analysisthat crunches historical price data with machine‑learning algorithms to generate short‑term ranges.. For October2025, models projected a low of $0.000000000959 and a high of $0.000000001031 - a spread of roughly 7% on a token priced in nano‑cents.

Price Predictions from Major Sources (2025‑2029)

| Source | Methodology | 2025 Low | 2025 High | 2029 Maximum |

|---|---|---|---|---|

| DigitalCoinPrice | AI‑driven technical trends | $0.000000000959 | $0.000000001031 | $0.000379 |

| CoinDataFlow | Macro‑money‑flow analysis | $0.00017 | $0.000333 | $0.000435 |

| 3Commas | Deep AI technical analysis | $0.000000001083 | $0.000000001086 | $0.000350 |

| LiteFinance | Machine‑gradient pricing | $0.000000000959 | $0.000000001023 | $0.000320 |

| WalletInvestor | Historical pattern recognition | $0.000078 | $0.000187 | $0.000280 |

The spread is huge - the most conservative models keep the token under $0.000001, while the most bullish see a potential rise to $0.00033 by year‑end 2025. Keep in mind that even the “high” numbers are still a fraction of a cent; any real profit would require large position sizes or huge price swings.

Risks & Liquidity Challenges

Because BONK2.0 sits in the micro‑cap arenawith trading volume near zero, slippage is a daily reality.. A market order for just a few hundred dollars can push the price up or down by several percentage points. This makes the token vulnerable to pump‑and‑dump schemes and price manipulation.

Another red flag: there is no publicly verified development team, roadmap, or partnership announcements. Without a clear utility or ecosystem, the token’s value is almost entirely driven by speculative trading sentiment.

Regulatory exposure is also a concern. Being a meme‑style, low‑cap token, BONK2.0 could attract scrutiny from financial regulators if it’s deemed an unregistered security in certain jurisdictions.

How to Acquire BONK2.0 Safely

- Set up a non‑custodial wallet that supports the token’s underlying blockchain (most reports suggest it lives on Solana or a compatible layer‑2).

- Purchase a base coin (e.g., SOL, USDC) on a major exchange.

- Transfer the base coin to your wallet.

- Use a decentralized exchange (Serum, Raydium, or a niche DEX that lists BONK2.0) to swap for the token. Be prepared to set a high slippage tolerance (20‑30%) because of thin order books.

- Store the token in the wallet, double‑check the contract address from a trusted source (e.g., CoinGecko’s token page) to avoid counterfeit tokens.

Never commit more capital than you can afford to lose. Given the extreme volatility, many traders treat BONK2.0 as a “high‑risk, high‑reward” experiment rather than a long‑term investment.

Key Takeaways

- Bonk 2.0 is a speculative, micro‑cap crypto with almost no liquidity.

- Current price sits in the sub‑nano‑cent range; market‑cap places it at the bottom of the rankings.

- Price forecasts differ dramatically; most analysts agree on high volatility and limited upside.

- Risk factors include slippage, possible manipulation, and a lack of fundamental use‑case.

- If you decide to trade it, use a reputable DEX, verify the contract address, and keep position sizes tiny.

Frequently Asked Questions

What blockchain does BONK2.0 run on?

Most sources point to the Solana ecosystem, but the exact contract address should be confirmed on a trusted listing site before any transaction.

Why is the trading volume so low?

BONK2.0 is a niche meme‑coin with limited awareness and no major exchange listings, which naturally leads to near‑zero daily volume.

Is BONK2.0 a good long‑term investment?

Given the lack of a clear utility, thin liquidity, and extreme price swings, most experts label it as a high‑risk speculative asset rather than a long‑term hold.

How can I protect myself from pump‑and‑dump schemes?

Only trade small amounts, use limit orders, verify the contract address, and avoid chasing price spikes promoted on social media.

Where can I find real‑time BONK2.0 price data?

Crypto aggregators such as CoinGecko, CoinMarketCap, or niche Solana DEX dashboards list the token’s current price and liquidity stats.

One must first acknowledge the fundamental shortcomings of BONK2.0's underlying economics before entertaining any allocation of capital; the token's lack of verifiable development, coupled with its minuscule liquidity, renders it an archetype of speculative excess.

i cant help but feel like this whole thing is a crazy rollercoaster lol the price jumps like they’re on a caffeine binge and then poof, gone.

When you step back and look at the pattern, it’s almost philosophical – the market’s collective hope and fear manifesting in a token that barely registers on any radar. It makes you wonder what drives people to chase these micro‑caps.

There’s certainly room for curiosity here, but I’d advise everyone to tread lightly and keep an open mind about the risks while respecting personal limits.

It wouldn’t be far‑fetched to suggest that a shadowy group could be orchestrating the sudden spikes; the market’s opacity often masks coordinated manipulation, especially for tokens like this.

For anyone considering a dabble in BONK2.0, start with a tiny amount that you can comfortably lose. Verify the contract address on reputable sources, and always double‑check transaction details before confirming.

Picture this: a token so thin you can see through it – a whisper of value that disappears with a single trade. It’s a wild ride, but remember, the universe loves balance.

Oh great, another coin promising moon landings while the devs are hiding behind anonymity – because that’s never been a recipe for disaster before.

The token seems like a gamble with no clear purpose. If you decide to try, keep it small and watch the price closely.

Stay positive! Even the toughest markets can surprise you – just make sure you’re not over‑extending your bankroll.

Lol this coin is wild 😂💰 just don’t go all‑in, keep it chill 😎

It is imperative, dear readers, to approach the analysis of BONK2.0 with a measured and scholarly demeanor; the token’s market‑cap position, languishing near the bottom of the rankings, unequivocally signals an elevated risk profile.

First, the paucity of liquidity cannot be overstated; a modest trade may engender a price swing of double‑digit magnitude, thereby exposing participants to severe slippage.

Second, the absence of a verifiable development team or articulated roadmap renders any fundamental valuation speculative at best, and deceptive at worst.

Third, historical price oscillations have demonstrated a pattern of hyper‑volatile spikes, often precipitated by social media hype rather than intrinsic utility.

Fourth, regulatory scrutiny looms over meme‑style tokens, especially those lacking clear compliance frameworks, which may culminate in exchange delistings or legal repercussions.

Fifth, the token’s deployment on a blockchain with limited adoption further constricts its growth prospects, as ancillary infrastructure remains under‑developed.

Consequently, prudent investors should allocate only a nominal fraction of their capital-ideally a sum that would be tolerable to lose entirely.

Moreover, employing limit orders with generous slippage tolerances can mitigate inadvertent market impact during execution.

In addition, vigilant monitoring of contract addresses via reputable aggregators such as CoinGecko is essential to avoid counterfeit tokens.

Finally, a diversified portfolio strategy, emphasizing assets with demonstrable use cases and robust liquidity, remains the cornerstone of sound crypto investment practice.

In summation, while the allure of astronomical returns may tempt the speculative mindset, the confluence of low liquidity, absent fundamentals, and regulatory ambiguity renders BONK2.0 a high‑risk endeavor best approached with caution and disciplined risk management.

With due deference to the preceding exposition, it is advisable to conduct a comprehensive due‑diligence review, cross‑referencing multiple data sources prior to any transactional commitment.

look man the token is kinda sus but also kinda cool its like you dont know if its legit or not its just a thing

It has no real utility.

I appreciate the balanced overview; it’s clear that caution is warranted while also recognizing the community’s enthusiasm.

Hey folks, just a heads‑up: the token’s thin order books mean that even a modest swap can cause the price to bounce like a rubber ball – so set your slippage buffers high and double‑check the contract address on a trusted explorer to avoid landing on a rogue clone.

Dear community, please ensure you are using a reputable wallet and always verify the token contract address; this simple precaution can safeguard against inadvertent exposure to fraudulent assets.

👍 Great summary! I’d add that keeping the position tiny and using a limit order can really help avoid that nasty slippage. 🌟

This is a very bad idea and anyone who does it is stupid

Sure, let’s all just ignore the red flags and dive in “because I said so.” Nothing says patriotism like blindly backing a meme‑coin with no merit.

Yo, I totally get the hype around these ultra‑micro‑caps – the thrill of possibly catching a moonshot is intoxicating, and the community chatter can feel like a rallying cry for the underdogs. That said, it’s crucial to keep your emotions in check and remember that the market’s volatility isn’t just a rollercoaster; it’s more like a demolition derby where a single misstep can send you crashing. If you’re set on dabbling, start with an amount that would be just as fine to lose, keep a close eye on the DEX’s order book, and maybe set alerts for any sudden spikes. Also, always double‑verify the contract address – a tiny typo can land you on a scam. It doesn’t hurt to spread your risk across a few different projects rather than going all‑in on one. And hey, if you ever feel the stress mounting, take a step back, breathe, and remember that the crypto space is big enough for everyone’s experiments. Stay safe, stay savvy, and may your trades be ever in your favor.